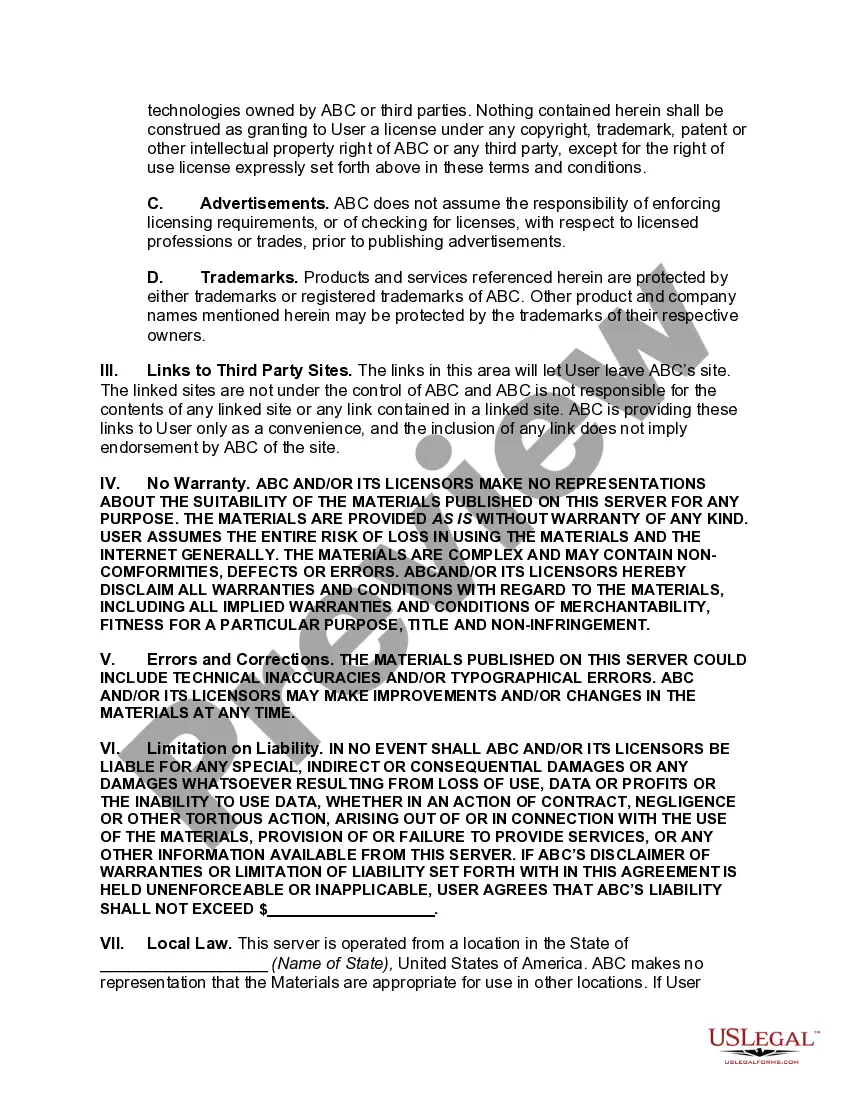

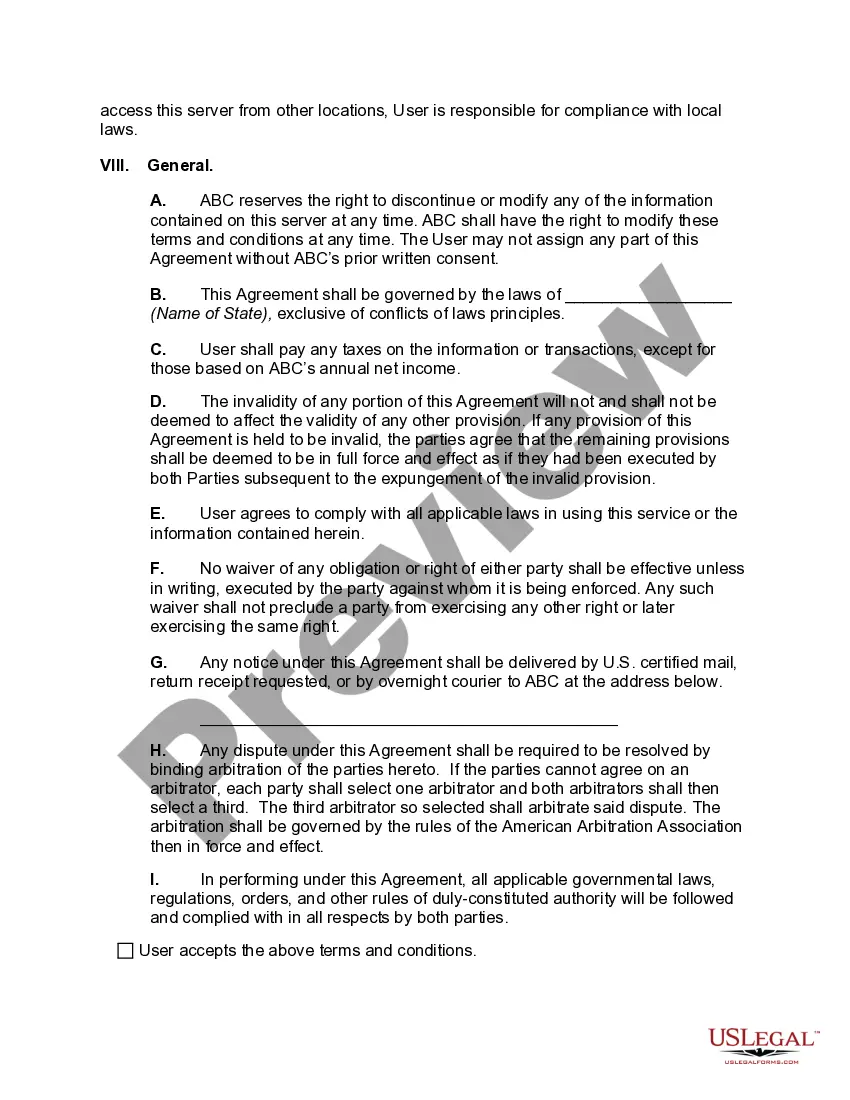

Missouri End User Online Services Terms and Conditions

Description

How to fill out End User Online Services Terms And Conditions?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a broad selection of legal document templates available for download or printing.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Missouri End User Online Services Terms and Conditions in seconds.

If you already hold a subscription, Log In and retrieve the Missouri End User Online Services Terms and Conditions from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make adjustments. Fill out, edit, print, and sign the downloaded Missouri End User Online Services Terms and Conditions. Each format you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Missouri End User Online Services Terms and Conditions with US Legal Forms, the most extensive catalog of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the content of the form.

- Check the form description to confirm you have chosen the right document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once satisfied with the form, affirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your information to sign up for an account.

Form popularity

FAQ

If you do not know your Missouri Tax Identification Number or PIN, contact the Department of Revenue at (573) 751-3505. Please note this information is considered confidential and will only be provided to a listed officer or Power of Attorney.

Form MO-NRI: Form MO-NRI is used when a nonresident elects to pay taxes on the percentage of income (Missouri income percentage) earned in Missouri, or when a part-year resident chooses to pay taxes on the percentage of income earned while a Missouri resident.

