Missouri Receipt and Withdrawal from Partnership

Description

How to fill out Receipt And Withdrawal From Partnership?

Are you presently facing the situation where you often require documents for business or personal purposes.

There are many authentic document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of form templates, such as the Missouri Receipt and Withdrawal from Partnership, designed to comply with federal and state regulations.

Select the payment plan you prefer, complete the necessary details to create your account, and pay for your order using PayPal or a credit card.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Missouri Receipt and Withdrawal from Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is appropriate for the specific state/county.

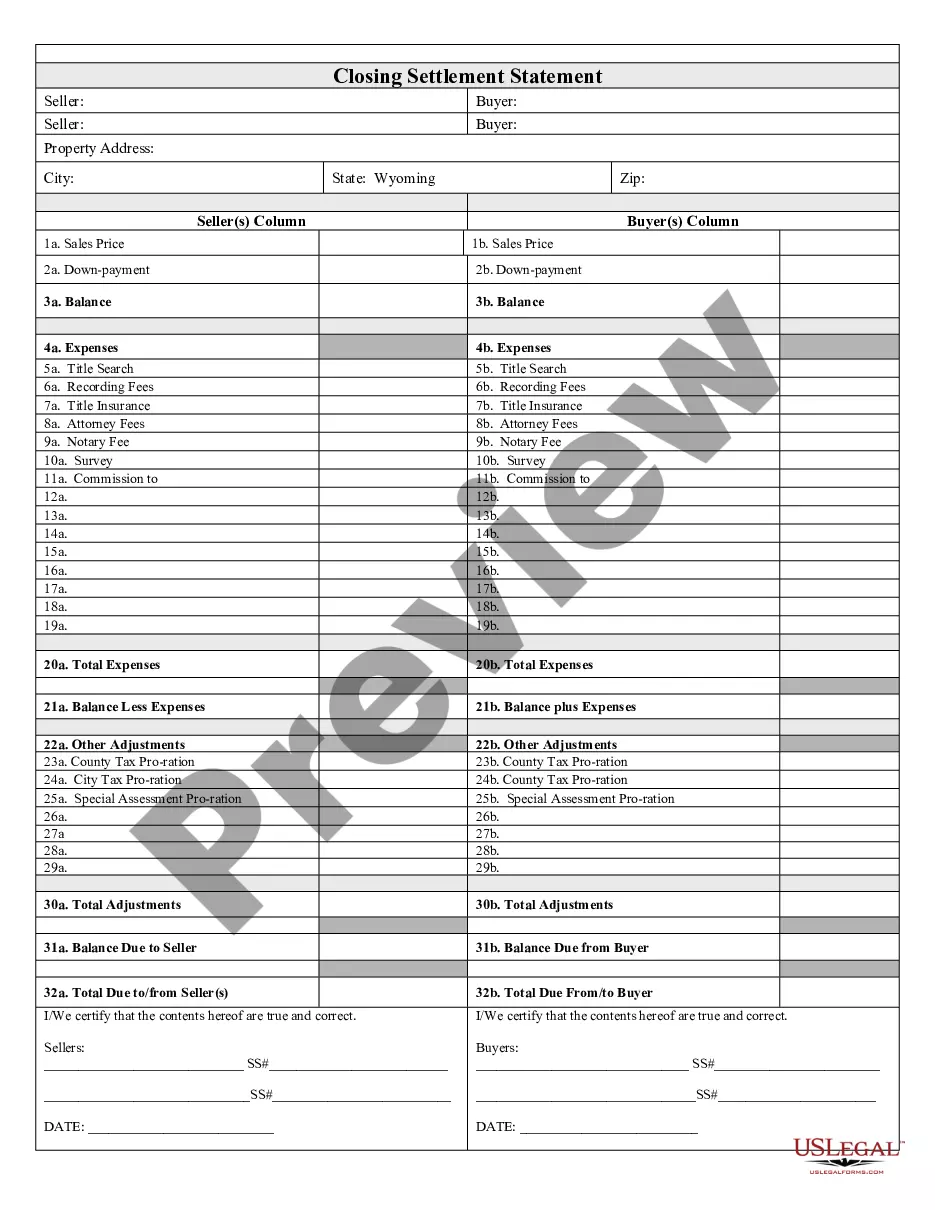

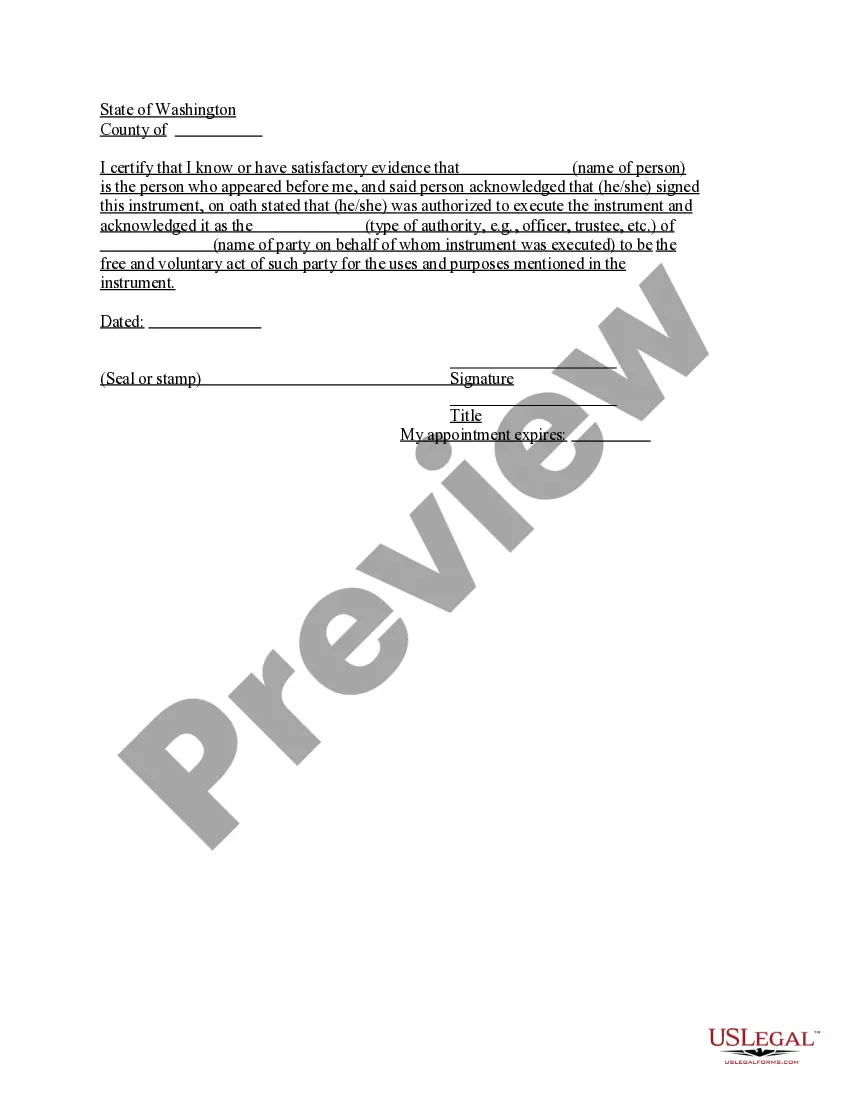

- Use the Preview button to review the form.

- Check the description to ensure you have chosen the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and criteria.

- Once you find the correct form, click Purchase now.

Form popularity

FAQ

The State of Missouri, like almost every other state, has a corporation income tax. In Missouri, the corporate tax is a flat 6.25% of Missouri taxable income. If your LLC is taxed as a corporation you'll need to pay this tax.

Yes, you'll need to attach a copy of your Federal Tax Return with your Missouri Tax Return.

The state use tax rate is 4.225%. Cities and counties may impose an additional local use tax. The amount of use tax due on a transaction depends on the combined (local and state) use tax rate in effect at the Missouri location where the tangible personal property is stored, used or consumed.

