Minnesota Catering Services Contract - Self-Employed Independent Contractor

Description

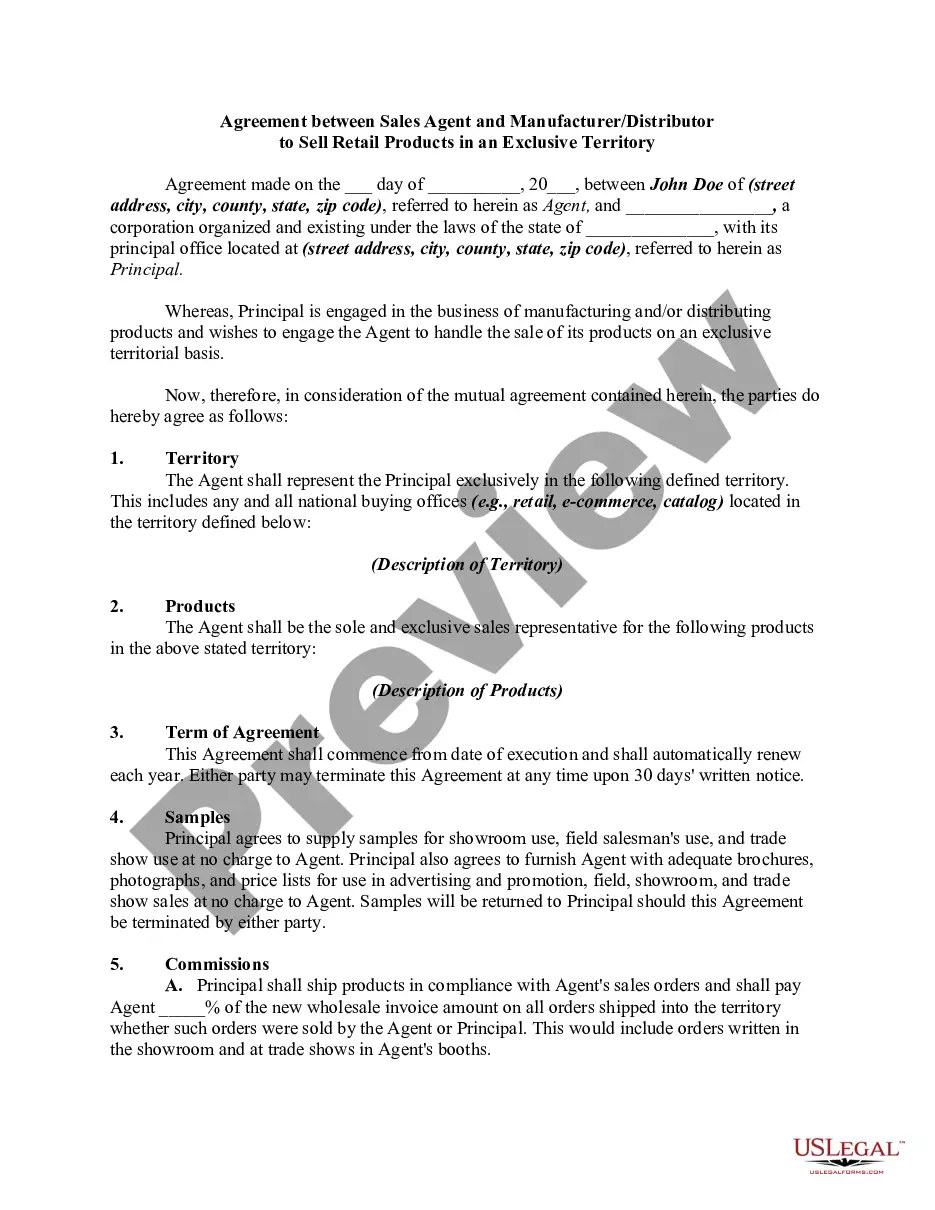

How to fill out Catering Services Contract - Self-Employed Independent Contractor?

Finding the correct authentic document template can be challenging.

Clearly, there are numerous formats accessible online, but how can you locate the authentic version you need.

Make use of the US Legal Forms website.

