Nevada Agreement to Arbitrate Disputed Open Account

Description

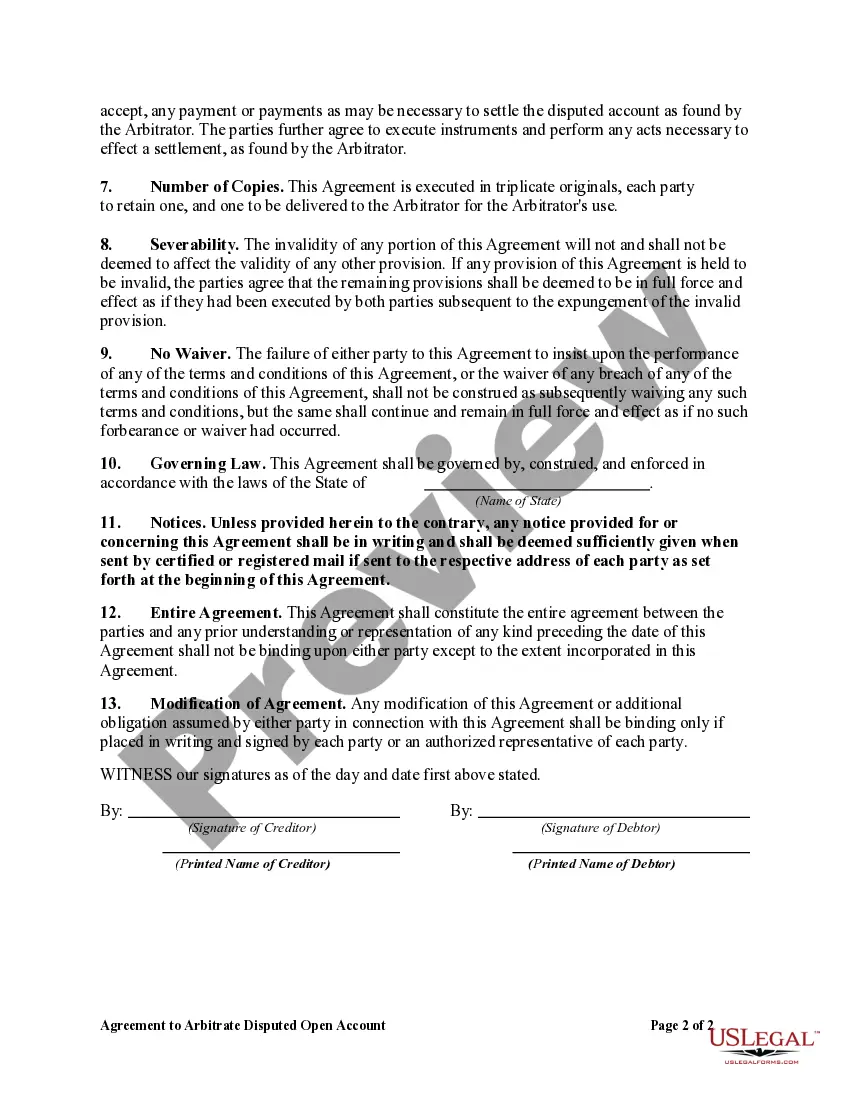

How to fill out Agreement To Arbitrate Disputed Open Account?

You have the capability to spend time online looking for the valid documents template that meets the state and federal requirements you require.

US Legal Forms offers a wide range of valid forms that have been reviewed by experts.

You can easily download or print the Nevada Agreement to Arbitrate Disputed Open Account from my service.

If available, use the Review button to go through the document template as well.

- If you already have a US Legal Forms account, you may sign in and click the Obtain button.

- After that, you can fill out, modify, print, or sign the Nevada Agreement to Arbitrate Disputed Open Account.

- Each valid document template you purchase is yours for an extended period.

- To get another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/city of choice.

- Check the form details to confirm you have chosen the right form.

Form popularity

FAQ

To arbitrate a dispute, start by following the guidelines outlined in your Nevada Agreement to Arbitrate Disputed Open Account. Typically, this involves selecting an arbitrator, submitting the necessary documentation, and engaging in a hearing where both parties present their cases. Ensure you understand the terms of the agreement to navigate the arbitration process smoothly.

Choosing between settlement and arbitration depends on your specific situation. Settling can provide a quicker resolution and greater control over the outcome, while arbitration offers a legal framework for resolving disputes. Using a Nevada Agreement to Arbitrate Disputed Open Account can help clarify the arbitration process, making it easier to decide which route aligns with your goals.

The charges for arbitration can vary based on several factors, including the complexity of the case and the arbitrator's fees. Generally, fees may include the arbitrator's hourly rate, administrative costs, and any expenses related to the hearing. When using a Nevada Agreement to Arbitrate Disputed Open Account, it is important to review the associated costs upfront to understand your financial commitment.

Opting out of an arbitration agreement with your bank might protect your rights to challenge disputes in court. A Nevada Agreement to Arbitrate Disputed Open Account can limit legal options, so consider your comfort with that risk. Evaluate how opting out might impact your banking relationship and decisions.

A bank arbitration agreement is a contract that requires parties to settle disputes through arbitration rather than litigation. In the context of a Nevada Agreement to Arbitrate Disputed Open Account, this can significantly affect how you resolve any financial disputes with the bank. Understand the implications before signing.

Choosing not to enter into arbitration agreements can provide court access if a dispute arises. Arbitration may limit your ability to appeal a decision made, which is a critical consideration when considering a Nevada Agreement to Arbitrate Disputed Open Account. Weigh the risks and benefits against your legal options carefully.

You are not obligated to agree to an arbitration agreement typically, but doing so may be necessary for certain contracts, including a Nevada Agreement to Arbitrate Disputed Open Account. Review the terms and understand that refusing may impact your contractual relationship. It's always best to seek clarification on any stipulations involved.

If you do not agree to arbitration in a Nevada Agreement to Arbitrate Disputed Open Account, you may be bound to traditional legal processes. This could require a longer timeframe and higher costs associated with court proceedings. It’s crucial to know what your rejection means for any current or future contracts.

Agreeing to an arbitration agreement can streamline dispute resolution, making it faster and potentially less expensive. If you enter into a Nevada Agreement to Arbitrate Disputed Open Account, ensure you are comfortable with the limitations it may impose on your rights. Consider all aspects and seek advice if unsure.

Opting out of an arbitration agreement can protect your rights to take disputes to court. If you decide on a Nevada Agreement to Arbitrate Disputed Open Account, make sure you understand how it may affect future legal actions. Weigh the benefits of quicker resolutions against your comfort in possibly limiting legal recourse.