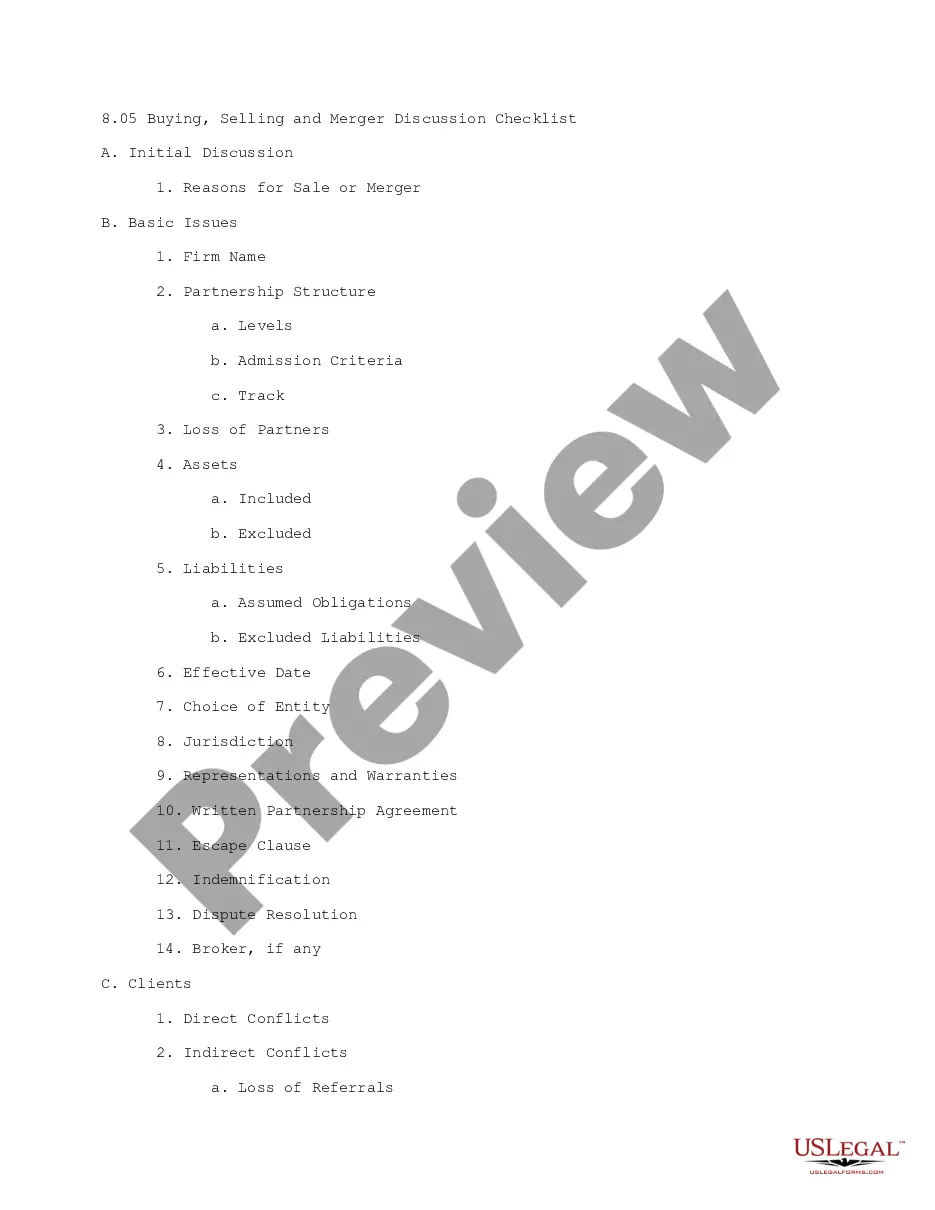

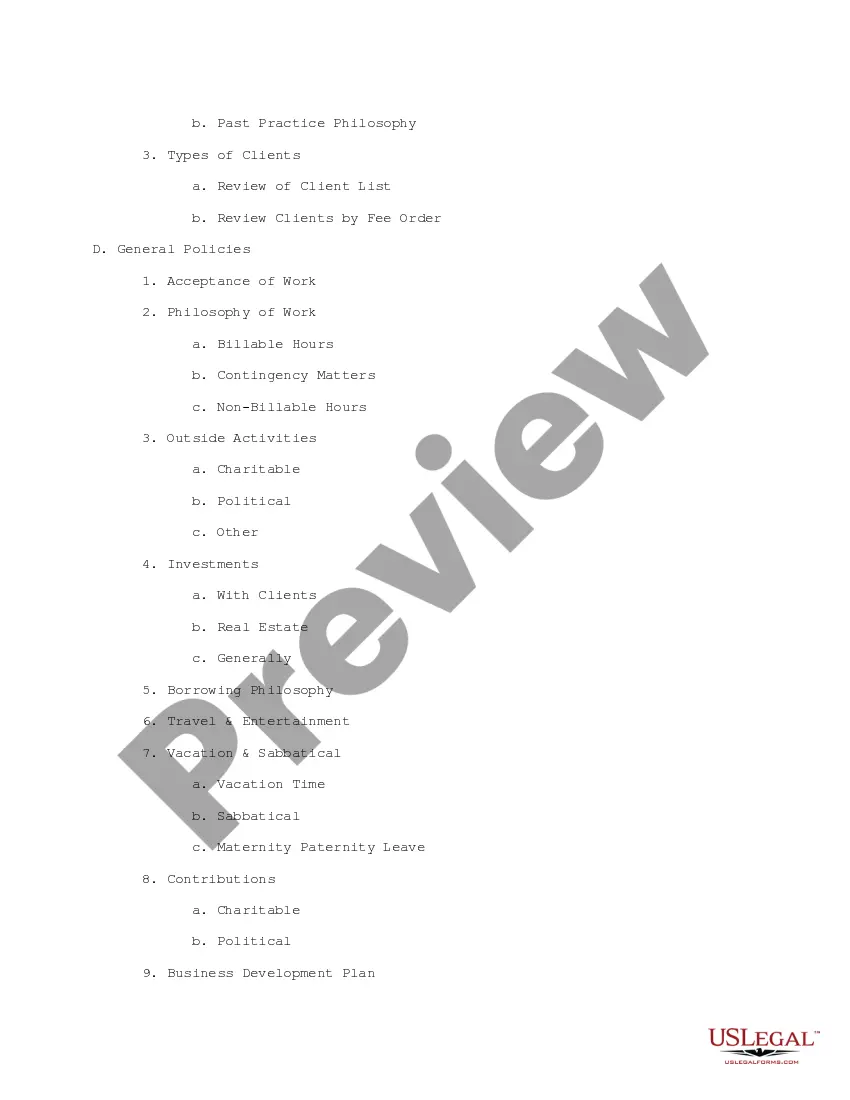

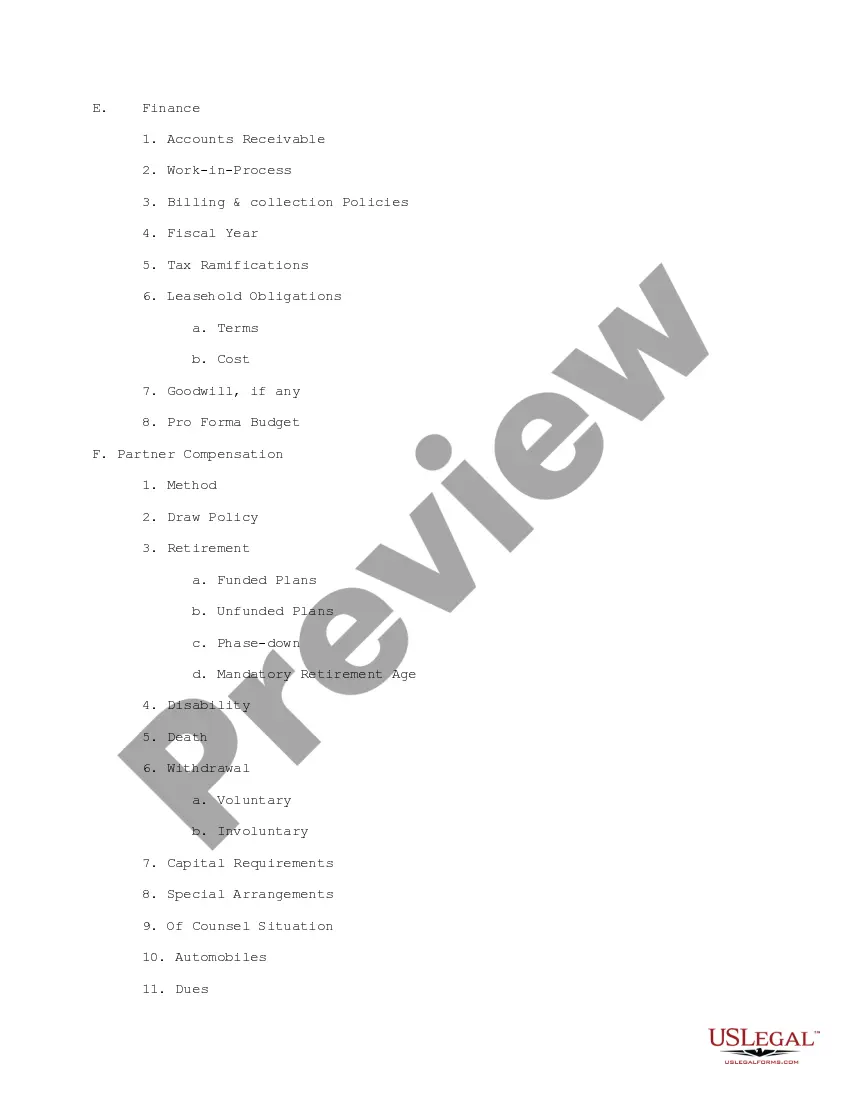

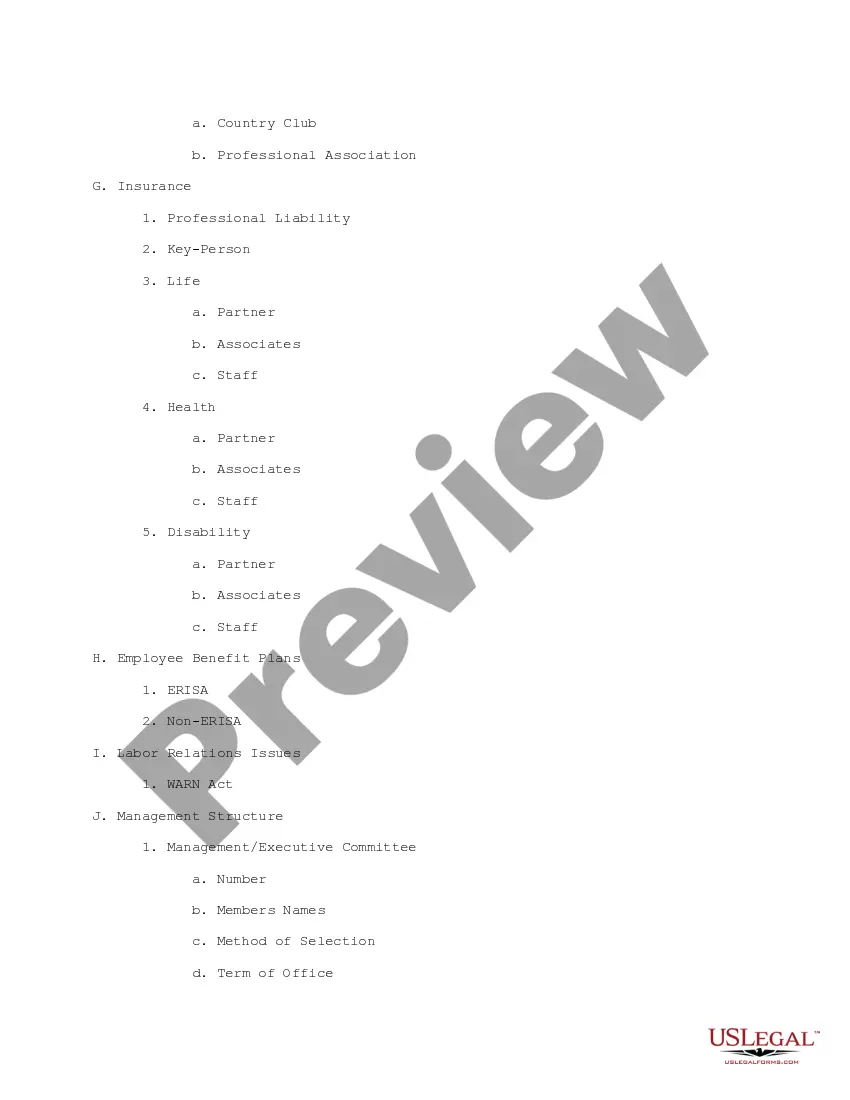

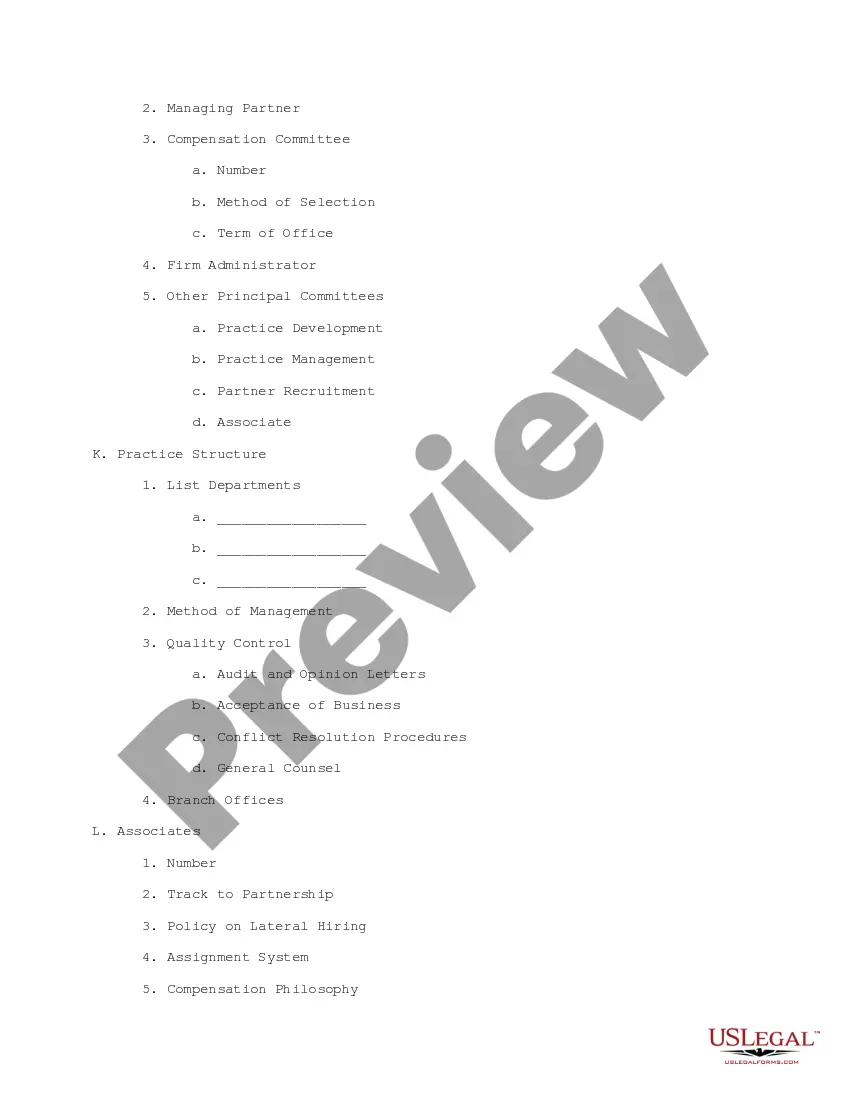

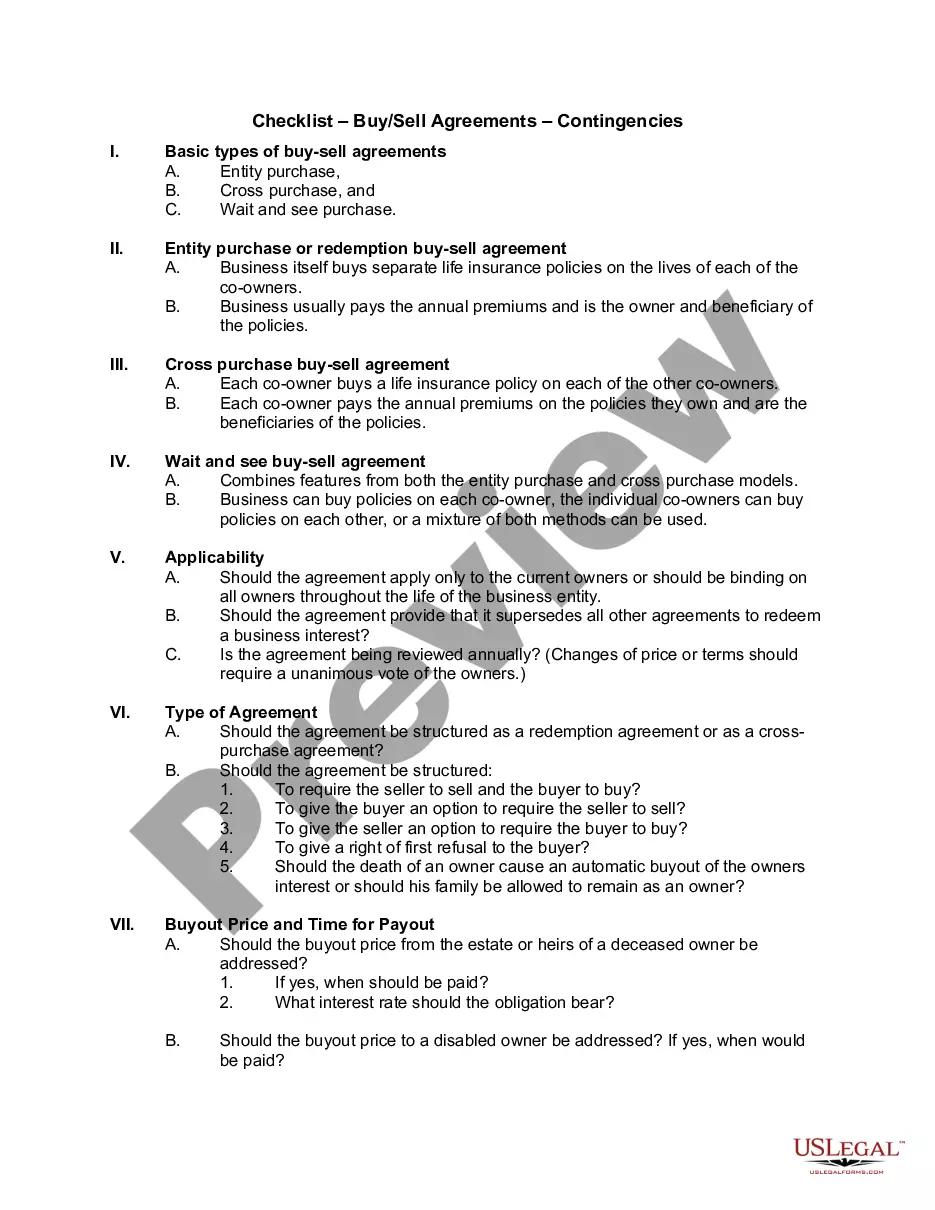

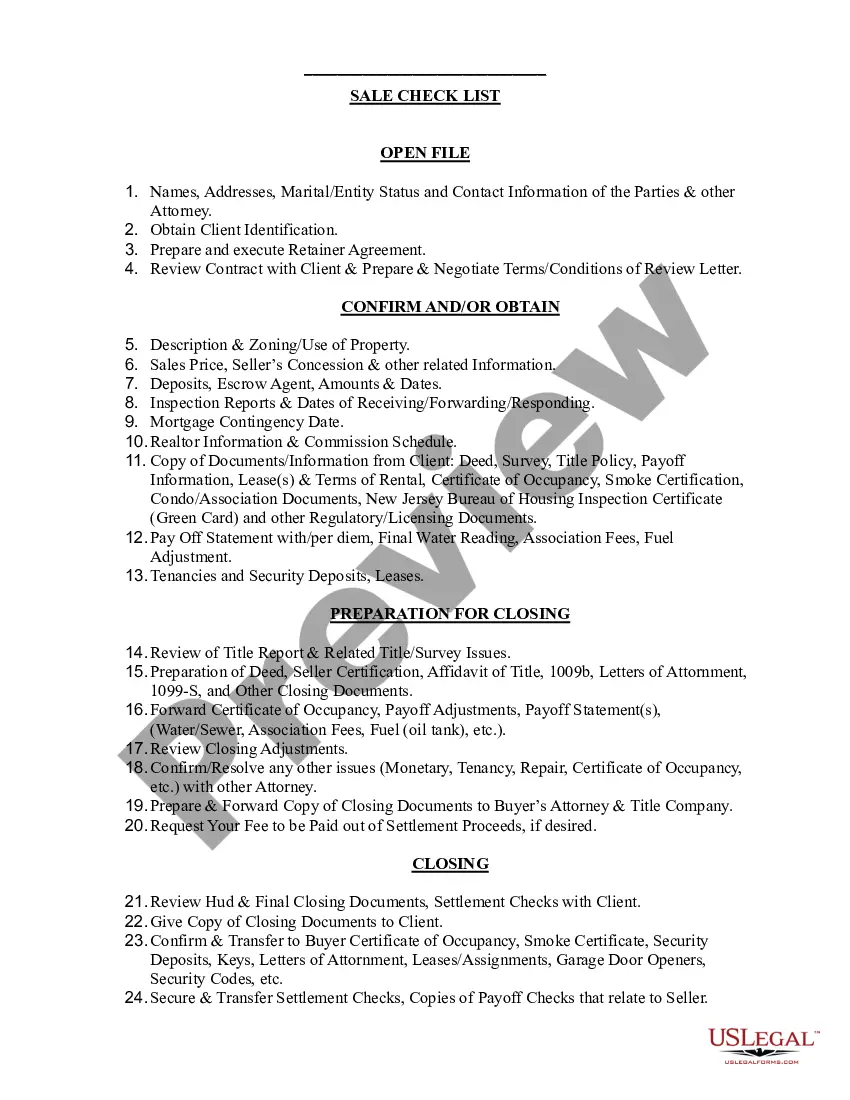

This is a checklist for the discussion of buying, selling, or merger of a law firm. Each category (clients, finance, partner compensation, etc.) is broken into sub-categories as a way of bringing to mind all issues to be discussed.

Minnesota Buying, Selling and Merger Discussion Checklist

Description

How to fill out Buying, Selling And Merger Discussion Checklist?

If you wish to total, acquire, or print out legitimate papers layouts, use US Legal Forms, the most important variety of legitimate forms, which can be found on-line. Use the site`s