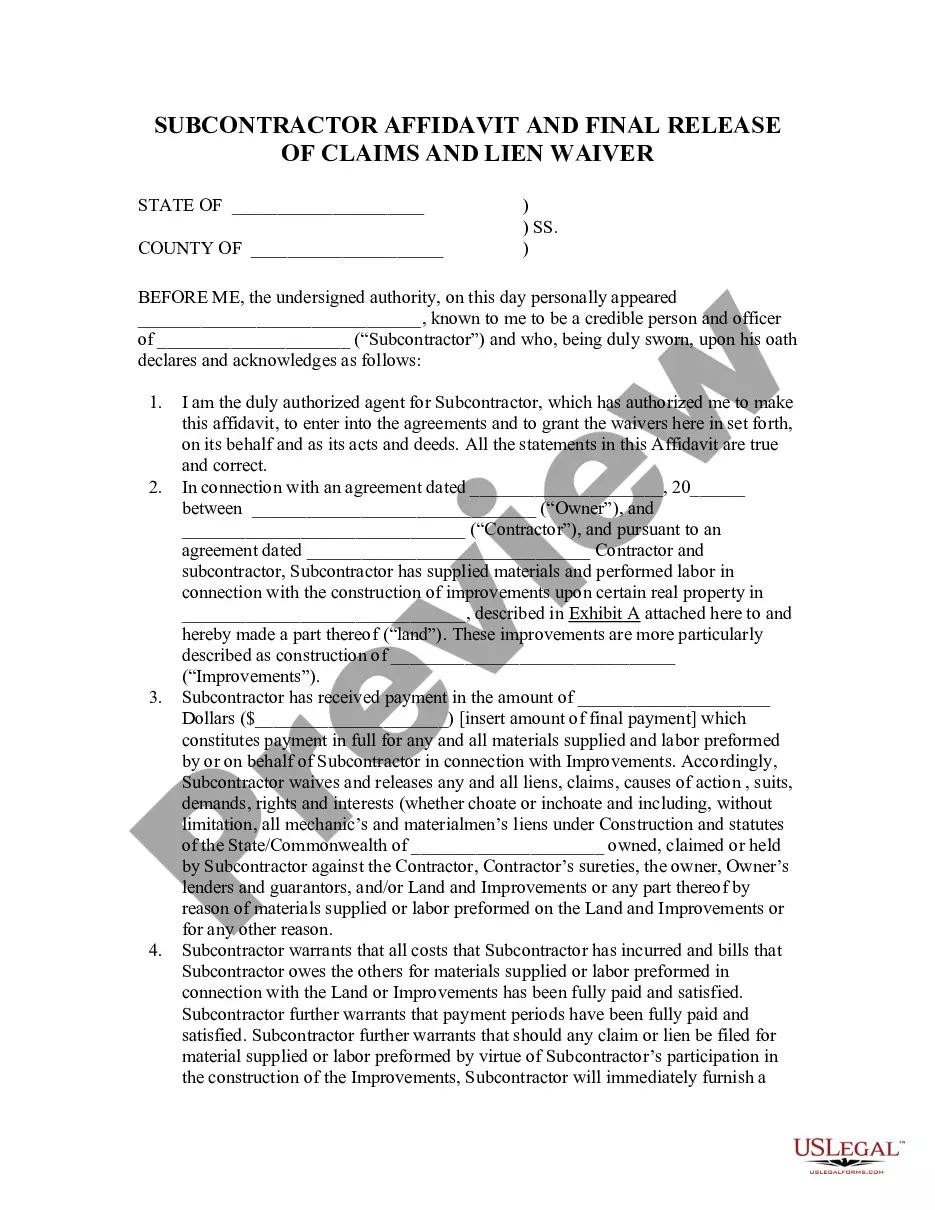

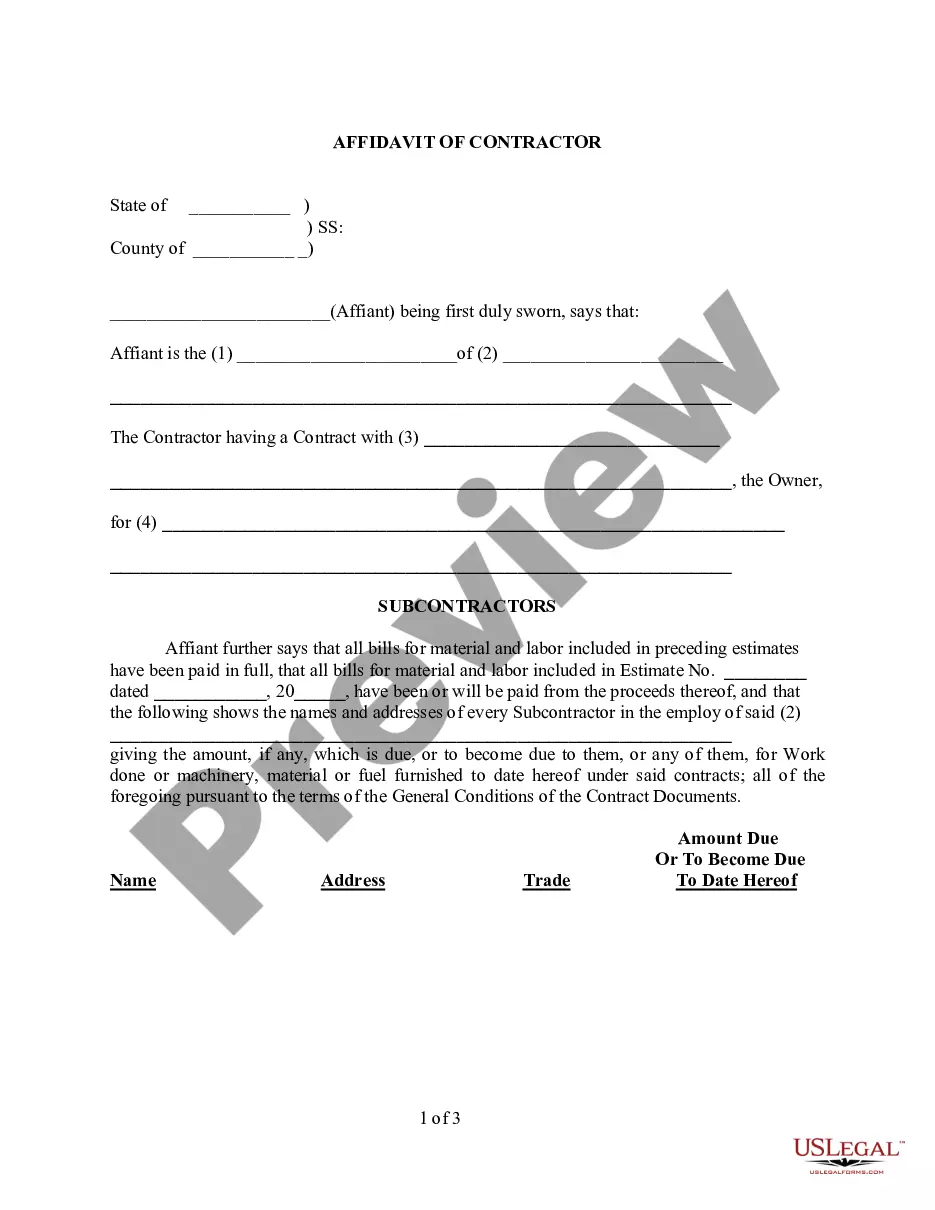

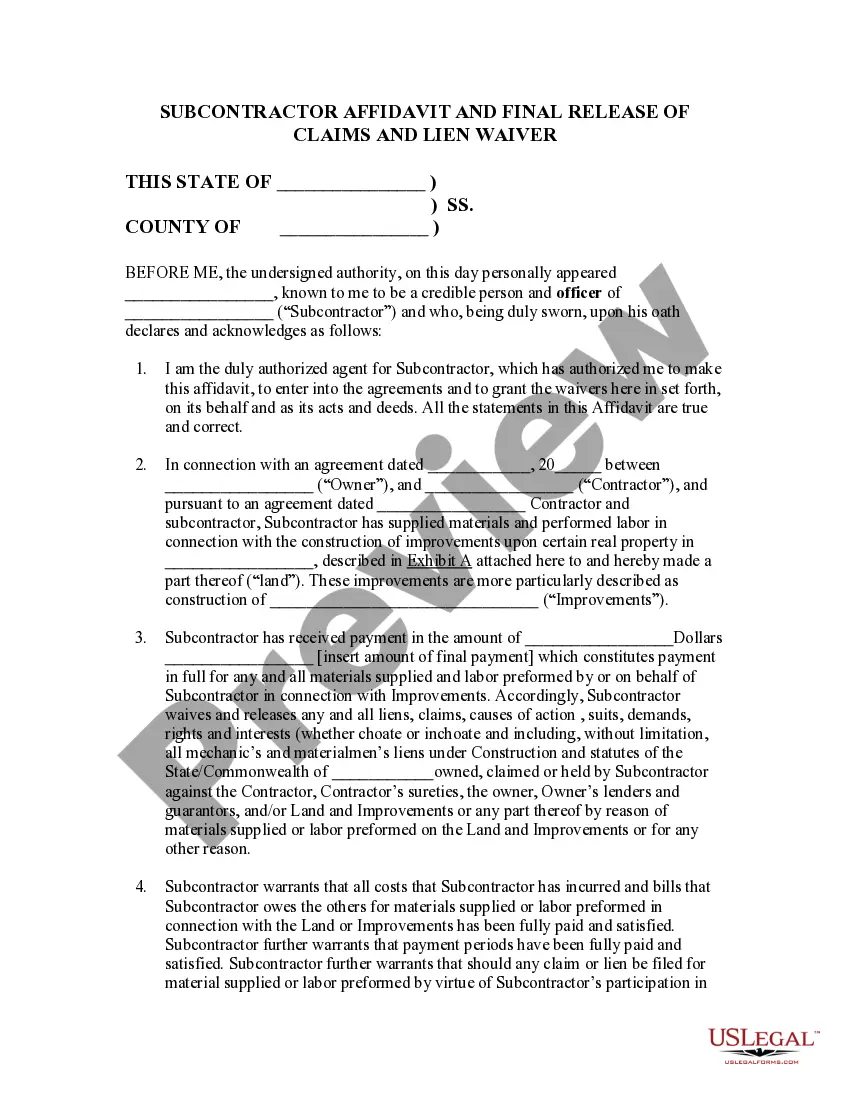

Missouri Contractor's Affidavit of Payment to Subs

Description

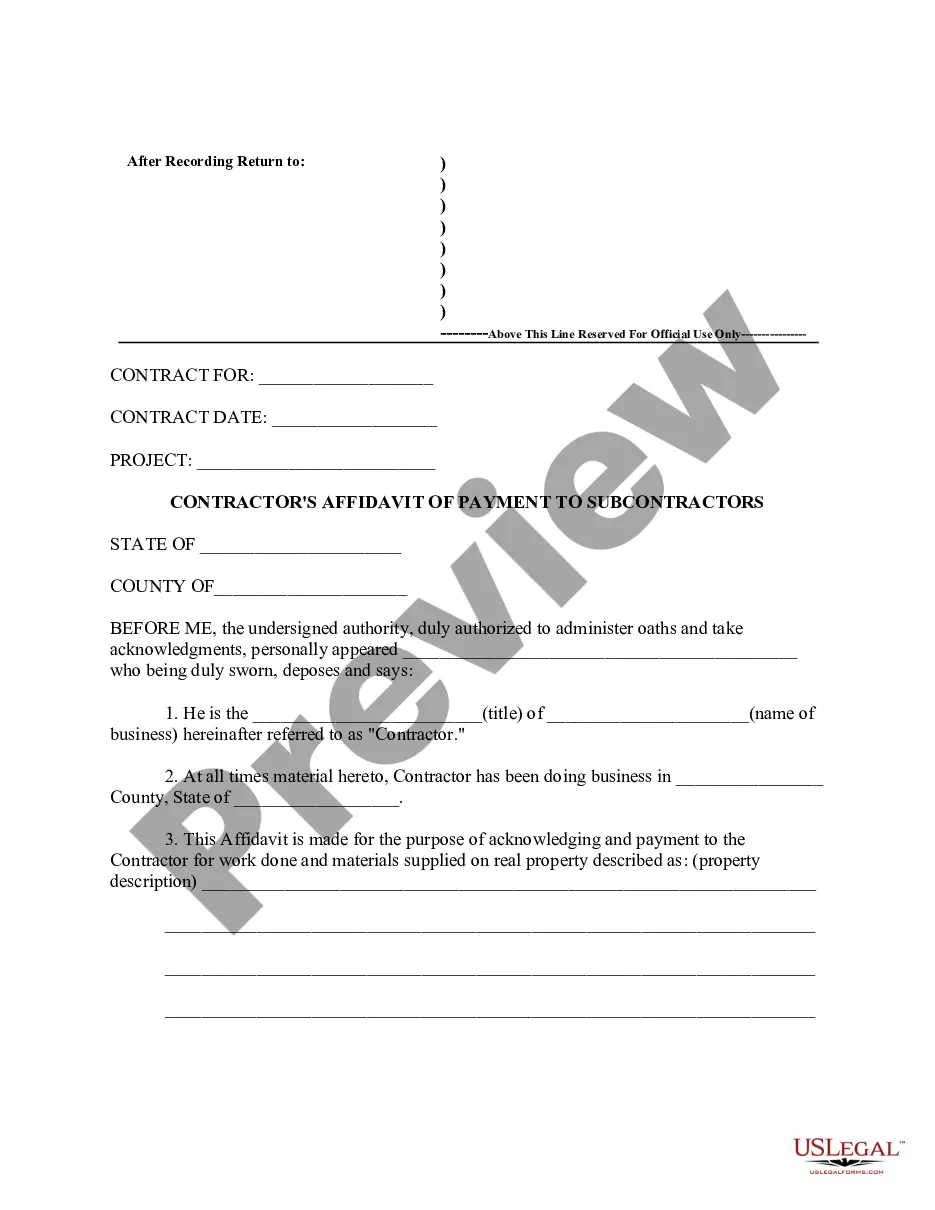

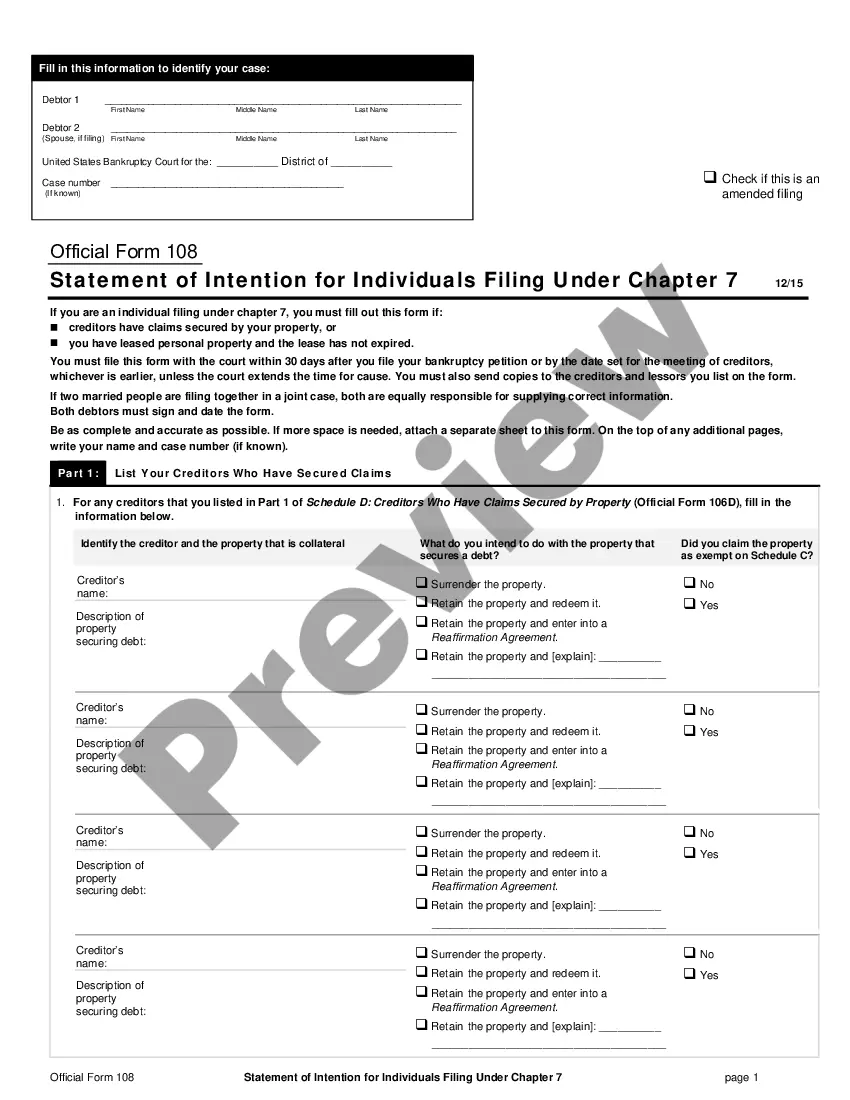