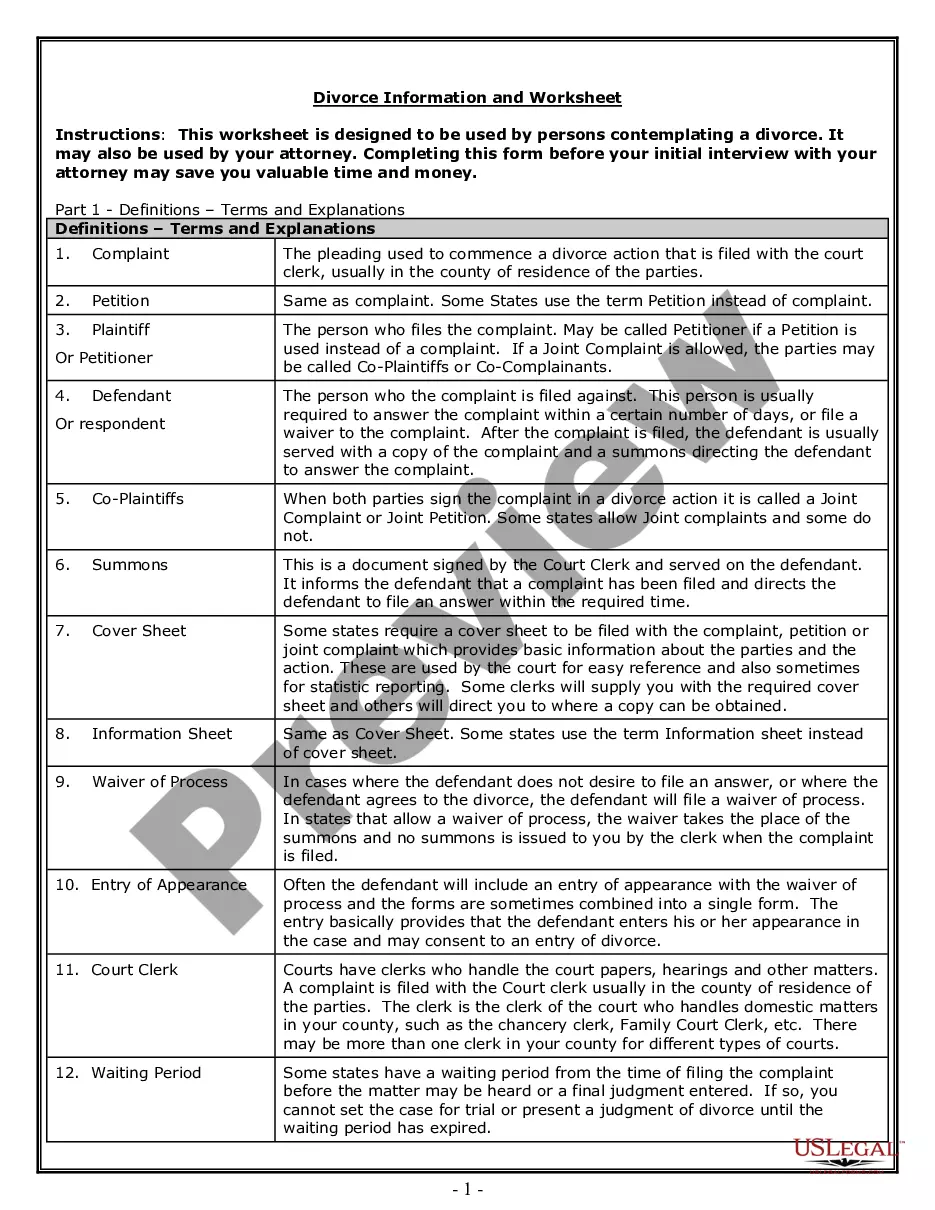

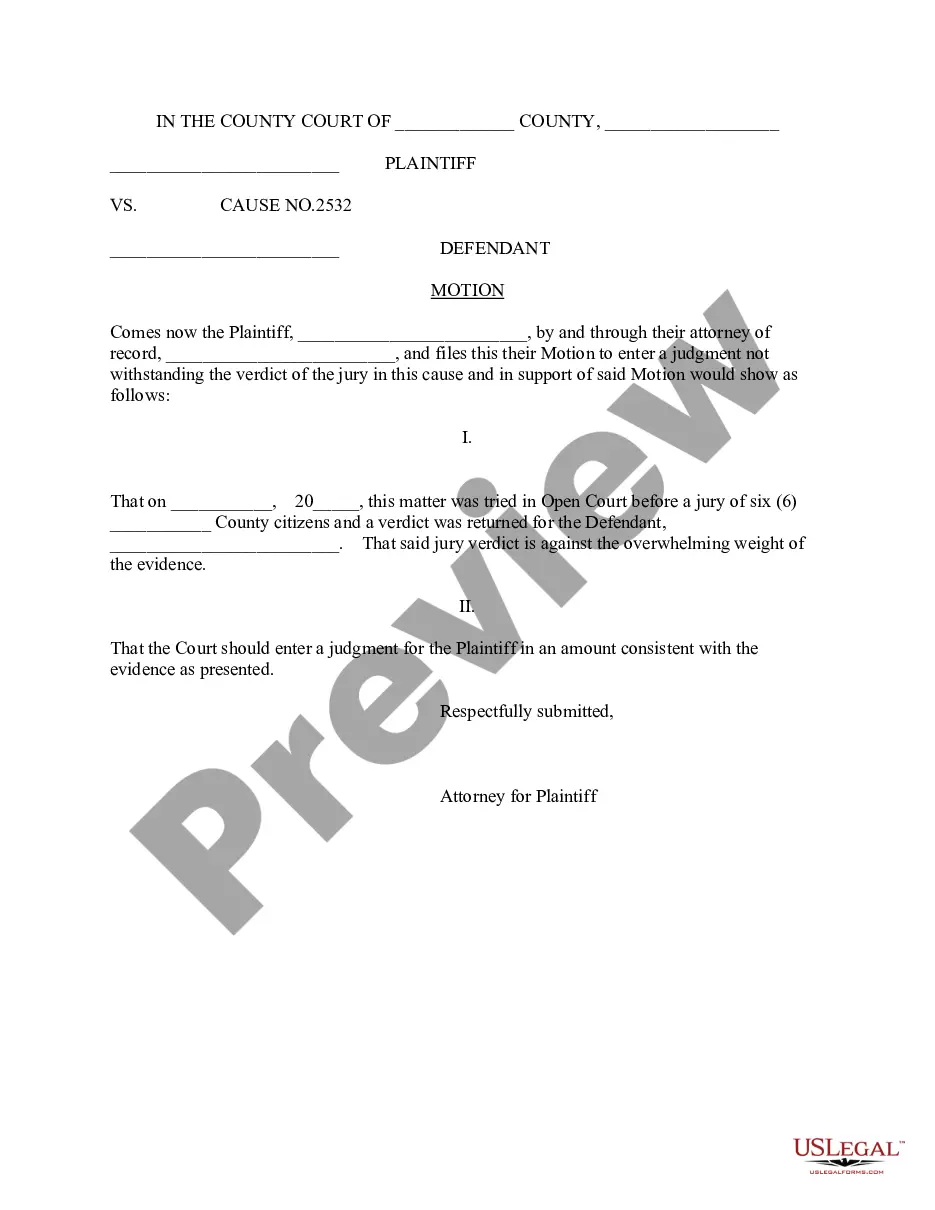

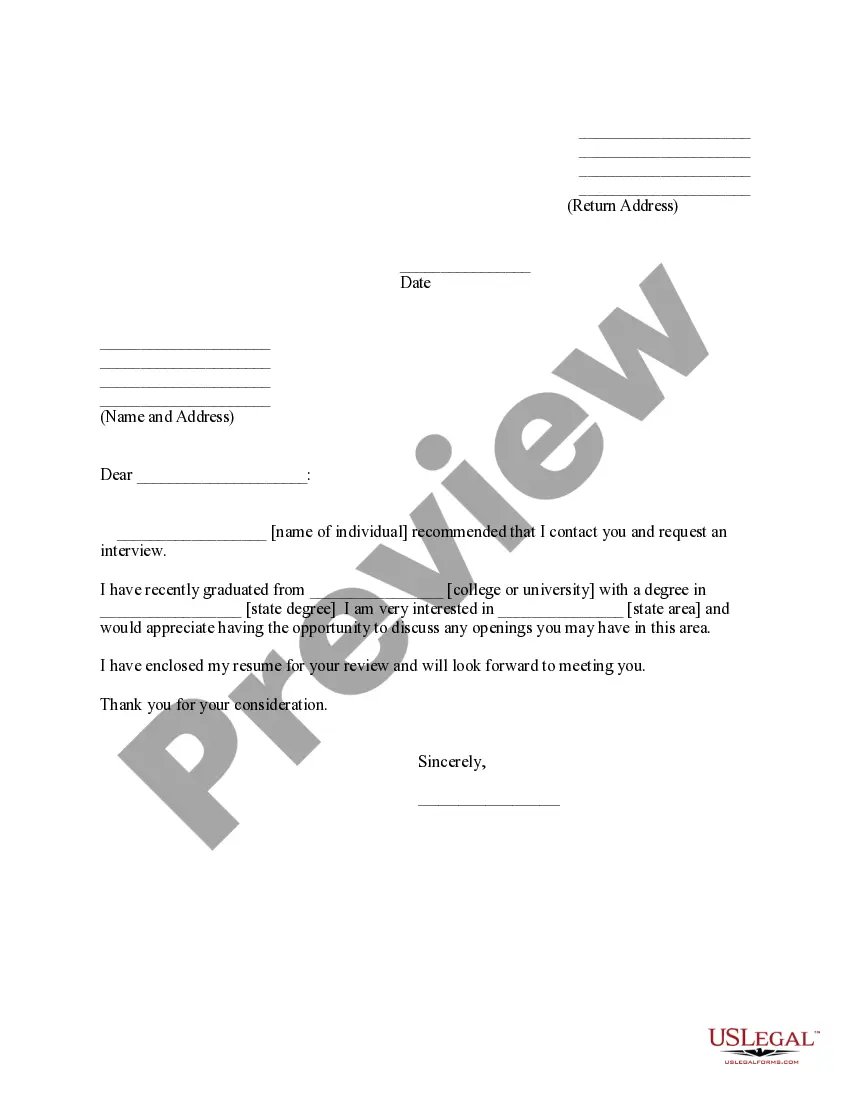

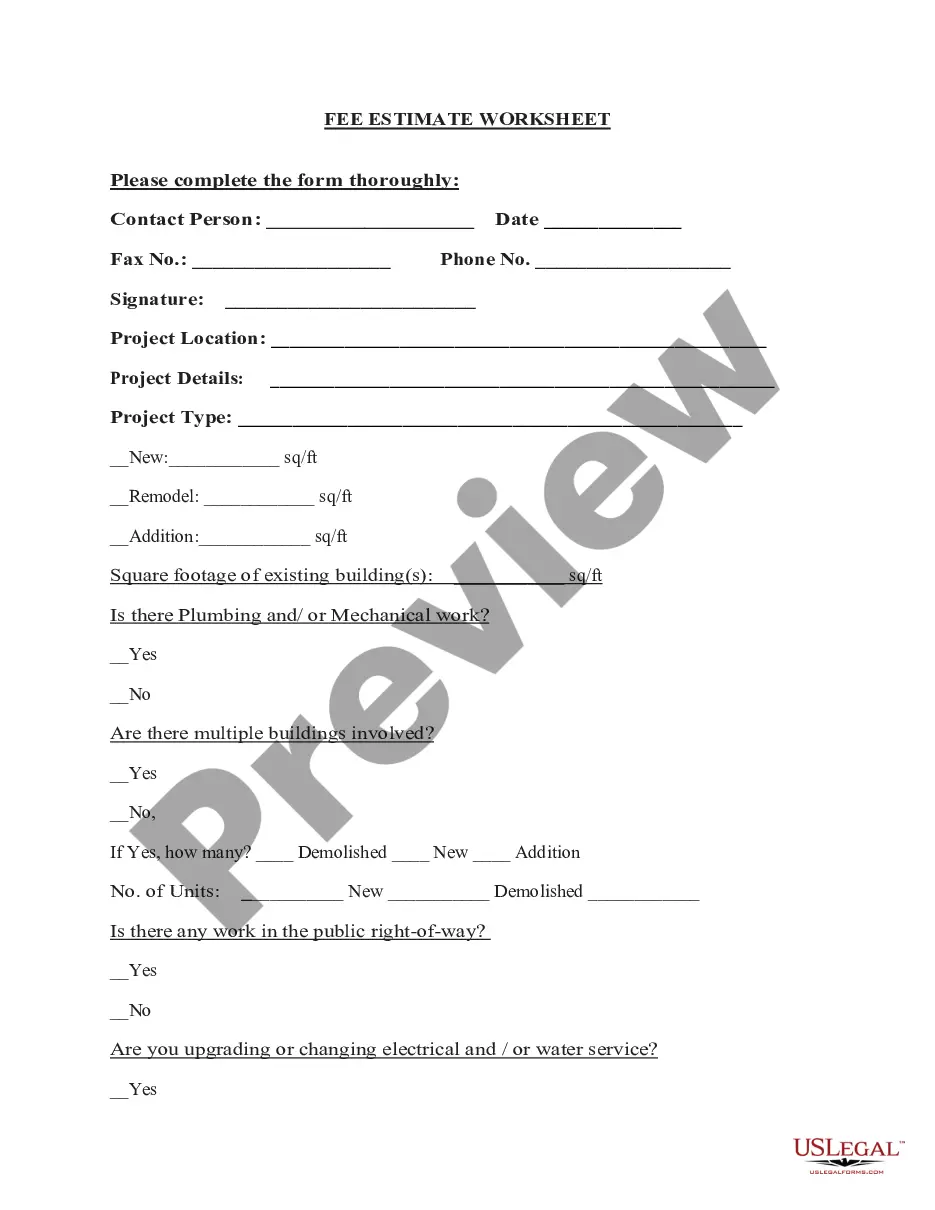

First, ensure you have selected the correct form for your location. You can browse the form using the Preview option and read the document description to confirm this is indeed the right one for you.

- The service offers a multitude of templates, including the Minnesota Catering Services Contract - Self-Employed Independent Contractor, which you can utilize for business and personal purposes.

- All of the documents are reviewed by experts and comply with state and federal standards.

- If you are already registered, Log In to your account and click the Acquire button to locate the Minnesota Catering Services Contract - Self-Employed Independent Contractor.

- Use your account to search through the legal forms you have purchased previously.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new client of US Legal Forms, here are straightforward steps you can follow.

Form popularity

FAQ

The new federal rule on independent contractors focuses on the criteria used to classify workers as independent contractors versus employees. Under this rule, core factors such as control over work and opportunity for profit are crucial. It aims to provide clearer guidelines for