Minnesota Gift Deed of Mineral Interest with No Warranty

Description

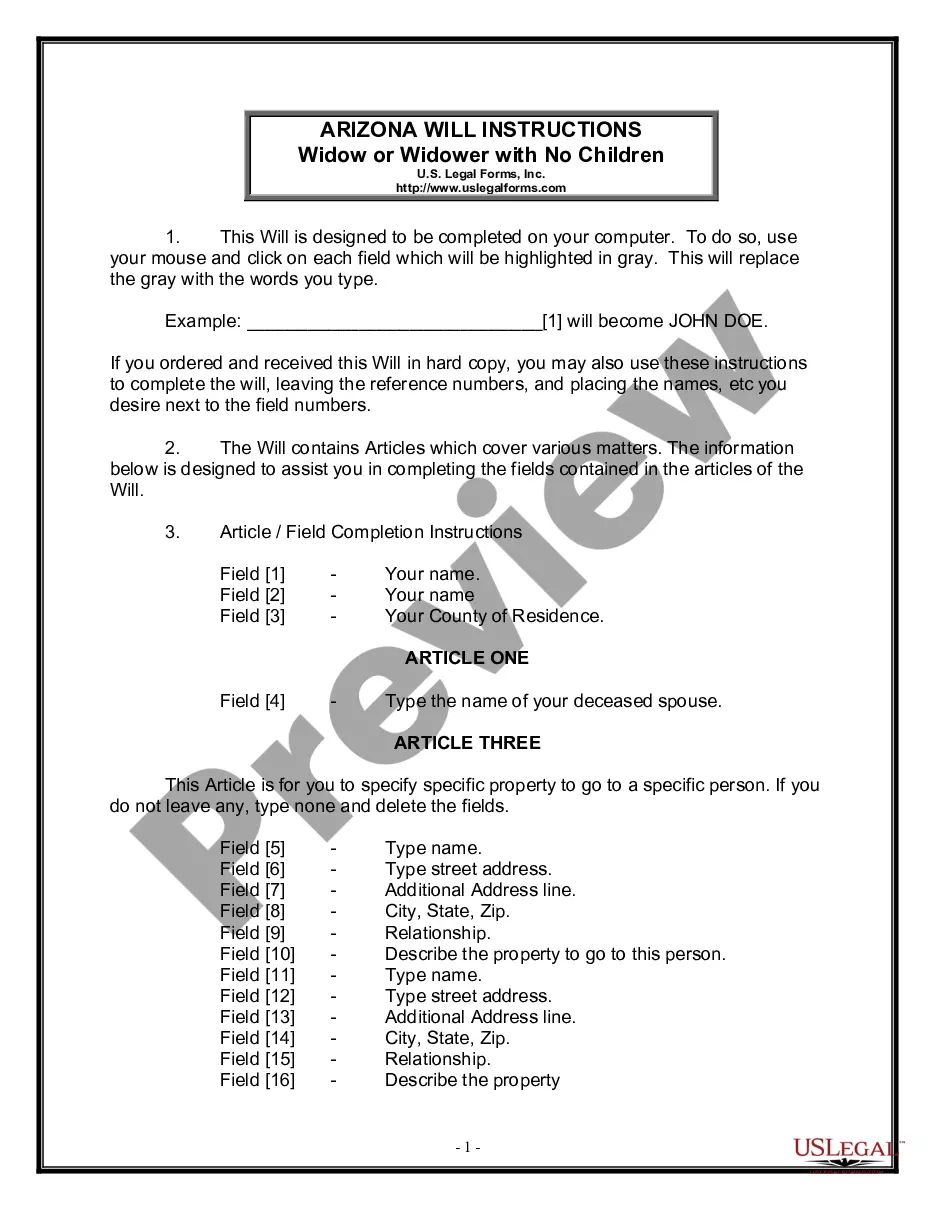

How to fill out Gift Deed Of Mineral Interest With No Warranty?

US Legal Forms - among the most significant libraries of legal kinds in the United States - gives a variety of legal record templates you may down load or printing. Making use of the site, you can get 1000s of kinds for company and personal reasons, sorted by groups, states, or search phrases.You can get the latest variations of kinds just like the Minnesota Gift Deed of Mineral Interest with No Warranty within minutes.

If you currently have a subscription, log in and down load Minnesota Gift Deed of Mineral Interest with No Warranty from the US Legal Forms library. The Download switch will appear on each kind you perspective. You have access to all earlier saved kinds from the My Forms tab of your accounts.

If you would like use US Legal Forms for the first time, listed here are basic directions to get you began:

- Be sure you have chosen the proper kind for your personal area/county. Select the Preview switch to review the form`s content material. Read the kind explanation to ensure that you have selected the correct kind.

- In case the kind does not match your specifications, use the Look for field near the top of the display screen to obtain the one that does.

- In case you are content with the shape, confirm your choice by visiting the Acquire now switch. Then, opt for the rates strategy you like and offer your credentials to register on an accounts.

- Process the deal. Make use of your Visa or Mastercard or PayPal accounts to perform the deal.

- Find the structure and down load the shape on the product.

- Make adjustments. Load, modify and printing and indicator the saved Minnesota Gift Deed of Mineral Interest with No Warranty.

Each web template you added to your money lacks an expiration day and is also yours eternally. So, if you would like down load or printing an additional backup, just check out the My Forms section and click on about the kind you need.

Obtain access to the Minnesota Gift Deed of Mineral Interest with No Warranty with US Legal Forms, probably the most comprehensive library of legal record templates. Use 1000s of professional and express-particular templates that fulfill your small business or personal demands and specifications.

Form popularity

FAQ

The gift of immovable property must be registered and the movable property can be made valid by delivery of possession or registered deed. The gift must be accepted by the donee and the acceptance must be during the lifetime of the donee and the acceptance must be given while the donee was still capable of giving.

The legal term for transferring real property or property title to a new owner is conveyance. A real estate attorney can help the conveyance by taking the wishes of the buyer and the seller and translating them into a legal document called a deed.

Good to know: Beware that a Gift Deed cannot be revoked. Once the property is given away, you cannot get it back unless the person who received it transfers it back.

Giving a gift of equity is a way for owners to gift real estate to their children or other relatives even if these buyers don't have enough cash to cover a down payment or the larger monthly payment that would come from a home sold at market value.

Gift Deed. A grantor may make a gift of property to the grantee, and use a grant deed form or a quitclaim deed form for the purpose. Grantor may, but need not, say in the deed that grantor makes the transfer because of love and affection for the grantee.

There are several type of gifts in property law, most notably inter vivos gifts which are made in the donor's lifetime and causa mortis (deathbed) gifts which are made in expectation of the donor's imminent death.

A grant deed is the most common method Californians use to transfer title to real property.

A bequest is a gift of personal property that you leave to an individual or organization in your last will and testament. Bequests can include cash, stocks or other investment assets, and personal property (like jewelry, artwork, or furniture).