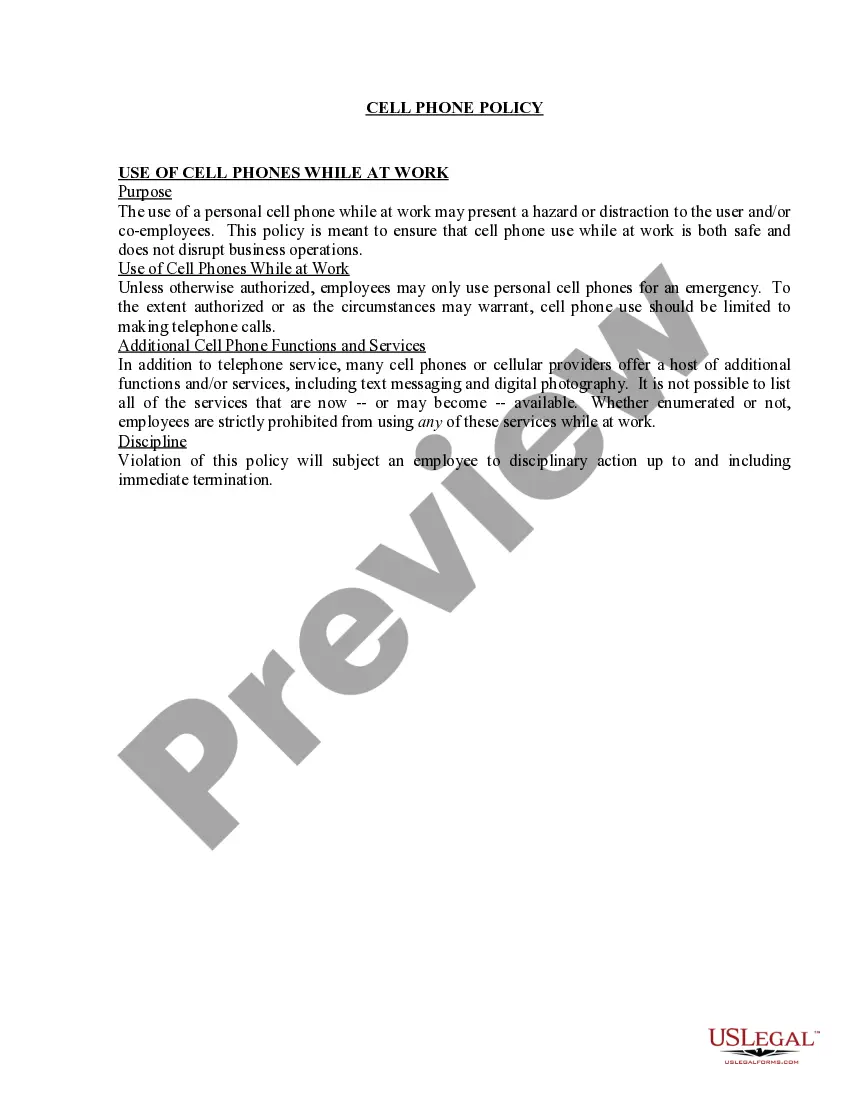

Missouri Employee Cell Phone Usage Policy

Description

How to fill out Employee Cell Phone Usage Policy?

Selecting the most suitable legal document template can be quite a challenge.

Of course, there are numerous templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The service provides a vast array of templates, such as the Missouri Employee Cell Phone Usage Policy, which can be used for both business and personal purposes.

