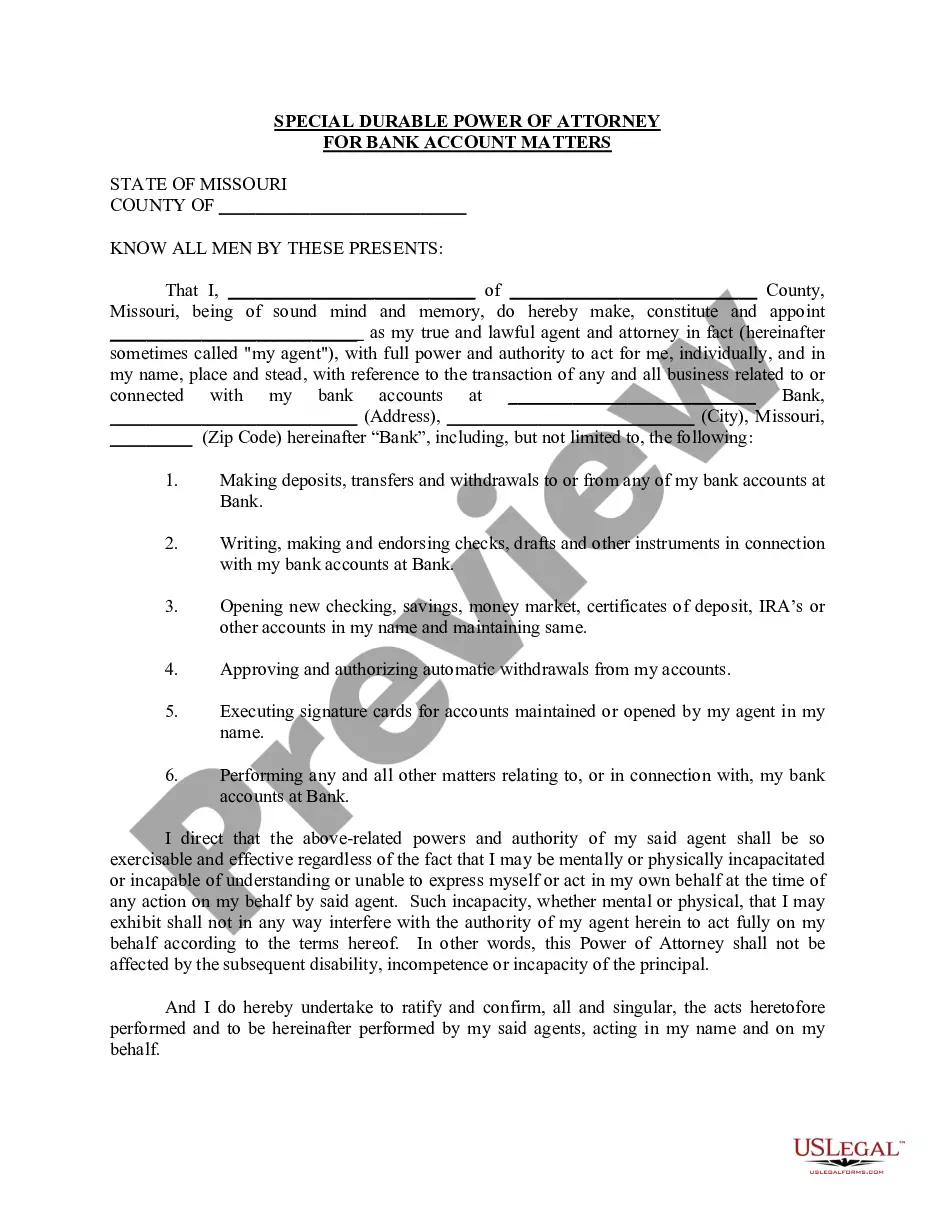

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Missouri Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Missouri Special Durable Power Of Attorney For Bank Account Matters?

Obtain a printable Missouri Special Durable Power of Attorney for Bank Account Matters in just a few clicks from the most extensive collection of legal e-documents.

Locate, download, and print expertly prepared and verified samples on the US Legal Forms platform. US Legal Forms has been the leading source of cost-effective legal and tax documents for US citizens and residents online since 1997.

