Missouri Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions

Description

How to fill out Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

Are you currently in a situation where you require documents for either business or personal reasons on a regular basis.

There are numerous legal document templates accessible online, but finding reliable versions is not easy.

US Legal Forms offers a vast array of form templates, such as the Missouri Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions, which can be tailored to meet local and federal requirements.

Once you find the right form, click on Purchase now.

Select the payment plan you prefer, fill out the necessary information to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Missouri Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and verify that it is for the correct city/region.

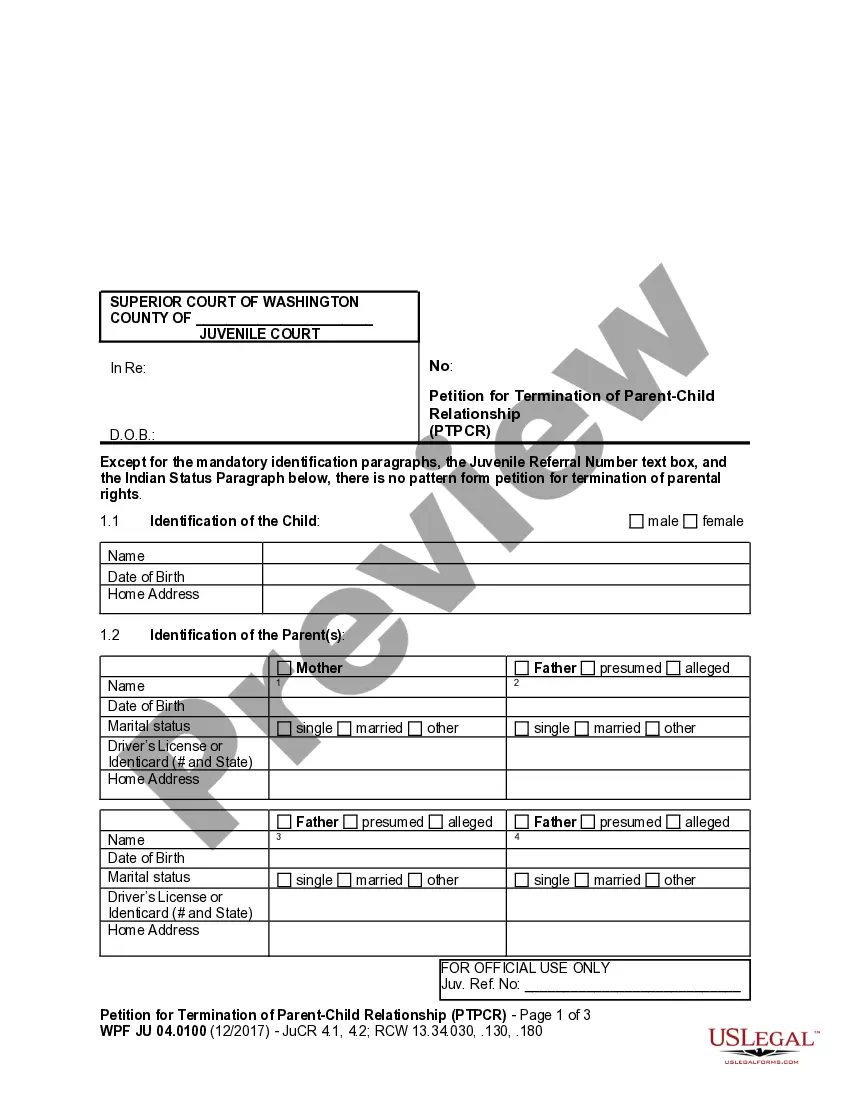

- Use the Preview button to review the form.

- Check the details to make sure you have selected the correct form.

- If the form does not meet your expectations, use the Search section to find the form that fits your needs and requirements.

Form popularity

FAQ

Yes, there is a statute of limitations on debt in Missouri. This period varies depending on the type of debt, but for most cases, it is five years. After this time, creditors may still seek payment, but they cannot sue to enforce the debt. Knowing the statute of limitations can help you better understand your rights and obligations, especially when dealing with promissory notes.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Corporate resolutions are formal declarations of major decisions made by a corporate entity. The resolutions are used to determine which corporate officers are legally able to sign contracts, make transfers or assignments, sell or lease real estate, and make other important decisions that bind the corporation.

A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances. Corporate resolutions provide a paper trail of the decisions made by the board and the executive management team.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

The exact form of a corporate resolution is determined by your state's business services department, but in general, a corporate resolution must include:The date of the resolution.The state in which the corporation is formed and under whose laws it is acting.More items...?

In general, under the federal Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.

A granted authority that will put a firm into debt that is passed by a resolution of stock holders.

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

A corporate resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of your corporation. If this information isn't specifically covered in your Articles of Incorporation or bylaws, your bank may require a resolution.