simple and easy handy search to get the papers you will need. Various layouts for enterprise and individual functions are categorized by classes and states, or keywords and phrases. Use US Legal Forms to get the Minnesota Buying, Selling and Merger Discussion Checklist in just a handful of mouse clicks.

If you are currently a US Legal Forms customer, log in to your profile and click on the Obtain button to have the Minnesota Buying, Selling and Merger Discussion Checklist. You can also gain access to forms you earlier downloaded inside the My Forms tab of your profile.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Make sure you have chosen the form for your appropriate city/nation.

- Step 2. Use the Preview method to look through the form`s content. Do not neglect to learn the description.

- Step 3. If you are not satisfied with the form, utilize the Research area towards the top of the monitor to discover other models in the legitimate form format.

- Step 4. Once you have identified the form you will need, click on the Acquire now button. Choose the rates program you prefer and add your references to register for the profile.

- Step 5. Procedure the purchase. You can use your bank card or PayPal profile to finish the purchase.

- Step 6. Select the format in the legitimate form and acquire it in your system.

- Step 7. Comprehensive, modify and print out or sign the Minnesota Buying, Selling and Merger Discussion Checklist.

Each legitimate papers format you acquire is the one you have permanently. You might have acces to each form you downloaded inside your acccount. Go through the My Forms segment and decide on a form to print out or acquire yet again.

