Missouri Paint Removal And Cleaning Services Contract - Self-Employed

Description

How to fill out Paint Removal And Cleaning Services Contract - Self-Employed?

You have the ability to spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are vetted by professionals.

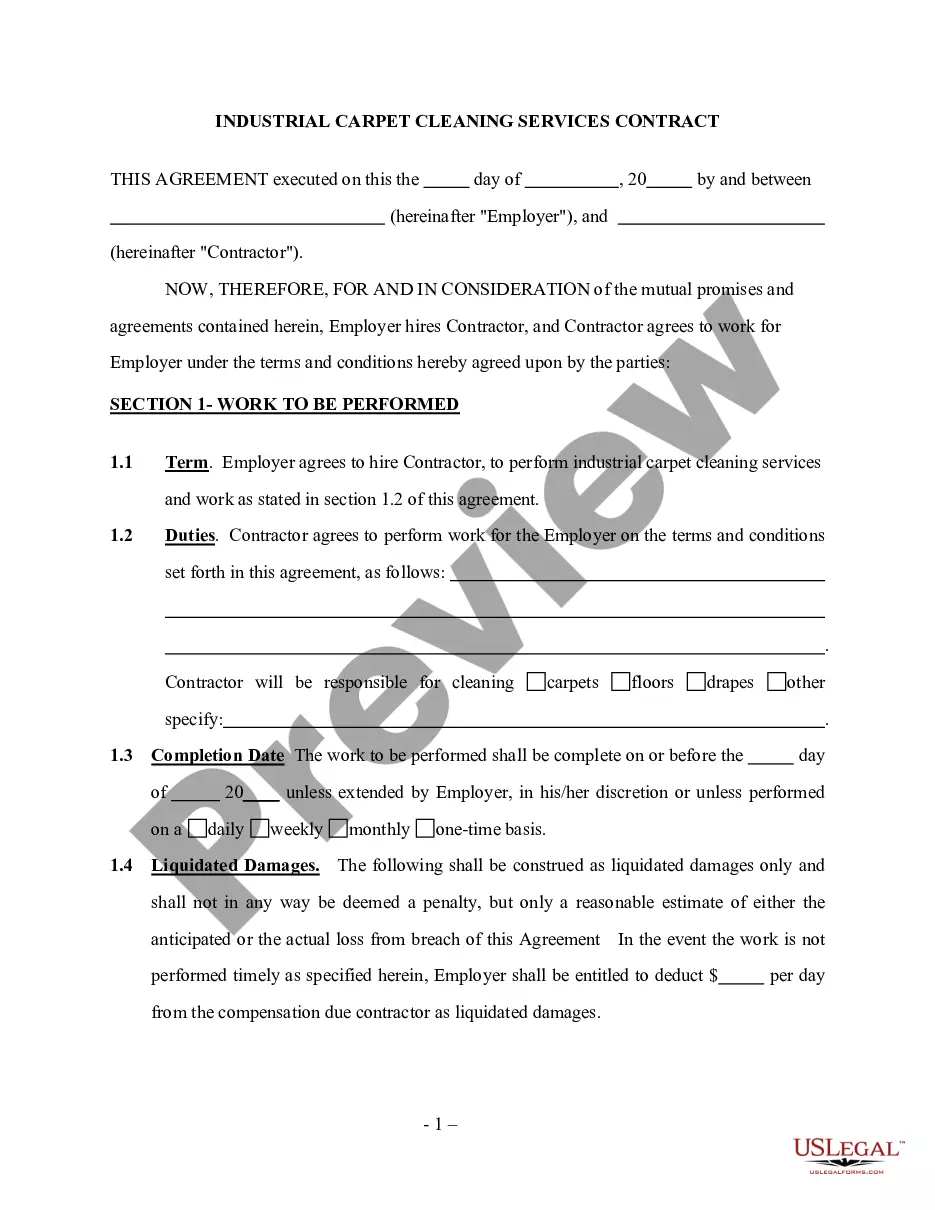

You can easily download or print the Missouri Paint Removal And Cleaning Services Contract - Self-Employed from the service.

