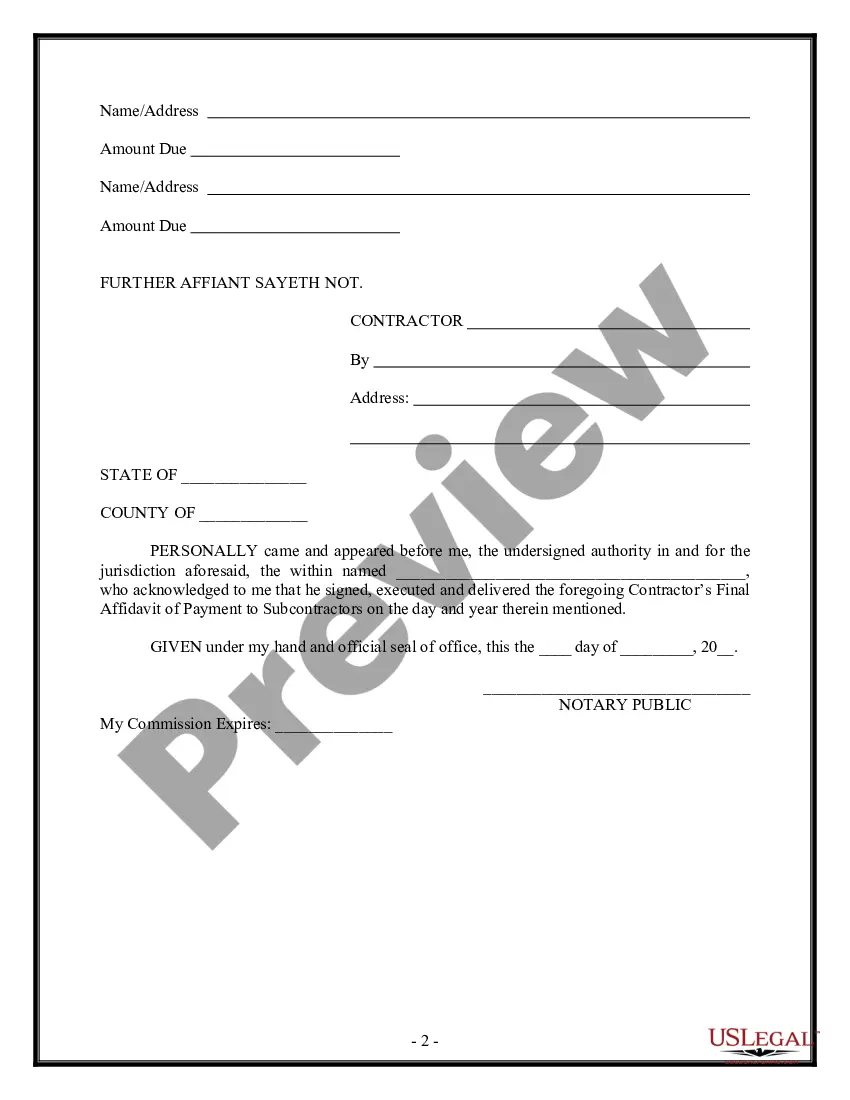

Missouri Contractor's Final Affidavit of Payment to Subcontractors

Description

How to fill out Contractor's Final Affidavit Of Payment To Subcontractors?

US Legal Forms - one of the most prominent collections of legal documents in the USA - offers a broad selection of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal needs, organized by type, state, or keywords.

You can obtain the most recent editions of forms like the Missouri Contractor's Final Affidavit of Payment to Subcontractors in just a few minutes.

Read the form details to make sure you have chosen the right form.

If the form doesn't align with your needs, use the Search section at the top of the screen to find one that does.

- If you currently possess a membership, Log In and download the Missouri Contractor's Final Affidavit of Payment to Subcontractors from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you begin.

- Ensure you have selected the correct form for your state/region.

- Click the Preview button to review the form's content.

Form popularity

FAQ

Federal Laws The US Prompt Payment Act requires federal construction contracts to include a prompt payment clause. This requires the prime to pay subcontractors for satisfactory performance within seven days of receipt of payment.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

A general rule of contributory negligence is that a main contractor is not liable for the negligence of its independent subcontractor. There are some exceptions to this rule, including: The main contractor had actual knowledge that the sub-contractor's work had been done in a foreseeably dangerous way and condoned it.

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.

Missouri does not require that lien waivers be notarized in order to be effective. However, there are specific signature requirements that apply to residential jobs.

How to get paid (faster) on every construction projectGet licensed.Write a credit policy.Prequalify potential customers.Get the contract in writing.Collect information about the property and other parties.Track your deadlines.Send Preliminary Notice.Submit Detailed Pay Applications or Invoices.More items...?

A lien waiver is a written instrument by which a contractor, subcontractor, material supplier or other potential lien claimant fully or partially relinquishes its right to assert a lien against another's property.

Payment timing The contractor must pay subcontractors within 15 days of being paid by the owner or face potential penalty interest of 1.5 percent per month.

The waivers need not be notarized. It is sufficient that it is in writing. The taxpayer is bound to submit his duly executed waiver to the officers of the Bureau and to retain his copy of the accepted waiver.