Minnesota Framework Contractor Agreement - Self-Employed

Description

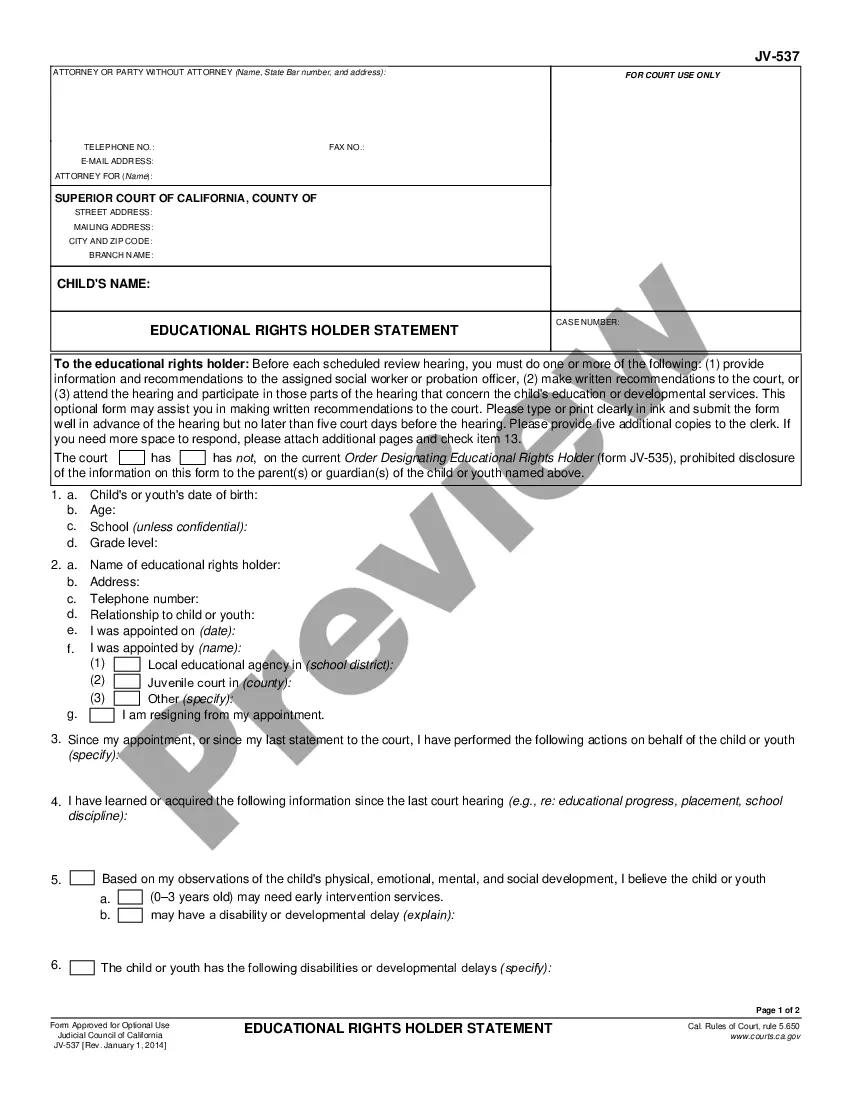

How to fill out Framework Contractor Agreement - Self-Employed?

If you want to download, retrieve, or print authentic document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Take advantage of the site's simple and user-friendly search to find the documents you require.

A selection of templates for commercial and personal use is categorized by regions and states, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Minnesota Framework Contractor Agreement - Self-Employed. Every legal document format you acquire is yours indefinitely. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Compete and download, and print the Minnesota Framework Contractor Agreement - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to acquire the Minnesota Framework Contractor Agreement - Self-Employed in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to locate the Minnesota Framework Contractor Agreement - Self-Employed.

- You can also access forms you've previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form's content. Don't forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form format.

Form popularity

FAQ

Whether to say self-employed or independent contractor depends on context. Both terms describe individuals who work independently, but self-employed often refers more broadly to anyone running their own business. On the other hand, independent contractor specifically emphasizes the relationship with clients for project-based work. Choosing the Minnesota Framework Contractor Agreement - Self-Employed strengthens your position regardless of the term you prefer.

In Minnesota, an independent contractor agreement defines the working relationship between a contractor and a client. This contract delineates the specific tasks, responsibilities, and payment arrangements. It is crucial to include clauses that comply with Minnesota law to avoid misclassification issues. Utilize the Minnesota Framework Contractor Agreement - Self-Employed to ensure proper documentation.

Filling out an independent contractor form involves providing necessary information about the contractor, such as name, address, and Social Security number. You'll also need to describe the nature of the work and payment agreement. Make sure to adhere to Minnesota requirements by using resources like the Minnesota Framework Contractor Agreement - Self-Employed, which simplifies this process.

Filling out an independent contractor agreement requires a careful approach. Begin by entering the personal details of both parties, including names and addresses. Next, specify the project's details and set the payment terms. Lastly, review the document to ensure accuracy, and refer to the Minnesota Framework Contractor Agreement - Self-Employed for guidance tailored to Minnesota laws.

To write an independent contractor agreement, start by defining the scope of work you expect the contractor to complete. Clearly outline the payment terms, deadlines, and the responsibilities of both parties. It's essential to ensure that the agreement complies with state laws, including those specific to Minnesota. For a solid foundation, consider using the Minnesota Framework Contractor Agreement - Self-Employed to meet all legal standards.

To set up as a self-employed contractor, start by obtaining any necessary licenses or permits in your state. Next, consider drafting or using a Minnesota Framework Contractor Agreement - Self-Employed to outline your terms with clients. Additionally, you should create a separate business bank account to manage your finances, and keep detailed records for tax purposes. Utilizing platforms like uslegalforms can help simplify the process of managing your contracts and understand your obligations.

Yes, independent contractors typically file as self-employed individuals. When you enter into a Minnesota Framework Contractor Agreement - Self-Employed, you take on the responsibility for your taxes. This means you will report your earnings as a self-employed person on your tax return. It’s important to keep accurate records of your income and expenses, which can help minimize your tax liability.

Creating an independent contractor agreement involves a few straightforward steps. Begin by outlining the terms of work, including payment, deadlines, and responsibilities. A well-structured template, such as the Minnesota Framework Contractor Agreement - Self-Employed, provides a solid foundation. Utilize this template from US Legal Forms to ensure accuracy, compliance, and professionalism in the agreement.

The independent contractor agreement can be written by either the contractor or the business hiring them. However, it's often beneficial for both parties to collaborate on this document to ensure clarity and mutual understanding. Using a reliable template, like the Minnesota Framework Contractor Agreement - Self-Employed, can simplify the writing process. This agreement outlines the expectations and responsibilities, helping to avoid potential disputes in the future.