Alabama General Release and Settlement Agreement

About this form

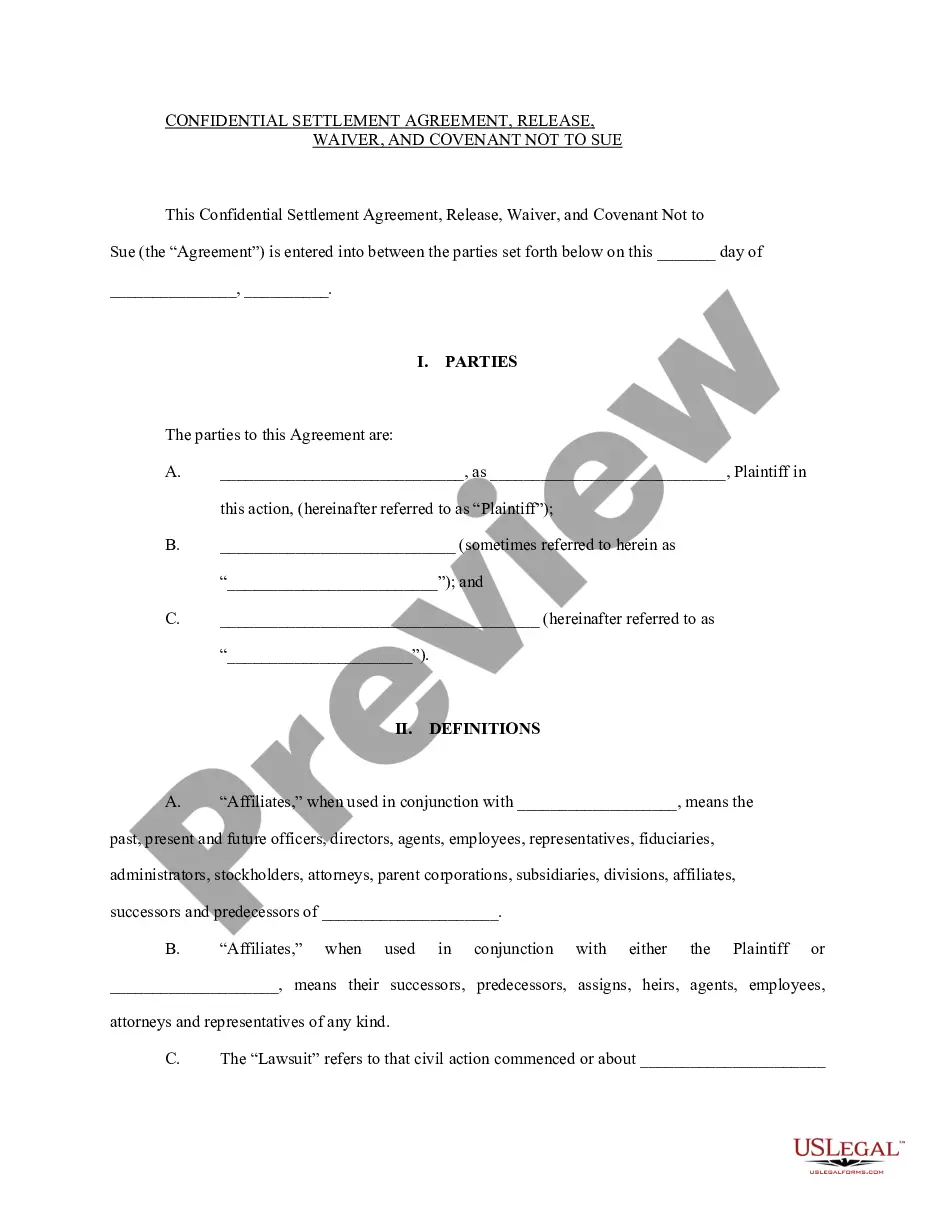

The General Release and Settlement Agreement is a legal document in which the claimant accepts a specified monetary sum in exchange for relinquishing any and all claims against the releasee. This form ensures that the releasee is protected from future claims related to the matter in question. It is distinct from other forms of settlement agreements as it includes a full release of liability for any damages, known or unknown, and ensures that each party will bear their own legal fees.