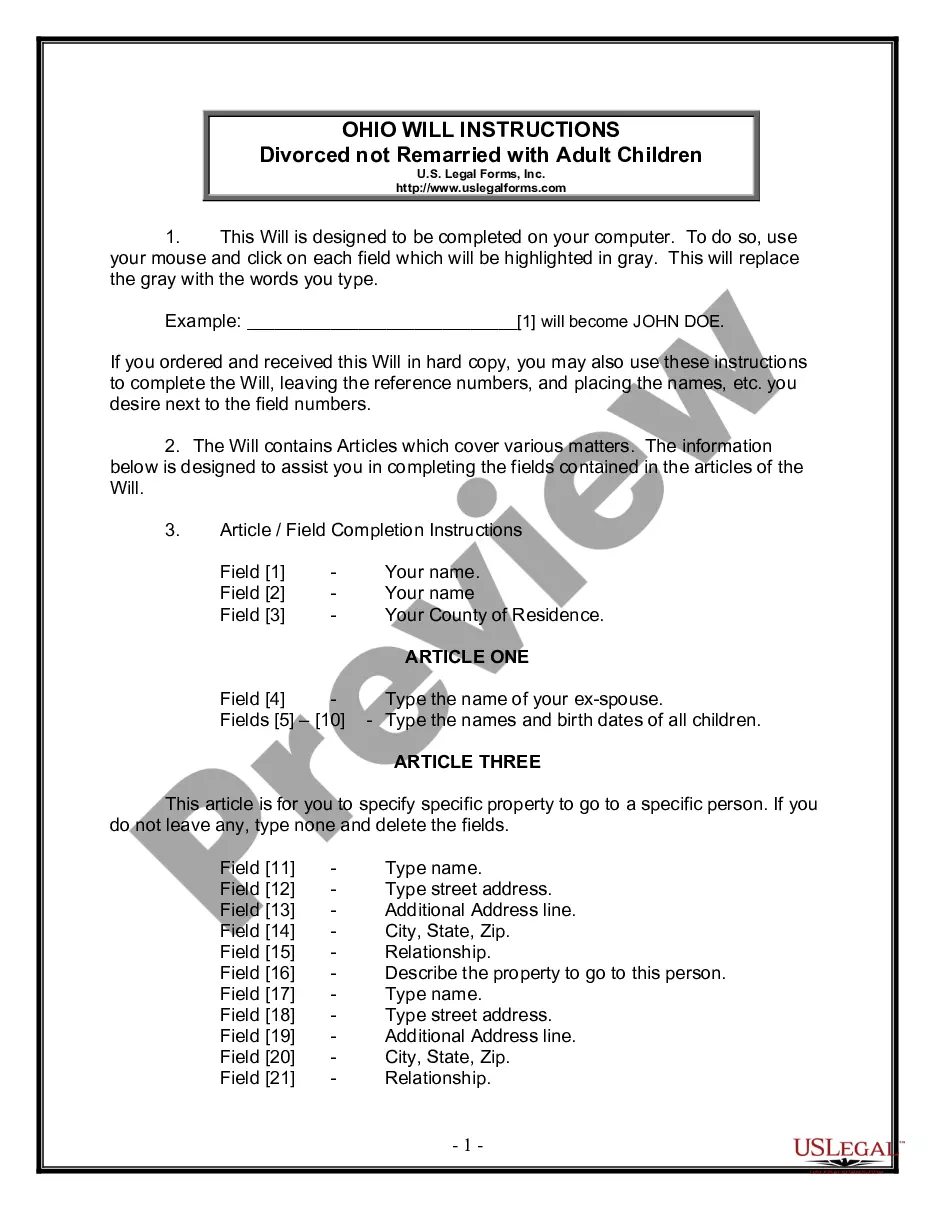

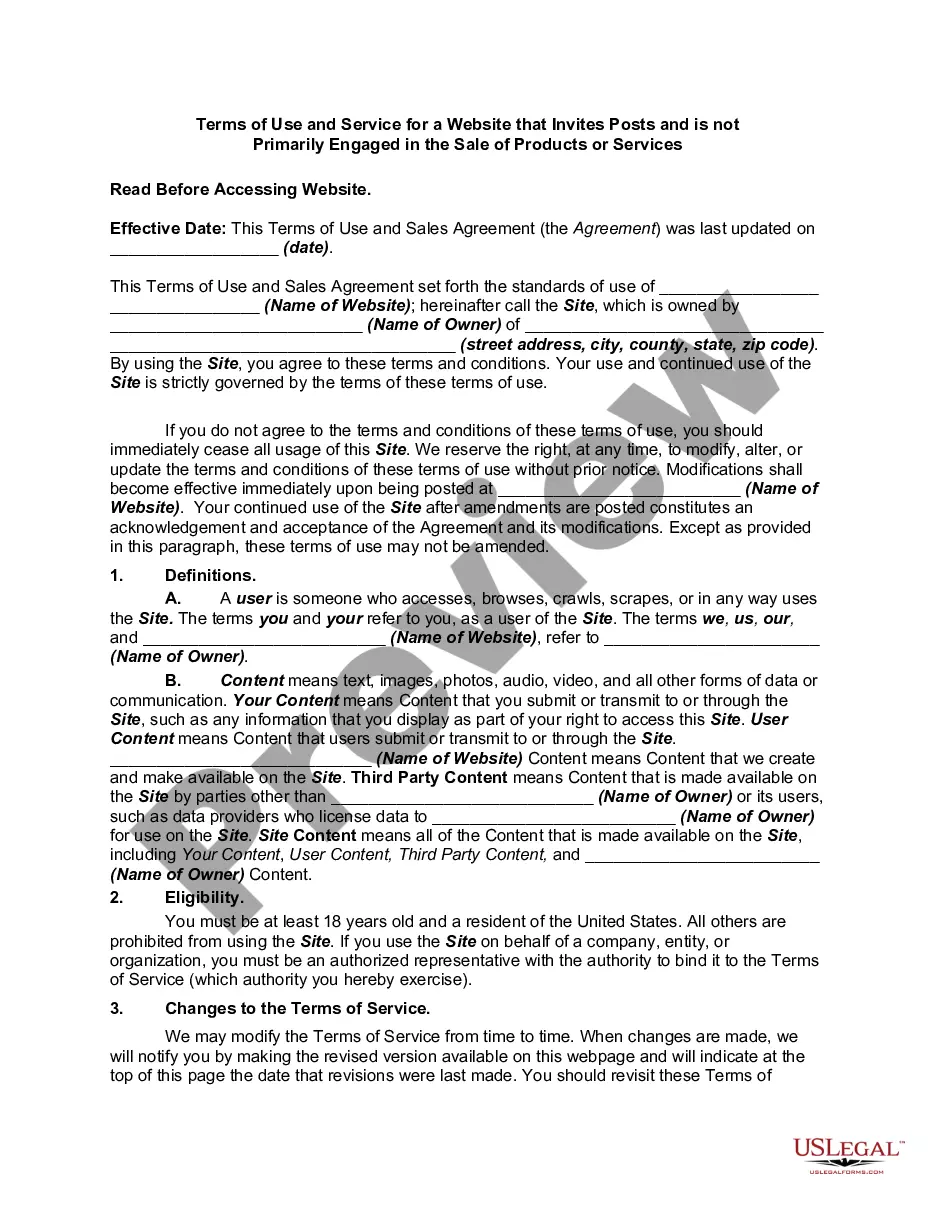

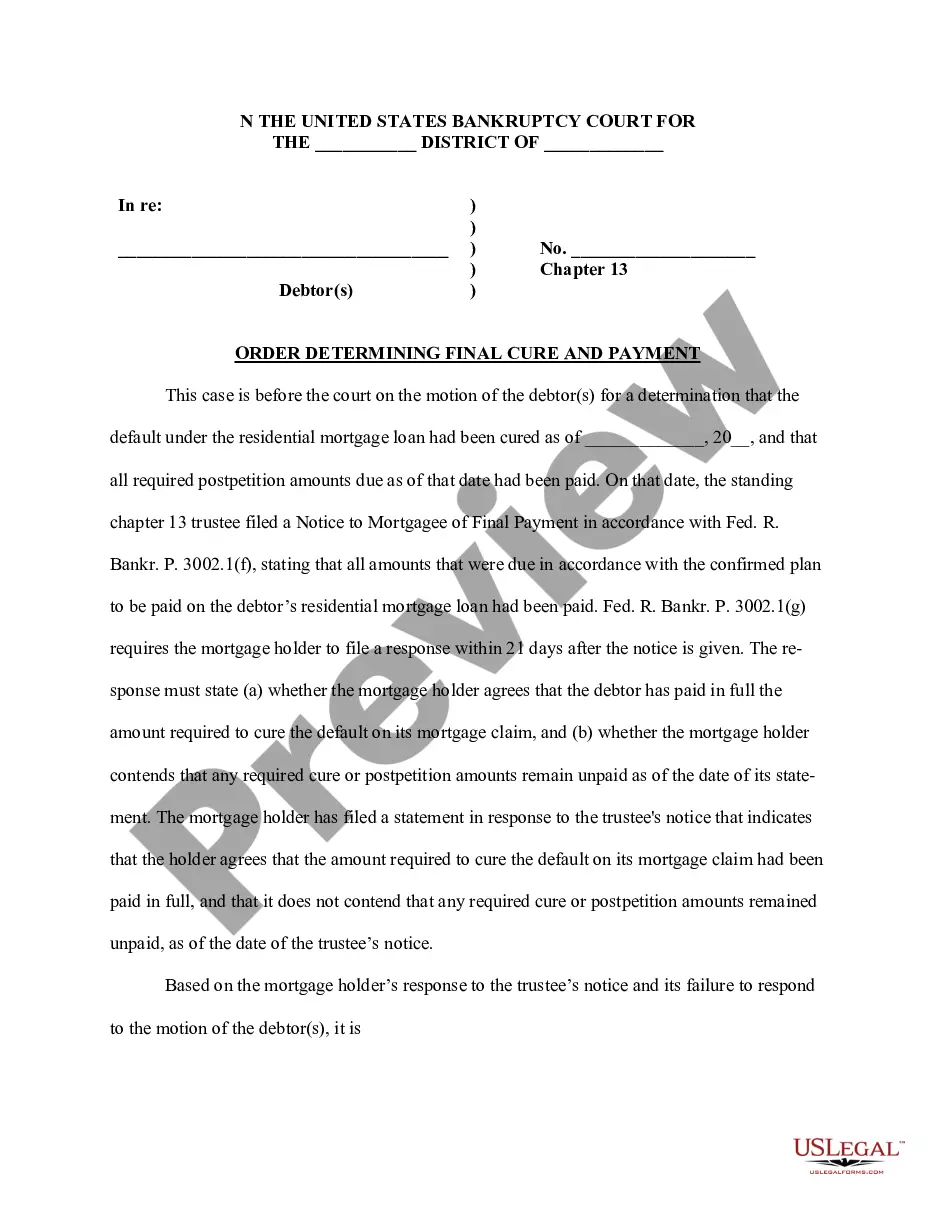

How to fill out Contractor's Affidavit Of Payment To Subs?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse assortment of legal form templates that you can obtain or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can retrieve the latest form types such as the Missouri Contractor's Affidavit of Payment to Subs within moments.

If you hold a membership, Log In and acquire the Missouri Contractor's Affidavit of Payment to Subs from the US Legal Forms library. The Download button will be visible on each form you view. You can find all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Missouri Contractor's Affidavit of Payment to Subs. Every template stored in your account has no expiration date and belongs to you permanently. Hence, if you wish to download or print another version, simply navigate to the My documents section and click on the form you need. Access the Missouri Contractor's Affidavit of Payment to Subs with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Make sure you have selected the appropriate form for your locality/region.

- Click the Preview button to examine the form's content.

- Check the form description to ensure you've picked the correct document.

- If the form does not meet your needs, use the Search field at the top of the page to locate one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

