Missouri Self-Settled Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Overview of this form

The Self-Settled Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor is a legal document designed to establish a trust in which the Trustor can manage their property while also being a beneficiary. This type of trust offers asset protection by safeguarding the Trustor's assets from creditors, while also allowing the Trustor the ability to access its benefits during their lifetime. Unlike a standard trust, this irrevocable trust cannot be amended or revoked once created, ensuring that the assets placed in it are protected for the specified beneficiaries.

Main sections of this form

- Identification of the Trustor and Trustee, including necessary addresses.

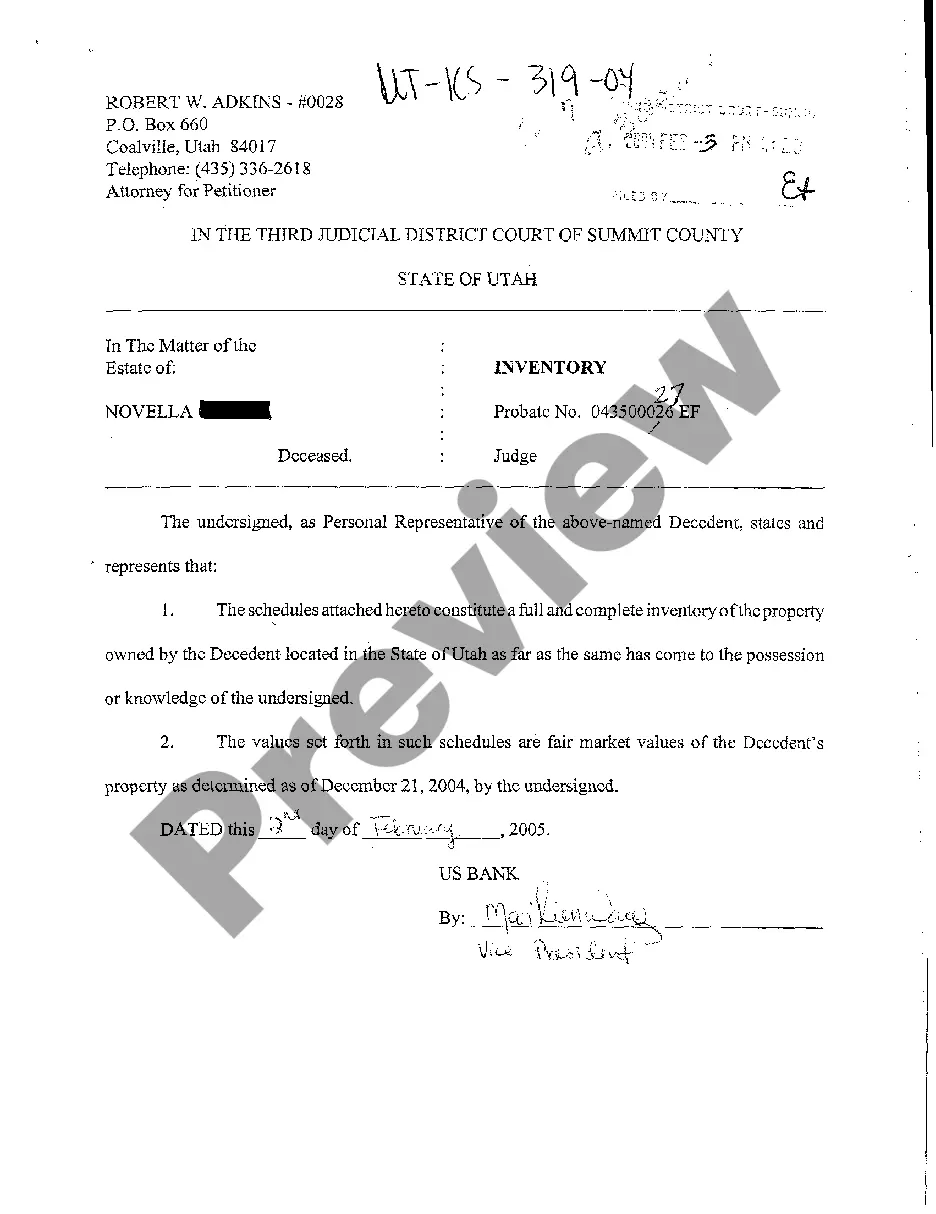

- A detailed description of the property being transferred into the trust.