Form components explained

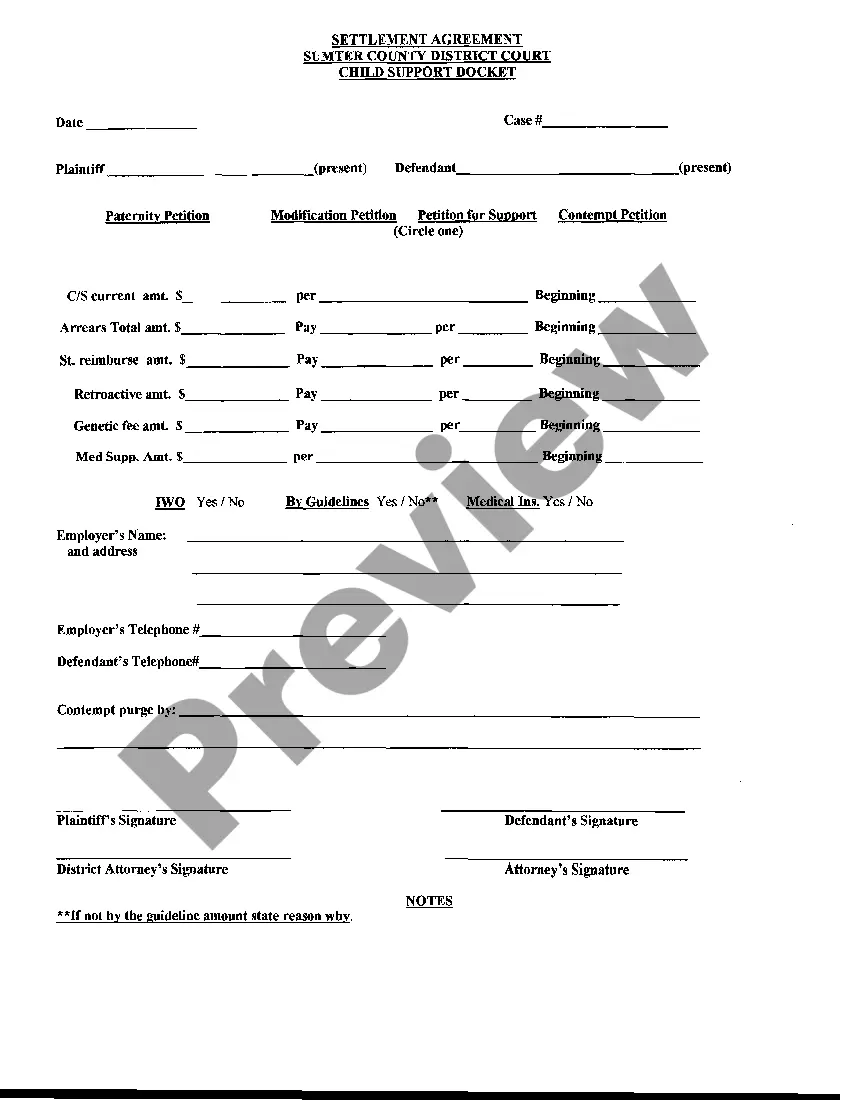

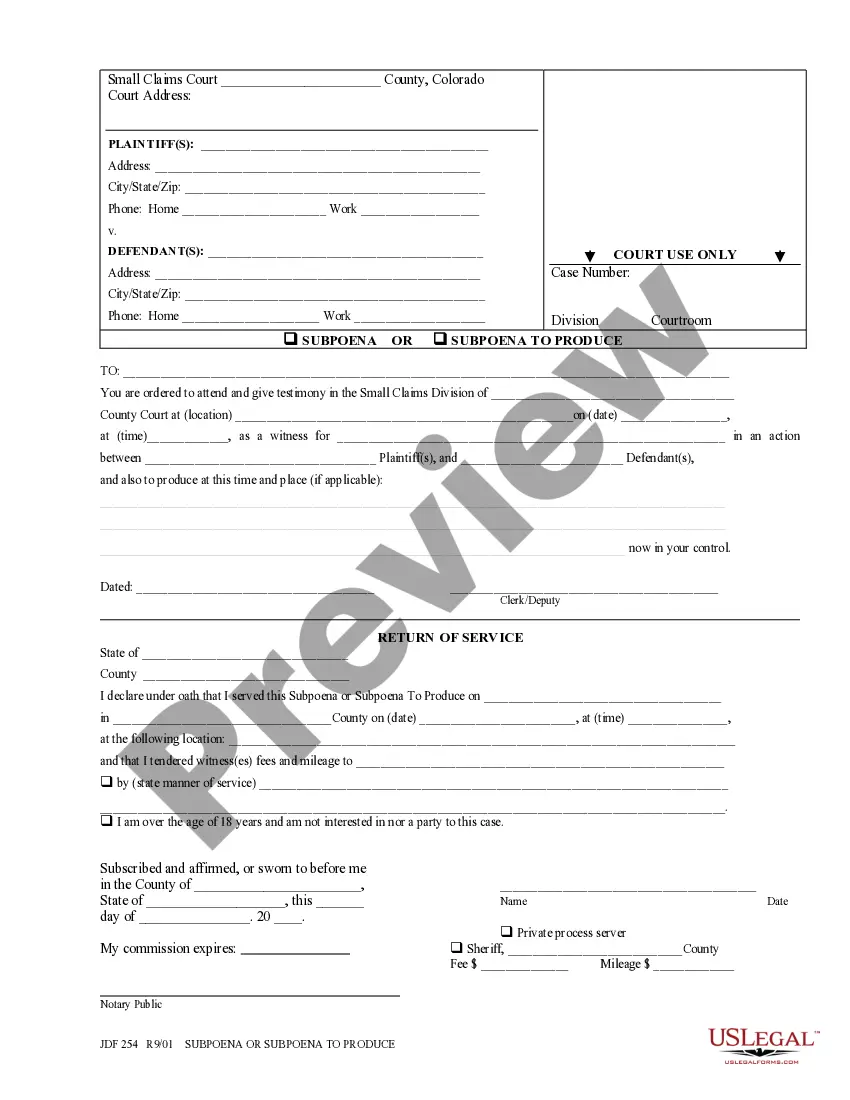