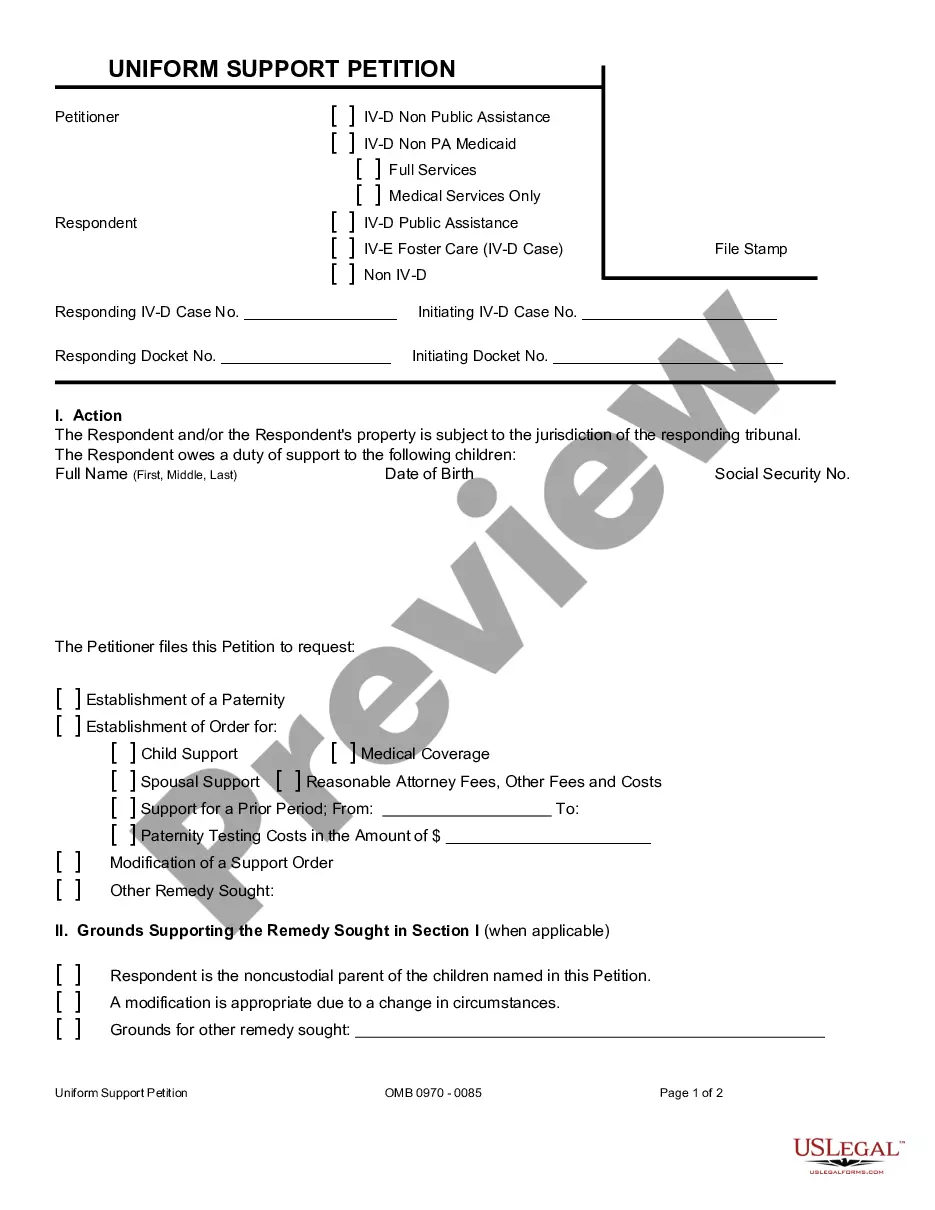

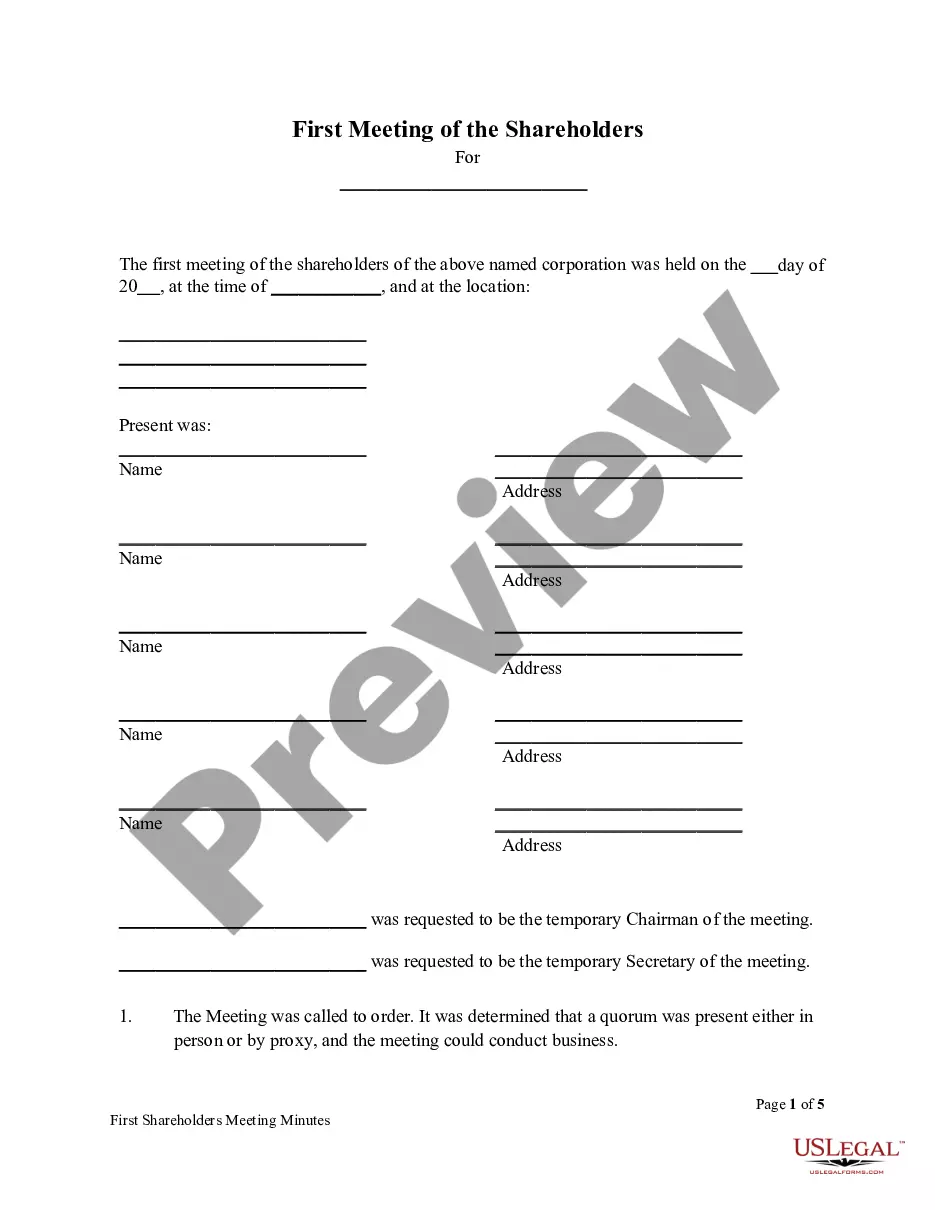

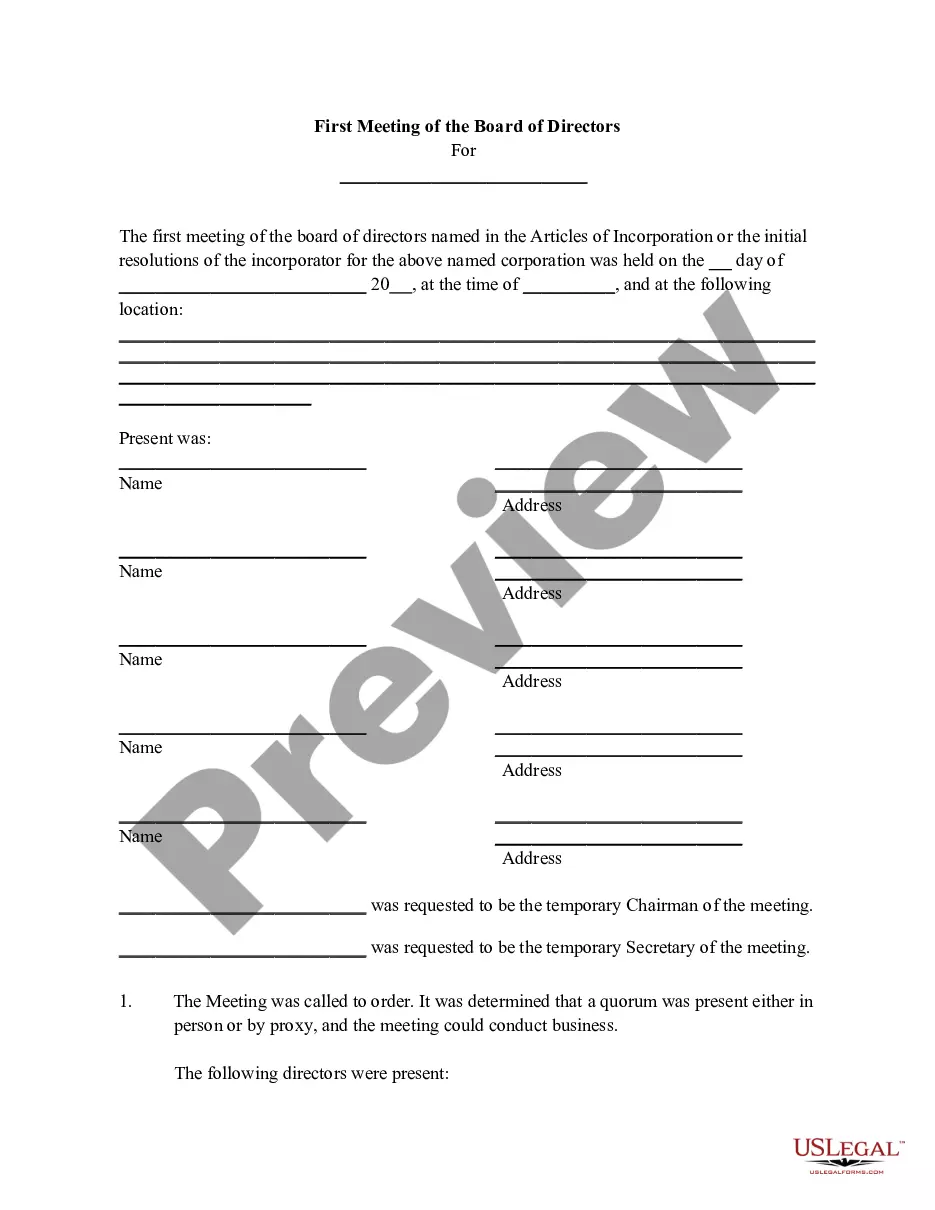

If available, use the Preview button to browse through the document template as well. If you wish to find another version of the form, use the Search field to locate the template that fits your needs and requirements. Once you have found the template you want, click on Purchase now to proceed. Select the pricing plan you prefer, enter your details, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make adjustments to the document if necessary. You can complete, modify, sign, and print the Missouri Paint Removal And Cleaning Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Missouri Paint Removal And Cleaning Services Contract - Self-Employed.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area or city of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

You can find commercial cleaning contracts, including the Missouri Paint Removal And Cleaning Services Contract - Self-Employed, through various online platforms. Websites like USLegalForms provide easy access to customizable templates specific to cleaning services. These resources allow you to create a contract tailored to your business needs without unnecessary hassle. Always ensure that the contracts meet your local legal requirements to protect your interests.

When writing a cleaning contract agreement, focus on clarity and specificity. Include detailed descriptions of cleaning services, duration, rates, and any special requirements like paint removal. Remember to make it legally sound by incorporating terms for changes or cancellations. Utilizing US Legal Forms for a Missouri Paint Removal And Cleaning Services Contract - Self-Employed can assure you have all bases covered.

