Missouri Memorandum to Stop Direct Deposit

Description

How to fill out Memorandum To Stop Direct Deposit?

Are you currently in a situation where you require documents for both business or personal purposes on a daily basis.

There are numerous legal document templates accessible online, but finding reliable ones isn't straightforward.

US Legal Forms provides thousands of form templates, including the Missouri Memorandum to Cease Direct Deposit, which are designed to meet federal and state regulations.

Once you find the correct form, click Get now.

Choose the payment plan you prefer, fill out the required details to process your payment, and complete your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Missouri Memorandum to Cease Direct Deposit template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and verify that it corresponds to the correct city/region.

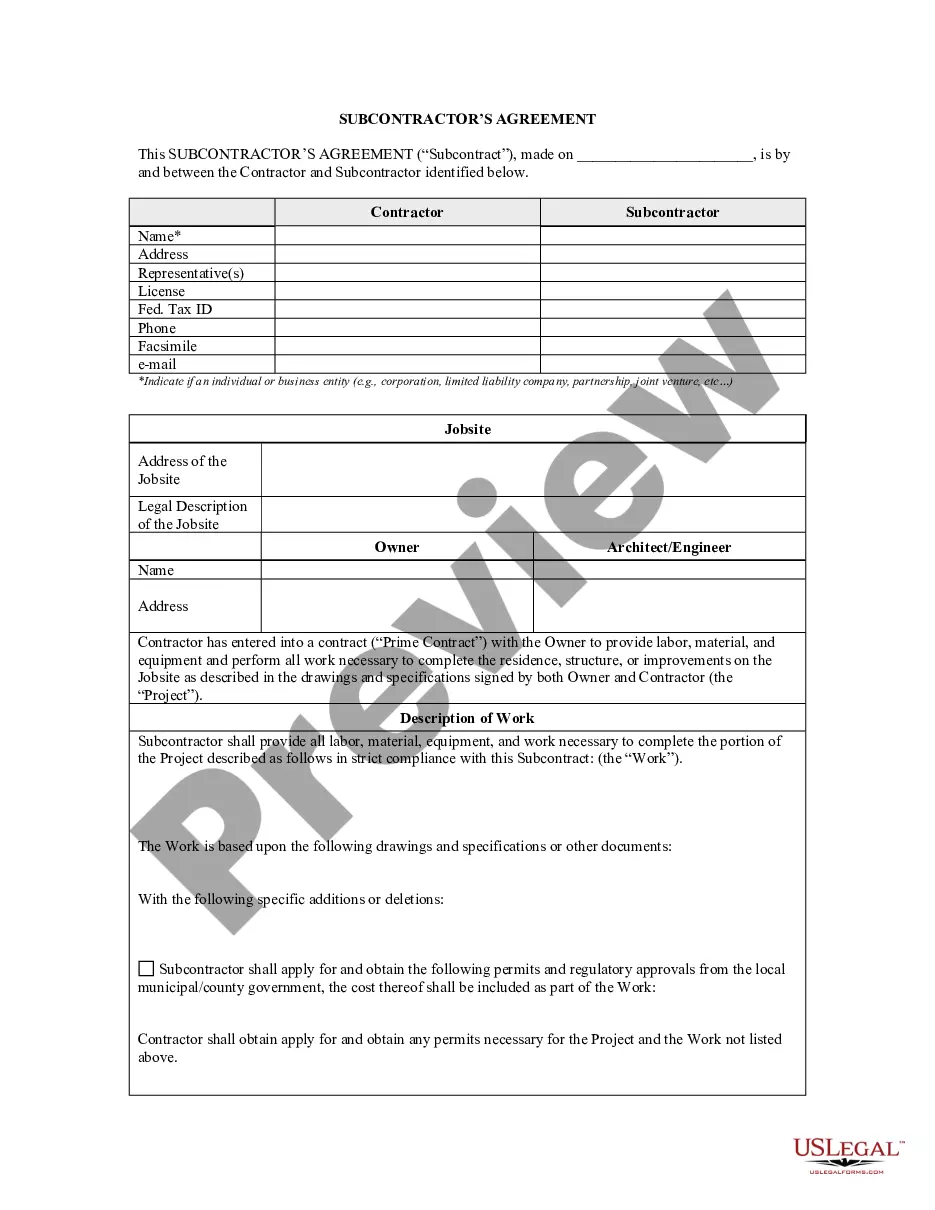

- Use the Preview button to review the form.

- Check the description to ensure you have selected the right form.

- If the form isn’t what you are looking for, utilize the Search field to locate the form that fits your needs and criteria.

Form popularity

FAQ

If you choose not to e-file, you may print any Missouri tax form from our website at dor.mo.gov/forms. Questions? Contact us at Income@dor.mo.gov or PropertyTaxCredit@dor.mo.gov.

The Individual Income Tax Return (Form MO-1040) is Missouri's long form. It is a universal form that can be used by any taxpayer. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form.

Louis Refund? It is a Form used when part of the previous year's state refund is in your federal income. So if you entered a 1099-G in your federal 1040 for a state refund you received last year, this forms subtracts it out for the state return.

The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax years 2021 and forward. For those who previously filed MO-1040P, you will now file Form MO-1040 and attach Form MO-PTS and Form MO-A, if applicable. See MO-1040 Instructions for more details.

Form MO-A - 2020 Individual Income Tax Adjustments.

The parent who cares for a child most of the time (called the "custodial parent") tends to receive the child support payments, because the law assumes that the custodial parent already spends money directly on the child. The parent with less parenting time (called the "non-custodial parent") usually makes the payments.

Form MO-NRI: Form MO-NRI is used when a nonresident elects to pay taxes on the percentage of income (Missouri income percentage) earned in Missouri, or when a part-year resident chooses to pay taxes on the percentage of income earned while a Missouri resident.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

1. The Missouri adjusted gross income of a resident individual shall be the taxpayer's federal adjusted gross income subject to the modifications in this section.

Filing Requirementsyou are a resident and have less than $1,200 of Missouri adjusted gross income; you are a nonresident with less than $600 of Missouri income; or. your Missouri adjusted gross income is less than the amount of your standard deduction plus your personal exemption.