Missouri Assignment and Conveyance of Net Profits Interest

Description

How to fill out Assignment And Conveyance Of Net Profits Interest?

Have you been in the place in which you need documents for both organization or specific reasons just about every day time? There are a variety of legal record templates available online, but getting versions you can rely on isn`t effortless. US Legal Forms provides a huge number of form templates, much like the Missouri Assignment and Conveyance of Net Profits Interest, which are composed in order to meet state and federal specifications.

When you are previously informed about US Legal Forms site and also have an account, merely log in. Afterward, you can download the Missouri Assignment and Conveyance of Net Profits Interest web template.

If you do not provide an accounts and would like to begin using US Legal Forms, adopt these measures:

- Get the form you want and ensure it is to the correct metropolis/state.

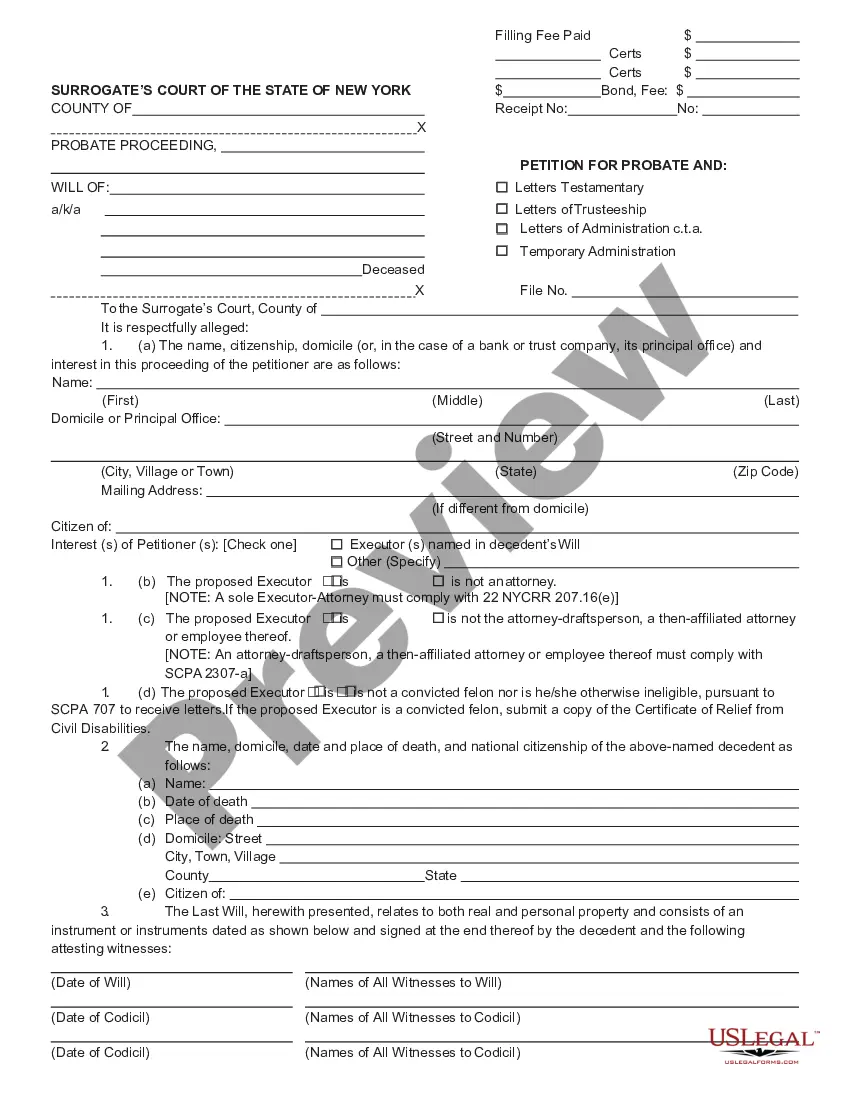

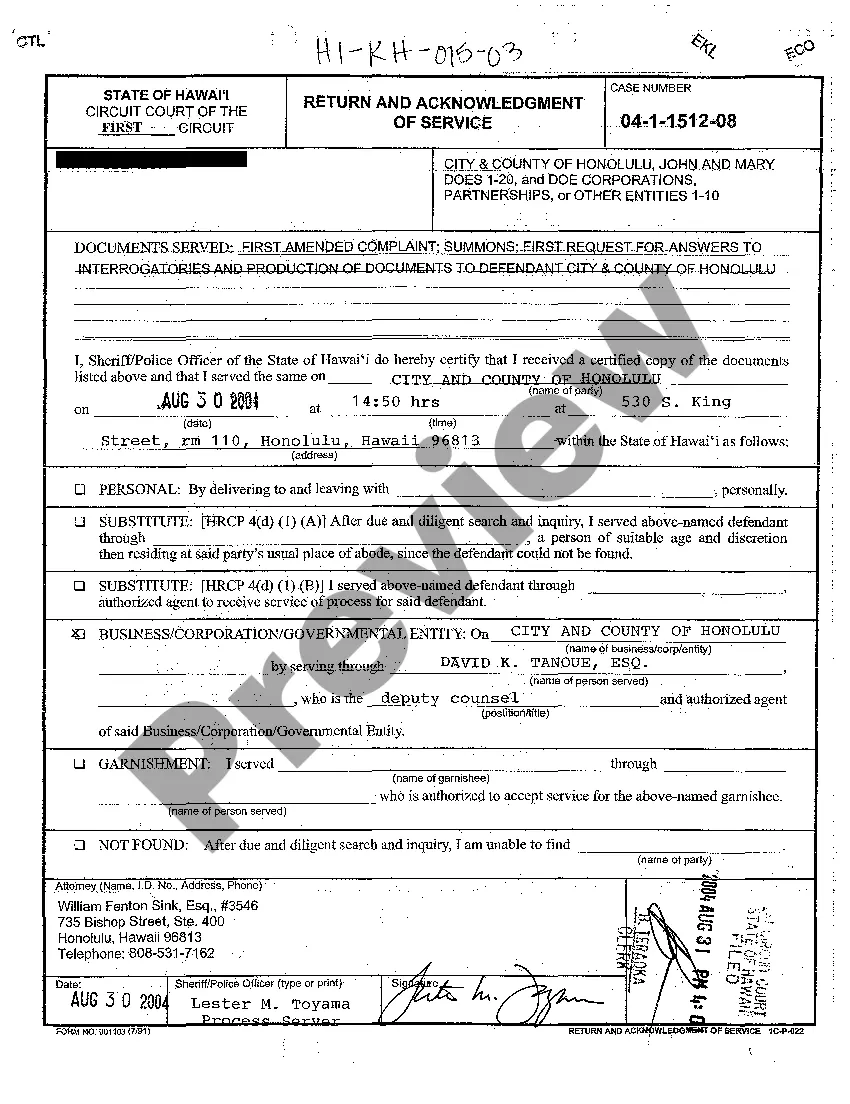

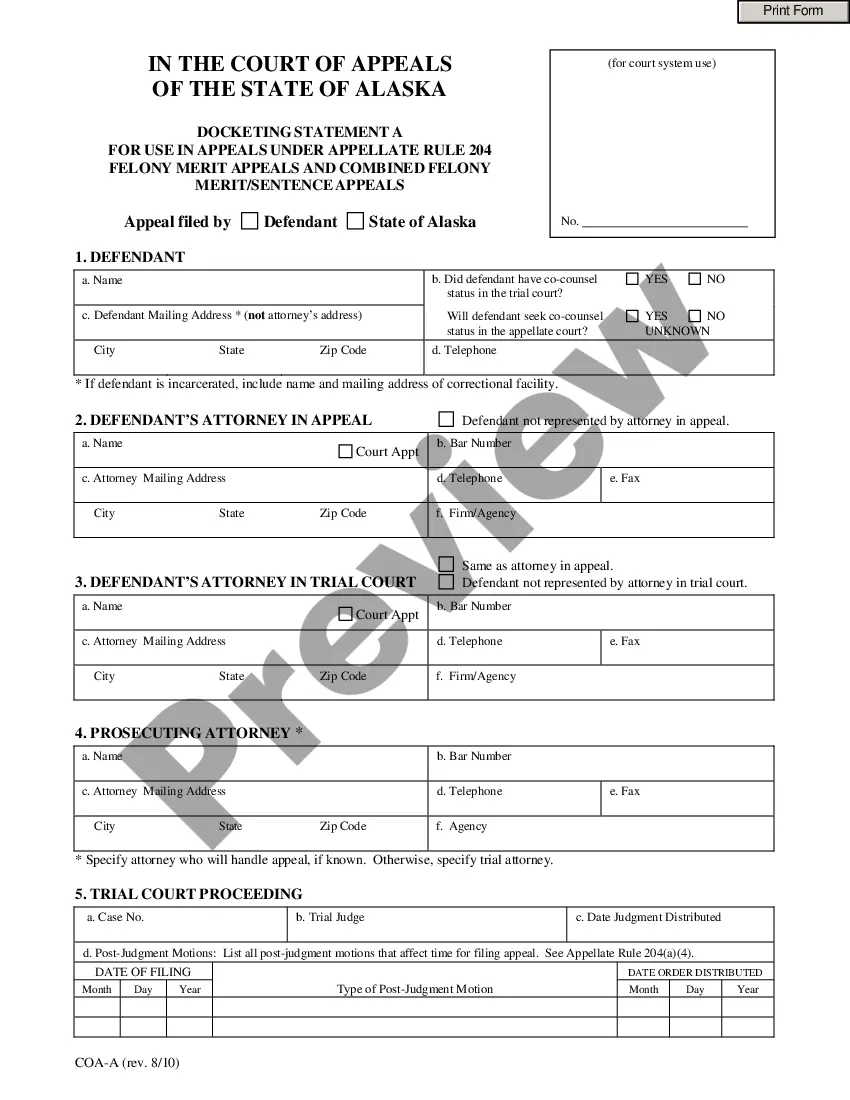

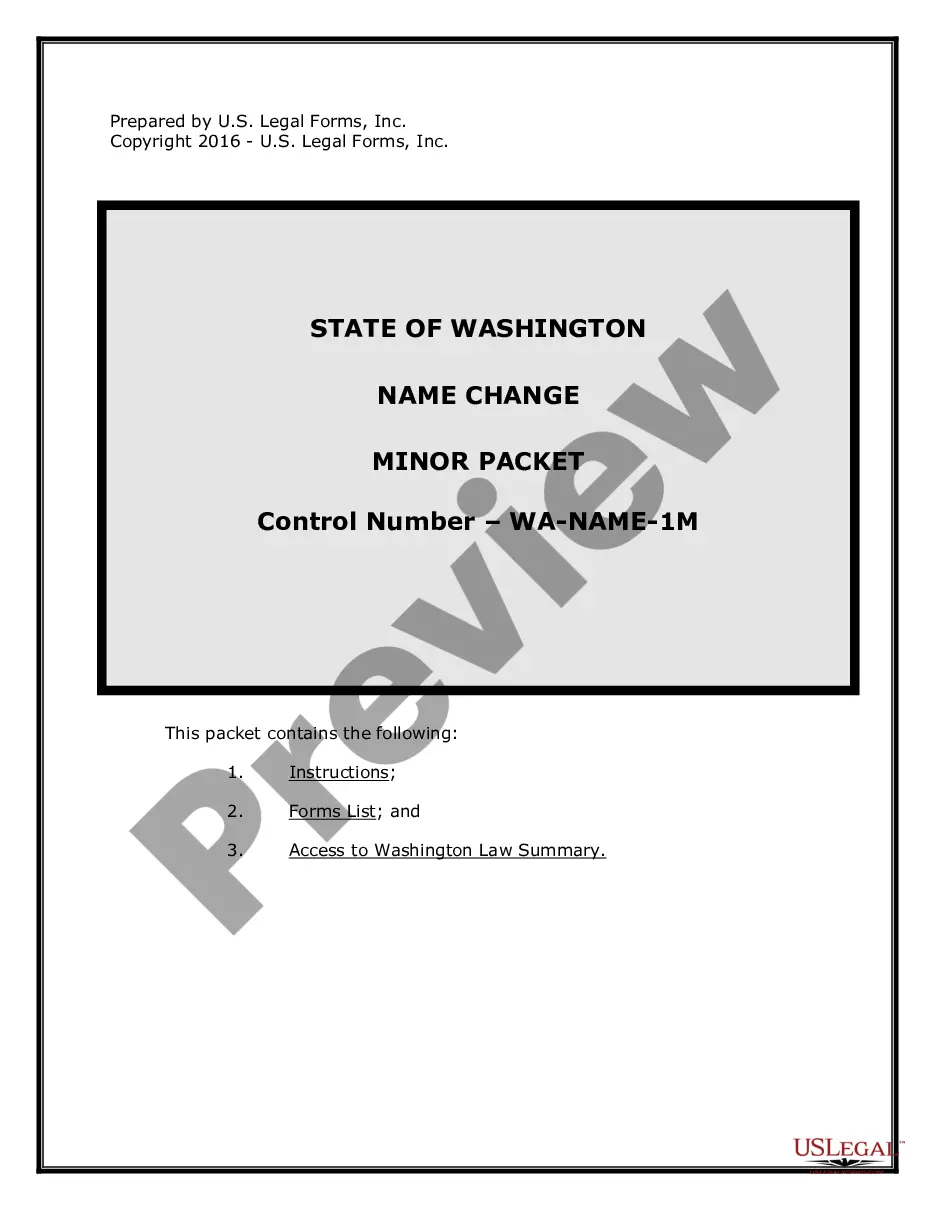