businesses and freelancers alike, impacting contracts, including the Minnesota Catering Services Contract for self-employed independent contractors. Understanding these rules can help you navigate the legal landscape effectively.

Creating an independent contractor contract involves several key steps. First, clearly define the scope of work and deliverables to manage expectations effectively. Next, outline payment details, including rates and payment schedules, and include any confidentiality clauses if necessary. Utilizing platforms like US Legal Forms can simplify this process, providing ready-to-use templates tailored to Minnesota catering services contracts for self-employed independent contractors.

A basic independent contractor agreement outlines the terms of engagement between a client and a self-employed individual, typically referred to as the contractor. This agreement specifies the scope of work, payment terms, deadlines, and rights to intellectual property. It serves to protect both parties and ensures clarity, making it essential in Minnesota for catering services contracts involving self-employed independent contractors.

Filling out an independent contractor form involves several key steps. Start with the contractor's personal information, including name and address, followed by a description of the services being provided. Be sure to include financial aspects, such as payment rates and deadlines. To make this process easier, consider using the resources available at uslegalforms when working with a Minnesota Catering Services Contract - Self-Employed Independent Contractor.

The terms self-employed and independent contractor are often used interchangeably, but they carry slight distinctions. A self-employed individual typically runs their business and may have multiple clients, while an independent contractor usually refers to someone hired for a specific project. Whether you choose to use the Minnesota Catering Services Contract - Self-Employed Independent Contractor depends largely on your business model and the preferences of your clients.

To write an independent contractor agreement, begin by clearly identifying the parties involved, as well as the scope of work. Next, include essential terms such as payment schedules, confidentiality clauses, and duration of the contract. For a Minnesota Catering Services Contract - Self-Employed Independent Contractor, consider using templates available on platforms like uslegalforms, which simplify the process and ensure you include all legal necessities.

Filling out an independent contractor agreement requires careful attention to detail. First, include the names and contact information of both parties. Then, outline the services to be provided under the Minnesota Catering Services Contract - Self-Employed Independent Contractor. Finally, specify the payment terms, deadlines, and any additional clauses that may be necessary.

Yes, a contract is highly recommended for independent contractors. It sets clear expectations and protects you legally, especially in industries like catering. When you use a Minnesota Catering Services Contract - Self-Employed Independent Contractor, you formalize your agreement, which can help you secure fair payment and define the scope of work involved.

Legal requirements for independent contractors can include obtaining necessary licenses, following tax regulations, and ensuring safety compliance. In Minnesota, it’s crucial to adhere to local and state laws governing your specific industry. A Minnesota Catering Services Contract - Self-Employed Independent Contractor can help ensure you meet these requirements while safeguarding your business interests.

Without a contract, you may still have some rights, but they can be harder to enforce. Common law provides certain protections based on the understanding between parties. However, relying on an established Minnesota Catering Services Contract - Self-Employed Independent Contractor is safer, as it solidifies your rights and outlines remedies for any breaches.