Missouri Debt Agreement

Description

How to fill out Debt Agreement?

Are you in a situation where you require documents for various companies or particular purposes nearly every business day.

There are numerous legal form templates accessible online, yet finding ones that you can trust is challenging.

US Legal Forms offers an extensive array of form templates, such as the Missouri Debt Agreement, designed to comply with both federal and state regulations.

Once you locate the correct form, click Purchase now.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Debt Agreement template.

- If you do not have an account yet and wish to start using US Legal Forms, follow these steps.

- Select the form you need and verify that it corresponds to the correct city/state.

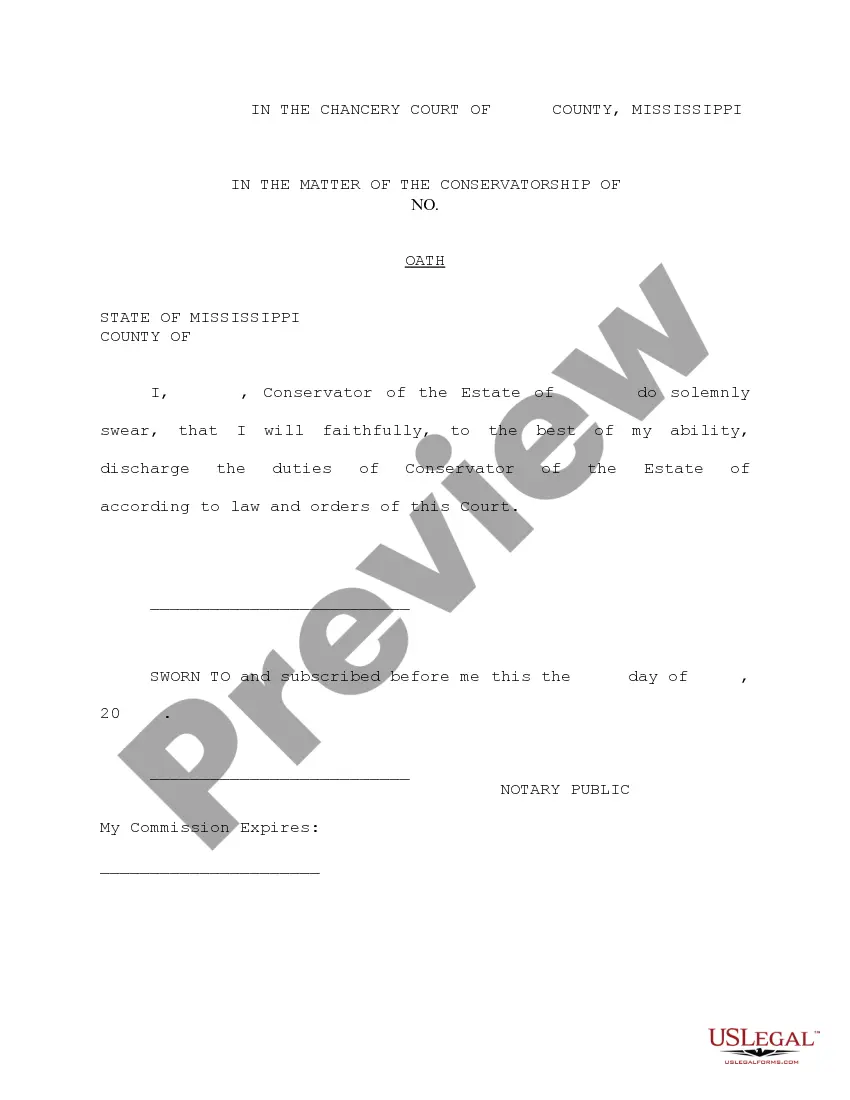

- Utilize the Preview button to review the form.

- Check the description to ensure that you have chosen the correct form.

- If the form does not meet your needs, utilize the Search field to find the form that suits your criteria.

Form popularity

FAQ

The debt collection law in Missouri comprises various statutes that govern how creditors can collect debts. The law aims to protect consumers by ensuring transparent communication and limiting harassment, especially under a Missouri Debt Agreement. Understanding these laws helps you navigate financial challenges more confidently. If you need clarification, platforms like UsLegalForms provide resources to help you understand your rights.

Debts in Missouri typically become uncollectible after a five-year period. This time frame applies to most debts, allowing consumers to regain control over their financial situation through strategies like a Missouri Debt Agreement. It is important to know the specific type of debt you have, as some can have different limitations. Knowing these rules can empower you to manage your debts effectively.

The Missouri Debt Collection Act regulates how creditors can communicate with debtors and the responsibilities they must follow. This legislation promotes fair practices during the collection of debts, including those addressed under a Missouri Debt Agreement. By understanding this Act, consumers can protect themselves from aggressive or unlawful collection tactics. It is crucial to be aware of your rights when dealing with debt collectors.

In Missouri, a debt becomes uncollectible after five years, but this period can depend on the type of debt. Creditors may pursue collections for this duration under the Missouri Debt Agreement. Once this time elapses, you can dispute the debt more effectively, and it generally must not be reported on your credit history. Knowing this timeline can be beneficial in managing your debts.

A debt agreement can be a beneficial solution for those struggling with multiple debts, as it allows for negotiated settlement terms. With a Missouri Debt Agreement, you can often reduce the overall amount owed, making repayment more manageable. However, it’s crucial to fully understand the implications and ensure it aligns with your overall financial goals. Professional counsel is advisable to navigate the specifics.

In Missouri, debt collectors can legally pursue old debt for a maximum of 5 years for most debt types. This period is defined by the statute of limitations, which starts from the date of your last payment or acknowledgment of the debt. If you find yourself facing such situations, a Missouri Debt Agreement may provide a structured way to handle the repayment process. Seeking expert guidance can aid in navigating this landscape.

Yes, a 10-year-old debt can still be collected in Missouri, depending on the type of debt and the statute of limitations. While the general limit for most debts in Missouri is typically 5 years, some debts may fall under different rules. It’s important to understand your rights and the specifics of any Missouri Debt Agreement you might consider to address old debts. Consulting a professional can help clarify your options.

In Missouri, responsibility for debts can depend on whether the debts were incurred during the marriage. Generally, any shared debt is subject to division as part of the divorce settlement. A Missouri Debt Agreement can clarify these obligations and provide a structured approach to addressing debts. It's important to address these issues thoroughly to protect your own financial interests.

While Missouri law mandates equitable distribution of marital assets, it does not guarantee a strict 50/50 split. Instead, the court considers various factors, such as the duration of the marriage and contributions of each spouse. A Missouri Debt Agreement may help in defining asset division, particularly when debts are involved. It’s vital to consult legal resources to understand your specific situation.

In Missouri, marital property is subject to division during a divorce. The husband may be entitled to half of the marital assets, which include anything acquired during the marriage. If there's a Missouri Debt Agreement involved, it can assist in clarifying the separation of debts and assets. Understanding your rights under Missouri law can ensure a fair outcome.