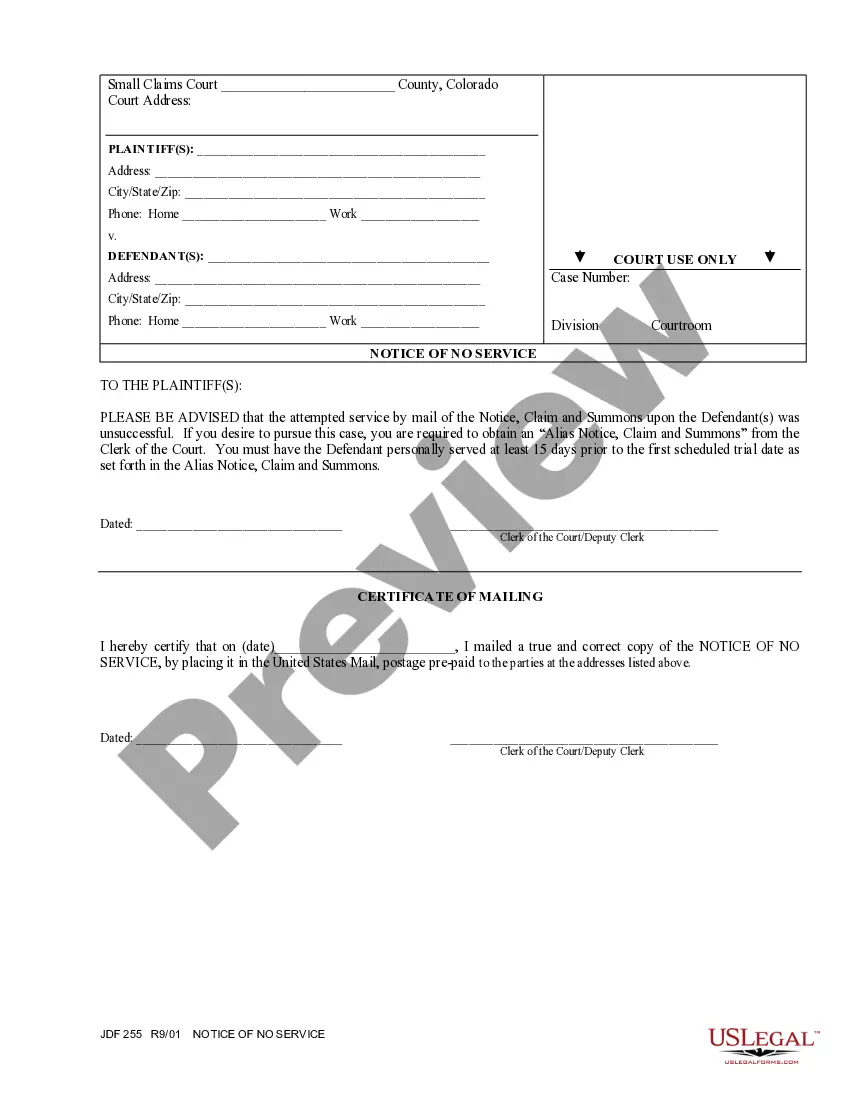

- Identification of the parties involved in the agreement.

