Missouri Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

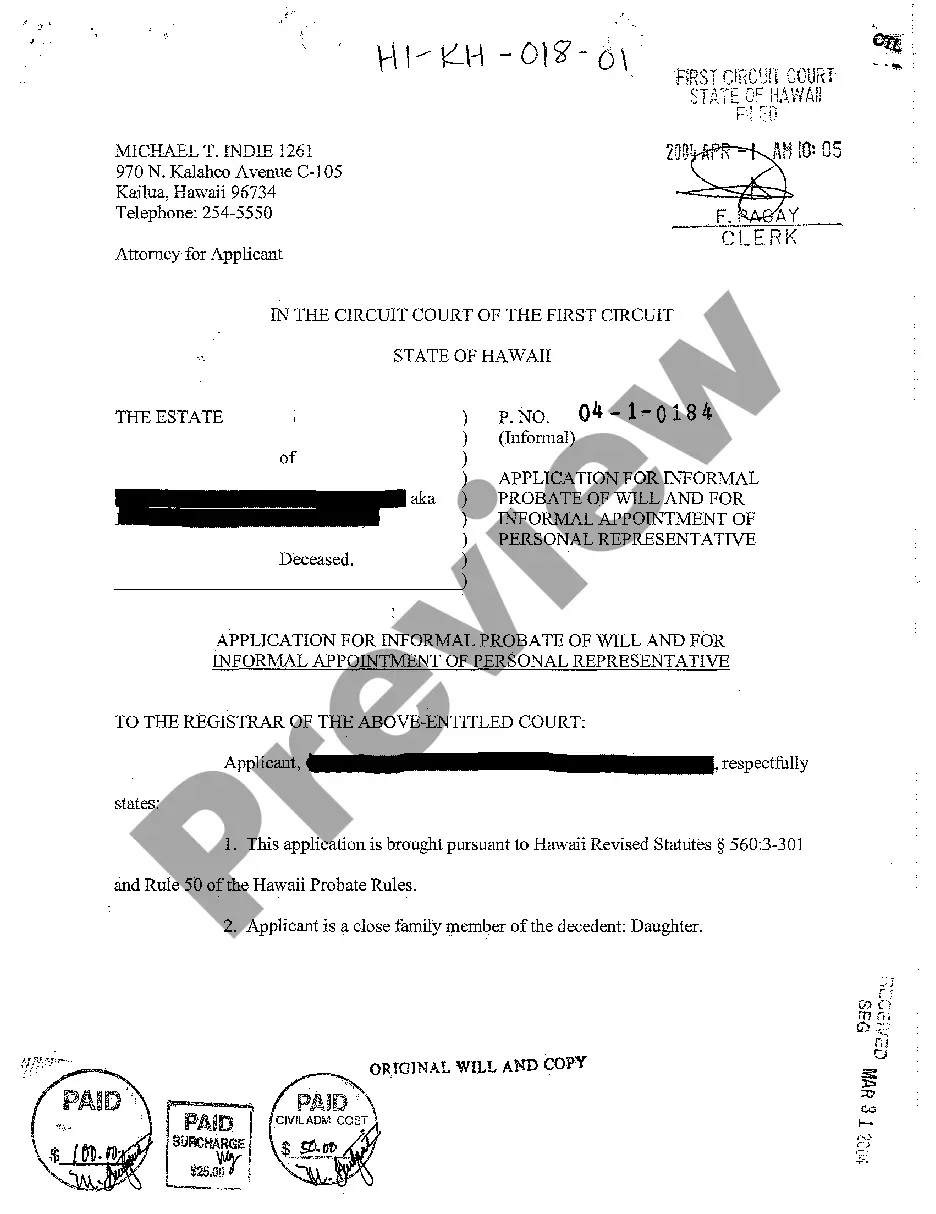

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

It is possible to devote time on the Internet trying to find the authorized record web template that fits the state and federal demands you will need. US Legal Forms gives thousands of authorized forms which can be evaluated by professionals. It is simple to obtain or produce the Missouri Assignment of Overriding Royalty Interest (No Proportionate Reduction) from the service.

If you already possess a US Legal Forms accounts, it is possible to log in and then click the Obtain option. After that, it is possible to comprehensive, edit, produce, or indication the Missouri Assignment of Overriding Royalty Interest (No Proportionate Reduction). Every single authorized record web template you acquire is yours eternally. To obtain another backup for any obtained form, go to the My Forms tab and then click the related option.

If you use the US Legal Forms site the first time, keep to the basic directions listed below:

- Very first, be sure that you have chosen the right record web template for that region/city of your choosing. Read the form outline to ensure you have chosen the right form. If available, use the Preview option to check through the record web template too.

- If you want to locate another edition of the form, use the Lookup area to get the web template that suits you and demands.

- After you have found the web template you desire, just click Purchase now to carry on.

- Find the pricing strategy you desire, type your accreditations, and sign up for an account on US Legal Forms.

- Total the financial transaction. You can use your charge card or PayPal accounts to fund the authorized form.

- Find the formatting of the record and obtain it to the device.

- Make alterations to the record if needed. It is possible to comprehensive, edit and indication and produce Missouri Assignment of Overriding Royalty Interest (No Proportionate Reduction).

Obtain and produce thousands of record web templates while using US Legal Forms web site, that offers the most important variety of authorized forms. Use skilled and state-specific web templates to tackle your company or personal needs.

Form popularity

FAQ

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Non-Participating Royalty Interest (NPRI) Unlike a mineral interest owner, the NPRI owner does not have ?executive? rights, meaning they cannot sign an oil and gas lease or participate in the benefits of lease bonus or delay rentals.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Several factors determine the value of an overriding royalty interest in a working lease. They include: Location ? A mineral interest in high producing shale basins will be more valuable. Producing Wells ? Producing wells are valued higher than non-producing wells.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

A proportionate-reduction clause, also known as a lesser-interest clause, is a provision in an oil-and-gas lease that allows the lessee to reduce payments proportionately if the lessor owns less than 100% of the mineral interest.

What Is Working Interest? Working interest is a term for a type of investment in oil and gas drilling operations in which the investor is directly liable for a portion of the ongoing costs associated with exploration, drilling, and production.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.