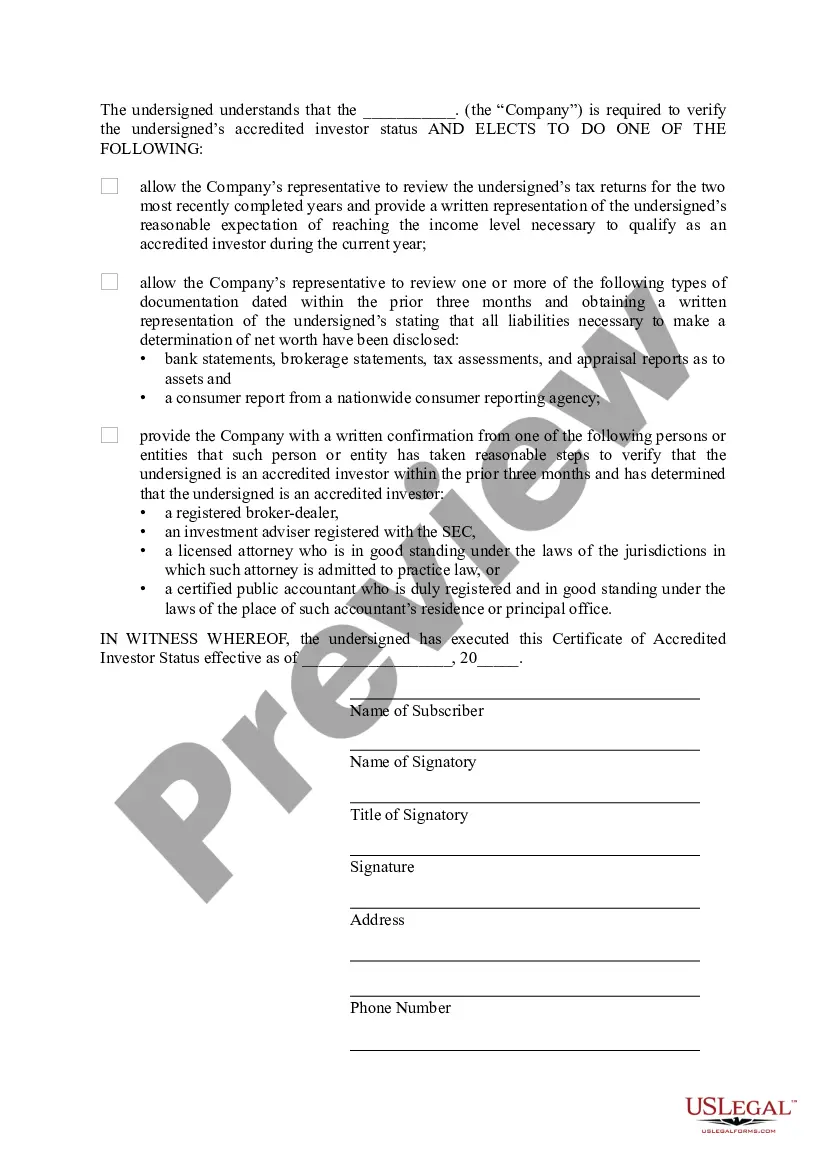

Missouri Certificate of Accredited Investor Status

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Certificate Of Accredited Investor Status?

You are able to devote several hours on-line trying to find the authorized record web template which fits the federal and state demands you need. US Legal Forms offers 1000s of authorized varieties which are reviewed by pros. You can easily download or produce the Missouri Certificate of Accredited Investor Status from our support.

If you currently have a US Legal Forms profile, you may log in and click the Download switch. Following that, you may full, edit, produce, or signal the Missouri Certificate of Accredited Investor Status. Every authorized record web template you acquire is yours for a long time. To have another backup of the obtained kind, check out the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms website initially, keep to the straightforward directions listed below:

- Very first, make certain you have selected the proper record web template for the county/town of your liking. Browse the kind information to ensure you have chosen the correct kind. If readily available, use the Review switch to appear with the record web template as well.

- If you would like locate another version of the kind, use the Search industry to obtain the web template that fits your needs and demands.

- When you have found the web template you would like, click Acquire now to move forward.

- Choose the rates plan you would like, type your credentials, and sign up for a free account on US Legal Forms.

- Complete the deal. You can utilize your Visa or Mastercard or PayPal profile to cover the authorized kind.

- Choose the formatting of the record and download it to your product.

- Make alterations to your record if required. You are able to full, edit and signal and produce Missouri Certificate of Accredited Investor Status.

Download and produce 1000s of record layouts making use of the US Legal Forms Internet site, that offers the biggest variety of authorized varieties. Use specialist and express-specific layouts to tackle your organization or specific requirements.

Form popularity

FAQ

The SEC's Rule 506 allows self-certification of investors in order for them to become accredited.

Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that: all purchasers in the offering are accredited investors. the issuer takes reasonable steps to verify purchasers' accredited investor status and. certain other conditions in Regulation D are satisfied.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Reviewing bank statements, brokerage statements, and other similar reports to determine net worth. Obtaining written confirmation of the investor's accredited investor status from one of the following persons: a registered broker-dealer, an investment adviser registered with the SEC, a licensed attorney, or a CPA.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.

Requirements for Accredited Investors An entity is considered an accredited investor if it is a private business development company or an organization with assets exceeding $5 million. Also, if an entity consists of equity owners who are accredited investors, the entity itself is an accredited investor.

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.