Missouri Agreement to Compromise Debt

Description

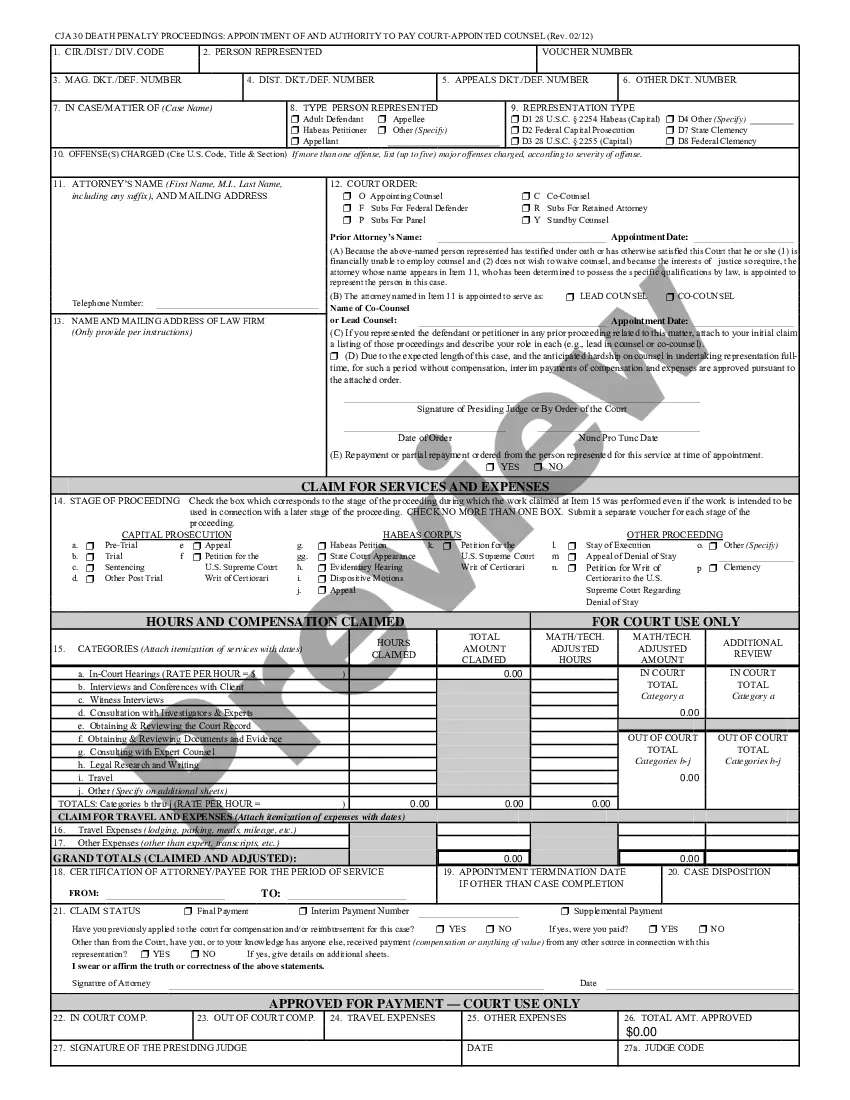

How to fill out Agreement To Compromise Debt?

Are you presently in the situation where you require documents for both business or personal purposes nearly every day.

There are numerous legitimate document templates accessible online, but identifying ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the Missouri Agreement to Compromise Debt, which are crafted to comply with federal and state regulations.

Select the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, just Log In.

- Once logged in, you can download the Missouri Agreement to Compromise Debt template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Review option to evaluate the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Lookup area to find the form that meets your needs.

- When you discover the correct form, click Get now.

Form popularity

FAQ

To file an offer in compromise with the IRS or Missouri Department of Revenue, start by gathering all required documents related to your income, assets, and debts. Next, use Form 656 for the IRS or the appropriate state form to submit your Missouri Agreement to Compromise Debt. After submission, be prepared to provide additional information if requested, and be patient as the review process can take several months.

Receiving a letter from the Missouri Department of Revenue may indicate outstanding debt or a need for clarification on your tax records. This could relate to your Missouri Agreement to Compromise Debt process if you are seeking to resolve unpaid taxes. Reacting promptly is crucial, as it allows you to address any issues and negotiate your obligations effectively.

When considering a Missouri Agreement to Compromise Debt, it's essential to understand its potential downsides. One major concern is the impact on your credit score, as an accepted offer may stay on your record. Additionally, the IRS may require that you keep up with your tax obligations for five years after acceptance. Failure to do so could lead to the reinstatement of your original tax obligation.

Your Missouri tax refund may have been intercepted due to unpaid debts such as back taxes or child support. The state utilizes this measure to recover funds owed. If this situation affects you, a Missouri Agreement to Compromise Debt could offer a path toward resolving your financial obligations.

In Missouri, tax liens are placed on properties when property taxes remain unpaid. This means that the state has a legal claim to the property to recover owed taxes. If you're facing a tax lien, consider using a Missouri Agreement to Compromise Debt to negotiate a more manageable settlement.

The redemption period for tax liens in Missouri is generally one year from the date the property was sold at a tax sale. During this period, you can reclaim your property by settling the tax debt, including additional fees. Exploring a Missouri Agreement to Compromise Debt can be instrumental in navigating this process.

A tax lien in Missouri remains valid for 10 years unless it is resolved earlier. During this time, the lien secures the state’s claim against your property until you settle your tax obligations. If you have concerns about a tax lien, a Missouri Agreement to Compromise Debt might help you manage your debts effectively.

In Missouri, the state can collect back taxes for up to 10 years from the date the tax was due. This timeframe allows them to pursue collection through various means, including liens and garnishments. Using a Missouri Agreement to Compromise Debt, you may find relief by negotiating a settlement on your outstanding debt before the 10-year period ends.

To set up a payment plan for Missouri state taxes, you need to contact the Missouri Department of Revenue directly. They will guide you through the necessary steps to establish a manageable payment option tailored to your situation. Additionally, the Missouri Agreement to Compromise Debt may offer further assistance if a payment plan does not meet your needs. Taking this step can help you regain control over your financial obligations.