Minnesota Pump Installation And Repair Services Contract - Self-Employed

Description

How to fill out Pump Installation And Repair Services Contract - Self-Employed?

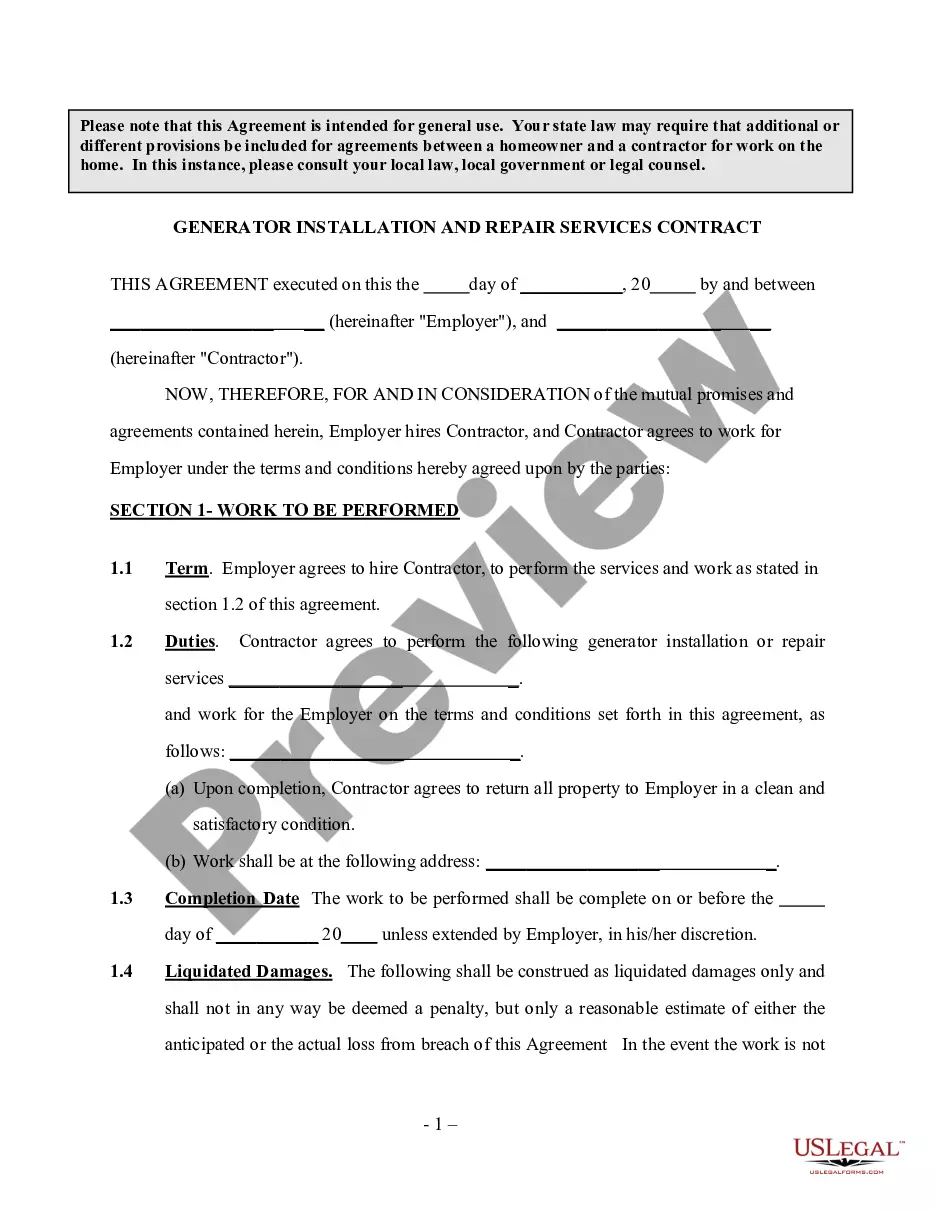

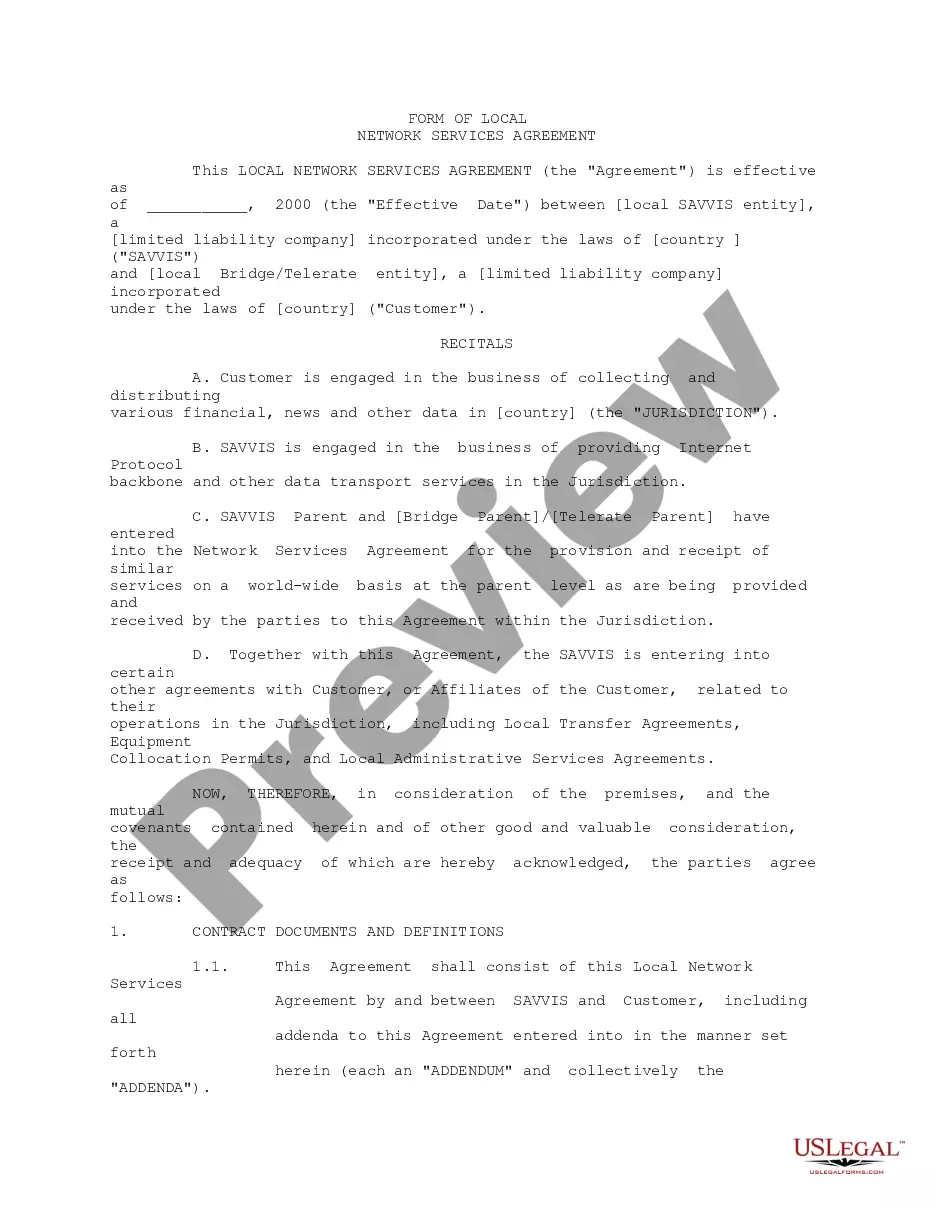

Selecting the correct valid document template can be a challenge. It goes without saying that there are numerous designs accessible online, but how do you acquire the valid form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Minnesota Pump Installation And Repair Services Contract - Self-Employed, which can be utilized for both professional and personal purposes. All of the forms are verified by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Minnesota Pump Installation And Repair Services Contract - Self-Employed. Use your account to view the legal forms you have previously purchased. Navigate to the My documents section of your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions that you should adhere to: First, make sure you have selected the correct form for your city/county. You can review the form using the Preview button and examine the form description to ensure this is indeed the right one for you. If the form does not meet your needs, utilize the Search field to find the appropriate form. Once you are certain that the form is correct, click the Buy now button to purchase the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired Minnesota Pump Installation And Repair Services Contract - Self-Employed.

Take advantage of US Legal Forms to simplify your document needs with ease and confidence.

- US Legal Forms is the largest repository of legal forms where you can find numerous document templates.

- Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- Ensure that the selected form matches your specific needs.

- Review the form description thoroughly before proceeding.

- Use the search feature for better accuracy in finding the right document.

- Complete the transaction securely using available payment methods.

Form popularity

FAQ

In Minnesota, some plumbing work can be performed without a license. Homeowners can often handle routine maintenance tasks like clearing clogged drains or replacing faucets. Additionally, installing water-using appliances may be permissible for homeowners. However, for more complex installations or repairs, such as those involving Minnesota Pump Installation And Repair Services Contract - Self-Employed, it is advisable to consult licensed professionals to ensure compliance with regulations and standards.

