Missouri Disability Services Contract - Self-Employed

Description

How to fill out Disability Services Contract - Self-Employed?

If you intend to total, obtain, or print out authentic document templates, utilize US Legal Forms, the leading selection of legal forms, accessible online.

Employ the site’s simple and convenient search to locate the files you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to find the Missouri Disability Services Contract - Self-Employed in just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, modify, and print or sign the Missouri Disability Services Contract - Self-Employed. Each legal document template you receive is yours indefinitely. You have access to every form you downloaded within your account. Choose the My documents section and select a form to print or download again. Be proactive and obtain and print the Missouri Disability Services Contract - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to obtain the Missouri Disability Services Contract - Self-Employed.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

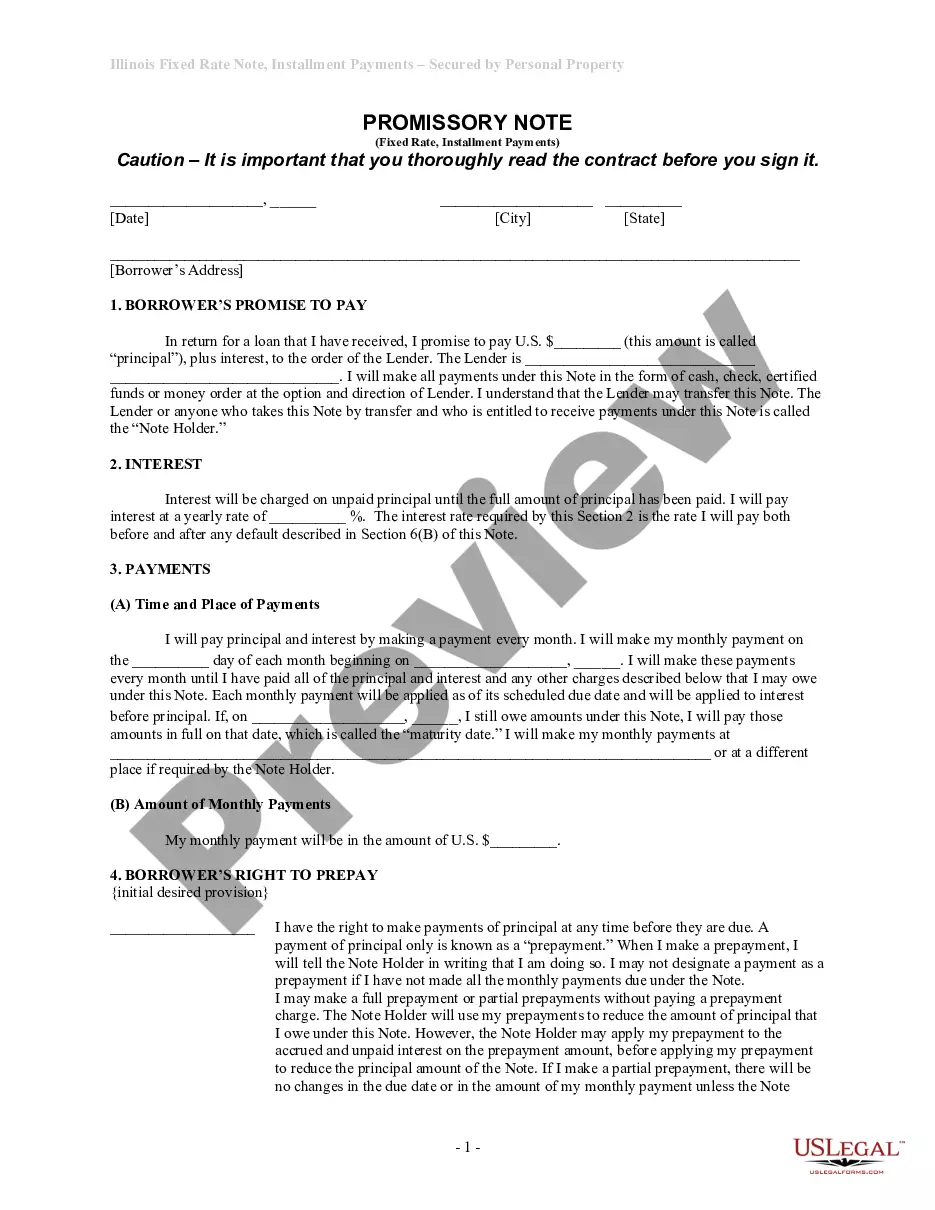

- Step 2. Use the Review option to inspect the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types of your legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for the account.

Form popularity

FAQ

The Missouri employment contract outlines the terms and conditions between an employer and an employee. This contract can also apply to self-employed individuals who wish to understand their rights and responsibilities. In the context of a Missouri Disability Services Contract - Self-Employed, having a clear contract protects your interests and ensures compliance with state laws. Using the uslegalforms platform can help you create a tailored employment contract that meets your specific needs.

Qualifying for disability as a self-employed individual hinges on various factors, including your medical condition and work credits. If your disability prevents you from working, you may meet the criteria set under the Missouri Disability Services Contract - Self-Employed. To gain clarity on your situation, it can be beneficial to utilize resources provided by uslegalforms that specialize in helping self-employed individuals navigate these requirements.

Yes, self-employed individuals can claim Social Security benefits, including disability benefits if they meet eligibility requirements. Your work history and earnings will play a significant role in qualifying for these benefits. It's crucial to maintain accurate records of your earnings from self-employment to support your application under the Missouri Disability Services Contract - Self-Employed. Uslegalforms offers guidance to help ensure a smooth claims process.

Yes, a 1099 employee can collect disability benefits if they meet specific criteria, such as having enough work history and medical evidence of a qualifying disability. The key is to show that your ailment affects your ability to work, which is a requirement under the Missouri Disability Services Contract - Self-Employed. Consulting uslegalforms can clarify your eligibility and help you gather the necessary documentation.

The best disability insurance for self-employed individuals typically offers coverage that reflects your unique income situation. Look for plans that provide replacement income sufficient to meet your living expenses. It's wise to compare options that cater specifically to self-employed professionals. Resources from uslegalforms can provide insights into various policies available to suit your needs.

Yes, if you receive income reported on a 1099 form, you may qualify for disability benefits. As a 1099 worker, your eligibility for benefits links to your net earnings and work credits. It is essential to present a clear record of your earnings to demonstrate that you meet the criteria outlined in the Missouri Disability Services Contract - Self-Employed. Uslegalforms can help streamline the paperwork process.

Social Security Disability Insurance (SSDI) calculates your self-employment income based on your reported net earnings. This amount is determined after deducting your business expenses from your gross income. It's critical to accurately report your earnings to ensure you meet the needed thresholds for benefits under the Missouri Disability Services Contract - Self-Employed. Uslegalforms can guide you in gathering the right documentation.

Yes, self-employed individuals can be eligible for disability benefits under the Missouri Disability Services Contract - Self-Employed. To qualify, you need to have earned enough work credits through your self-employment history. Your health condition must also impede your ability to work. Understanding the requirements can be easier with help from uslegalforms, which offers resources tailored for self-employed applicants.

employed person can access disability insurance through various providers. First, assess your needs and research plans that include the Missouri Disability Services Contract SelfEmployed. Once you select a policy, complete an application and provide necessary documentation. Securing this protection gives you peace of mind knowing you have a safety net in place.

Yes, 1099 employees can obtain disability coverage. Many insurance providers offer plans tailored specifically for self-employed individuals. By exploring options like the Missouri Disability Services Contract - Self-Employed, you can find a suitable policy that meets your needs while ensuring financial security. Understanding your options empowers you to protect your earnings effectively.