Missouri Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

Are you presently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible on the internet, but finding reliable versions is quite challenging.

US Legal Forms offers thousands of form templates, including the Missouri Qualified Written RESPA Request to Dispute or Validate Debt, which can be used to meet state and federal regulations.

Select the pricing plan you prefer, fill out the necessary information to create your account, and pay for the transaction using PayPal or a credit card.

Choose a convenient file format and download your copy. Find all the document templates you have purchased in the My documents menu. You can obtain a duplicate of the Missouri Qualified Written RESPA Request to Dispute or Validate Debt anytime, if necessary. Just follow the required steps to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and minimize mistakes. The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Qualified Written RESPA Request to Dispute or Validate Debt template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

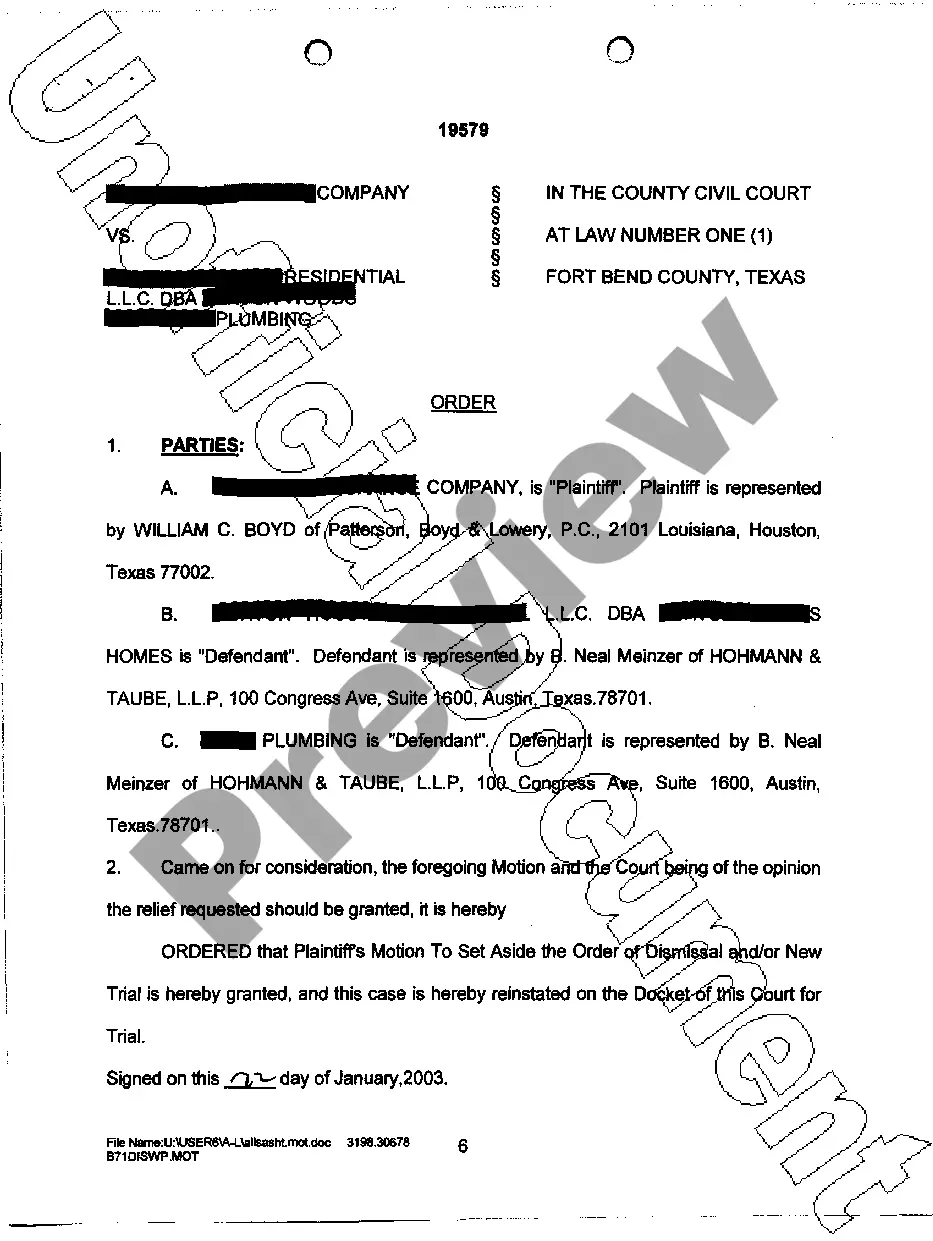

- Use the Review option to inspect the form.