In Minnesota, certain minor repairs and projects can be completed without a contractor's license. This flexibility might be beneficial for self-employed individuals providing services under a Minnesota Pump Installation And Repair Services Contract - Self-Employed. However, for larger installations or significant repairs, obtaining a license is necessary to adhere to state laws and regulations.

In Minnesota, several services are taxable, including those related to tangible goods and certain construction-related services. When engaging in a Minnesota Pump Installation And Repair Services Contract - Self-Employed, understanding which aspects of your work are taxable can help avoid unexpected fees. Typically, if your service significantly enhances the property, it may fall under taxable services.

In Minnesota, labor can be subject to taxation, especially when it relates to services like those in a Minnesota Pump Installation And Repair Services Contract - Self-Employed. Generally, if you're providing an installation service, the labor charges you include may be taxable. It's essential to understand the specific regulations surrounding your services to ensure compliance with tax laws.

In Minnesota, subcontractors typically must hold the appropriate licenses for their work, depending on the trade. This requirement ensures that they meet the state's standards for safety and quality, particularly in specialized services like pump installation and repair. If you are working under a Minnesota Pump Installation And Repair Services Contract - Self-Employed, understanding licensing requirements is essential, and platforms like US Legal Forms can provide you with the necessary legal documents to navigate these requirements efficiently.

