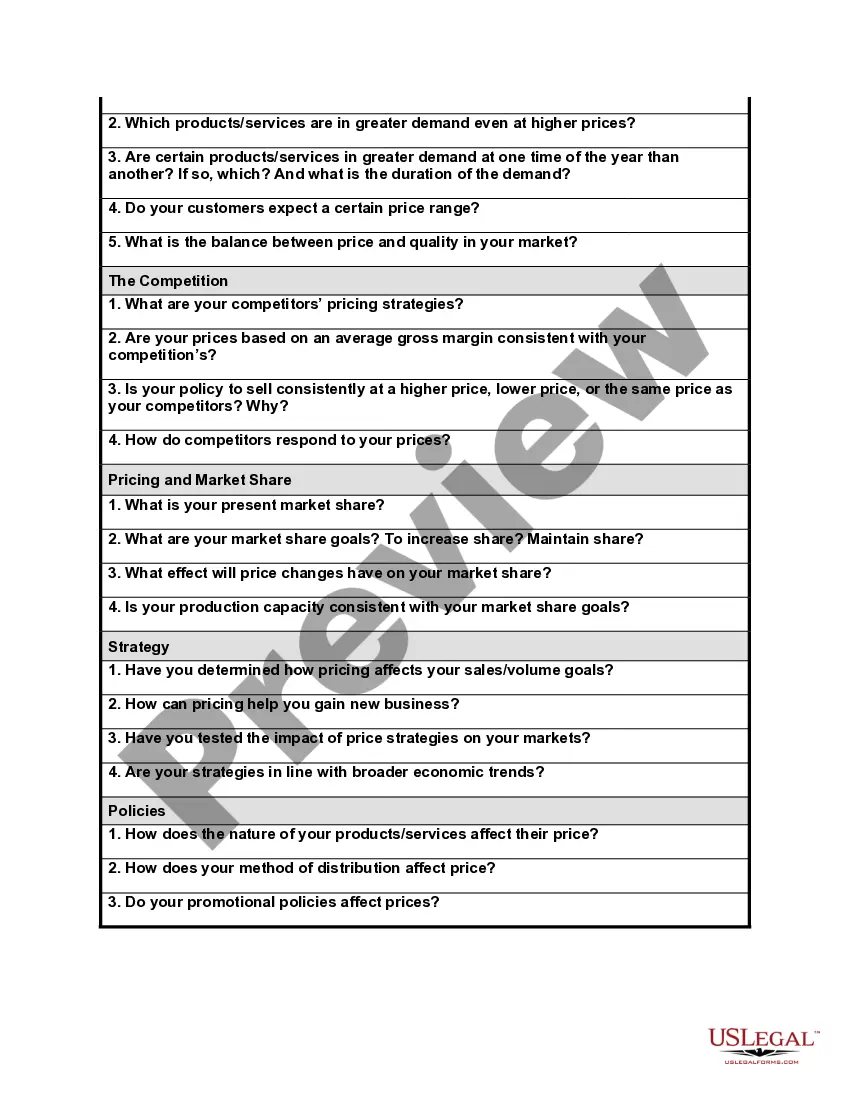

Idaho Price Setting Worksheet

Description

How to fill out Price Setting Worksheet?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Idaho Price Setting Worksheet in just seconds.

If the form doesn’t meet your needs, use the Search field at the top of the screen to find the one that does.

Once you’re satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred pricing plan and provide your information to register for an account.

- If you already have a subscription, Log In and download the Idaho Price Setting Worksheet from the US Legal Forms library.

- The Download button will be available on every form you view.

- You can access all previously downloaded forms in the My documents tab of your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview option to review the content of the form.

Form popularity

FAQ

The grocery tax credit offsets the sales tax you pay on groceries throughout the year. For most Idaho residents it averages $100 per person. You must be an Idaho resident to be eligible, and you may be able to claim a grocery credit for your dependents, too.

What is a Sales Tax Decalculator?Step 1: take the total price and divide it by one plus the tax rate.Step 2: multiply the result from step one by the tax rate to get the dollars of tax.Step 3: subtract the dollars of tax from step 2 from the total price.Pre-Tax Price = TP (TP / (1 + r) x rTP = Total Price.More items...

The Idaho standard deduction amounts are the same as the federal standard deduction. For 2020: Single or married filing separately $12,400. Head of household $18,650.

You can make payments:In person at our Boise office or at our other offices. (We recommend you don't leave cash in a drop box.)Online by credit/debit card or e-check. The credit cards we accept are: American Express, Discover, MasterCard, and Visa.

Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

The latest changes, signed into law in late 2017 via the Tax Cuts and Jobs Act, limit the deduction to no more than $10,000, regardless of whether the taxpayer claims state income or state sales tax. Previously no cap was imposed.

The current Idaho sales tax rate is 6%. The use tax rate is the same as the sales tax rate.

To request a plan for income tax without a TAP account:Go to tax.idaho.gov/gototap.Scroll down to Payments area and click Request a Payment Plan.Enter your information. When asked for the Letter ID, look on a letter we've sent you in the past two years.Complete and submit your request.

If you are an individual, you may qualify to apply online if: Long-term payment plan (installment agreement): You owe $50,000 or less in combined tax, penalties and interest, and filed all required returns. Short-term payment plan: You owe less than $100,000 in combined tax, penalties and interest.

Unlike the default pass-through tax situation, when an LLC elects to be taxed as a corporation, the company itself must file a separate tax return. The State of Idaho, like almost every other state, taxes corporation income. In Idaho, corporation income generally is taxed at a flat 7.4% rate plus an additional $10.