Mail the application and bond to: Missouri Department of Revenue, P.O. Box 357, Jefferson City, MO 65105-0357 or call (573) 751-5860 for assistance (TTY (800) 735-2966). For sales, use and withholding tax facts, sales tax rates, and FAQs, visit our website at dor.mo.gov/taxation/business/.

Effective next year, sellers on certain online platforms like Etsy and eBay will receive a 1099-K if their sales are at least $600, down from the current threshold of $20,000 with a minimum of 200 transactions. Not all online sales are taxable, whether you receive tax form or not.

Create a MyTax Missouri Account Please accept the MyTax Missouri usage terms to register for a portal account. You will need to provide your First and Last Name, Phone Number, and e-mail address to create a user ID for the Missouri Department of Revenue's MyTax Missouri.

Mike Parson has signed a bill to require online retailers to collect sales taxes on purchases made by Missouri residents. June 30, 2021, at a.m. JEFFERSON CITY, Mo. (AP) Gov.

Form MO-A - 2020 Individual Income Tax Adjustments.

Effective Jan. 1, 2023, remote sellers with more than $100,000 of taxable sales into Missouri, in the previous calendar year or current calendar year, must collect the state 4.225% vendor use tax rate and any applicable local use taxes.

The basic rule for collecting sales tax from online sales is: If your business has a physical presence, or nexus, in a state, you must collect applicable sales taxes from online customers in that state. If you do not have a physical presence, you generally do not have to collect sales tax for online sales.

Missouri Governor Mike Parson signed into law legislation that will require online retailers to collect sales taxes on purchases made by Missouri residents. That means, that Missourians who shop online will pay the state sales tax of 4.2%. Missouri is the last state with a sales tax to approve such a requirement.