Minnesota Chef Services Contract - Self-Employed

Description

How to fill out Chef Services Contract - Self-Employed?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a vast selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can quickly find the latest versions of forms such as the Minnesota Chef Services Contract - Self-Employed.

If you already have a subscription, Log In to retrieve the Minnesota Chef Services Contract - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved Minnesota Chef Services Contract - Self-Employed. Every document you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you desire. Access the Minnesota Chef Services Contract - Self-Employed with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and needs.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/state.

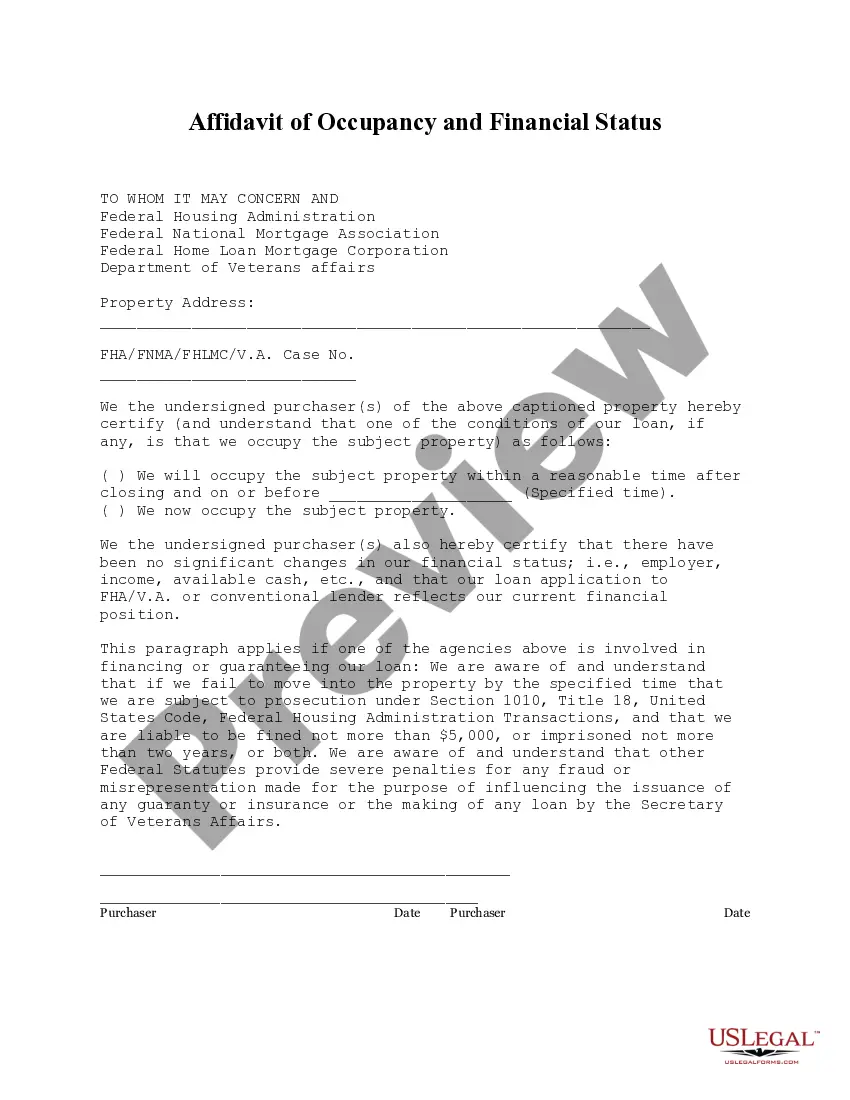

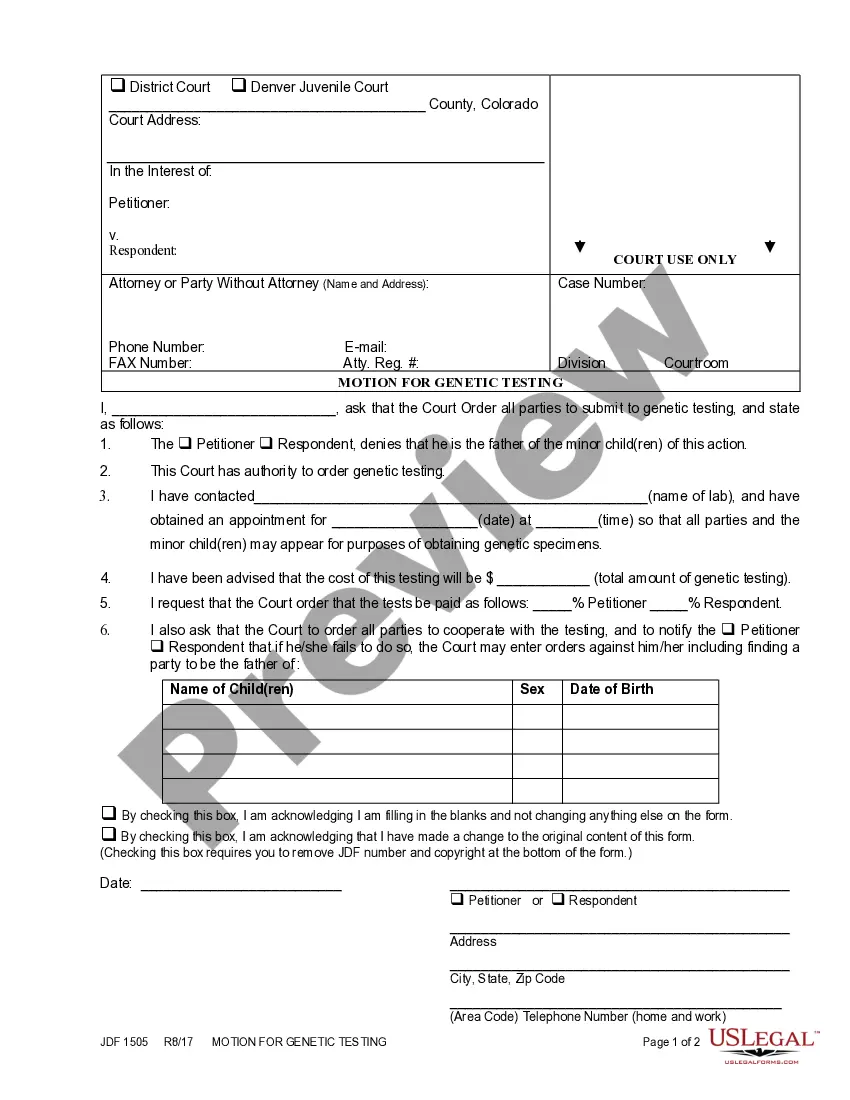

- Click the Preview button to review the form's details.

- Read the form information to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

The rules for self-employed individuals continuously evolve, particularly regarding tax obligations and benefits. Recent changes may affect how you report income, qualify for deductions, and receive health coverage. Familiarizing yourself with these updates while utilizing a Minnesota Chef Services Contract - Self-Employed can ensure compliance and optimize your business operations.

Yes, as a self-employed individual, you can and should have a written contract. A Minnesota Chef Services Contract - Self-Employed serves as a vital tool for establishing the terms of your services, payment details, and deadlines. This contract outlines the relationship you have with clients, protecting both parties and reducing potential conflicts.

Yes, contract work is considered self-employment. If you work on a per-project basis or for specific clients without traditional employment benefits, you fall under the category of self-employed. Using a Minnesota Chef Services Contract - Self-Employed can formalize your work arrangements and clarify the terms, ensuring that both you and your clients understand the expectations.

To file as an independent contractor, start by obtaining a business license if required in your area. Next, you will need to file a Schedule C form with your tax return to report income and expenses related to your work. Establishing a solid Minnesota Chef Services Contract - Self-Employed also supports your status and helps organize your financial obligations.