In Missouri there is no separate tax form required for partnerships, but the state may require an informational return (also known as an annual report) from some partnerships.

Include only Missouri withholding as shown on your Forms W-2, 1099, or 1099-R. Do not include withholding for federal taxes, local taxes, city earnings taxes, other state's withholding, or payments submitted with Form MO-2NR or Form MO-2ENT. Attach a copy of all Forms W-2 and 1099.

For all types of partnership, the general rule is that tax is not payable by the partnership itself but by each partner. Each partner's share of the partnership income is added to his or her other taxable income. The partner pays tax on the total of his or her earnings, including their share of the partnership profits.

What is Missouri partnership tax and who must file? A Missouri Partnership Return of Income (Form MO-1065) must be filed if Federal Form 1065 is required to be filed and the partnership has (1) a partner that is a Missouri resident or (2) any income derived from Missouri sources, Section 143.581, RSMo.

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

This is your Missouri resident credit. Enter the amount on Form MO-1040, Line 29Y and 29S. (If you have multiple credits, add the amounts on Line 11 from each MO-CR). Your total credit cannot exceed the tax paid or the percent of tax due to Missouri on that part of your income. Information to complete Form MO-CR.

Complete Forms MO-1040 and MO-A, pages 1 and 2, using corrected figures. Attach all schedules along with a copy of your federal changes and your Federal Form 1040X. If you are due a refund, mail to: Department of Revenue, P.O. Box 500, Jefferson City, MO 65106-0500.