Missouri Accredited Investor Suitability

Description

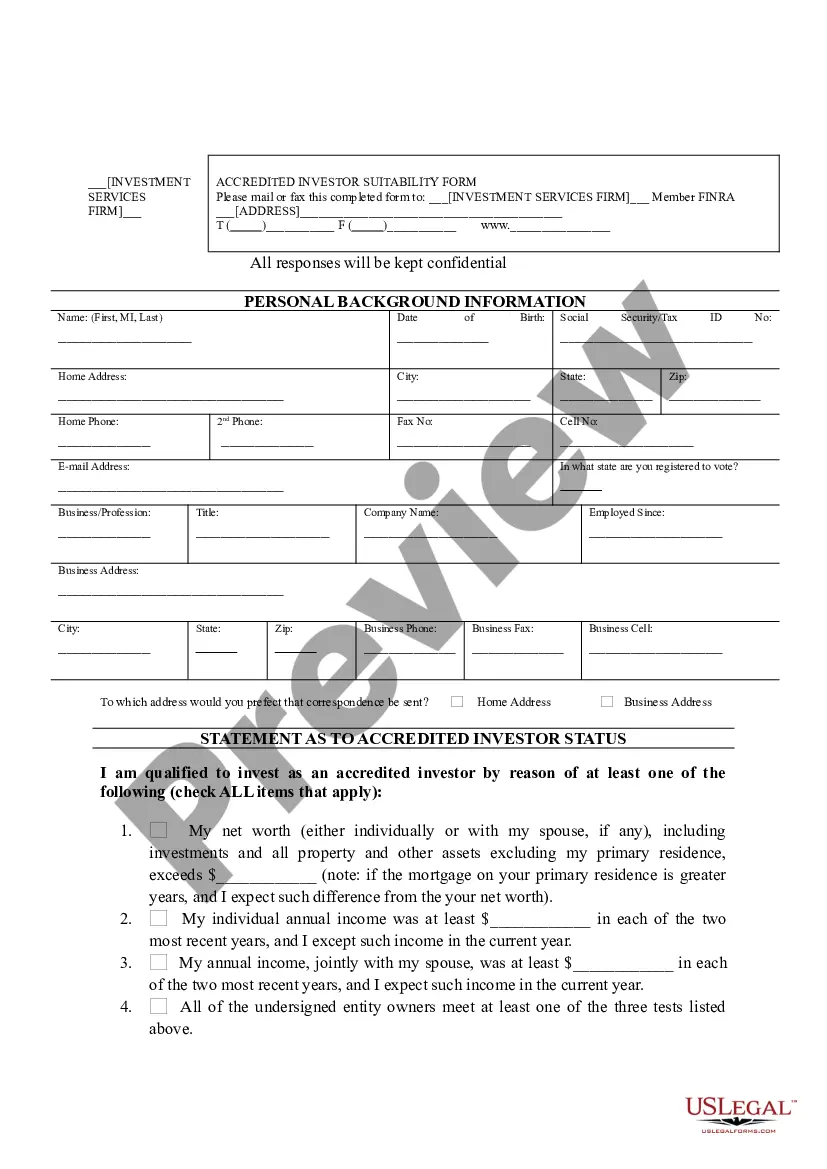

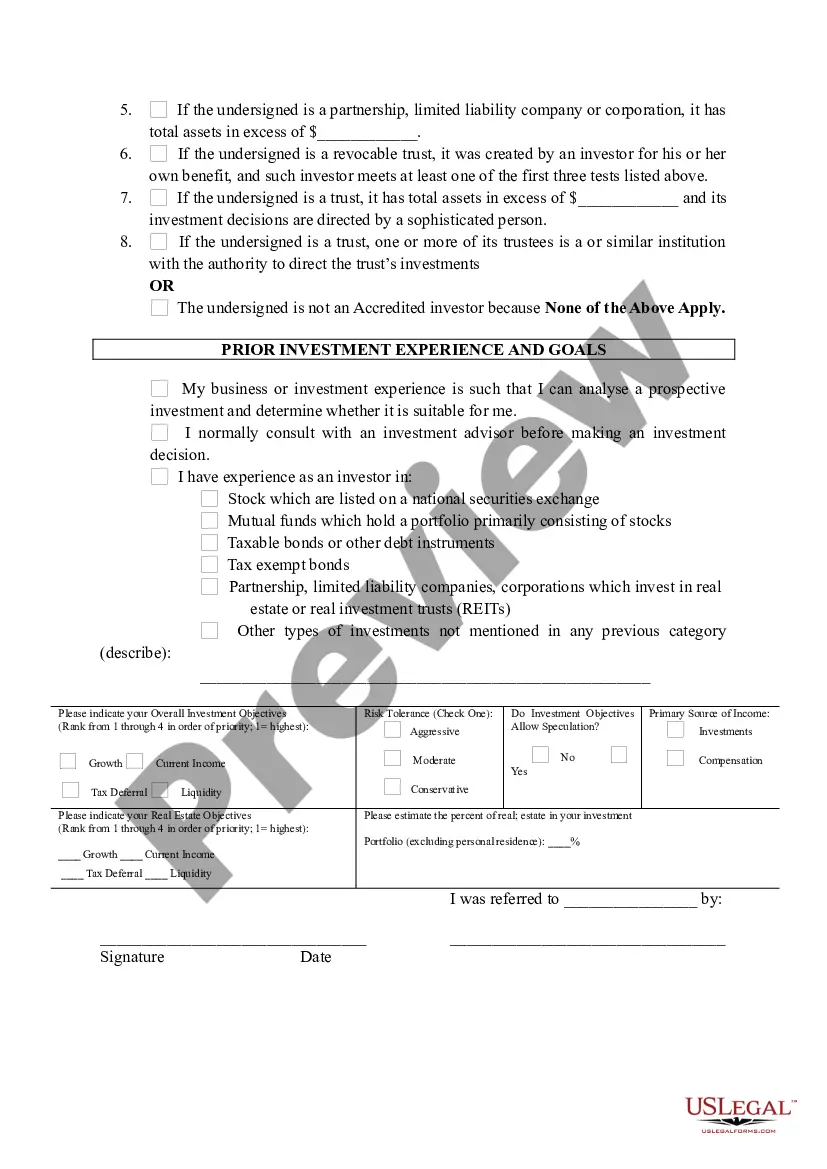

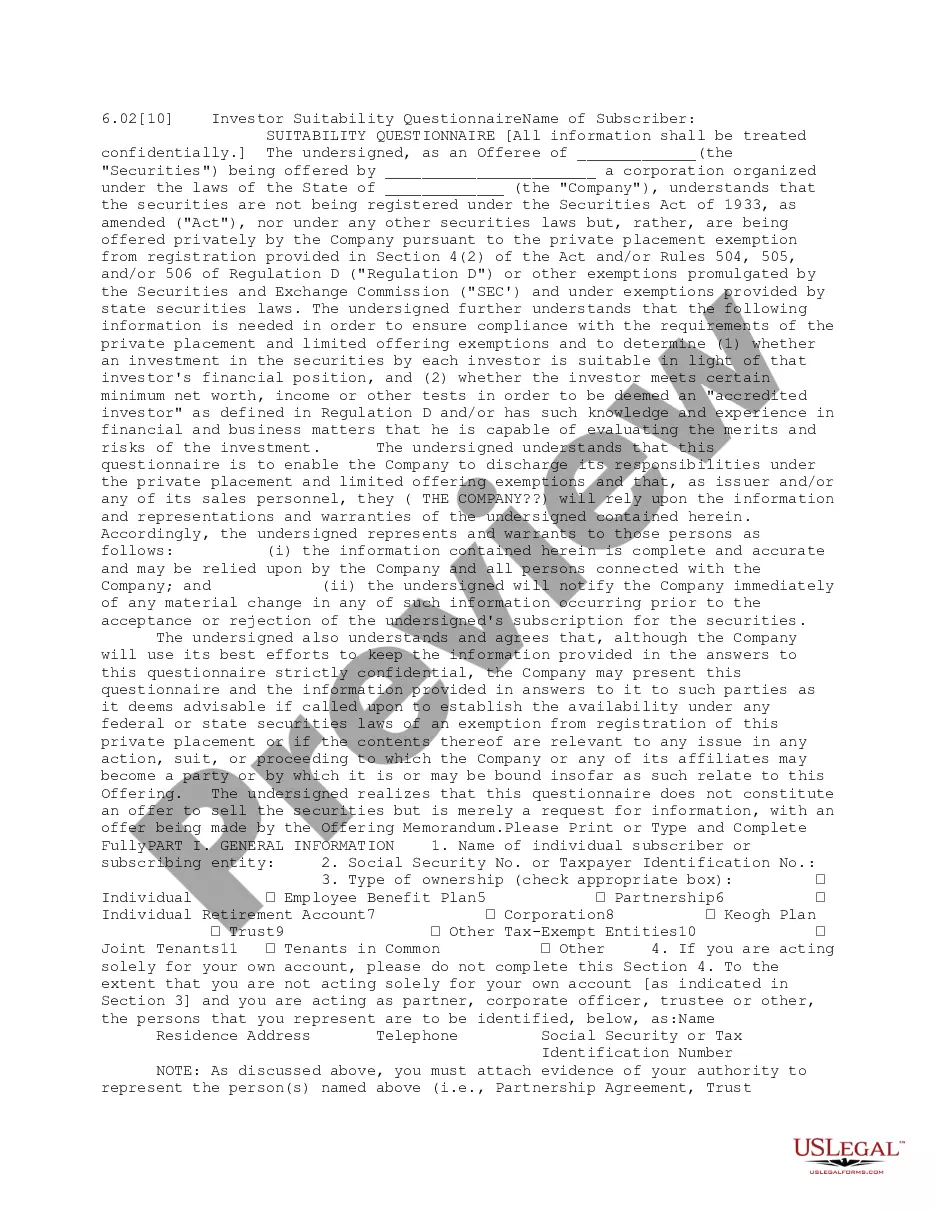

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Suitability?

US Legal Forms - one of several greatest libraries of lawful forms in the United States - provides a variety of lawful document web templates you may acquire or print out. Utilizing the web site, you can find a large number of forms for organization and individual purposes, categorized by categories, says, or key phrases.You can find the most up-to-date variations of forms much like the Missouri Accredited Investor Suitability in seconds.

If you have a membership, log in and acquire Missouri Accredited Investor Suitability from the US Legal Forms local library. The Down load option will appear on every single form you see. You have access to all formerly delivered electronically forms within the My Forms tab of the profile.

In order to use US Legal Forms for the first time, here are basic directions to help you get began:

- Ensure you have chosen the best form for your city/county. Click on the Preview option to check the form`s content. Look at the form explanation to ensure that you have chosen the correct form.

- If the form doesn`t satisfy your specifications, take advantage of the Look for discipline towards the top of the display screen to get the one who does.

- If you are satisfied with the shape, validate your option by clicking the Purchase now option. Then, pick the pricing plan you favor and give your credentials to sign up on an profile.

- Approach the purchase. Make use of bank card or PayPal profile to complete the purchase.

- Choose the format and acquire the shape on the device.

- Make modifications. Fill out, edit and print out and signal the delivered electronically Missouri Accredited Investor Suitability.

Every format you included with your account lacks an expiry particular date and is your own permanently. So, if you wish to acquire or print out an additional copy, just visit the My Forms section and then click about the form you want.

Gain access to the Missouri Accredited Investor Suitability with US Legal Forms, by far the most comprehensive local library of lawful document web templates. Use a large number of skilled and condition-certain web templates that meet up with your company or individual requires and specifications.

