Missouri Nonqualified Defined Benefit Deferred Compensation Agreement

Description

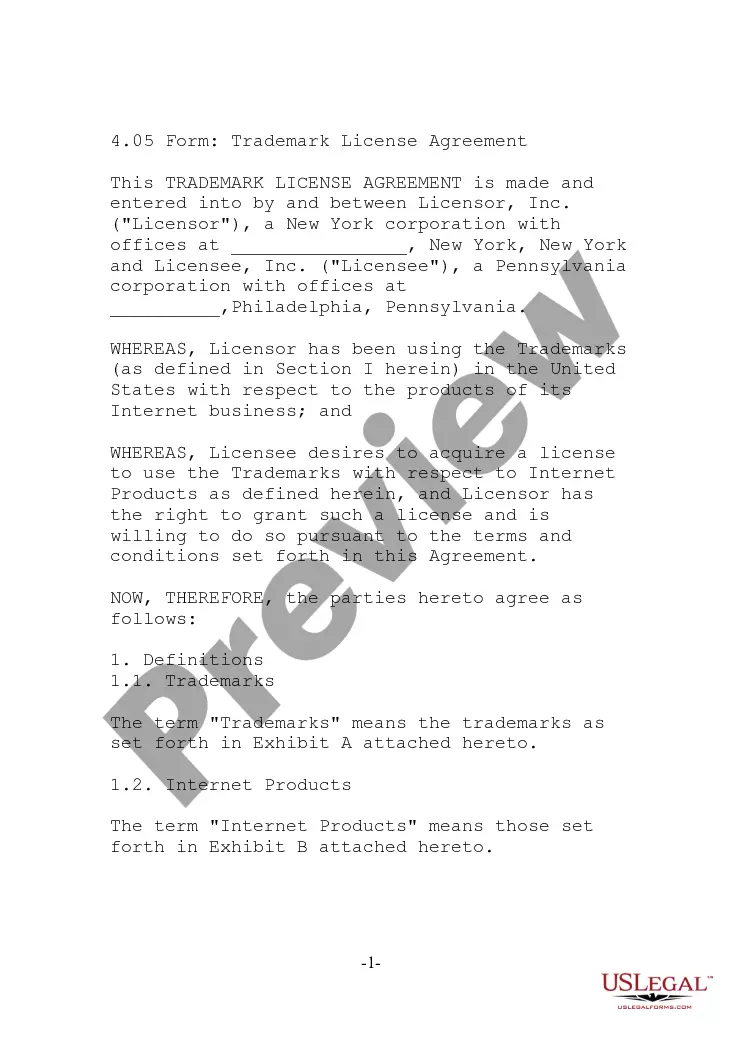

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

Finding the appropriate legal document template can be quite a challenge.

Certainly, there are numerous templates accessible online, but how do you locate the legal form you require? Utilize the US Legal Forms website.

The service provides a vast array of templates, including the Missouri Nonqualified Defined Benefit Deferred Compensation Agreement, which can be utilized for both business and personal purposes.

If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident the form is accurate, click on the Get now button to access the form.

- All the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Acquire button to locate the Missouri Nonqualified Defined Benefit Deferred Compensation Agreement.

- Use your account to search through the legal forms you may have acquired previously.

- Navigate to the My documents tab in your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your jurisdiction/state. You can browse the form using the Preview option and review the form details to make sure it is suitable for you.

Form popularity

FAQ

A nonqualified deferred compensation arrangement is a financial agreement that allows employees to defer a portion of their income until a later date, typically retirement. Unlike qualified plans, these arrangements do not receive favorable tax treatment upfront, but they offer greater flexibility regarding contribution amounts and distribution timing. The Missouri Nonqualified Defined Benefit Deferred Compensation Agreement is an example of such an arrangement, allowing participants to tailor benefits according to their individual needs. Engaging with platforms like US Legal Forms can help you navigate the setup and compliance of these agreements.

To determine if your retirement plan is qualified or nonqualified, consider how the plan is structured and whether it meets IRS regulations. A qualified plan must adhere to strict guidelines, including contribution limits and tax benefits. In contrast, a Missouri Nonqualified Defined Benefit Deferred Compensation Agreement provides more flexibility in funding and distribution options. Reviewing the plan documents or consulting with a retirement plan specialist can clarify your plan's status.

No, the Missouri deferred compensation plan is not an Individual Retirement Account (IRA). While both are retirement savings options, they operate differently and have distinct tax implications. If you are considering options like a Missouri Nonqualified Defined Benefit Deferred Compensation Agreement, this could provide benefits that differentiate it from an IRA, including more flexibility in contribution limits and employee control over investments.

A nonqualified deferred compensation plan allows employees to earn income while deferring taxes until they withdraw the funds. This plan is especially useful for those looking to enhance their retirement savings beyond what traditional pensions offer. With a Missouri Nonqualified Defined Benefit Deferred Compensation Agreement, you can effectively manage your tax liabilities and grow your retirement funds efficiently.

In Missouri, certain pensions are not subject to state income tax, including federal and military pensions. Social Security benefits also remain untaxed. Understanding how different pensions impact your financial planning is essential, especially if you're considering a Missouri Nonqualified Defined Benefit Deferred Compensation Agreement. It allows you to optimize your retirement plan by providing additional income without the burden of state taxes.

Non-qualified plans do not require IRS approval, which allows for more flexibility compared to qualified plans. However, it is essential to comply with the tax regulations and report the plan benefits correctly. Understanding the nuances of Missouri Nonqualified Defined Benefit Deferred Compensation Agreements can help you create a plan that meets your needs without incurring IRS penalties. If you're unsure, consulting uslegalforms can provide you with the resources to maintain compliance.

Nonqualified deferred compensation is a type of retirement savings arrangement that allows an employee to defer a portion of their income until a later date. This compensation can be advantageous in tax planning, as it may lower taxable income in the present. In the context of Missouri Nonqualified Defined Benefit Deferred Compensation Agreements, such plans offer unique benefits tailored to high earners looking for additional retirement savings options. To navigate the complexities, using a platform like uslegalforms can help ensure that your agreement is set up correctly.

To set up a non-qualified deferred compensation plan, you should first outline the plan's objectives and eligibility requirements. Next, draft a Missouri Nonqualified Defined Benefit Deferred Compensation Agreement that details the terms, including deferral amounts and payment schedules. It's essential to involve legal and tax professionals during this process to ensure compliance. You can also check out uslegalforms for templates and professional guidance in establishing your plan.

The 10-year rule for nonqualified deferred compensation states that participants must receive their deferred payments within ten years following the end of their service. This rule is crucial for Missouri Nonqualified Defined Benefit Deferred Compensation Agreements, as it helps ensure compliance with tax requirements. Understanding this rule can also aid in effective financial planning. For personalized assistance with your agreement, consider using the services of uslegalforms.

Target date funds are investment options offered within some deferred compensation plans that automatically adjust the asset mix based on the participant's retirement date. In Missouri, these funds can simplify investment decisions, as they aim for a specific retirement date with a risk profile that grows more conservative over time. When paired with a Missouri Nonqualified Defined Benefit Deferred Compensation Agreement, target date funds can enhance your investment strategy, allowing for a smoother transition into retirement.