If you want to total, acquire, or print out lawful papers templates, use US Legal Forms, the biggest variety of lawful kinds, that can be found on the web. Take advantage of the site`s easy and hassle-free lookup to obtain the files you need. Various templates for enterprise and person purposes are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to obtain the Missouri Guide to Complying with the Red Flags Rule under FCRA and FACTA within a few clicks.

When you are presently a US Legal Forms customer, log in for your profile and click on the Acquire switch to have the Missouri Guide to Complying with the Red Flags Rule under FCRA and FACTA. You may also access kinds you formerly acquired inside the My Forms tab of your respective profile.

If you are using US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have chosen the form for the correct area/country.

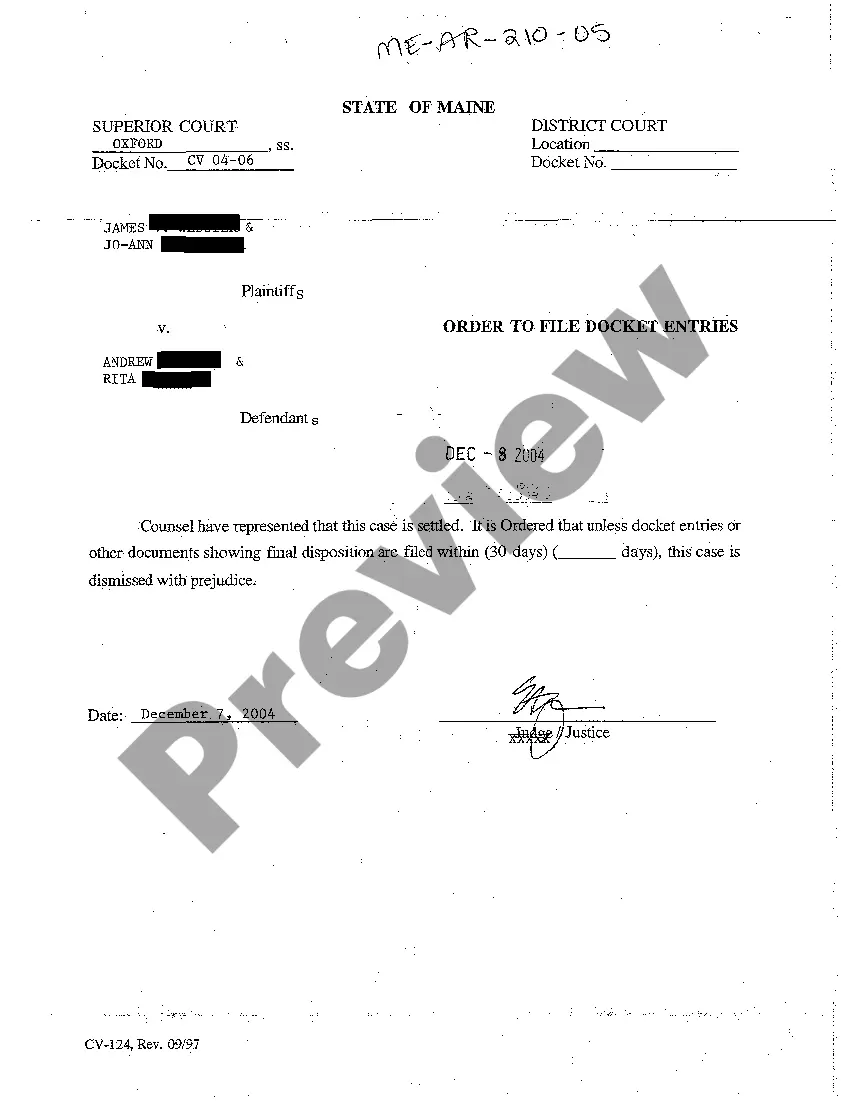

- Step 2. Make use of the Review option to look over the form`s content. Don`t overlook to learn the explanation.

- Step 3. When you are unsatisfied together with the develop, utilize the Research discipline towards the top of the display to find other versions of the lawful develop web template.

- Step 4. After you have located the form you need, go through the Buy now switch. Opt for the costs plan you like and add your references to register to have an profile.

- Step 5. Method the deal. You may use your charge card or PayPal profile to finish the deal.

- Step 6. Pick the file format of the lawful develop and acquire it on your own product.

- Step 7. Total, modify and print out or indicator the Missouri Guide to Complying with the Red Flags Rule under FCRA and FACTA.

Each and every lawful papers web template you get is your own eternally. You may have acces to every single develop you acquired with your acccount. Click on the My Forms section and choose a develop to print out or acquire once again.

Contend and acquire, and print out the Missouri Guide to Complying with the Red Flags Rule under FCRA and FACTA with US Legal Forms. There are millions of skilled and state-certain kinds you can utilize to your enterprise or person requirements.