After downloading your Missouri Special Durable Power of Attorney for Bank Account Matters, you can complete it in any online editor or print it out and fill it in by hand. Utilize US Legal Forms to access 85,000 expertly drafted, state-specific documents.

- Customers with a subscription must Log In directly to their US Legal Forms account, retrieve the Missouri Special Durable Power of Attorney for Bank Account Matters, and find it stored in the My documents section.

- Ensure your template complies with your state’s regulations.

- If available, examine the form’s description to gain more insights.

- If accessible, inspect the form to uncover additional content.

- Once you’re certain the template satisfies your needs, simply click Buy Now.

- Establish a personal account.

- Select a subscription plan.

- Make payment via PayPal or credit card.

- Download the template in Word or PDF format.

Form popularity

FAQ

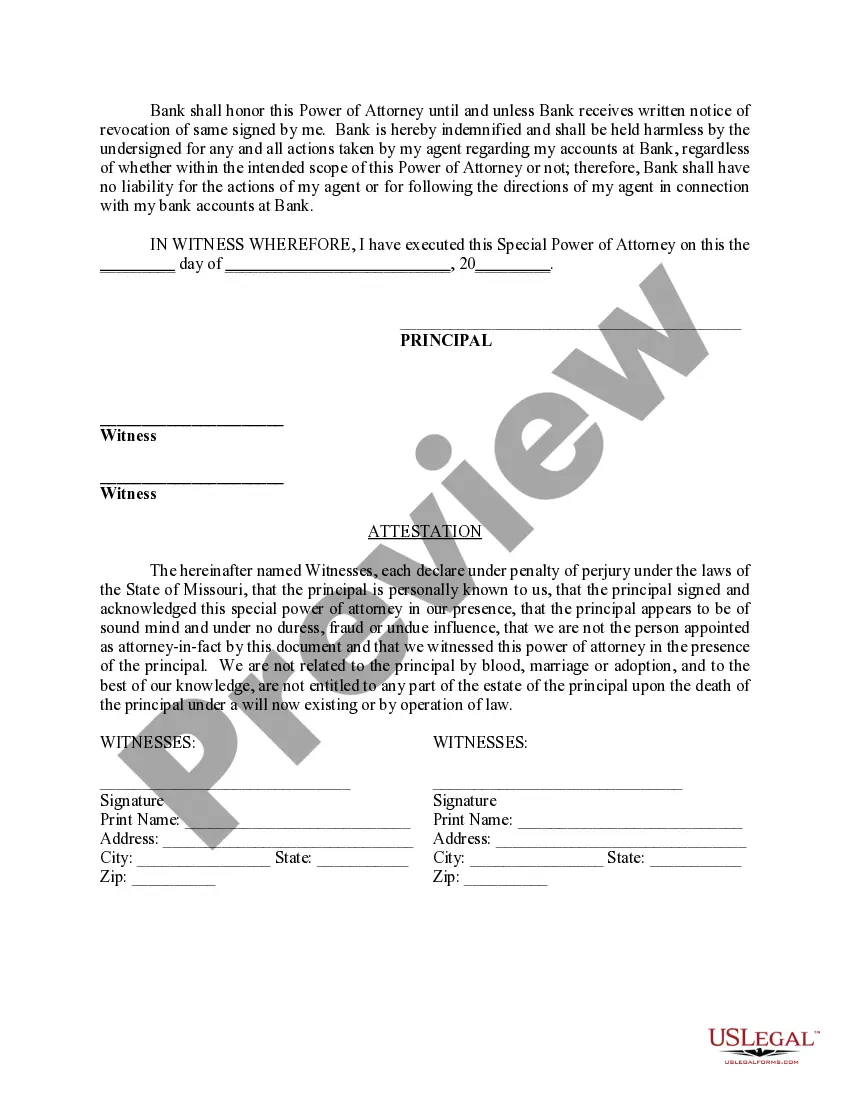

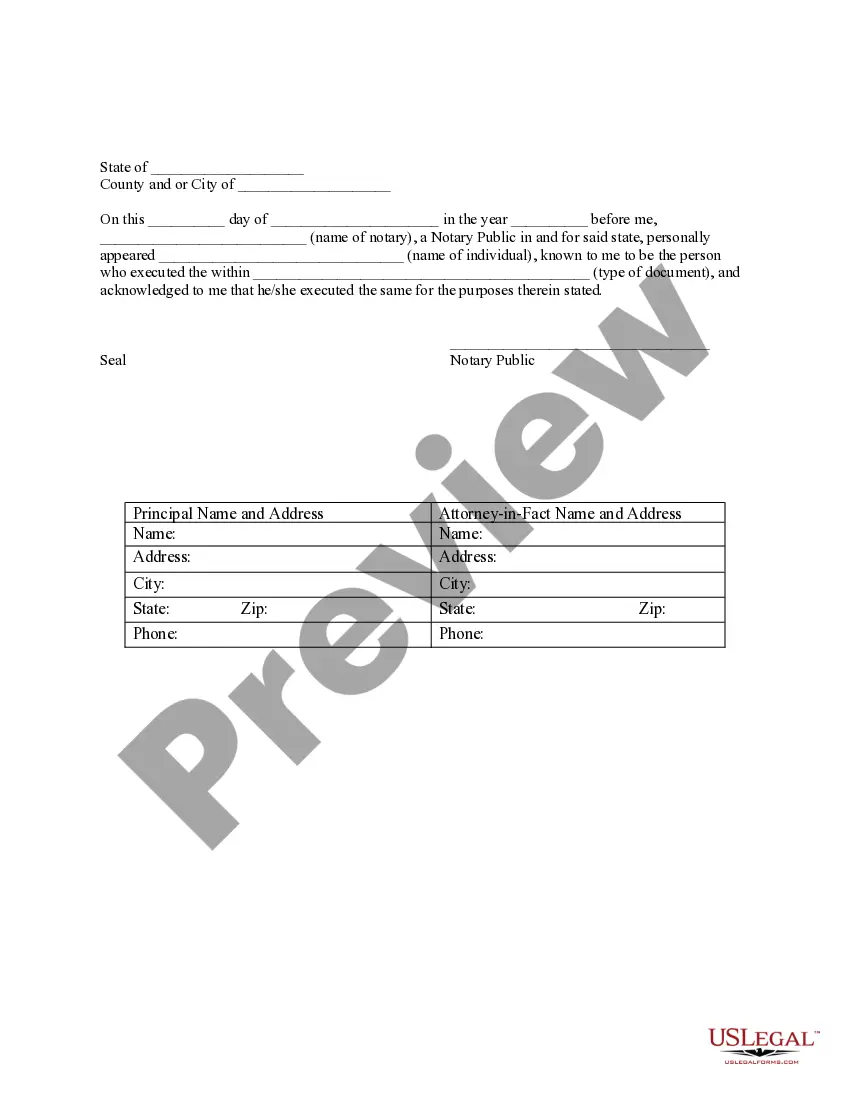

Yes, a durable power of attorney must be notarized in Missouri to be legally binding. Notarization adds an extra layer of authenticity and helps prevent fraud. When you create a Missouri Special Durable Power of Attorney for Bank Account Matters, ensure that you have it signed in front of a notary public. This step is vital for your agent to effectively access and manage your bank accounts.

A durable power of attorney for finances in Missouri is a legal document that allows you to appoint someone to handle your financial affairs. This includes managing bank accounts, paying bills, and making investment decisions on your behalf. A Missouri Special Durable Power of Attorney for Bank Account Matters is specifically tailored for accessing and managing bank-related issues. This tool provides peace of mind, knowing your financial matters are in trusted hands.

To get financial power of attorney in Missouri, you need to create a durable power of attorney document that clearly outlines your wishes. You can use resources like USLegalForms to easily draft this document, ensuring it meets state requirements. It is crucial to specify the powers you wish to grant, especially regarding bank account matters. Once completed, you and your agent should sign the document in front of a notary.

Missouri Power of Attorney Forms permit individuals to have third party representation by authorizing agents to act on their behalf.There is no state statute that requires witnesses when executing the document but it is usually required to have a notary public acknowledge and stamp the completed and signed form.

