Missouri Self-Employed Independent Contractor Questionnaire

Description

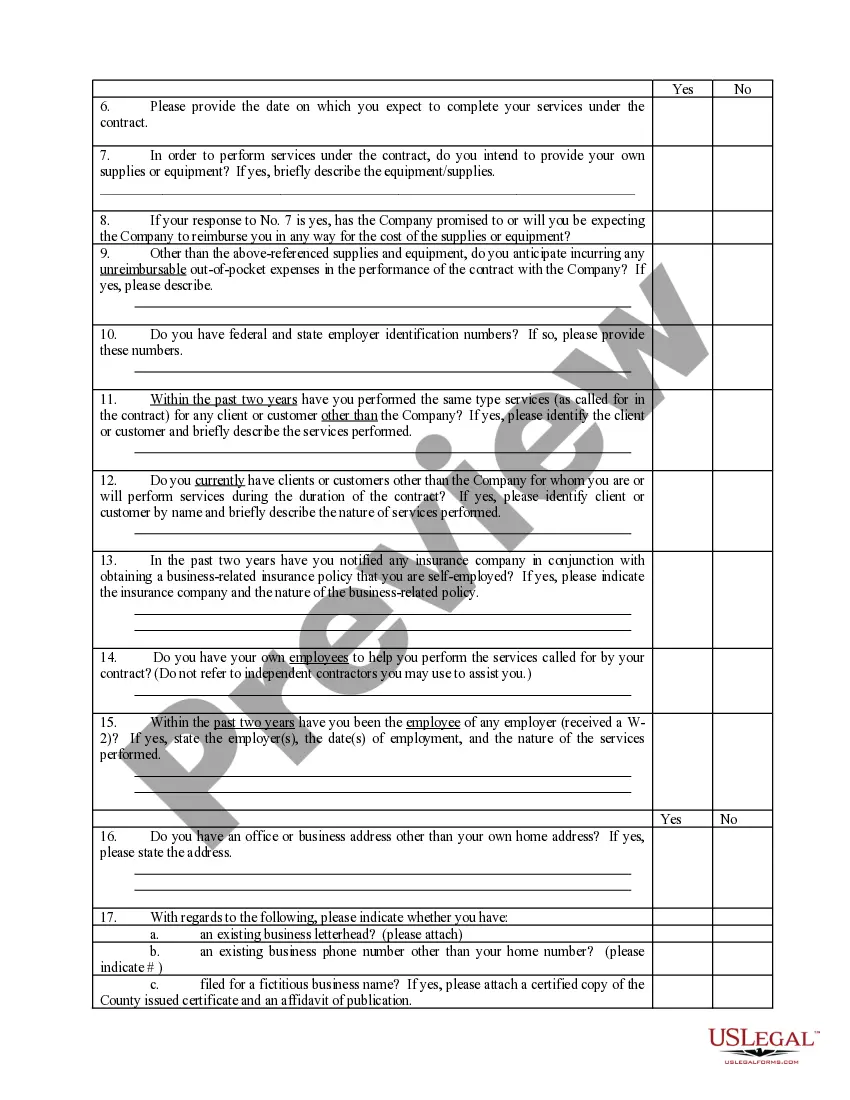

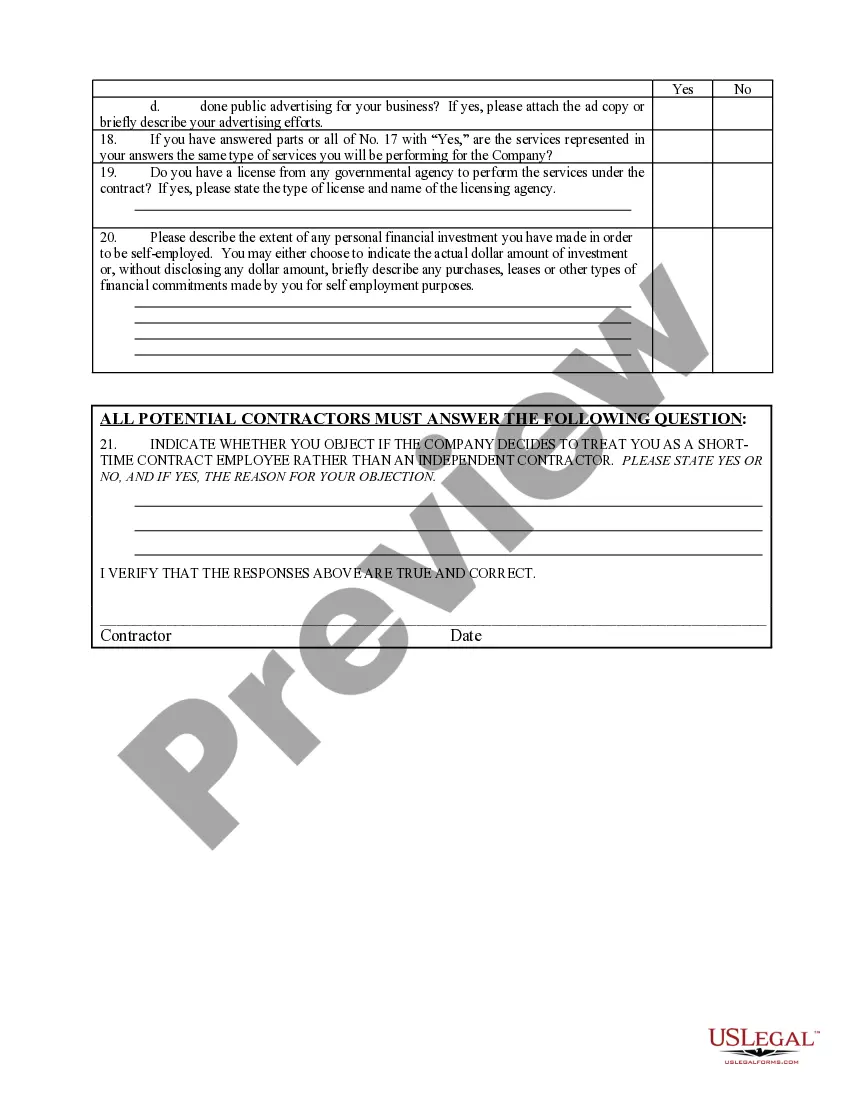

How to fill out Self-Employed Independent Contractor Questionnaire?

If you need to total, obtain, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to locate the documents you require.

A range of templates for both business and personal purposes are organized by categories and states, or by keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form template.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to sign up for an account.

- Utilize US Legal Forms to locate the Missouri Self-Employed Independent Contractor Questionnaire with just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to access the Missouri Self-Employed Independent Contractor Questionnaire.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Remember to read the information carefully.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

The Missouri Supreme Court has defined an independent contractor as "one who, exercising an independent employment, contracts to do a piece of work according to his own methods, without being subject to the control of his employer, except as to the result of his work" (Vaseleou v. St.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.