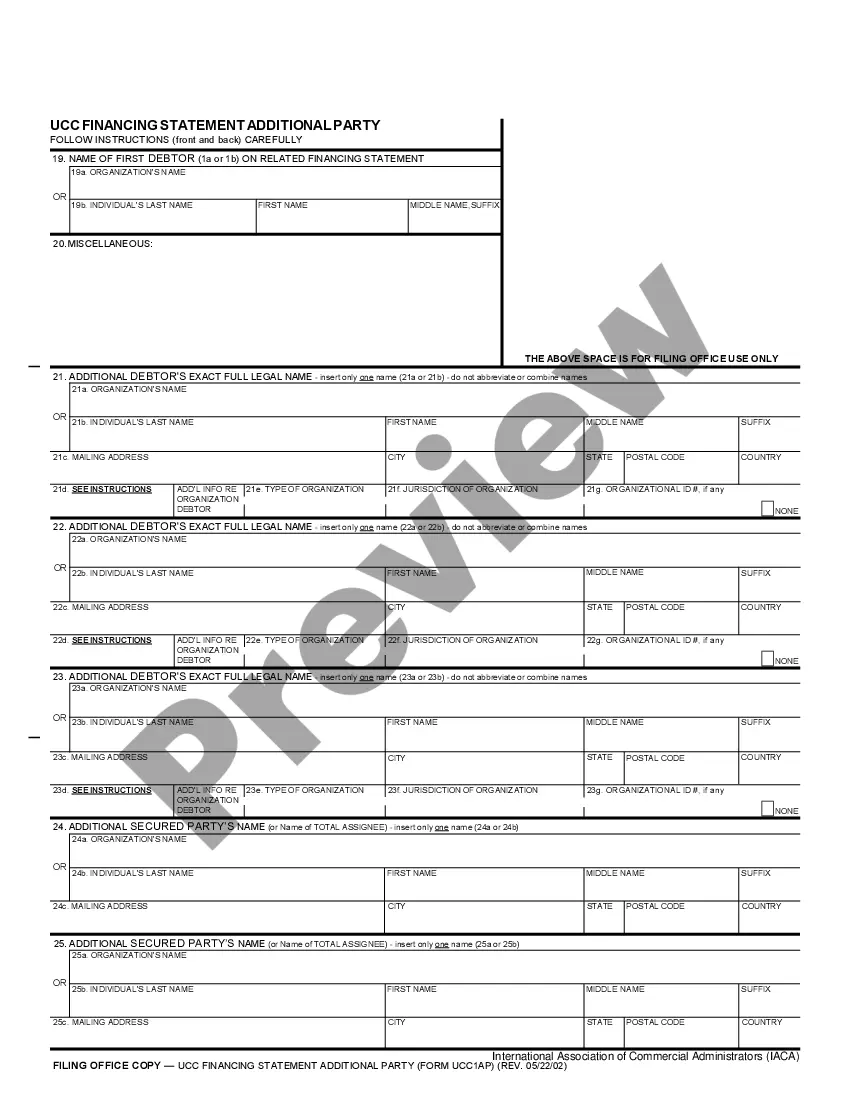

If the form does not meet your requirements, use the Search box to find the appropriate form. Once you are sure the form is suitable, click the Purchase now button to obtain the form. Select the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, edit, print, and sign the acquired Missouri Employee Cell Phone Usage Policy. US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize the service to obtain professionally-crafted documents that comply with state regulations.

- All the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Missouri Employee Cell Phone Usage Policy.

- Use your account to search for the legal forms you have acquired previously.

- Visit the My documents tab of your account to retrieve another copy of the document you need.

- If you are a first-time user of US Legal Forms, here are some simple steps for you to follow.

- First, ensure you have chosen the correct form for your area/county. You can view the form using the Preview button and examine the form details to confirm it suits your needs.

Form popularity

FAQ

1145.) In sum, employers must reimburse California employees (without distinction) for cell phone use when employees are required to use their personal cell phones for business purposes. Reimbursement is required even if the employee does not actually incur extra expenses as a result of his or her use.

What is the average mobile stipend provided to employees? Businesses and public sector organizations that provide mobile phone stipends for BYOD employees pay $36.13 per month on average, according to the Oxford Economics survey. This amounts to about $430 per year for each employee.

In California, when employees must use their personal cell phones for work-related calls, employers must pay some reasonable percentage of those phone bills even if employees incurred no extra expenses using their cell phone for work.

Employees who hold positions that include the need for a cell phone may receive a monthly cell phone stipend of $30 to compensate for business-related costs incurred when using their individually-owned cell phones. The stipend will be considered a non-taxable fringe benefit to the employee.

Federal law generally does not require employers to reimburse employees for cell phone expenses. Some states have laws that require employers to reimburse employees for the costs of necessary job expenses. This includes the business use of an employee's personal cell phone.

This article presents a tactical approach to creating a cell phone policy. Ultimately, we recommend that you use your employee expense workflow to reimburse each employee either $50 or $75 a month. This policy is IRS-compliant, scalable, and convenient for employees and finance admins.

This is not a universal rule and there is no legal precedent that requires them to do so. While you can refuse to use your own device for work, do so knowing that there is a chance that you will get into some type of trouble, including the possibility of termination.

If you need a cell phone for work, your employer can insist that you use your own. Many businesses prefer providing staff with company phones. If your employer swings the other way and requires you use your personal phone, the company may reimburse you.

In California, when employees must use their personal cell phones for work-related calls, employers must pay some reasonable percentage of those phone bills even if employees incurred no extra expenses using their cell phone for work.

First, a definition: A cell phone reimbursement stipend, or a cell phone allowance, is a sum of money given to employees for them to purchase on their cell phone plans. Further details on what they are: Stipends are often given out monthly.