Missouri Approval of performance goals for bonus

Description

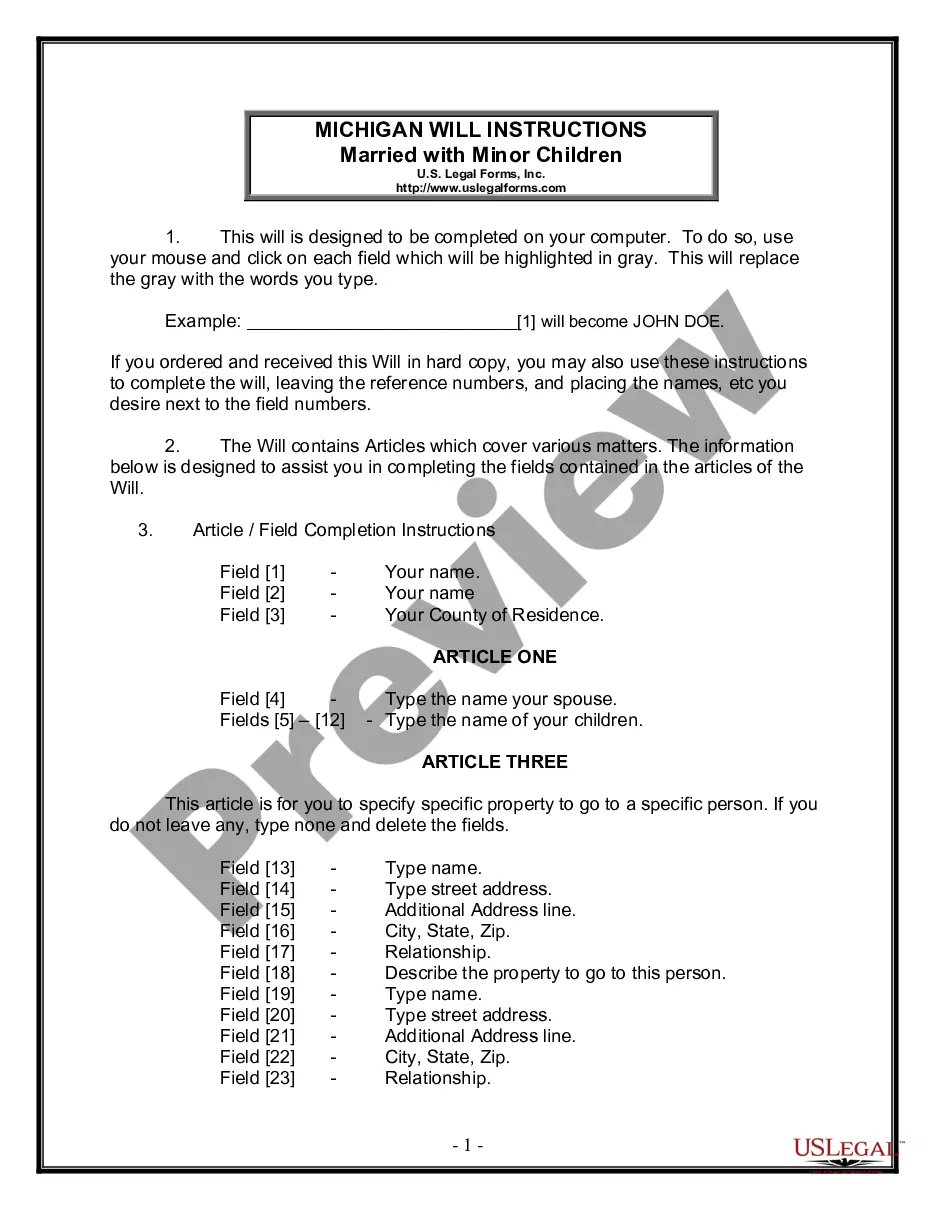

How to fill out Approval Of Performance Goals For Bonus?

If you need to complete, acquire, or produce authorized file themes, use US Legal Forms, the most important assortment of authorized kinds, that can be found on the web. Utilize the site`s basic and practical look for to find the documents you need. Numerous themes for company and individual functions are categorized by categories and suggests, or keywords. Use US Legal Forms to find the Missouri Approval of performance goals for bonus in just a number of clicks.

In case you are previously a US Legal Forms consumer, log in for your profile and then click the Download option to have the Missouri Approval of performance goals for bonus. You can also access kinds you previously delivered electronically inside the My Forms tab of your own profile.

If you are using US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for the proper town/land.

- Step 2. Use the Review option to examine the form`s information. Do not overlook to see the outline.

- Step 3. In case you are not happy together with the form, utilize the Look for field on top of the monitor to locate other variations of the authorized form design.

- Step 4. After you have located the form you need, click the Purchase now option. Choose the prices strategy you like and add your accreditations to sign up to have an profile.

- Step 5. Process the deal. You should use your credit card or PayPal profile to perform the deal.

- Step 6. Pick the structure of the authorized form and acquire it on the device.

- Step 7. Complete, change and produce or indication the Missouri Approval of performance goals for bonus.

Every authorized file design you buy is your own for a long time. You have acces to each form you delivered electronically with your acccount. Click the My Forms section and select a form to produce or acquire once again.

Remain competitive and acquire, and produce the Missouri Approval of performance goals for bonus with US Legal Forms. There are thousands of specialist and status-distinct kinds you can use for your personal company or individual needs.

Form popularity

FAQ

Missouri has no minimum or maximum amount of hours you have to work to be considered full-time or part-time. Instead, they leave that up to your employer to decide.

It may come as a surprise, but Missouri has no legal mandate regarding breaks during the workday. This essentially means that employers are not required to provide a break to their employees, even through an entire eight-hour shift. However, this doesn't mean it is not possible.

Wages. Reportable wages include gross payments plus the reasonable cash value of any goods or services which the employee receives for work performed in lieu of money. These are called ?in-kind? wages (meals receive special treatment). Bonuses, commissions, vacation pay, holiday pay and termination pay are wages.

Employers are required to pay a discharged employee all wages due at the time of dismissal. If not paid at that time, the employee should contact his or her former employer by certified mail return receipt requested, requesting wages that are due. The employer has seven days to respond to the written request.

Companies usually give annual bonuses when the organization has a successful year. For some companies, annual bonuses are a guarantee, though the amount may differ from year to year depending on the company's profits. Other companies only distribute annual bonuses after a particularly successful year.

The performance bonus A performance bonus is normally paid for good performance, and should be based as a percentage of the employee's salary or wages. A performance bonus can also be paid as a lump sum to a department, and split up in equal amounts to each employee in that department.

Deduction. An employer may deduct funds from an employee's wages for cash register shortages, damage to equipment, or for similar reasons. Deductions can be made from an employee's wages as long as the deductions do not take the employee's wages below the required minimum hourly wage rate.

Even if an employee is not guaranteed under contract to receive a performance bonus, they may be instituted at the direction of the employer. Performance bonuses may be instituted regularly, such as annually, biannually, or monthly.