Minnesota Employer Training Memo - Payroll Deductions

Description

How to fill out Employer Training Memo - Payroll Deductions?

If you need to finalize, download, or print off legal document templates, utilize US Legal Forms, the largest assortment of lawful forms that can be accessed online.

Take advantage of the website's simple and convenient search to locate the documents you require.

A variety of templates for business and personal use are categorized by types and states, or keywords. Utilize US Legal Forms to find the Minnesota Employer Training Memo - Payroll Deductions with just a few clicks.

Every legal document template you obtain is yours indefinitely. You can access every form you saved in your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the Minnesota Employer Training Memo - Payroll Deductions with US Legal Forms. There are countless professional and state-specific templates available for your business or personal requirements.

- If you are currently a US Legal Forms member, Log Into your account and click on the Download button to obtain the Minnesota Employer Training Memo - Payroll Deductions.

- You can also access forms you've previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

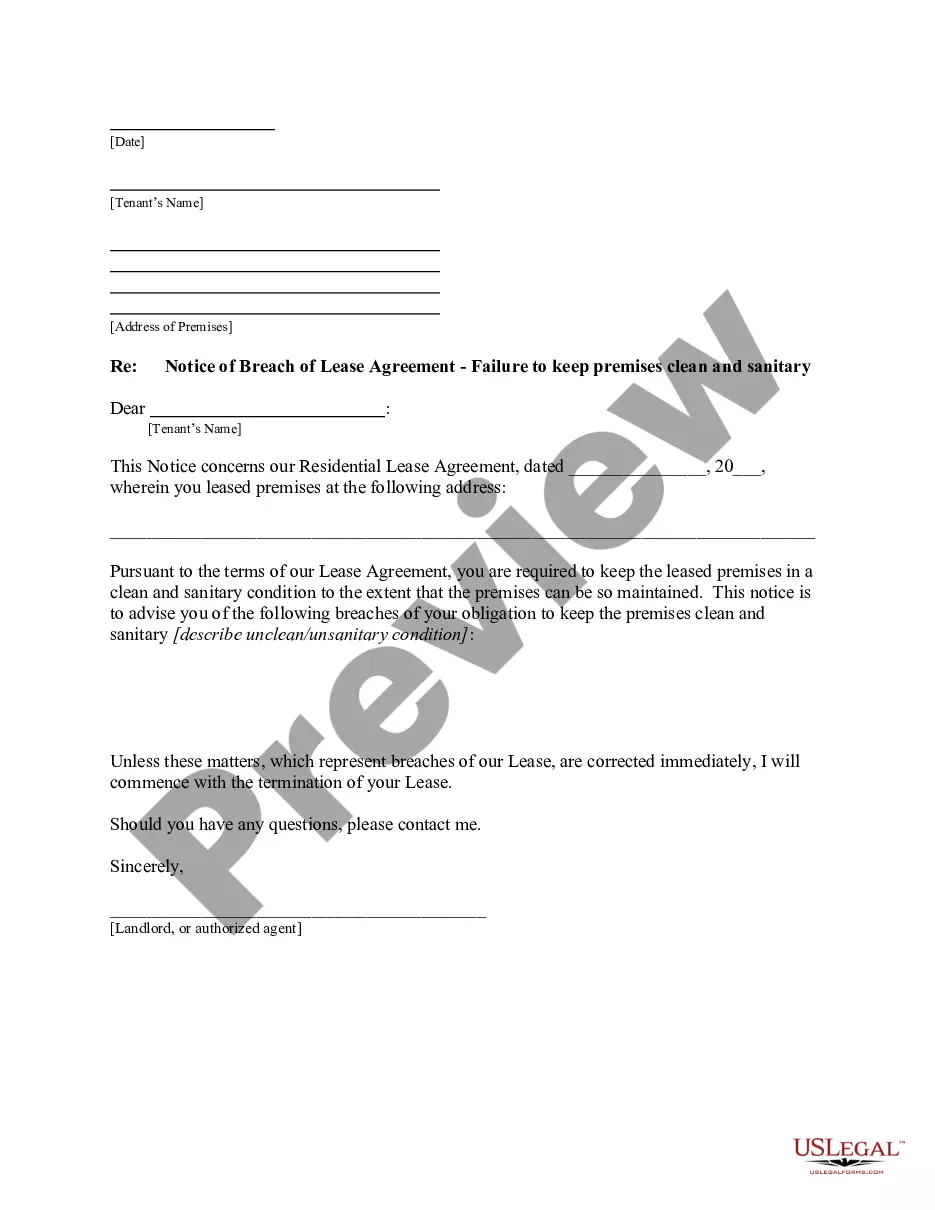

- Step 2. Use the Preview option to review the form's contents. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and provide your details to sign up for the account.

- Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify and print or sign the Minnesota Employer Training Memo - Payroll Deductions.

Form popularity

FAQ

To fill out a W 4MN, start by entering your personal information, including your name and address. Next, indicate your marital status and the number of allowances you are claiming, which impacts how much tax is withheld from your paycheck. It’s essential to refer to the Minnesota Employer Training Memo - Payroll Deductions for specific guidance on state deductions and adjustments. If you have questions or need assistance with this form, uslegalforms provides resources to help you navigate the process smoothly.

Employers typically make four common deductions from employee wages, which include federal income tax, state income tax, Social Security tax, and Medicare tax. Understanding these deductions is essential for compliance with the Minnesota Employer Training Memo - Payroll Deductions. Each deduction plays a crucial role in funding government programs and ensuring employees receive their benefits. It is wise to consult the Minnesota Employer Training Memo - Payroll Deductions for detailed guidance on processing these deductions correctly.

Typically, payroll deductions are taken in a specific order, beginning with mandatory deductions such as federal, state, and local taxes. Next, consider other compulsory deductions like Social Security and Medicare. Finally, voluntary deductions such as retirement contributions or health insurance premiums follow. This structured approach aligns with the protocols outlined in the Minnesota Employer Training Memo - Payroll Deductions.