Be competitive and acquire, and print out the Minnesota Buying, Selling and Merger Discussion Checklist with US Legal Forms. There are thousands of skilled and express-certain forms you can use to your enterprise or individual needs.

Form popularity

FAQ

A merger between companies will eliminate competition among them, thus reducing the advertising price of the products. In addition, the reduction in prices will benefit customers and eventually increase sales. Mergers may result in better planning and utilization of financial resources.

The process of due diligence ensures that potential acquirers gain an accurate and complete understanding of a company. It helps evaluate a company's strengths, weaknesses, risks, and opportunities. The creation of a due diligence checklist provides the detailed roadmap required to guide such an extensive analysis.

Pre-transaction success factors The right partner. Trust between the parties. Due diligence en good valuation. Experience from previous mergers and acquisitions. Communication before the execution of the merger or acquisition. Quality of the plan. Execution of the plan. Swiftness of integration.

The due diligence process helps stakeholders understand the synergies and potential scalability of the businesses after the merger/acquisition. During the process, all internal and external factors that create risk in the acquisition are identified and focus is driven towards key factors that drive profitability.

Epstein (2005) proposed six determinants of merger success: due diligence, strategic vision and fit, deal structure, pre-merger planning, external factors, and post-merger integration.

Commonly-used measures include the company's share price; accounting measures such as sales, profits, return on assets, return on investments; or involve managers' subjective assessments of performance. Depending on the metric used, results differ.

Create a merger agreement If both sides decide that the merger makes sense financially, they proceed with a merger agreement. One company may purchase all of the second company's stock in exchange for its own stock, or the two companies may decide to create a new corporation that has its own stock.

Small Business Merger Guidelines Compare and analyze the corporate structures. Determine the leadership of the new company. Compare the company cultures. Determine the branding of the new company. Analyze all financial positions. Determine operating costs. Do your due diligence. Conduct a valuation of all companies.