This form is a trust used to provide supplemental support for a disabled beneficiary without loss of government benefits. It may be revocable or irrevocable, as the funds are contributed by a third party, and not the beneficiary. The Omnibus Budget Reconciliation Act of 1993 established the supplemental needs trusts.

Missouri Supplemental Needs Trust for Third Party - Disabled Beneficiary

Description

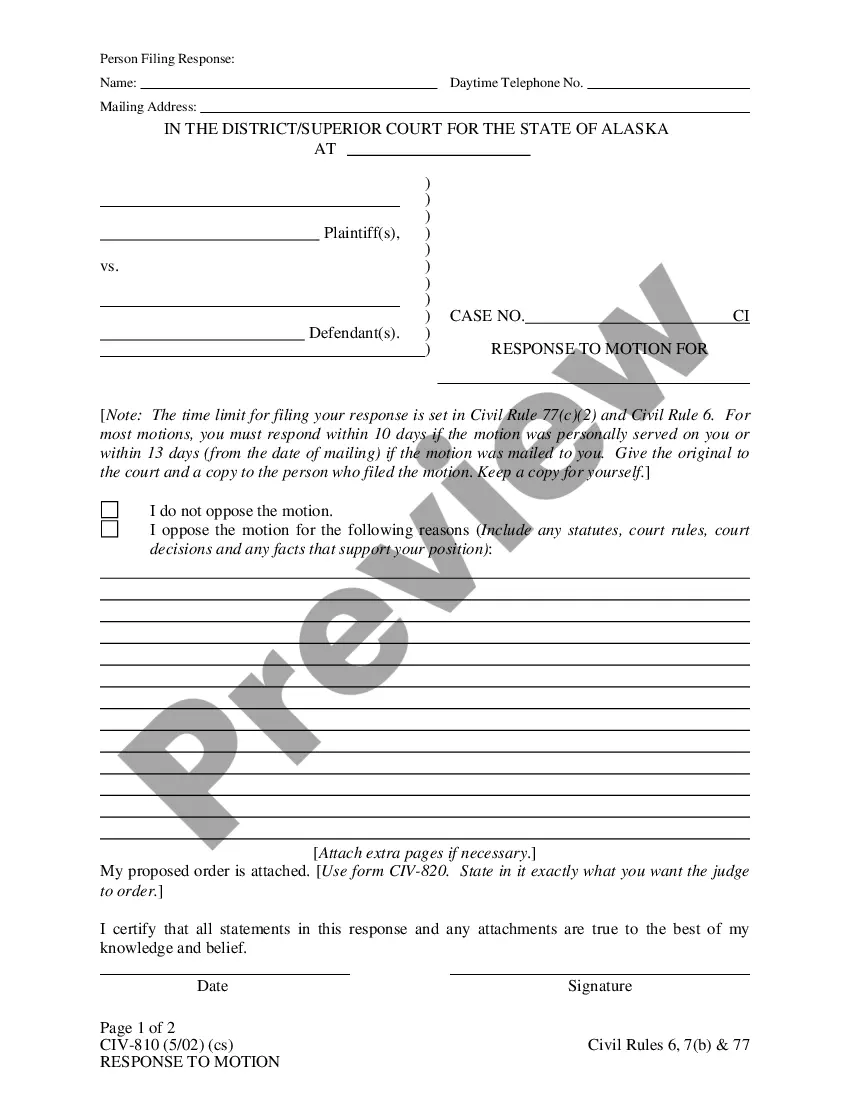

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

Are you in a situation where you frequently require documents for either business or personal reasons.

Many legal document templates are available online, but finding reliable versions can be challenging.

US Legal Forms provides thousands of form templates, including the Missouri Supplemental Needs Trust for Third Party - Disabled Beneficiary, designed to comply with both federal and state regulations.

Once you have the correct form, click on Get now.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Supplemental Needs Trust for Third Party - Disabled Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the needed form and verify it's for the correct area/region.

