Missouri Leased Personal Property Workform

Description

How to fill out Leased Personal Property Workform?

Are you presently in a position where you require documentation for both business or personal purposes almost every day.

There are numerous legitimate form templates accessible online, but finding ones you can trust isn't straightforward.

US Legal Forms offers a vast array of form templates, including the Missouri Leased Personal Property Workform, that are designed to comply with state and federal regulations.

Once you find the correct form, click on Buy now.

Select the pricing plan you want, provide the required information to create your account, and pay for your order with your PayPal or credit card. Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Leased Personal Property Workform template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/region.

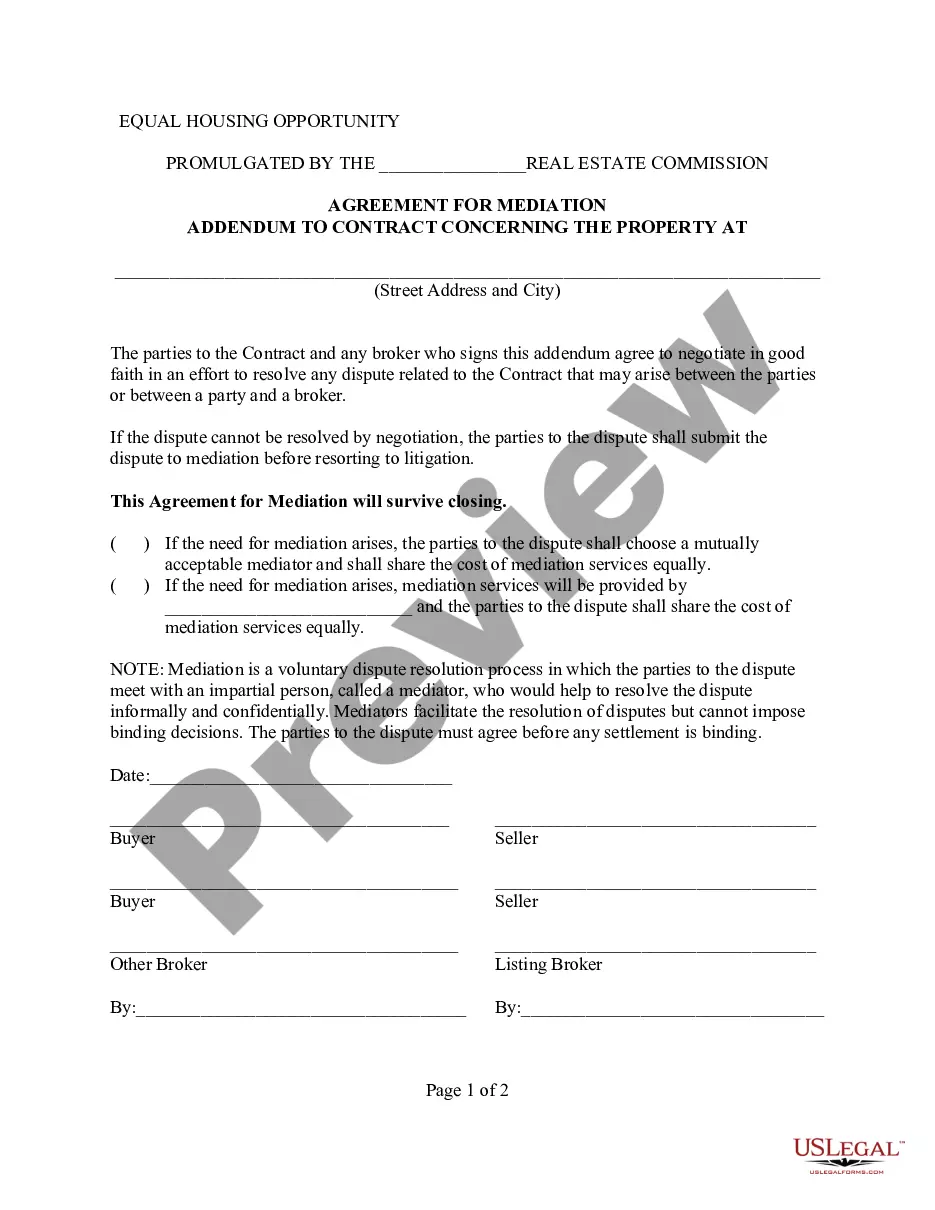

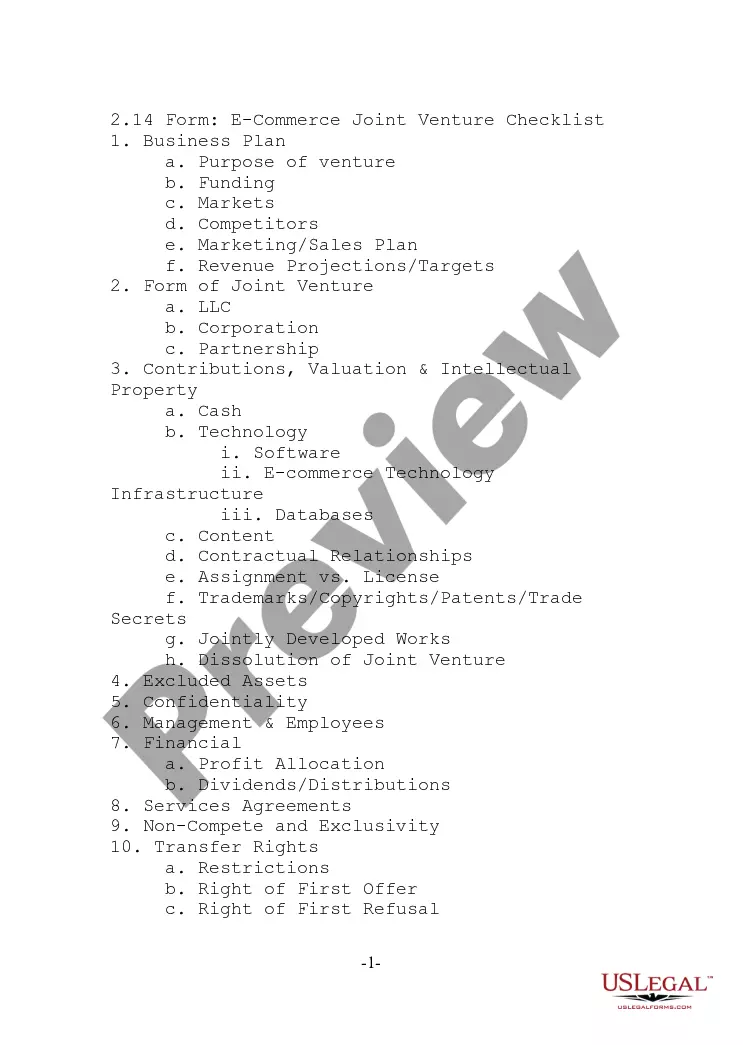

- Utilize the Preview button to review the form.

- Examine the details to confirm that you have selected the right form.

- If the form isn't what you're looking for, use the Search box to find the form that meets your needs and specifications.

Form popularity

FAQ

The personal property law in Missouri governs the ownership and rental of personal belongings, especially in leasing scenarios. This law provides guidelines on how leased personal property is treated and the rights of both lessors and lessees. To navigate this legal landscape, utilizing resources such as the Missouri Leased Personal Property Workform becomes essential. This form simplifies the process, enabling you to correctly outline terms and conditions that protect your interests.

To obtain a copy of your personal property tax receipt in Missouri, you can contact your local county assessor’s office or visit their website. They provide options to request a duplicate receipt online, by mail, or in person. Utilizing the Missouri Leased Personal Property Workform can simplify the process of tracking your assets and tax obligations. This ensures you have all necessary information when you contact your assessor.

In Missouri, personal property includes movable items that are not attached to land. Common examples are vehicles, furniture, equipment, and machinery. To effectively manage your personal asset transactions, the Missouri Leased Personal Property Workform is essential. This workform helps you keep precise records and ensures compliance with local regulations.