Although third parties do sometimes refuse to honor an Agent's authority under a POA agreement, in most cases that refusal is not legal.In that case, the law allows you to collect attorney's fees if the third party unreasonably refused to accept the POA.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power.If you grant a power of attorney, check with your bank to find out whether the document you intend to use is sufficient. You may want to change the document or even change your bank.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

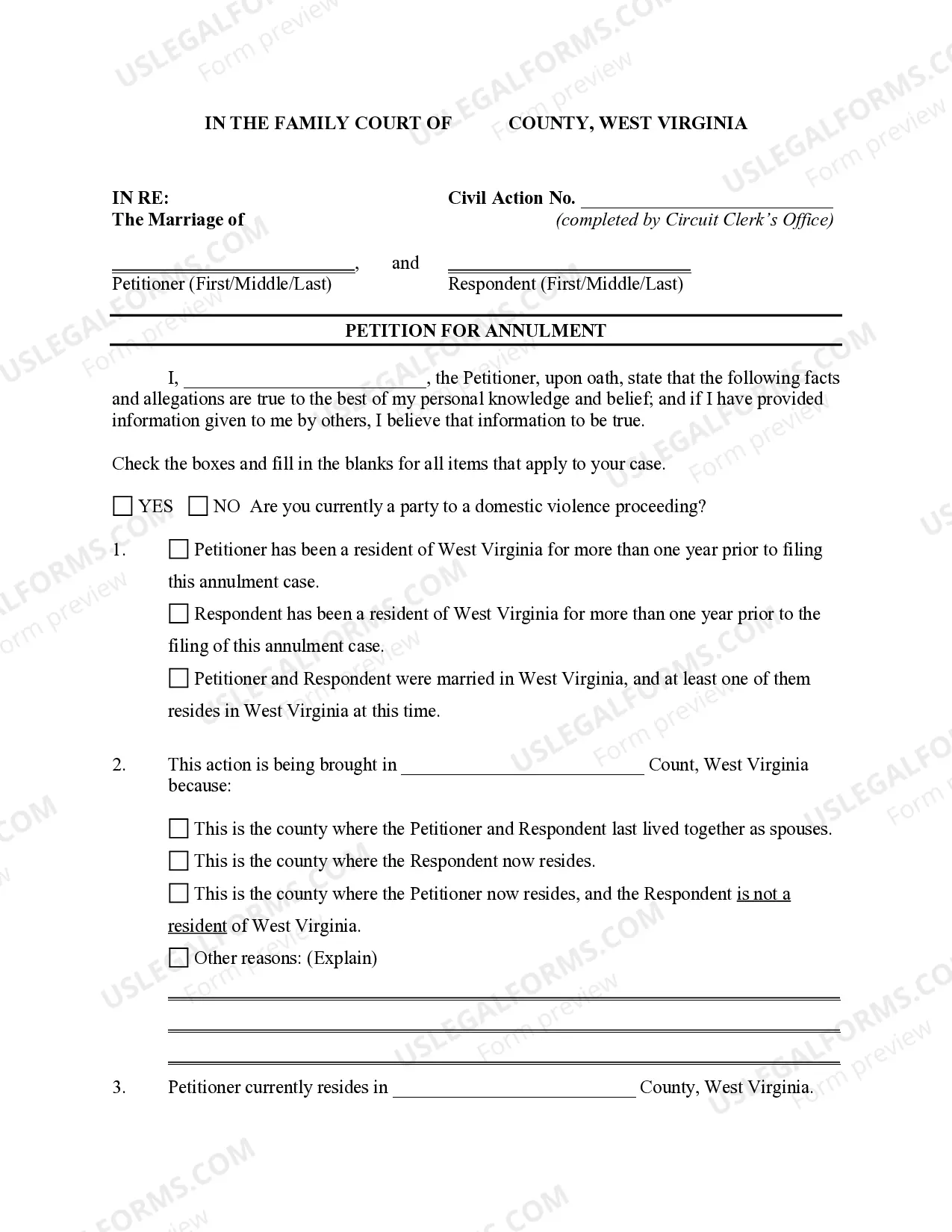

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

Through the use of a valid Power of Attorney, an Agent can sign checks for the Principal, withdraw and deposit funds from the Principal's financial accounts, change or create beneficiary designations for financial assets, and perform many other financial transactions.