Missouri Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

If you need to acquire, receive, or create official document templates, utilize US Legal Forms, the leading source of legal forms available online.

Make use of the site's straightforward and user-friendly search to locate the documents you seek. Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Utilize US Legal Forms to find the Missouri Equipment Lease Checklist in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Compete and obtain, and print the Missouri Equipment Lease Checklist with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to download the Missouri Equipment Lease Checklist.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/region.

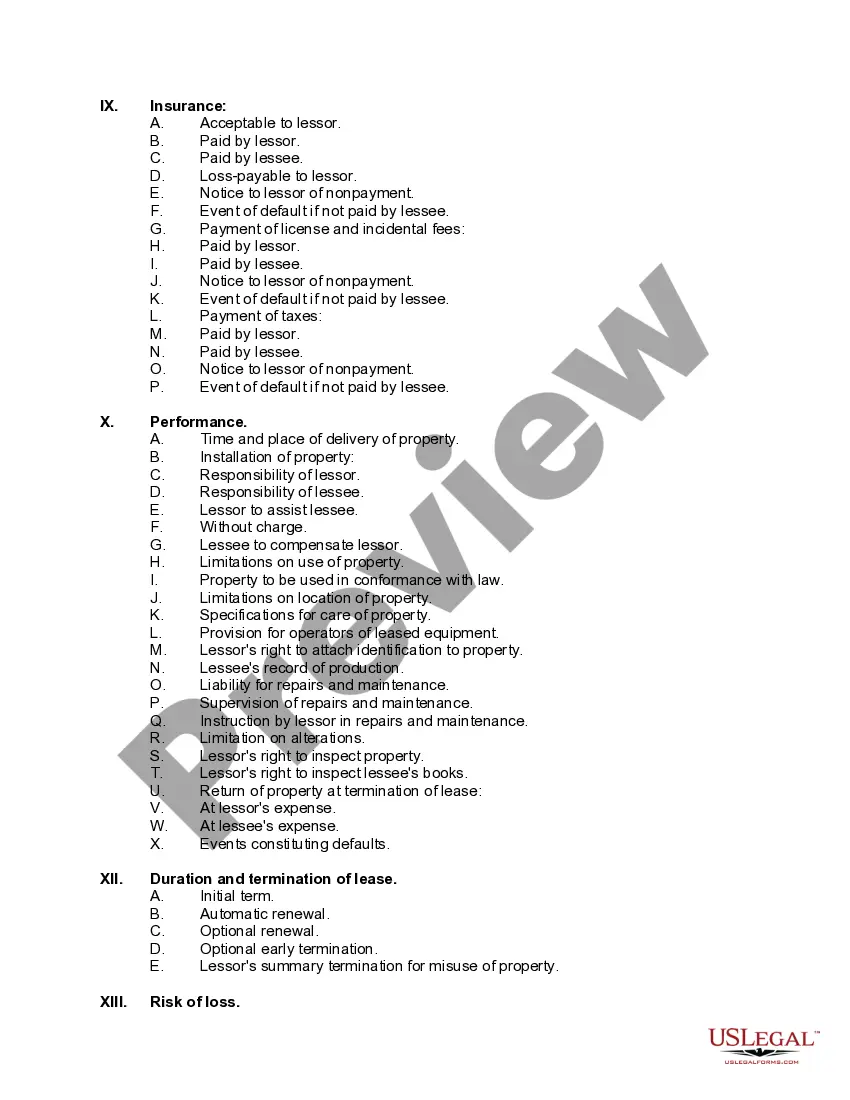

- Step 2. Use the Preview option to review the form’s contents. Be sure to check the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Select your preferred pricing plan and provide your details to create an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, modify, print, or sign the Missouri Equipment Lease Checklist.

Form popularity

FAQ

MO Form 2643 is the Missouri Corporate Franchise Tax Return. This form is essential for corporations that do business within the state, enforcing compliance with tax laws. For detailed instructions and requirements, the Missouri Equipment Lease Checklist can help you navigate the guidelines effectively.

Along with your Missouri tax return, you will need to include applicable schedules, forms like the MO-1040, and documentation for credits or deductions claimed. To make sure you don’t miss anything, the Missouri Equipment Lease Checklist can serve as a reliable resource for ensuring that all necessary forms accompany your return.

When submitting your tax return, you typically need various documents, including W-2 forms, 1099 forms, and any receipts that support deductions. The Missouri Equipment Lease Checklist is an excellent tool to find out which documents apply to your case, making your tax filing process smoother and more organized.

Form 2928 is utilized for reporting the Missouri apportionment of income for partnerships and corporations. It plays a crucial role in determining the allocation of business income across multiple states. To streamline this process, refer to the Missouri Equipment Lease Checklist to ensure you have the correct form filled out accurately.

To file your Missouri state taxes, you'll primarily need Form MO-1040, along with any supporting schedules or forms relevant to your situation. The Missouri Equipment Lease Checklist can guide you in gathering these forms efficiently, ensuring that you don’t overlook any critical paperwork.

In Missouri, most taxpayers typically use the 1040 form for personal income tax returns. However, the 1040A is available for simpler tax situations with specific income thresholds. It's advisable to consult the Missouri Equipment Lease Checklist to determine which form is best suited for your needs and circumstances.

Filing requirements in Missouri vary based on several factors, including your income type and amount. To ensure your compliance, refer to the Missouri Equipment Lease Checklist. This checklist will help you understand what documents you need to prepare, along with any deadlines that apply to your situation.

To find a lease-to-own option, explore local listings and online platforms that specialize in such arrangements. Additionally, you can refer to the Missouri Equipment Lease Checklist to understand the terms and conditions you should look for in a lease-to-own agreement. This approach will empower you to make well-informed decisions.

Finding someone's lease can be challenging due to privacy laws. Lease agreements are not public records, so accessing them usually requires consent from the parties involved. If you need guidance on how to manage your lease, consider referring to the Missouri Equipment Lease Checklist.

Lease agreements generally are not considered public records in Missouri. They typically remain private documents unless specific circumstances arise, such as court proceedings. Understanding this aspect is important, and the Missouri Equipment Lease Checklist can clarify what information to keep private.