Alabama Settlement Statement

About this form

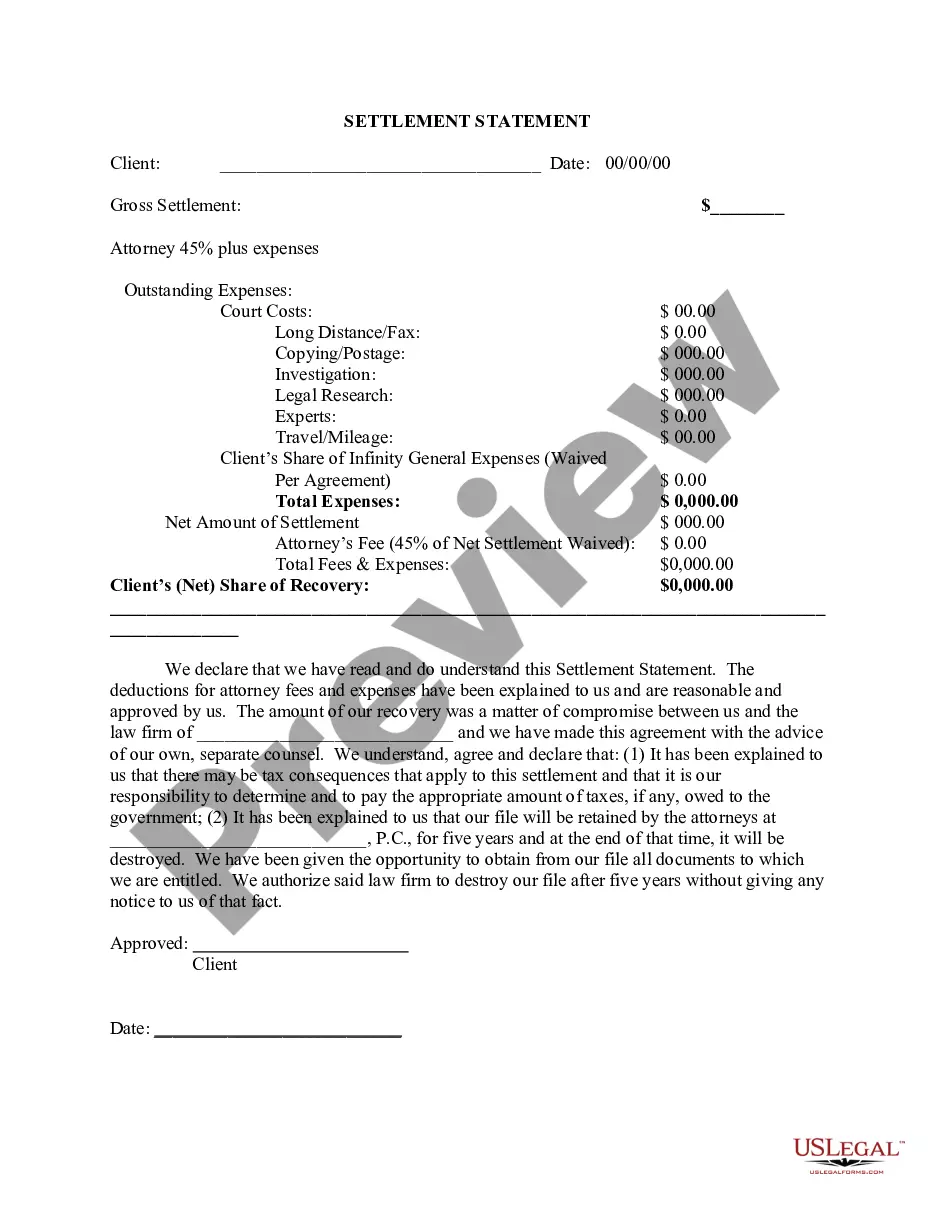

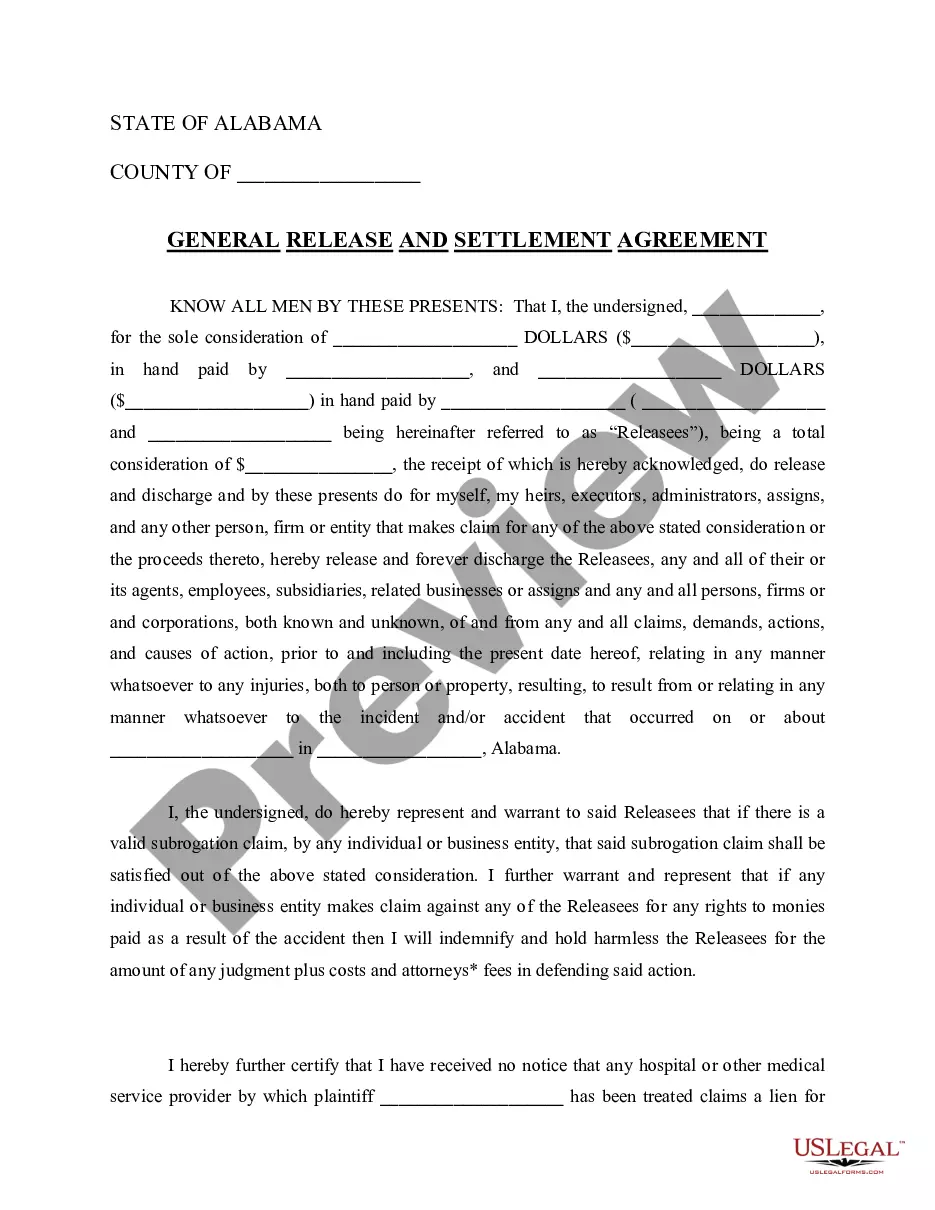

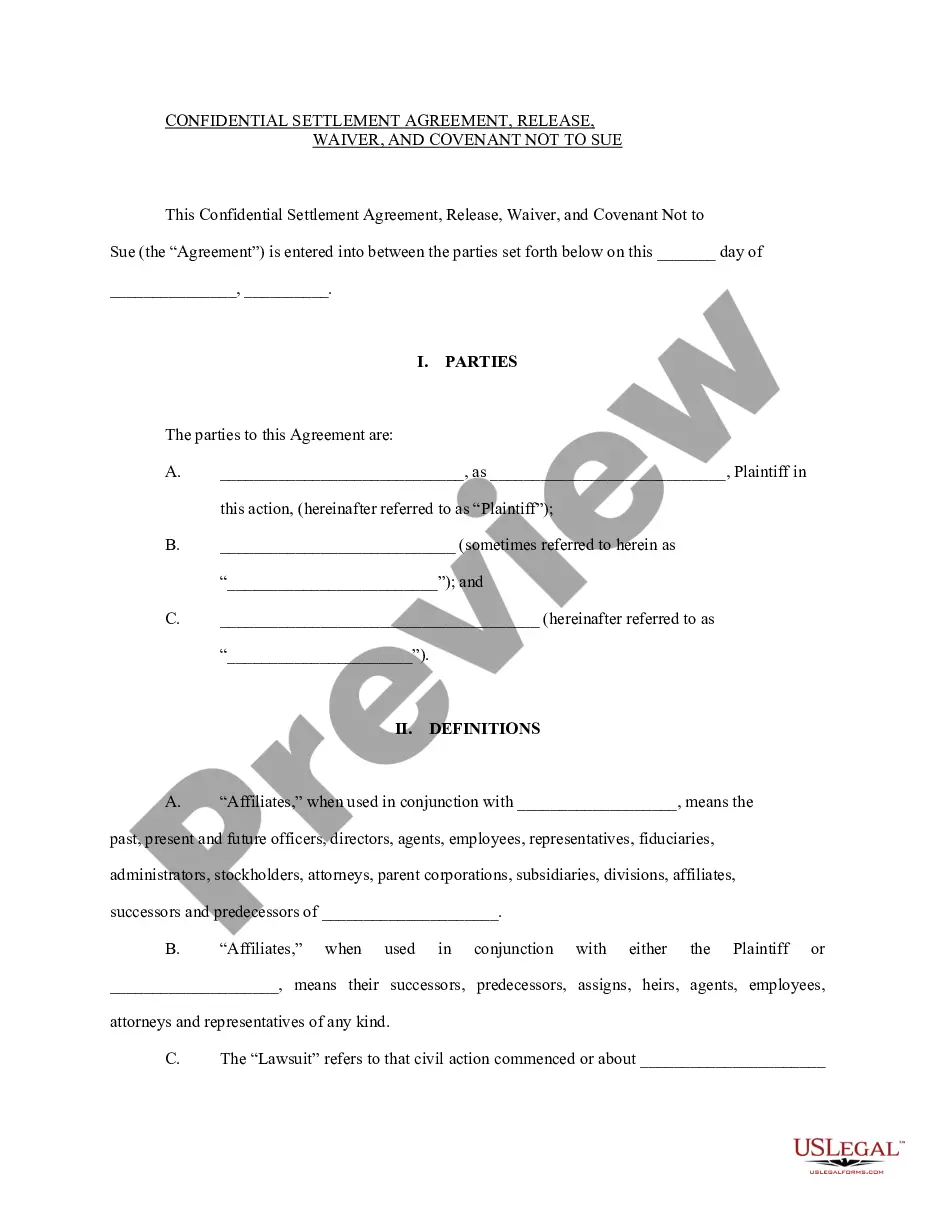

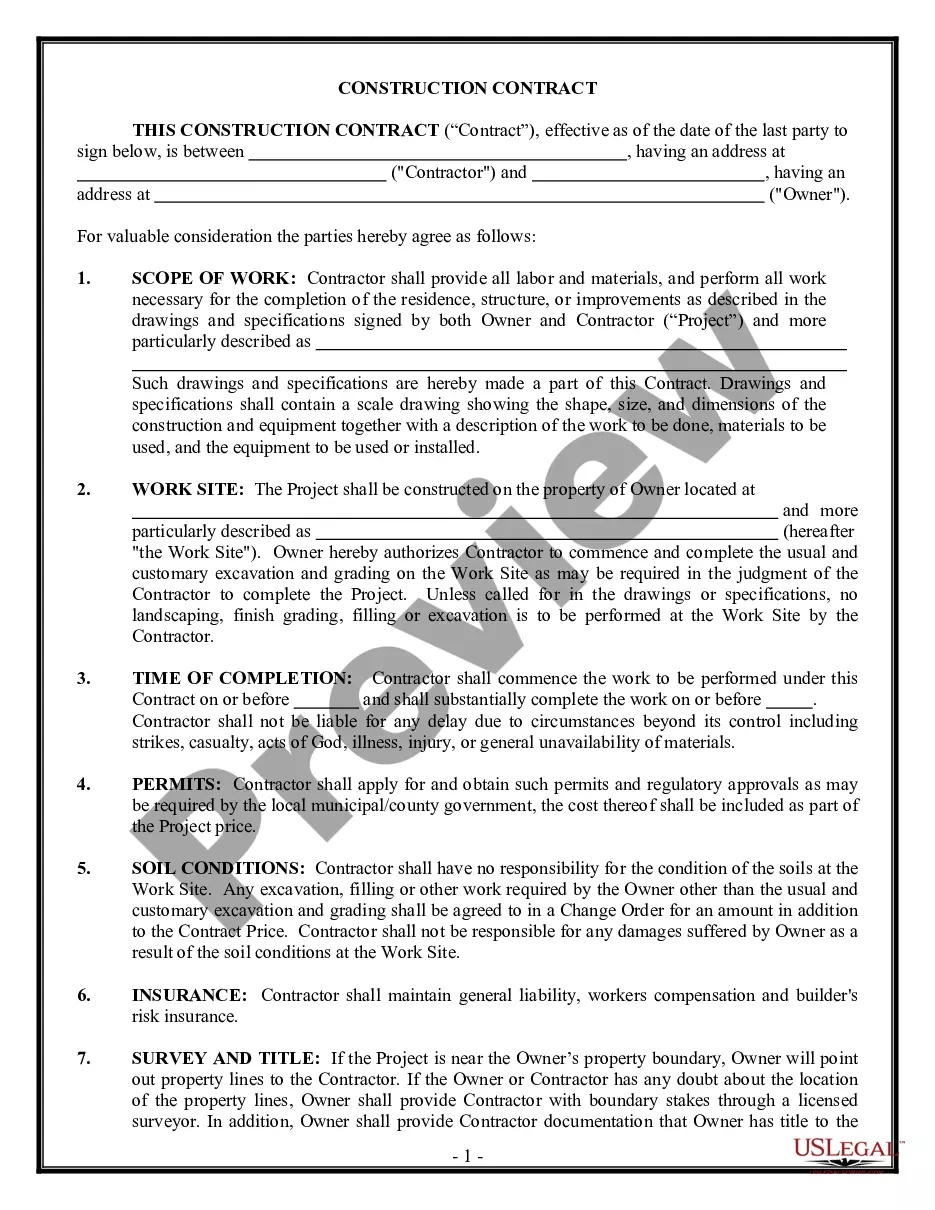

The Settlement Statement is a legal document used to provide a clear account of a clientâs settlement in a legal case. It summarizes the gross settlement amount, details the attorney's fees, enumerates any outstanding expenses, and states the net amount the client will receive. This form differs from other forms by including important disclosures regarding file retention and potential tax implications related to the settlement. It is essential for ensuring transparency between clients and law firms.

Main sections of this form

- Client identification section with date of agreement.

- Gross settlement amount and clientâs net share calculation.

- Breakdown of attorney fees and outstanding expenses.

- Client's agreement regarding file retention and destruction.

- Declaration of understanding of tax implications.

Common use cases

This form is used when a client reaches a settlement in a legal case. It is essential in cases involving personal injury, contract disputes, or other civil matters where a financial agreement is needed following negotiations. The Settlement Statement should be utilized to formally document the terms agreed upon by the client and their attorney.