- Use the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form isn't what you're seeking, utilize the Search field to find a form that satisfies your needs and criteria.

Form popularity

FAQ

A disabled trust, also known as a supplemental needs trust, is crafted specifically to benefit individuals with disabilities. This trust allows assets to be held for the beneficiary while maintaining their eligibility for essential government benefits. In the context of Missouri Supplemental Needs Trust for Third Party - Disabled Beneficiary, setting up a disabled trust can provide financial stability and security for the beneficiary’s future needs, ensuring they receive proper care and support.

Choosing the right trustee for a special needs trust is vital for the effective management of the trust's funds. An ideal trustee should be someone knowledgeable about the needs of the disabled beneficiary, understand the nuances of the Missouri Supplemental Needs Trust for Third Party - Disabled Beneficiary, and act in the best interest of the beneficiary. Many families select a trusted family member, a friend, or even a professional fiduciary who has experience managing such trusts.

A special disability trust, often referred to as a supplemental needs trust, is designed to provide financial support for individuals with disabilities. It allows funds to be used for various needs without jeopardizing eligibility for government assistance. This type of trust is particularly beneficial in the context of Missouri Supplemental Needs Trust for Third Party - Disabled Beneficiary, as it helps ensure that the disabled beneficiary receives necessary care and benefits without financial constraints.

Setting up a third party special needs trust is a straightforward process. First, consult with an attorney experienced in Missouri Supplemental Needs Trust for Third Party - Disabled Beneficiary. They will help you draft the trust document, ensuring it meets legal requirements and aligns with your beneficiary's needs. Finally, fund the trust to provide financial support for the disabled beneficiary without affecting their eligibility for government benefits.

To set up a trust fund for a disabled person, you can create a Missouri Supplemental Needs Trust for Third Party - Disabled Beneficiary that allows for maximum benefits without affecting government assistance. Start by selecting a reliable trustee who understands the needs of the beneficiary. Next, draft the trust agreement to include crucial details about the fund's management and distributions. Finally, fund the trust properly to ensure it meets legal standards and supports the disabled individual's quality of life.

Setting up a disability trust, specifically a Missouri Supplemental Needs Trust for Third Party - Disabled Beneficiary, involves several key steps. First, you need to choose a trustee who will manage the trust according to its terms. Next, you must draft the trust document, which should outline the purpose of the trust and how the funds will be used. Finally, you should fund the trust with assets or contributions that will benefit the disabled individual while ensuring compliance with any legal requirements.

A supplemental needs trust is not necessarily classified as a qualified disability trust. While both serve to protect assets and support disabled individuals, they function under different legal structures. A qualified disability trust may provide specific tax benefits that a supplemental needs trust does not. To fully understand the distinctions, it's highly advisable to consult with a legal expert familiar with Missouri laws regarding trusts.

Similar to the previous answer, there are a few disadvantages associated with establishing a third-party special needs trust. One must consider the ongoing administrative costs, including legal and trustee fees. Moreover, if funds are not allocated correctly, it could impact the effectiveness of the trust itself. Working with a knowledgeable specialist can help navigate these potential issues and optimize the trust's setup.

While a Missouri Supplemental Needs Trust for Third Party - Disabled Beneficiary offers numerous benefits, there are some disadvantages to consider. For instance, the trust must be managed carefully to comply with legal requirements and fiduciary duties. Additionally, the funds cannot be used for basic living expenses, which can create limitations. However, these drawbacks can be mitigated with proper planning and guidance from an experienced advisor.

party special needs trust functions by holding assets for a disabled beneficiary while preserving their eligibility for government assistance. The trust is funded by family or friends without directly benefiting the disabled individual until needed. When properly established, the assets can be used for supplementary needs, such as education, medical expenses, or recreational activities. This structure allows the disabled beneficiary to enjoy a better quality of life without losing vital benefits.