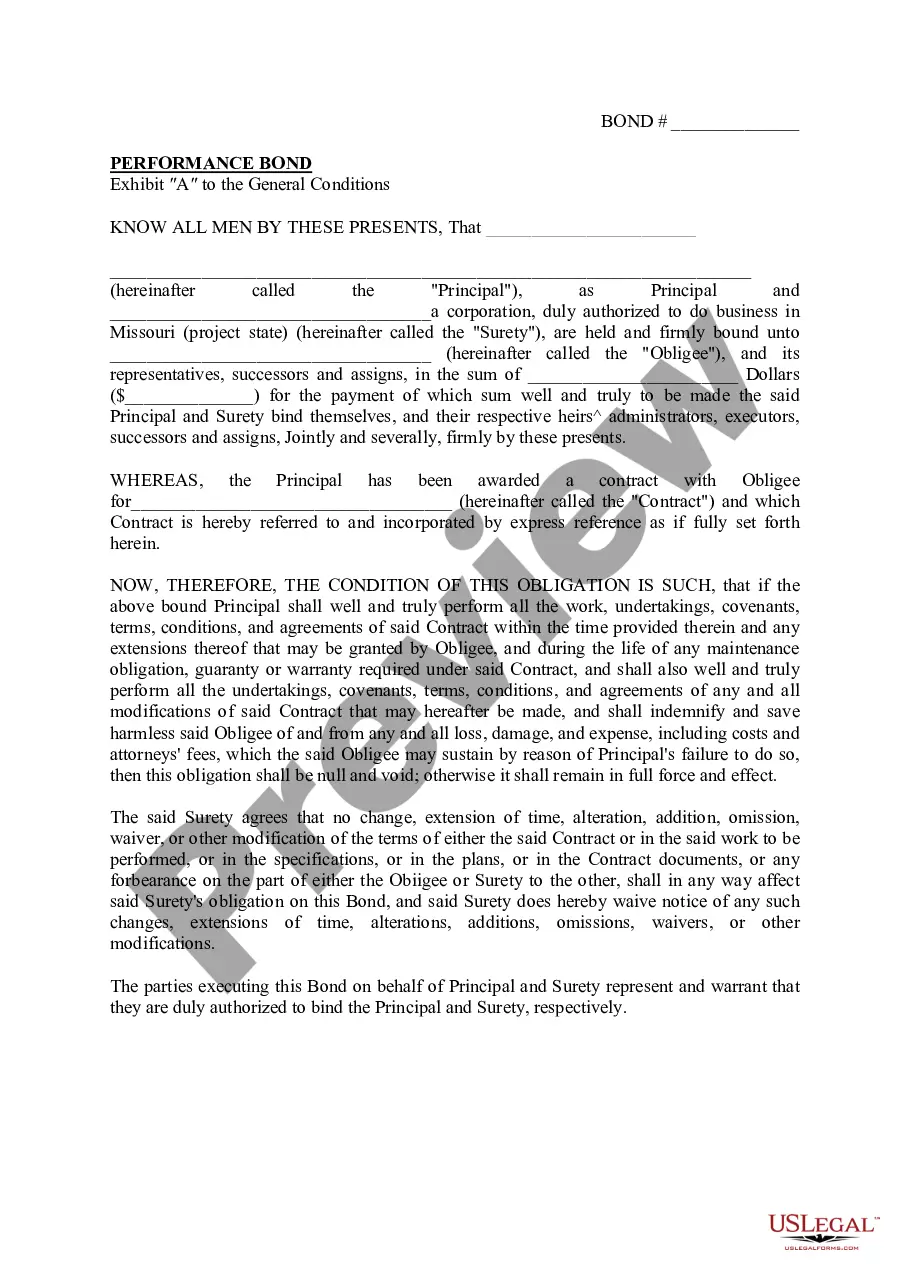

Missouri Performance Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Performance Bond?

Access any template from 85,000 legal documents including Missouri Performance Bond online with US Legal Forms. Each template is crafted and revised by state-certified lawyers.

If you already possess a subscription, Log In. Once you’re on the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, follow the instructions outlined below: Check the state-specific criteria for the Missouri Performance Bond you need to utilize. Review the description and preview the sample. When you are assured the template meets your requirements, simply click Buy Now. Choose a subscription plan that fits your budget. Create a personal account. Make payment in one of two suitable methods: by credit card or through PayPal. Choose a format to download the file in; two options are available (PDF or Word). Download the file to the My documents tab. Once your reusable template is prepared, print it out or save it to your device.

- With US Legal Forms, you will always have swift access to the correct downloadable sample.

- The platform will provide you access to documents and categorizes them to simplify your search.

- Utilize US Legal Forms to acquire your Missouri Performance Bond quickly and effortlessly.

Form popularity

FAQ

While it may seem challenging to obtain a Missouri Performance Bond, it largely depends on your financial status and project history. If you have a strong credit score and a reliable track record, the process can be much easier. Many contractors find success by working with reputable providers and being proactive in their applications. US Legal Forms can assist you in streamlining this process.

To secure a Missouri Performance Bond, you'll need to provide specific documentation, including your financial statements, project details, and proof of experience. Insurers will review your creditworthiness and may require collateral for higher bond amounts. Being prepared with these documents can expedite your bonding process. Utilize resources from US Legal Forms to ensure you meet all requirements.

A Missouri Performance Bond is typically triggered when a contractor fails to fulfill the terms of a contract. This could include delays, substandard work, or not completing the project at all. When such issues arise, the bond provides financial protection for project owners, ensuring they can recover costs. Understanding these triggers is vital for both contractors and project owners.

Obtaining a Missouri Performance Bond can be straightforward if you meet the necessary qualifications. Insurers assess your credit score, financial history, and project details. Having solid financial backing and a good reputation can greatly simplify the process. Consider using US Legal Forms to navigate the application process smoothly.

An example of a bond claim involves a contractor failing to complete a construction project as specified in the contract. The project owner may file a claim against the Missouri Performance Bond, seeking compensation for the incomplete work. This process highlights the bond's role in providing financial security and ensuring accountability in contractual agreements.

To claim a Missouri Performance Bond, start by reviewing the bond's specifics to understand the claim process. Collect necessary documentation, such as contracts and evidence of default, to support your claim. Submit your claim to the bond issuer, ensuring you follow their guidelines for a timely resolution.

If someone claims a bonded title in Missouri, the bond serves as a financial guarantee that the title is legitimate. The bond issuer will investigate the claim, assessing its validity based on provided evidence. If the claim is deemed valid, the bond may cover any losses incurred, protecting the rightful owner.

Common disputes related to Missouri Performance Bonds often arise from misunderstandings about contract terms or performance expectations. Disagreements may also occur when the bond issuer challenges the validity of a claim. To avoid disputes, clear communication and thorough documentation are essential during the bonding process.

To make a claim on a Missouri Performance Bond, you should first review the bond's terms and conditions. Gather all relevant documentation, such as contracts and evidence of non-performance. Then, submit your claim to the bond issuer, providing all required information to support your case and ensure a smooth process.

To record a Missouri Performance Bond, you need to file it with the appropriate local government office, usually the county clerk or recorder's office. Ensure you have all necessary documentation, including the bond agreement and any required signatures. After submission, keep a copy for your records, as this will serve as proof of the bond's existence.