Form popularity

FAQ

For the net worth test, you (or you and a spouse or spousal equivalent) must show enough assets to evidence a net worth of at least $1,000,000 USD ignoring the value of your primary residence and after discounting all your other liabilities (including liabilities exceeding the value of your primary residence and ...

The series 65 is an exam administered by the Financial Industry Regulatory Authority (FINRA) and provides individuals' license to act as investment advisers in the U.S. After you pass the test and receive your license, you also need to be in ?good standing? to meet the accredited investor definition as per the SEC.

How to invest without being an accredited investor requires only that the investor has a net worth of less than $1 million. This includes the net worth of his or her spouse. The investor must also have earned $200,000 or more annually for the last two years.

Accredited Individual Investor ? By Income IR8A/income tax form declaring personal income not less than S$300,000 (or an equivalent document) A copy of employment letter/contract stating position and income, salary payslip, and bank statement recording such income.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

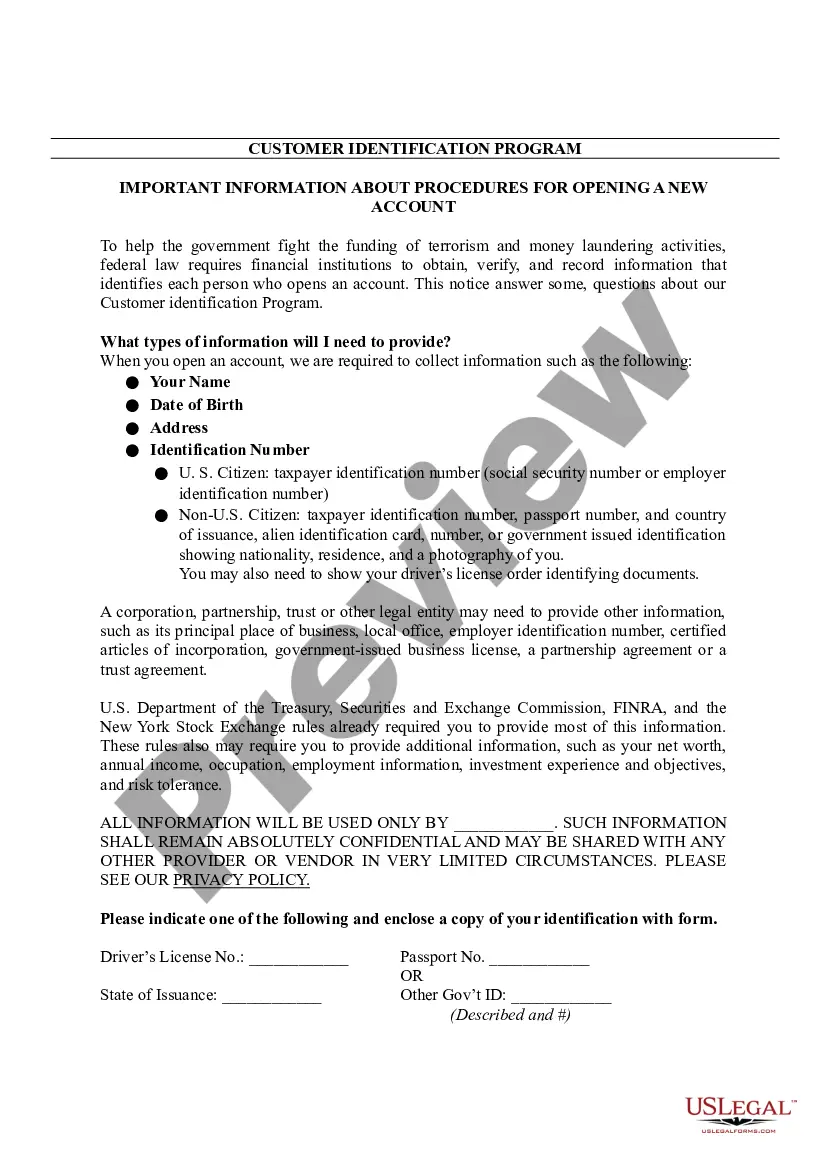

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.