A simple contract agreement should consist of key elements: the parties involved, the services offered, payment terms, and timeline. Clearly outline each party's obligations to prevent misunderstandings. For those creating a Missouri Paint Removal And Cleaning Services Contract - Self-Employed, using a trusted source like US Legal Forms can help you formulate a straightforward yet comprehensive agreement.

To write a contract agreement for cleaning services, start by defining the scope of work clearly. Specify the services you will provide, including paint removal and cleaning tasks, duration, and payment terms. This Missouri Paint Removal And Cleaning Services Contract - Self-Employed should also detail responsibilities and termination clauses. Using a template from US Legal Forms can streamline this process and ensure all necessary components are included.

Yes, obtaining a business license is often required to clean houses legally in Missouri, depending on your city or county regulations. If you plan to engage in activities outlined in the Missouri Paint Removal And Cleaning Services Contract - Self-Employed, check local requirements for licensing. This step ensures you remain compliant with the law while building a reputable business.

Yes, a cleaning business is typically regarded as a contractor if you operate as a self-employed individual providing services to clients. Under the Missouri Paint Removal And Cleaning Services Contract - Self-Employed, you will be classified as an independent contractor. This classification brings specific tax responsibilities and potential benefits, so understanding your status is crucial.

Filing taxes as an independent contractor involves several key steps. First, you need to maintain accurate records of your income and expenses related to the Missouri Paint Removal And Cleaning Services Contract - Self-Employed. Use forms such as Schedule C for reporting your income, and consider utilizing tax software or consulting an accountant to ensure compliance.

Yes, cleaning services are generally taxable in Missouri, with some exceptions based on the type of cleaning provided. If you classify your work under the Missouri Paint Removal And Cleaning Services Contract - Self-Employed, it's important to consult tax regulations to determine your obligations. Understanding these tax requirements can help you avoid potential issues.

Missouri has a range of taxable services, including but not limited to certain cleaning services, repair services, and maintenance work. If your services relate to the Missouri Paint Removal And Cleaning Services Contract - Self-Employed, you should be aware of the specific tax regulations that may apply. This knowledge is vital for managing your business finances effectively.

In Missouri, house cleaning services can be taxable, depending on the specific services offered. If your cleaning services include additional tasks, such as deep cleaning or specialty services, they may fall under taxable activities. When navigating the Missouri Paint Removal And Cleaning Services Contract - Self-Employed, it is essential to understand the tax implications to ensure compliance.