Minnesota does not legally require an operating agreement for LLCs, but it is highly recommended. An operating agreement clarifies the structure, roles, and responsibilities within your LLC, enhancing your business’s credibility. If you are self-employed and considering forming an LLC in Minnesota, drafting an operating agreement could provide additional security and clarity regarding your operations.

The terms self-employed and independent contractor can often be used interchangeably, but there are subtle differences. Generally, self-employed individuals manage their own business, while independent contractors may work on a contractual basis for various clients. In the context of a Minnesota Chef Services Contract - Self-Employed, either term can reflect your work style, but it’s important to clarify your status in any agreements.

Yes, a self-employed person can and should have a contract. Having a clearly defined Minnesota Chef Services Contract - Self-Employed is essential for setting expectations, protecting your rights, and outlining the responsibilities of both parties. This formal agreement helps to avoid misunderstandings and provides a legal basis should any disputes arise.

Absolutely, you can be a self-employed chef. This choice grants you the freedom to shape your culinary career and build your client base according to your vision. By implementing a Minnesota Chef Services Contract - Self-Employed, you can solidify your business practices, protect your rights, and foster strong relationships with clients.

A chef can operate as an independent contractor, especially when providing services to clients on a freelance basis. This status allows chefs to manage their businesses independently while ensuring they comply with legal and tax obligations. Utilizing a Minnesota Chef Services Contract - Self-Employed can help you navigate these aspects clearly.

While you can refer to yourself as a chef, gaining credibility often requires experience or formal training. Additionally, having a Minnesota Chef Services Contract - Self-Employed can enhance your professional image and demonstrate your commitment to quality service. This contract also provides legal foundations for your business, which is key to success.