- Provisions for the management and distribution of income and principal during the Trustor's lifetime.

- Rights reserved by Trustor to withdraw funds under certain conditions.

- Instructions for the disposition of assets upon the death of the Trustor.

- Listing of the powers granted to the Trustee for managing the trust assets.

Situations where this form applies

This form is used when an individual wishes to create an irrevocable trust that provides personal benefits during their lifetime while also protecting those assets from potential creditors. Situations may include planning for estate taxes, ensuring financial security for dependents, or preparing for unforeseen financial difficulties that may arise in the future.

Who this form is for

- Individuals looking to protect their assets from creditors.

- Trustors who want to manage their financial affairs while also benefiting from the assets within the trust.

- People planning for estate management and distribution to heirs posthumously.

- Anyone needing to secure their financial future while maintaining control over their assets.

How to complete this form

- Identify the parties involved: enter the names and addresses of the Trustor and Trustee.

- Specify the property being transferred into the trust by detailing it in Exhibit A.

- Decide on the terms for the distribution of income and principal and fill in the necessary clauses.

- Include the conditions for withdrawing funds, if applicable, and note the limits.

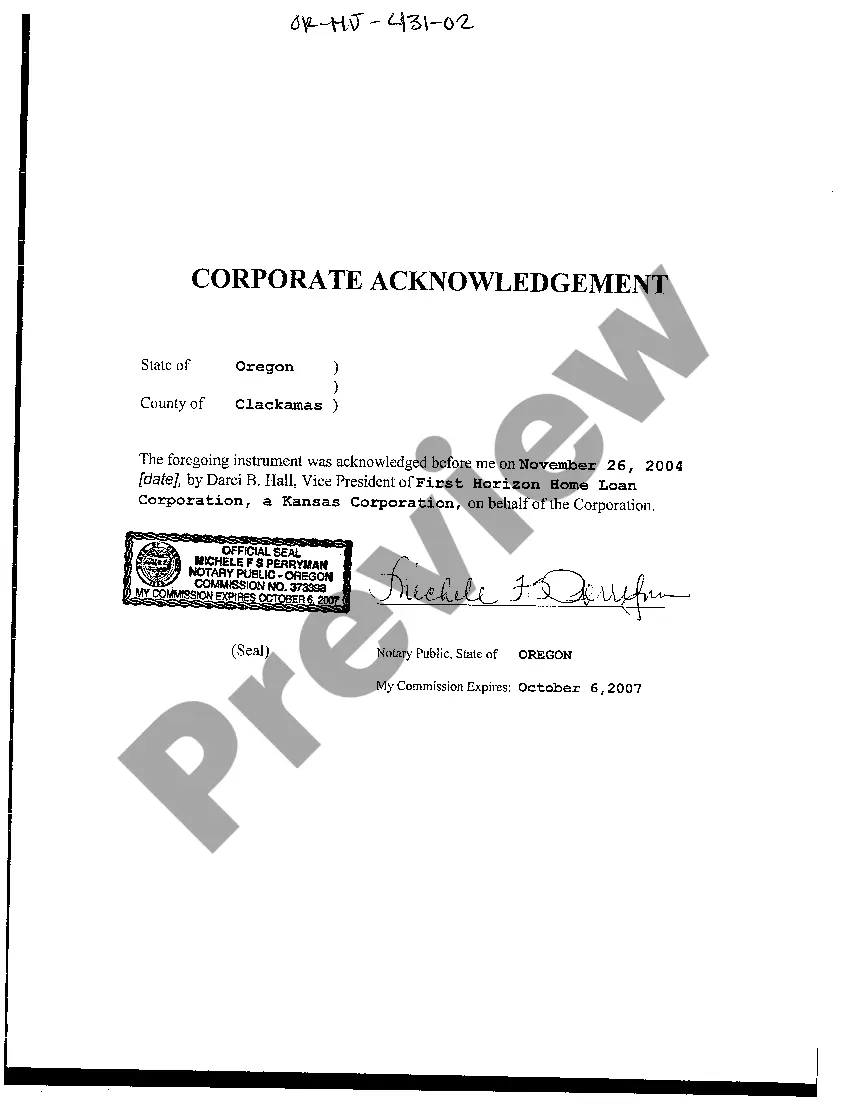

- Collect all necessary signatures and obtain notarization where required.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms offers integrated online notarization, allowing you to complete the process securely via a video call at any time without needing to travel.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to clearly describe the assets transferred into the trust.

- Not understanding the irrevocable nature of the trust, leading to confusion regarding control over assets.

- Omitting signatures or not notarizing the document when necessary.

- Neglecting to consider specific state laws that may affect the trust's validity.

Why complete this form online

- Convenient and accessible from anywhere at any time.

- Editable templates allow you to customize the form according to your specific needs.

- Reliability ensured by templates drafted by licensed attorneys.

Main things to remember

- The Self-Settled Irrevocable Trust protects assets while allowing the trustor to benefit during their lifetime.

- The trust is irrevocable, meaning it cannot be changed once established.

- It is essential to correctly outline asset descriptions and distribution terms to avoid confusion.

- Legal assistance is recommended for complex estate situations involving trusts.

Looking for another form?

Form popularity

FAQ