- Check the details to ensure you have selected the correct form.

- If the form is not what you need, use the Lookup field to find the form that meets your criteria.

- When you locate the right form, simply click Get now.

Form popularity

FAQ

The best sample for a debt validation letter clearly outlines your request and includes essential information. It should include your personal details, the creditor's information, and specifically mention your Missouri Qualified Written RESPA Request to Dispute or Validate Debt. You can find useful templates on platforms like US Legal Forms, which can guide you in drafting a comprehensive letter that effectively addresses your situation.

Writing a letter disputing a debt requires clarity and specificity. Start by stating your identification details and reference the debt in question. Then, incorporate your Missouri Qualified Written RESPA Request to Dispute or Validate Debt, asking for detailed documentation of the account. Be polite but firm, and keep a copy of your letter for your records.

Yes, you can dispute a valid debt under certain circumstances. If you believe the amount is incorrect or the debt is linked to fraudulent activity, you can file a Missouri Qualified Written RESPA Request to Dispute or Validate Debt. This request prompts the creditor to verify the debt details and can help clarify any discrepancies. Always ensure that your dispute is well-documented for future reference.

When you receive a debt validation letter, it is important to respond promptly. You can use a Missouri Qualified Written RESPA Request to Dispute or Validate Debt, which allows you to request detailed information about the debt. This formal request can prove beneficial by ensuring that the creditor provides accurate evidence of the claim. Take your time to review any information they send, as this can help you protect your rights.

To obtain a debt validation letter, you should first send a written request to the creditor detailing your request for validation. Utilize the Missouri Qualified Written RESPA Request to Dispute or Validate Debt to ensure your request is comprehensive. In your communication, ask for details about the debt’s origin and the original creditor, which will provide you with clarity and assurance regarding the validity of the debt.

To write a qualified written request, begin by addressing the relevant party with your personal information, clearly identifying the account and your request. Within your letter, explicitly state your concerns, referencing the Missouri Qualified Written RESPA Request to Dispute or Validate Debt. This approach emphasizes your rights and expectations for a prompt response, enhancing the efficacy of your request.

To write a letter disputing the validity of a debt, start by clearly stating your intention to dispute the debt. Include your personal information, such as your name and address, and the creditor’s details. Reference the Missouri Qualified Written RESPA Request to Dispute or Validate Debt in your letter to ensure proper handling of your request. Make sure to send your letter via certified mail, keeping a copy for your records.

A lender must provide required RESPA information to a buyer at specific points during the transaction process. Generally, lenders must deliver this information within specific timeframes after receiving a qualified written request. Utilizing a Missouri Qualified Written RESPA Request to Dispute or Validate Debt can trigger the lender's obligation to respond promptly. This responsiveness is critical for your financial awareness and decision-making.

RESPA prohibits two significant practices in the mortgage lending process. First, it prohibits kickbacks and referrals for services that are not rendered, ensuring transparency in lending. Second, RESPA protects borrowers by prohibiting the improper escrow account practices. Understanding these protections can empower you to use a Missouri Qualified Written RESPA Request to Dispute or Validate Debt effectively.

Submitting a qualified written request does not automatically stop foreclosure proceedings. However, it does require the mortgage servicer to investigate your request and respond in a timely manner. Using a Missouri Qualified Written RESPA Request to Dispute or Validate Debt can delay the foreclosure process, as servicers must acknowledge and address your inquiries. This provides you with additional time to resolve your issues.