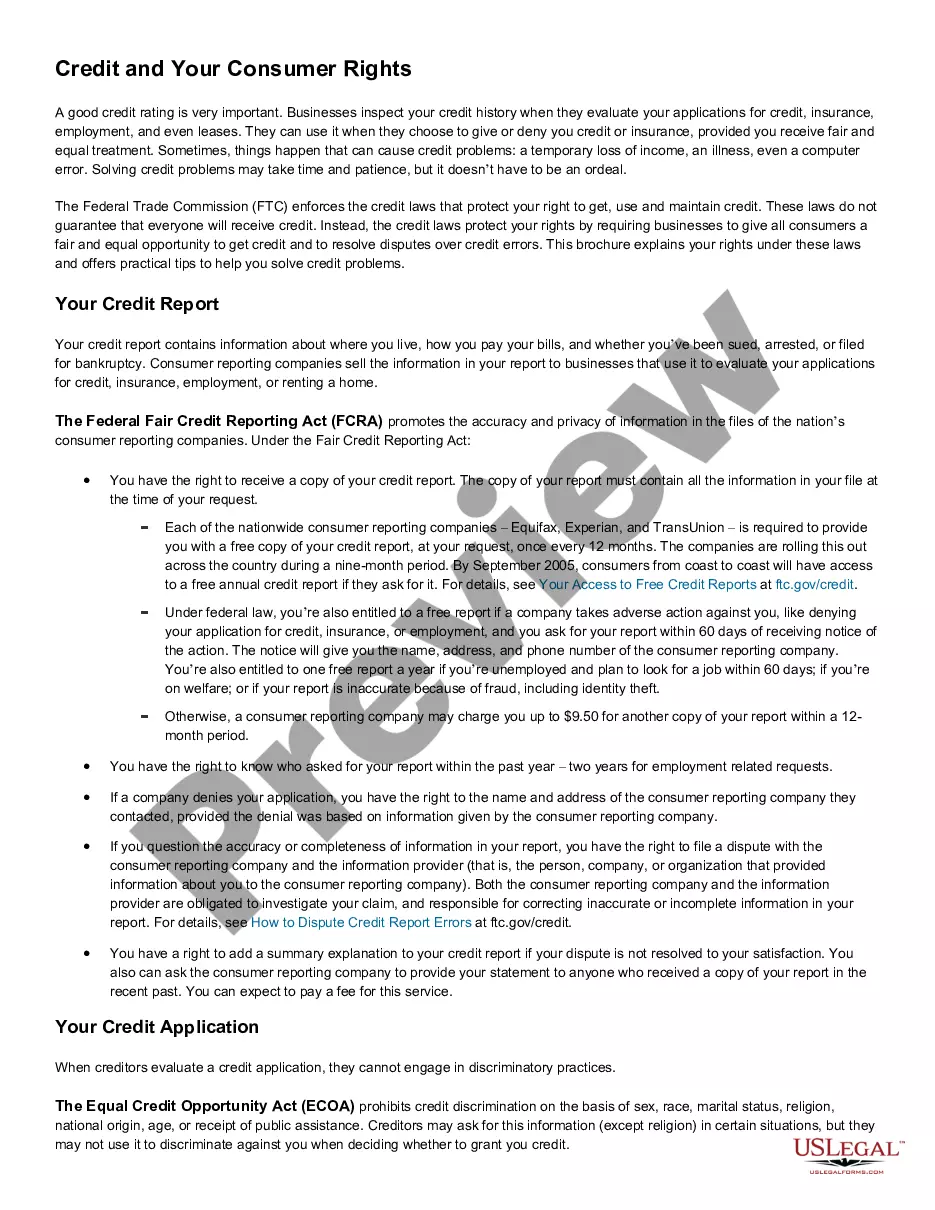

Missouri A Summary of Your Rights Under the Fair Credit Reporting Act

Description

How to fill out A Summary Of Your Rights Under The Fair Credit Reporting Act?

You may spend several hours online looking for the authorized record web template which fits the federal and state needs you need. US Legal Forms supplies a large number of authorized kinds that are examined by pros. You can actually down load or printing the Missouri A Summary of Your Rights Under the Fair Credit Reporting Act from your support.

If you have a US Legal Forms profile, you are able to log in and then click the Download option. Following that, you are able to full, change, printing, or indication the Missouri A Summary of Your Rights Under the Fair Credit Reporting Act. Every single authorized record web template you purchase is your own for a long time. To have one more copy of any purchased type, visit the My Forms tab and then click the related option.

If you use the US Legal Forms web site the very first time, follow the straightforward instructions below:

- First, make certain you have selected the right record web template for that region/town of your choosing. Read the type description to make sure you have chosen the right type. If available, use the Review option to appear with the record web template too.

- If you want to get one more edition of your type, use the Lookup area to discover the web template that fits your needs and needs.

- Upon having located the web template you would like, simply click Buy now to move forward.

- Choose the rates program you would like, type in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You can use your bank card or PayPal profile to pay for the authorized type.

- Choose the formatting of your record and down load it to the gadget.

- Make modifications to the record if necessary. You may full, change and indication and printing Missouri A Summary of Your Rights Under the Fair Credit Reporting Act.

Download and printing a large number of record themes using the US Legal Forms site, that offers the most important variety of authorized kinds. Use professional and status-certain themes to handle your organization or specific demands.

Form popularity

FAQ

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

Under the Fair Credit Reporting Act, you have a right to: You must have proper identification. You have a right to a free copy of your credit report within 15 days of your request. Protected Access ? The act limits access to your file to those with a valid need.

Under the FCRA, consumer reporting agencies are required to provide consumers with the information in their own file upon request, and consumer reporting agencies are not allowed to share information with third parties unless there is a permissible purpose. There are several permissible purposes outlined by the FCRA.

? You have the right to know what is in your file. information about you in the files of a consumer reporting agency (your ?file disclosure?). You will be required to provide proper identification, which may include your Social Security number. In many cases, the disclosure will be free.

The FCRA is beneficial for job applicants in that it informs them of any potential background checks prior to when they occur. It also gives them the opportunity to provide their consent.

Most Frequent Violations of the Fair Credit Reporting Act Reporting outdated information. Reporting false information. Accidentally mixing your files with another consumer. Failure to notify a creditor about a debt dispute. Failure to correct false information.

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must: ... Step 2: Certification To The Consumer Reporting Agency. ... Step 3: Provide Applicant With Pre-Adverse Action Documents. ... Step 4: Notify Applicant Of Adverse Action.

By this document, [Employer Name] discloses to you that a consumer report, including an investigative consumer report containing information as to your character, general reputation, personal characteristics and mode of living, may be obtained for employment purposes as part of the pre-employment background ...