The 2643 form in Missouri is known as the Missouri Leased Personal Property Workform. This document is essential for reporting leased personal property to the local tax authorities. By accurately completing the Missouri Leased Personal Property Workform, you ensure compliance with state regulations and avoid potential penalties. For seamless filing, consider using platforms like US Legal Forms that provide templates and guidance.

Personal property tax on a leased vehicle is calculated based on the vehicle’s value and the local tax rate. The Missouri Leased Personal Property Workform plays a significant role in reporting this accurately to the authorities. It's important to remember that tax liability can vary by county. Always check local resources for specific rates and regulations.

The personal property assessment in Missouri is a process where residents declare their personal property for taxation purposes. This includes all leased personal property, making the Missouri Leased Personal Property Workform essential for compliance. Assessments are done annually, and the information provided determines your tax liability. Understanding this process is vital for accurate reporting.

Yes, you can file the Missouri Personal Property Tax Credit (mo.ptc) online. Utilizing the Missouri Leased Personal Property Workform simplifies this process. It guides you through the required information, making online filing more efficient. Ensure that you have all necessary documentation ready when you start the filing process.

In Missouri, certain items are exempt from personal property tax, including agricultural equipment and some machinery used for manufacturing. Understanding these exemptions is crucial for accurately completing the Missouri Leased Personal Property Workform. Check the Missouri Department of Revenue for a complete list of exemptions. This can help you avoid unnecessary taxes on your leased property.

Yes, you must report a leased car on your taxes. The Missouri Leased Personal Property Workform helps in evaluating your tax responsibility related to the leased vehicle. You need to include the annual lease payments as part of your gross income. Make sure to consult a tax professional for accurate filing.