- Make use of the Review switch to examine the form.

- See the outline to ensure that you have chosen the appropriate form.

- In the event the form isn`t what you`re trying to find, use the Research industry to get the form that fits your needs and specifications.

- When you find the correct form, simply click Purchase now.

- Pick the pricing plan you would like, fill in the required information to generate your bank account, and purchase the transaction making use of your PayPal or Visa or Mastercard.

- Select a practical data file format and download your backup.

Get every one of the record templates you possess bought in the My Forms menus. You can obtain a additional backup of Missouri Assignment and Conveyance of Net Profits Interest whenever, if possible. Just click on the necessary form to download or print out the record web template.

Use US Legal Forms, by far the most considerable variety of legal types, to save lots of some time and stay away from mistakes. The support provides expertly manufactured legal record templates which you can use for an array of reasons. Create an account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

To title a motor vehicle in the state of Missouri, the owner must submit the following: The Certificate of Title, properly signed over to you (see instructions), or Manufacturer's Statement of Origin (MSO); A signed Application for Missouri Title and License (Form 108) Document;

A Transfer on Death (TOD) beneficiary is a simple way to transfer ownership of a vehicle after the titled owner has died. By naming a TOD beneficiary on your title application, you will avoid the need for the vehicle to go through probate upon your death.

You must submit the notarized lien release (copy or original), your current title (if in your possession) and pay an $8.50 title fee and a $6 processing fee. The new title (in your name, without the lien) should issue within 3-5 business days, and will then be mailed to you (at the address provided on the application).

Missouri residents are required to provide a valid title to buyers at the time of change in ownership. There are rare instances where someone may purchase a boat, motor and/or trailer with a incorrect title or may move into Missouri from another state that does not require a title.

The seller must complete all applicable information and sign this form. The Bill of Sale or Even-Trade Bill of Sale must be notarized when showing proof of ownership on major component parts of a rebuilt vehicle or when specifically requested to be notarized by the Department of Revenue.

Remember: All sellers and purchasers must print their names and sign the back of the title in the assignment area. These signatures do not need to be notarized. The seller must write in the odometer reading and date of sale. You may not use correction fluid (white-out) or erase marks from the title.

Missouri Car Title Transfer Information On the back of the title you will fill out the upper part within the block called ASSIGNMENT. Print the purchaser's name(s) and complete address on the two lines provided. Enter the SALE PRICE. Enter DATE OF SALE. Enter MODEL (Ford, Chev, etc)

How to Fill Out Form 108 Missouri? Pick the trans type, in the right corner of the page; Fill in the information about the owner, including name, address, city, state, email, and phone; Write down the data about your vehicle, including year, color, ID, fuel, mileage, and body style;