Minnesota Foundation Contractor Agreement - Self-Employed

Description

How to fill out Foundation Contractor Agreement - Self-Employed?

Have you ever found yourself in a situation where you require documentation for both business or personal purposes almost constantly.

There are numerous legal document templates accessible online, but locating ones you can trust is not simple.

US Legal Forms offers thousands of form templates, including the Minnesota Foundation Contractor Agreement - Self-Employed, which is designed to meet state and federal requirements.

Select the payment plan you desire, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Minnesota Foundation Contractor Agreement - Self-Employed at any time if needed. Simply select the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides expertly crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Minnesota Foundation Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your appropriate city/region.

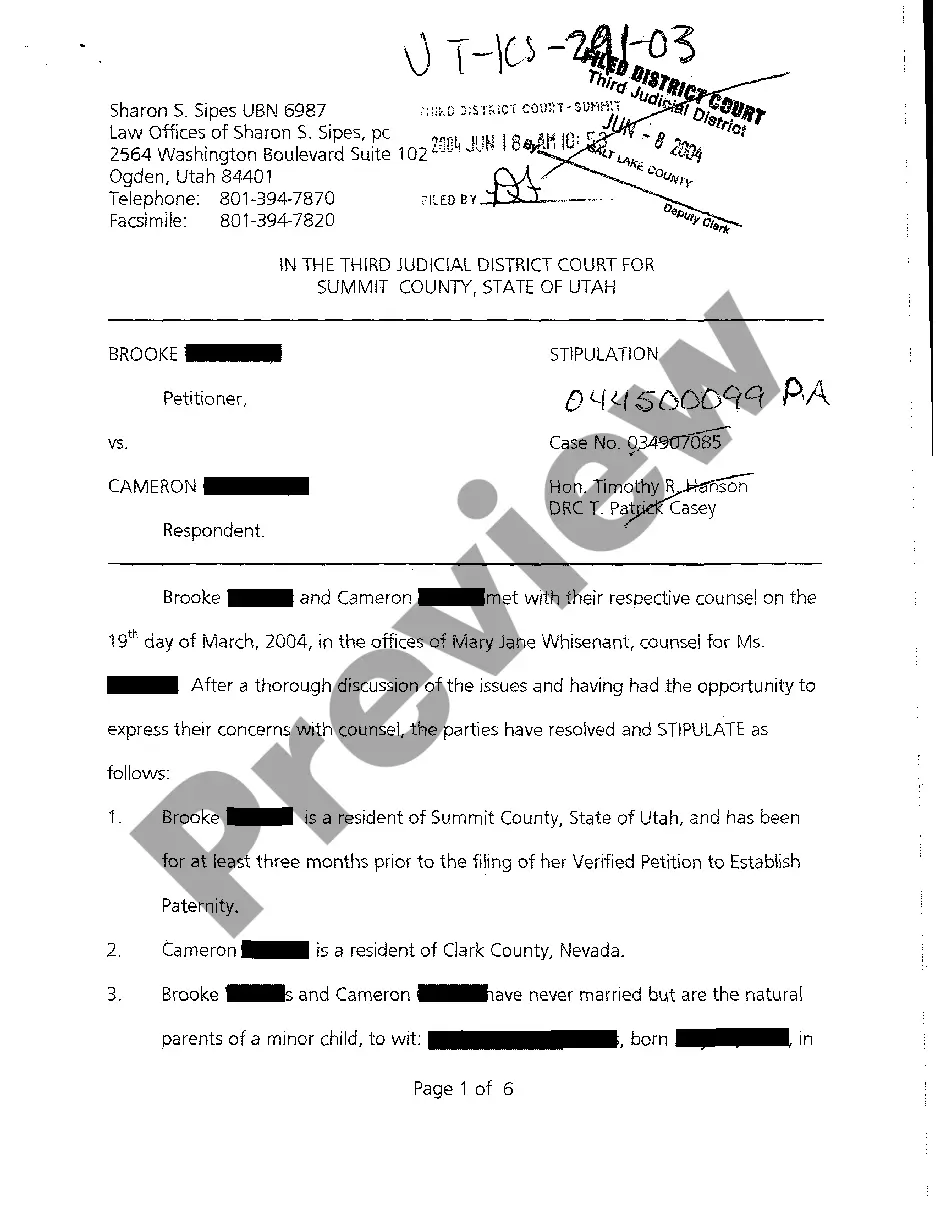

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you're looking for, use the Search area to find the form that fits your needs and requirements.

- Once you obtain the correct form, click Get now.

Form popularity

FAQ

A person is considered self-employed when they operate their own business or work for themselves rather than being employed by someone else. This includes independent contractors, freelancers, and sole proprietors. If you're forming a Minnesota Foundation Contractor Agreement - Self-Employed, make sure you understand the requirements and benefits of self-employment, as this can affect your tax situation and business decisions.

Yes, receiving a 1099 form typically indicates you are self-employed. The 1099 form shows that you have earned income as an independent contractor, not as an employee. Having a Minnesota Foundation Contractor Agreement - Self-Employed can help ensure proper documentation and compliance with tax obligations related to that income.

Indeed, an independent contractor is categorized as self-employed. This classification provides the contractor with the freedom to take on multiple clients without an employer-employee relationship. When drafting a Minnesota Foundation Contractor Agreement - Self-Employed, be sure to outline the terms clearly to reinforce your independence and business structure.

Yes, an independent contractor qualifies as self-employed. This status means they are not on a company's payroll and operate their own business. If you're entering into a Minnesota Foundation Contractor Agreement - Self-Employed, recognize that this classification allows for greater flexibility and control over your work while also requiring diligence in managing your taxes and expenses.

In Minnesota, an operating agreement is not legally required for an LLC, but it is highly recommended. This document outlines the management structure and operational guidelines, which can be crucial for a smooth running of your business. If you plan to work as a Minnesota Foundation Contractor Agreement - Self-Employed, having an operating agreement can help clarify responsibilities and protect your interests.

To fill out an independent contractor form, start with the contractor's personal information, such as name and address. Next, detail the nature of the work, payment terms, and relevant deadlines. For a comprehensive solution, consider the Minnesota Foundation Contractor Agreement - Self-Employed available on uslegalforms, which helps streamline the process and ensures accuracy.

An independent contractor typically needs to complete an agreement and may also need to fill out tax forms, such as a W-9. It's advisable to document any transactions or communications related to the work. By accessing the Minnesota Foundation Contractor Agreement - Self-Employed from uslegalforms, you can ensure that all important paperwork is easily prepared and organized.

To write an independent contractor agreement, start by clearly defining the scope of work. Include details such as payment terms, project timeline, and any specific responsibilities. Using a template, like the Minnesota Foundation Contractor Agreement - Self-Employed from uslegalforms, ensures that all necessary elements are covered, providing both parties with security and clarity.

Yes, an independent contractor is essentially self-employed. This relationship allows contractors to operate their businesses while providing services to clients. In a Minnesota Foundation Contractor Agreement - Self-Employed, both parties establish clear terms that exemplify this professional independence.

To prove you are an independent contractor, you should collect documents that confirm your business activity. This could include a Minnesota Foundation Contractor Agreement - Self-Employed, invoices you’ve issued, and records of payments received. Keeping organized records evidences your independent status to clients and tax authorities.