Who needs this form

- Clients who are settling a legal case.

- Attorneys representing clients in various legal matters.

- Individuals receiving compensation from settlements, such as in personal injury or contract disputes.

How to prepare this document

- Identify the parties involved and enter their names in the client section.

- Specify the date of the settlement and the gross settlement amount.

- List the attorney's fees and detailed line items for all outstanding expenses.

- Calculate the total expenses and subtract them from the gross settlement to find the net amount.

- Ensure both clients approve the statement by signing and dating it at the bottom.

Notarization requirements for this form

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to accurately list all outstanding expenses.

- Not signing and dating the form by all relevant parties.

- Neglecting to discuss potential tax consequences with a tax advisor.

Benefits of using this form online

- Convenient download options for immediate use.

- Editability allows for customization to fit specific cases.

- Access to reliable templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

The average personal injury settlement in Alabama can vary widely depending on case specifics but often ranges between $15,000 and $50,000. However, many factors influence settlement amounts, including the severity of injuries and liability. Understanding your rights and potential compensation is crucial, and consulting resources like the Alabama Settlement Statement can provide clarity. With US Legal Forms, you can access forms and information necessary to explore your settlement options effectively.

Typically, a real estate attorney or a closing agent prepares the Alabama Settlement Statement. This document outlines the financial details of the transaction, ensuring all parties understand the costs and proceeds. It's essential for both buyers and sellers to review this statement carefully to avoid any surprises at closing. Using platforms like US Legal Forms can simplify this process by providing templates and guidance.

A buyer should receive the Alabama Settlement Statement at least three days before the closing date. This timeframe allows for a thorough review of all charges and credits listed, ensuring there are no surprises at closing. It's essential to use this time to clarify any discrepancies with the closing agent or attorney. Being prepared will make your closing process smoother and more efficient.

A settlement statement, specifically the Alabama Settlement Statement, contains all financial details related to a real estate transaction. This includes costs for loans, title insurance, and other closing fees. Additionally, it outlines credits and debits for both parties, providing a comprehensive view of the financial aspects. Understanding this statement ensures that you are fully informed before closing.

When reading a seller's settlement statement, focus on the net proceeds section, which shows the total amount the seller will receive after all costs and fees are deducted. Look for specific expenses, such as agent commissions, property taxes, and any repairs agreed upon. Familiarizing yourself with these details can clarify what you owe and what you'll take home from the sale. The Alabama Settlement Statement will guide you through these vital figures.

Form C 34 is a state-specific form used in Alabama to detail the Alabama Settlement Statement. This form serves as an important disclosure document that outlines the terms of the financial transaction, including all costs and credits involved. Completing Form C 34 accurately is crucial for both buyers and sellers to ensure transparency during the closing process. Utilizing platforms like US Legal Forms can streamline the completion and understanding of this essential document, making the closing experience smoother.

The preparation of your Alabama Settlement Statement is typically the responsibility of the closing agent, which can be a title company or an attorney. They ensure the document accurately reflects all financial aspects of your transaction. If you have used a lender, they may also provide insights into who is responsible for this statement. For additional resources, you can explore USLegalForms to find comprehensive information.

Getting your Alabama Settlement Statement is straightforward. You should reach out to your lender or the title company to request it directly. They can provide you with the necessary details and any required forms. If you are facing challenges, USLegalForms offers helpful tools to simplify this process.

To obtain a copy of your Alabama Settlement Statement, contact your lender or the title company handling your transaction. They can provide you with a physical or digital copy upon request. If necessary, you may also be able to retrieve this document from the closing agent. For comprehensive information and resources, consider visiting USLegalForms, where you can find solutions to access your settlement statement easily.

You should receive your Alabama Settlement Statement before you close on your home. Generally, it is provided at least three days prior to the closing date, allowing you to review all costs and terms carefully. This early access lets you address any discrepancies or questions you might have. If you have concerns about timing, USLegalForms can guide you through the expected timeline.