The 5-year rule for irrevocable trusts is a critical consideration when planning for asset protection and Medicaid eligibility. Specifically, for Missouri Self-Settled Irrevocable Trusts for Lifetime Benefit of Trustor with Power of Invasion in Trustor, this rule states that any assets transferred into the trust within five years of applying for Medicaid may be subject to penalties. Understanding this rule can help you effectively plan your trust to ensure you maintain eligibility for benefits while securing your assets. For comprehensive guidance, consider utilizing the tools offered by US Legal Forms.

The recent rule on irrevocable trusts emphasizes the importance of clarity and transparency in trust management, particularly for Missouri Self-Settled Irrevocable Trusts for Lifetime Benefit of Trustor with Power of Invasion in Trustor. This rule mandates that all trust documents must clearly define the powers granted to the trustor and the terms under which benefits may be accessed. As a result, individuals can better understand their rights and responsibilities, making it essential to consult legal resources or platforms like US Legal Forms to ensure compliance with the latest regulations.

Statute 456.8 813 in Missouri pertains to the establishment and regulation of Missouri Self-Settled Irrevocable Trusts for the Lifetime Benefit of Trustors with Power of Invasion in Trustors. This statute outlines the legal framework that allows individuals to create trusts that provide lifelong benefits while maintaining certain powers. Understanding this statute is crucial for anyone considering setting up such a trust, as it defines the rights and obligations of the trustor and beneficiaries. For detailed information and assistance, you can explore the resources available on the US Legal Forms platform.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

To manage and control spending and investments to protect beneficiaries from poor judgment and waste; To avoid court-supervised probate of trust assets and be private; To protect trust assets from the beneficiaries' creditors;To reduce income taxes or shelter assets from estate and transfer taxes.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

A trust can be used to determine how a person's money should be managed and distributed while that person is alive, or after their death. A trust helps avoid taxes and probate. It can protect assets from creditors, and it can dictate the terms of an inheritance for beneficiaries.

Using a revocable living trust instead of a will means assets owned by your trust will bypass probate and flow to your heirs as you've outlined in the trust documents. A trust lets investors have control over their assets long after they pass away.

A will and a trust are separate legal documents that typically share a common goal of facilitating a unified estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, when there are discrepancies between the two.

Wills and Trusts FAQs Deciding between a will or a trust is a personal choice, and some experts recommend having both. A will is typically less expensive and easier to set up than a trust, an expensive and often complex legal document.