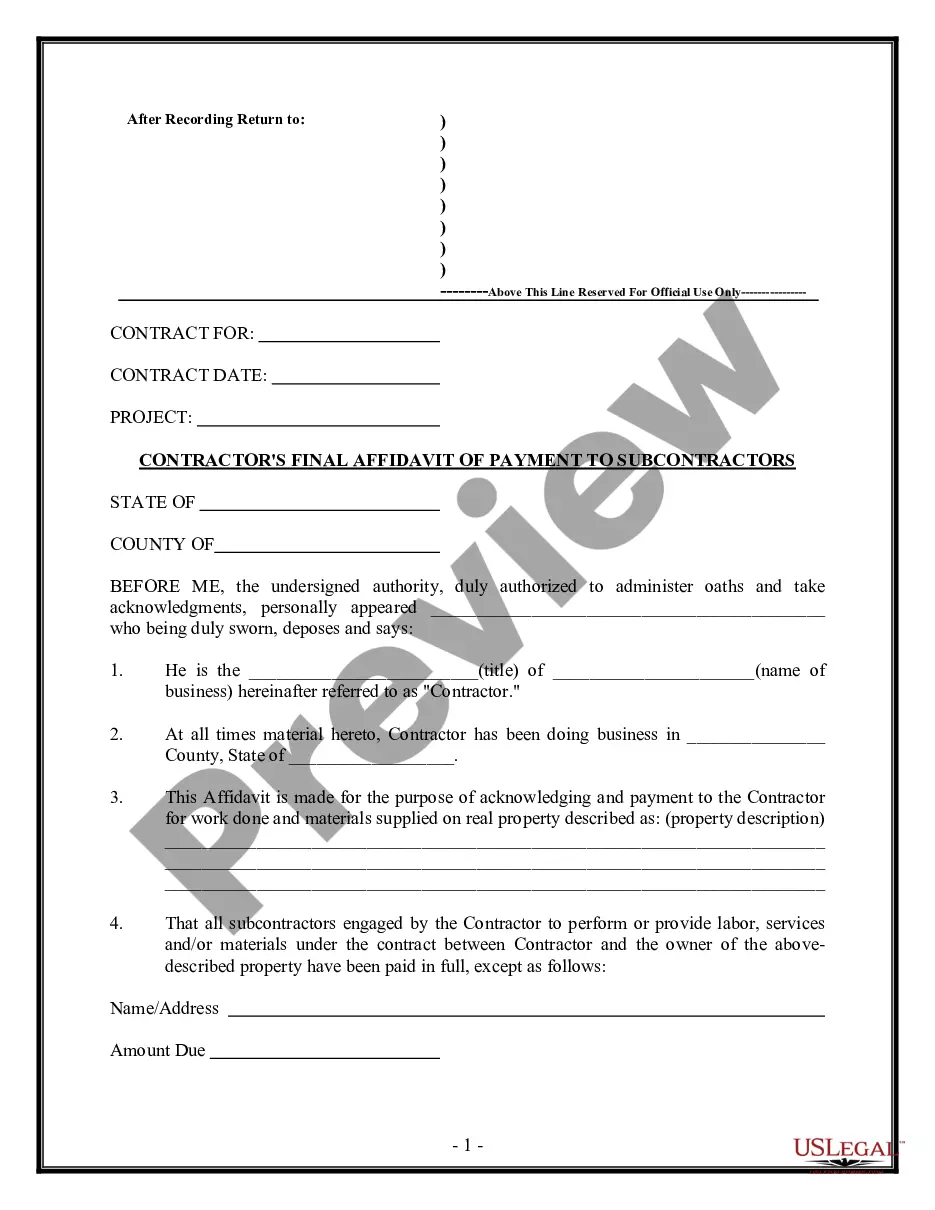

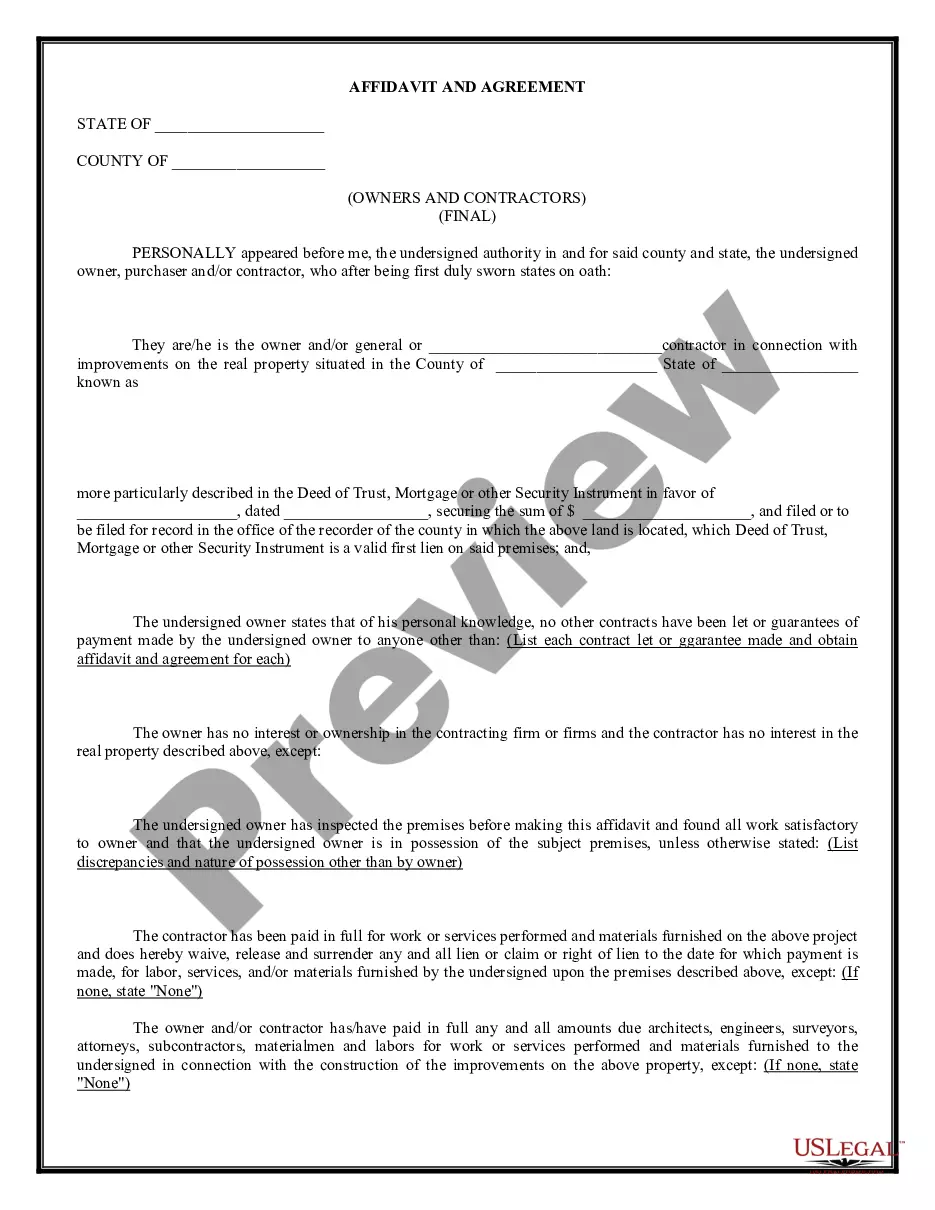

If the contractor defaults or otherwise doesn't take care of your wages, you can file a claim with the surety company to get at least part of your money. The surety company then takes the contractor to court to recover the amount.

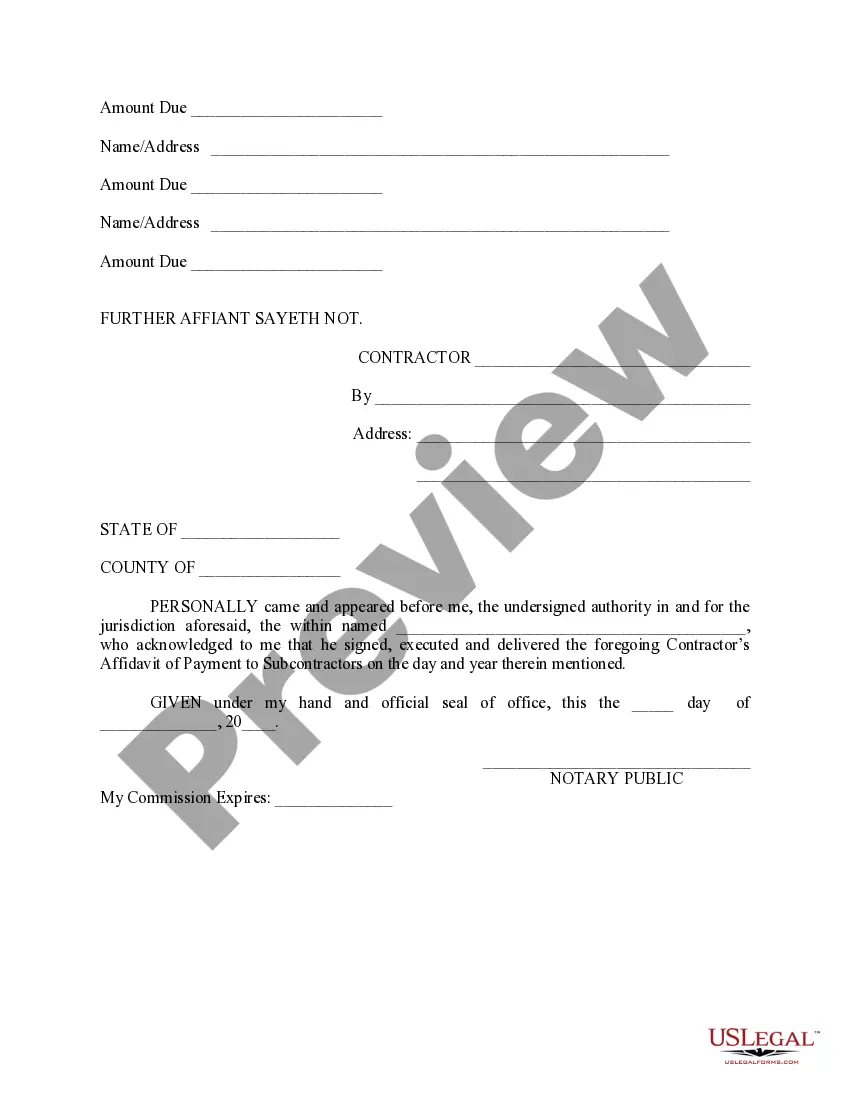

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.

The average pre-tax net profit for subcontractors is between 2.2 to 3.5 percent. To compensate for the risk, this is barely enough for most contractors to survive. Contractor markup is the percentage added to your direct costs to cover profit and overhead.

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

Payment timing The contractor must pay subcontractors within 15 days of being paid by the owner or face potential penalty interest of 1.5 percent per month.

The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

A nominated sub-contractor is one that is selected by the client to carry out an element of the works and then imposed on the main contractor after the main contractor has been appointed.

Contractors and subcontractors don't affect your payroll, because they're not employees. When you negotiate a job with the contractor, generally, you agree to pay them a flat fee not a salary or hourly rate.

The ability to withhold payment needs to be written out in the contract because, in most states, verbal agreements for commercial work are not binding and will not hold up in court. With a written contract that both parties agree to, it's safe for a contractor to withhold payment if a vendor becomes non-compliant.