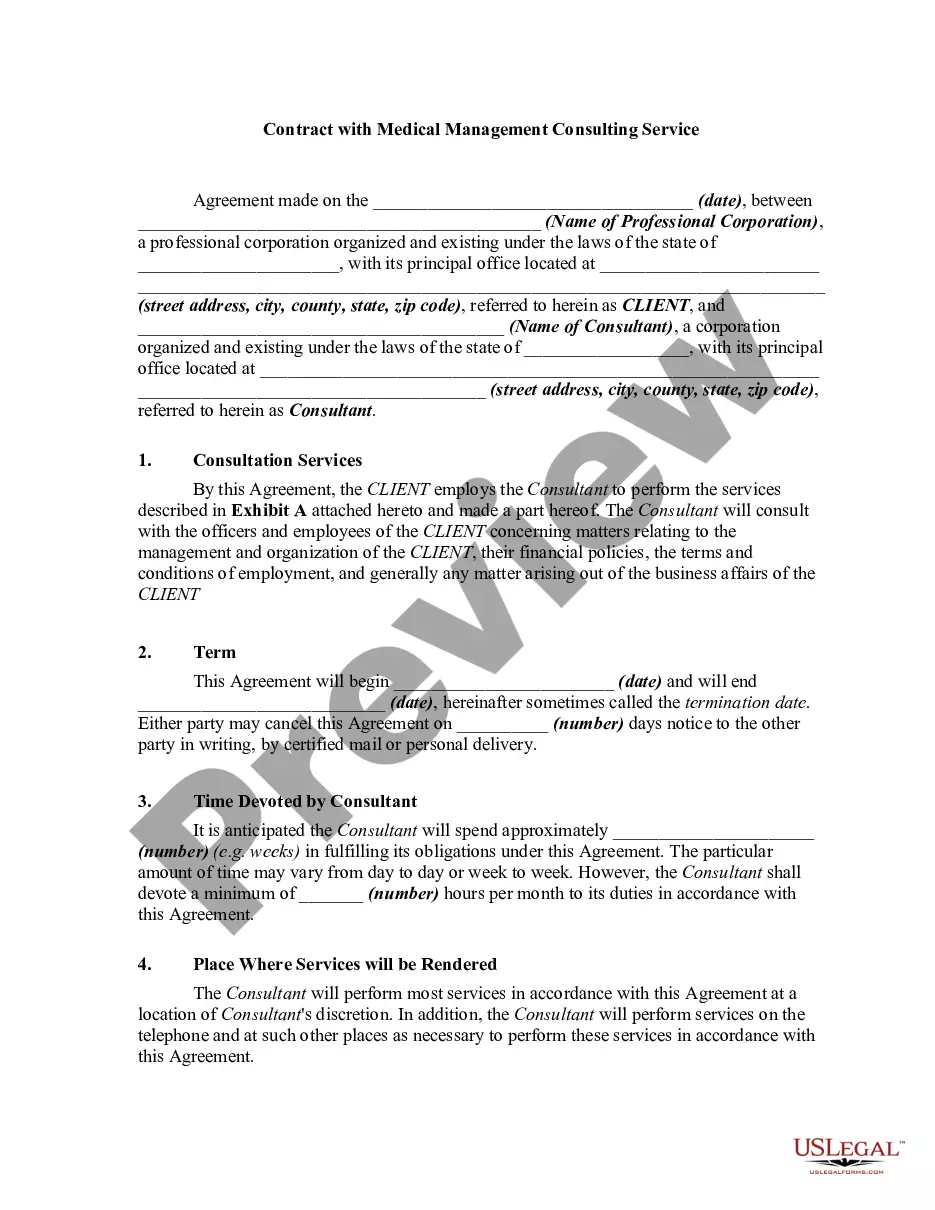

An independent contractor agreement in Minnesota is a legal document that outlines the terms of work between a business and a self-employed individual. This agreement details the responsibilities, compensation, and duration of the job, ensuring clarity and protection for both parties. When you engage in Minnesota pump installation and repair services as a self-employed contractor, having a clear agreement can help prevent misunderstandings and protect your rights.

Common examples include:Clothing for general use, see Clothing.Food (grocery items), see Food and Food Ingredients.Prescription and over-the-counter drugs for humans, see Drugs.

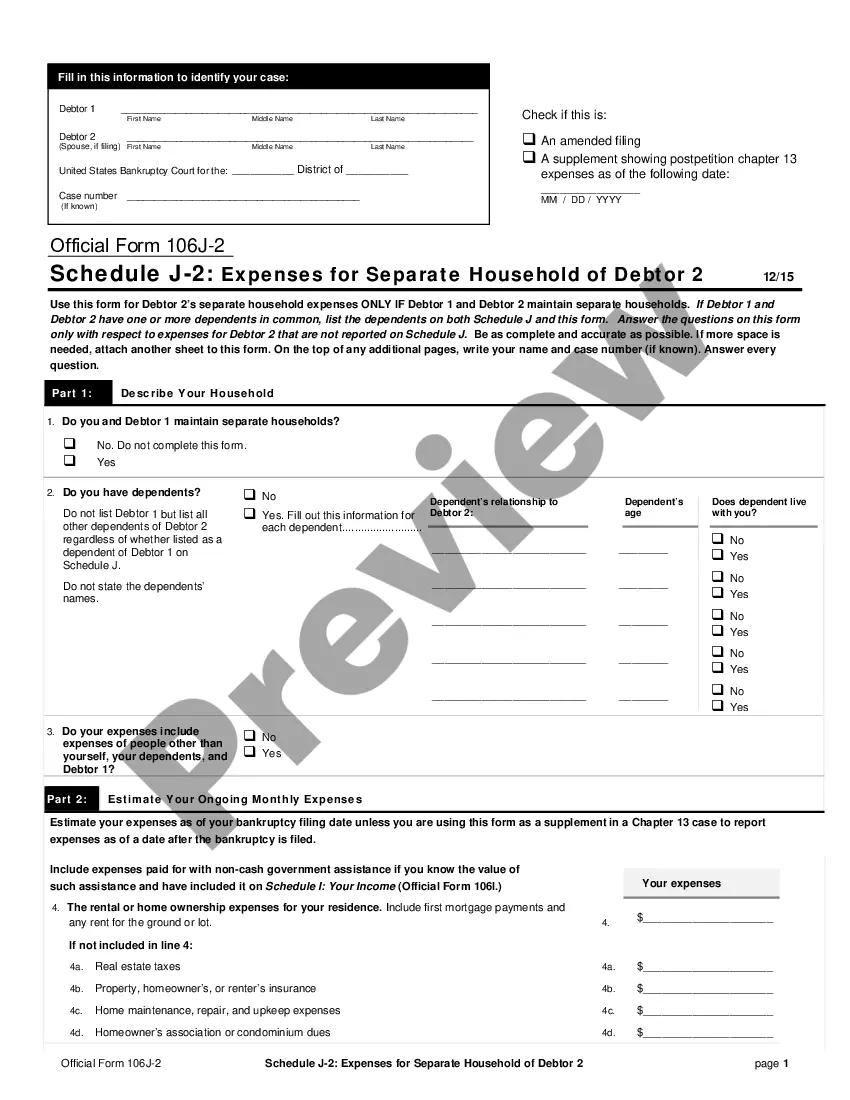

You may be eligible for benefits some weeks while working in self-employment and not others. To be eligible for benefits for any week, you must meet three requirements: Work less than 32 hours (in any combination of employment, self-employment, or volunteer work) and earn less than your weekly benefit amount.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Contract for service. A contract of service is an agreement between an employer and an employee. In a contract for service, an independent contractor, such as a self-employed person or vendor, is engaged for a fee to carry out an assignment or project.