The Missouri Contribution and Wage Adjustment Report is a document that is prepared and submitted by employers to the Missouri Department of Revenue. It is used to report employer-withheld taxes and wages paid to employees. This form is used to report the following taxes and wages for employees located in the state of Missouri: state income tax, withholding tax, employee contributions to the Missouri Healthier program, and wages paid to employees. There are two types of Missouri Contribution and Wage Adjustment Reports: the Annual Report and the Quarterly Report. The Annual Report is prepared and submitted annually and is used to report the total wages paid to employees as well as the taxes and contributions withheld from the wages. The Quarterly Report is prepared and submitted every three months and is used to report the cumulative wages paid to employees as well as the cumulative taxes and contributions withheld from the wages.

Missouri Contribution and Wage Adjustment Report

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Contribution And Wage Adjustment Report?

US Legal Forms is the simplest and most rewarding method to find suitable official templates.

It’s the most comprehensive online collection of business and personal legal documents created and validated by attorneys.

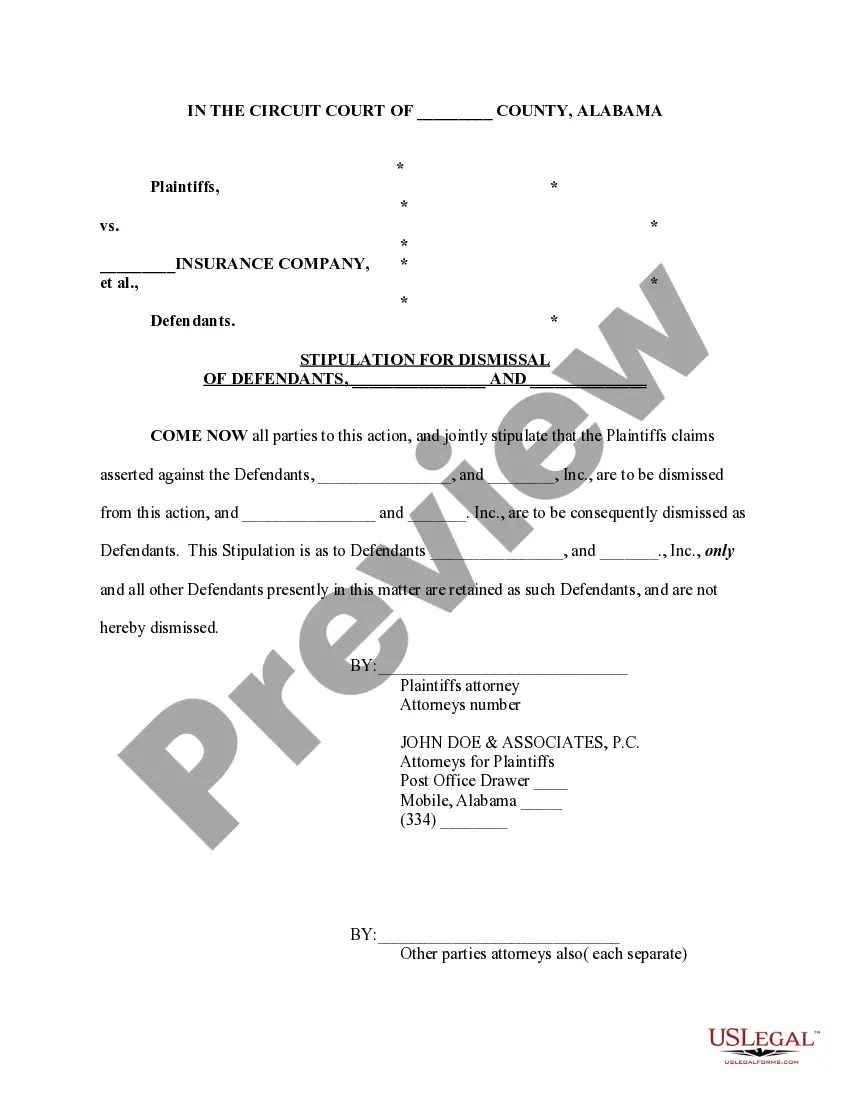

Here, you can discover printable and fillable templates that adhere to national and local laws - just like your Missouri Contribution and Wage Adjustment Report.

Examine the form description or preview the document to ensure you’ve selected the one that fits your requirements, or search for another using the search bar above.

Press Buy now when you’re confident about its suitability with all the criteria, and choose the subscription plan that appeals to you the most.

- Acquiring your template involves just a few easy steps.

- Users who already possess an account with a current subscription only need to Log In to the website and download the file onto their device.

- Then, they can locate it in their profile under the My documents section.

- And here’s how to obtain a accurately drafted Missouri Contribution and Wage Adjustment Report if you are using US Legal Forms for the first time.

Form popularity

FAQ

You can apply online, or over the phone by contacting your Claims Center. 3. How much will I receive? Your weekly benefit amount will be 4 percent of the average of the two highest quarterly wages in the base period, not to exceed $320.

Your weekly benefit amount will be 4 percent of the average of the two highest quarterly wages in the base period, not to exceed $320. All weekly benefits are rounded down to an even dollar.

File for Unemployment Benefits Eligible claimants may receive up to 20 weeks of unemployment insurance benefits through the state. Before applying, check to see if you qualify for unemployment benefits. Applicants must also register at Jobs.mo.gov.

You may be disqualified from receiving UI benefits if you've been discharged for misconduct connected with work, quit for reasons not attributable to work or your employer, refused a suitable work offer, or are not able or available to work.

MO MODES-4-7 Information Contribution and Wage Report forms are furnished by the DES and mailed to all established employers on the fourth from last working day at the end of each calendar quarter. The report should be filed and contributions paid by the last day of the month following the end of each calendar quarter.

MODES is an administrative agency of the state of Missouri. MODES's purpose is to promote employment security by providing for the payment of compensation to individuals who become unemployed through no fault of their own.

Employers covered by the state's approved UI program are required to pay 6.0% on wages up to $7,000 per worker per year to the Federal UI program.