- The amount of money being accepted as part of the settlement.

- A broad release of any claims against the releasees.

- Warranties regarding outstanding subrogation claims and lien satisfaction.

- Provisions stating the claimants relinquish rights to any further claims related to the incident.

- Signature lines for the claimant and an attorney, if applicable.

Common use cases

This form is typically used after a settlement has been reached in legal disputes, particularly in cases involving personal injury or property damage. It is essential when the claimant agrees to settle for a specific amount but is required to forfeit the right to pursue further claims regarding the same incident. Common scenarios include automobile accidents, workplace injuries, or other liability disputes.

Who can use this document

- Individuals who have reached a settlement after a legal dispute.

- Claimants seeking to waive their rights to future claims against the releasee.

- Parties involved in personal injury or property damage cases.

- Legal representatives who need to finalize settlements on behalf of their clients.

Completing this form step by step

- Identify and enter the names of the parties involved in the agreement.

- Clearly specify the settlement amount being paid.

- Detail the incident or accident that led to the agreement.

- Include any necessary indemnification clauses regarding liens or future claims.

- All parties must sign and date the document to finalize the agreement.

- If necessary, arrange for notarization for legal validation.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Common mistakes to avoid

- Failing to specify the exact amount of settlement agreed upon.

- Not clearly identifying all parties involved.

- Neglecting to include necessary indemnification clauses.

- Forgetting to sign and date the agreement.

Benefits of completing this form online

- Convenient access to legally vetted templates for immediate use.

- Editability allows customization to fit specific legal needs.

- Reliability by using forms drafted by licensed attorneys.

- Streamlined process for completing and filing the agreement.

Legal use & context

- This form serves as a legally binding agreement that prevents future claims related to the settled incident.

- Understanding the release's scope is crucial to avoid any misinterpretations of liability.

- Always consult with a legal professional to ensure compliance with jurisdiction-specific regulations.

Main things to remember

- The General Release and Settlement Agreement is vital for settling disputes and releasing liability.

- Clearly outline all parties, amounts, and incidents to avoid confusion.

- Consult local laws to ensure compliance and enforceability of the agreement.

- Utilizing online services for legal forms provides convenience and efficiency.

Form popularity

FAQ

An offer. This is what one party proposes to do, pay, etc. Acceptance. Valid consideration. Mutual assent. A legal purpose. A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

A release is an agreement not to sue; it waives your right to sue and company and "releases" your employer from legal liability for claims you may have against it. A release may be as broad or as narrow as the parties agree to make it.

2714 Retain relevant documents. 2714 Decide whether (and when) to make offer. 2714 Evaluate the reasons for settling. 2714 Assess motivating factors to settle. 2714 Confirm client's ability to settle. 2714 List all covered parties. 2714 List all legal issues to be settled.

A routine settlement agreement may take up to two hours to prepare. However, how long it takes to complete depends on how much back-and-forth there is between the two sides regarding revisions. Usually, there is not much of that with settlement agreements, but no two cases are the same.

Generally, the insurance company will not authorize the settlement check to be cashed until the Release is executed and returned back to the insurance company and the insurance company will typically require that the Release is signed by you and notarized by a certified Notary Public.

You need to have your written agreement notarized. Make sure, when you sign the agreement, that you understand everything you are agreeing to. This type of agreement is often called a marital settlement agreement or MSA.

Lawyers call an agreement to settle a dispute a "release," because in exchange for some act (often the payment of money), one person gives up (or releases) his or her claim against another.

Both parties involved in the accident should be identified. The letter should state that the payment is full and final, and that the injured party releases the responsible party from all present and future claims. If applicable, terms and conditions for payment should be mentioned.

The agreement should list the rights, claims, obligations, or interests that will be released in the settlement as well as any claims or obligations that are not part of the settlement.