Filling out an employee's withholding allowance certificate is crucial for determining the appropriate amount of tax withheld from their paycheck. This certificate provides important information regarding the employee's tax situation, which directly impacts payroll deductions. Referencing the Minnesota Employer Training Memo - Payroll Deductions will guide you in this important task.

To implement payroll deductions, start by determining the specific deductions that apply to each employee, which may include taxes, insurance, and retirement contributions. Next, calculate the amounts to deduct from each paycheck based on the individual's earnings. Using the Minnesota Employer Training Memo - Payroll Deductions, you can stay informed about the proper procedures and rates.

The journal entry for employer payroll taxes typically involves debiting the payroll tax expense and crediting the various liability accounts corresponding to the tax obligations. This reflects the employer's responsibility for taxes such as Social Security and Medicare. Following the guidelines in the Minnesota Employer Training Memo - Payroll Deductions can simplify this process.

Employers should meticulously document payroll deductions to ensure accurate financial reporting. Begin by listing each deduction in the employee's payroll records, such as taxes, retirement contributions, and health insurance premiums. Utilizing a systematic approach keeps your records organized, especially when referring back to the Minnesota Employer Training Memo - Payroll Deductions.

The requirements for payroll in Minnesota include accurate record-keeping and timely processing of employee wages, detailed in the Minnesota Employer Training Memo - Payroll Deductions. Employers must gather necessary employee information, such as tax withholdings and benefit selections. Additionally, ensuring compliance with state and federal laws is crucial for avoiding penalties. Using solutions like uslegalforms can streamline this process and keep you organized.

The Minnesota Employer Training Memo - Payroll Deductions specifies that certain items cannot be deducted from an employee's paycheck. For example, deductions for personal expenses or items unrelated to the job are not permitted. Additionally, state and federal regulations protect employees from unauthorized deductions. Understanding these limitations helps employers stay compliant and supports their workforce.

Yes, according to the Minnesota Employer Training Memo - Payroll Deductions, employees must provide written consent for most payroll deductions. This ensures transparency and protects employee rights. Employers should maintain these records to avoid discrepancies and potential disputes. Adhering to this guideline fosters a trustful work environment.