Missouri Revocable Living Trust for Single Person

Description

How to fill out Revocable Living Trust For Single Person?

US Legal Forms - one of the most substantial collections of legal documents in the USA - offers a wide selection of legal form templates that you can obtain or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the Missouri Revocable Living Trust for Single Person in moments.

If you have an account, Log In to obtain the Missouri Revocable Living Trust for Single Person from the US Legal Forms library. The Acquire button will appear on every document you view.

Once you are satisfied with the form, confirm your choice by clicking on the Purchase now button. Then, select the pricing plan you prefer and provide your information to register for the account.

Complete the purchase. Use your Visa or Mastercard or PayPal account to finalize the transaction.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are new to US Legal Forms, here are simple steps to get started.

- Ensure you have selected the correct form for your area/region.

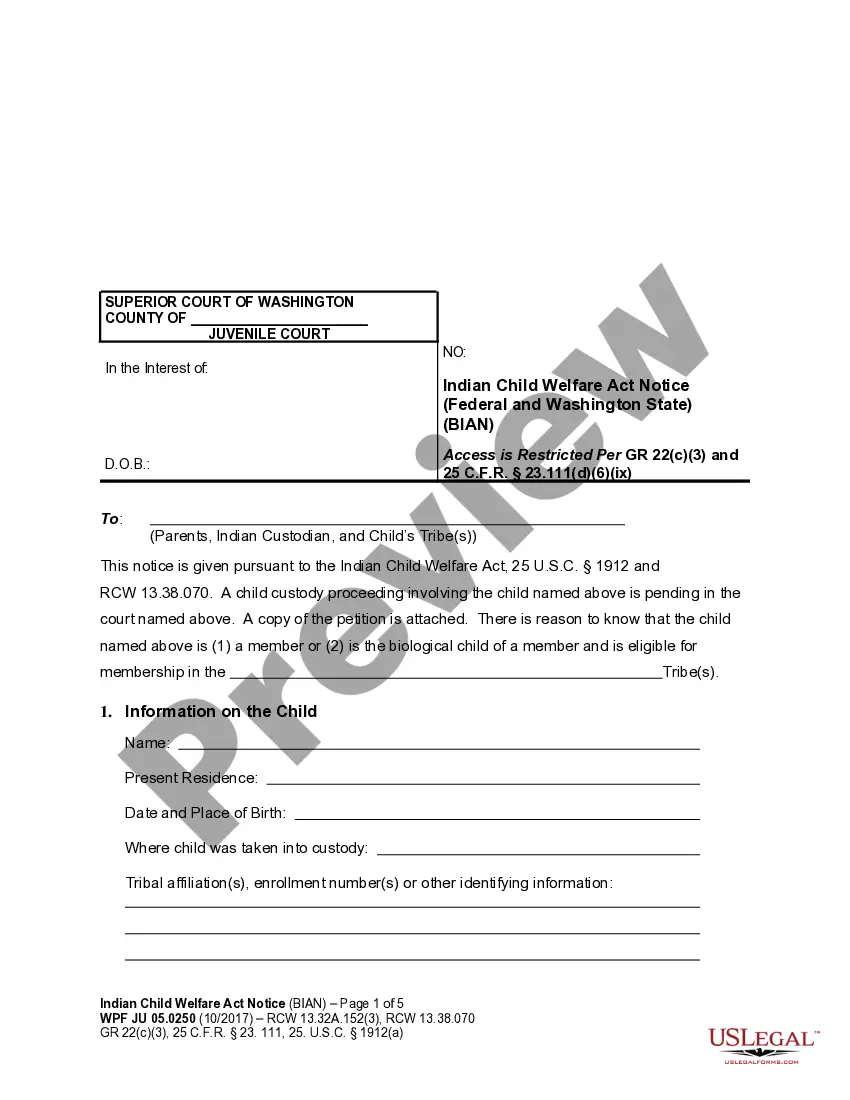

- Click on the Preview button to review the content of the form.

- Read the form description to confirm you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search area at the top of the screen to find one that does.

Form popularity

FAQ

Yes, a Missouri Revocable Living Trust for Single Person can certainly have a single beneficiary. Trusts are designed to provide flexibility, and you can designate one individual as the sole beneficiary. This arrangement allows you to transfer your assets to that person efficiently, ensuring they receive your inheritance directly. Additionally, this type of trust offers benefits such as avoiding probate and maintaining privacy regarding your estate.

Certain assets may not be ideal for inclusion in a Missouri Revocable Living Trust for Single Person. For example, life insurance policies may need to be structured differently, and personal possessions that do not hold significant value can be better managed outside of a trust. It’s important to evaluate your assets carefully and consider how a trust fits into your overall estate plan.

Some assets, like retirement accounts, may have restrictions on being placed directly into a trust immediately. This includes IRA and 401(k) accounts, which often require special considerations. However, assets such as property or bank accounts can generally be transferred without issue. It is advisable to consult a financial planner to navigate these complexities properly within a Missouri Revocable Living Trust for Single Person.

Setting up a Missouri Revocable Living Trust for Single Person involves a few essential steps. First, draft the trust document, detailing the terms and naming a trustee. Next, transfer ownership of your assets into the trust. Utilizing services like USLegalForms can simplify this process, ensuring you comply with Missouri laws.

Typically, certain government benefits, like Social Security or veterans' benefits, cannot be placed in a trust. Additionally, funds that exist solely for a specific purpose, such as an educational savings account, may not qualify. It’s essential to manage your funds wisely and understand how a Missouri Revocable Living Trust for Single Person can help you align your financial strategies.

Using a Missouri Revocable Living Trust for Single Person can be beneficial for managing your bank accounts. Placing your bank accounts in a trust can help avoid probate, allowing for a smoother transition of assets. Moreover, it offers flexibility, as you can modify the trust at any time while retaining control over your funds. Consider consulting with a professional to ensure proper setup.

Yes, you can write your own will in Missouri and have it notarized, but ensure it meets all legal requirements. Although not required for validity, notarization can make the process smoother by preventing disputes upon your death. A meticulously prepared will complements your Missouri Revocable Living Trust for Single Person, ensuring all your estate planning needs are addressed.

In Missouri, a trust operates by allowing you to manage your assets during your lifetime and dictate their distribution upon your passing. A Missouri Revocable Living Trust for Single Person offers flexibility, as you can alter it as your circumstances change. This type of trust avoids probate, allowing for a smoother transition of assets to your beneficiaries.

Setting up a Missouri Revocable Living Trust for Single Person involves several steps. Start by clearly defining your goals and identifying your assets. Next, create the trust document, ensuring it includes all necessary provisions. Finally, transfer your assets into the trust, which is often best done with the help of a legal professional.

You can write your own Missouri Revocable Living Trust for Single Person, but it's wise to proceed with caution. While many people choose to draft their own trusts, the guidance of a legal professional can ensure that your trust abides by state laws and truly reflects your wishes. Doing so can prevent issues later on, making professional assistance a valuable option.