Minnesota Shared Earnings Agreement between Fund & Company

Description

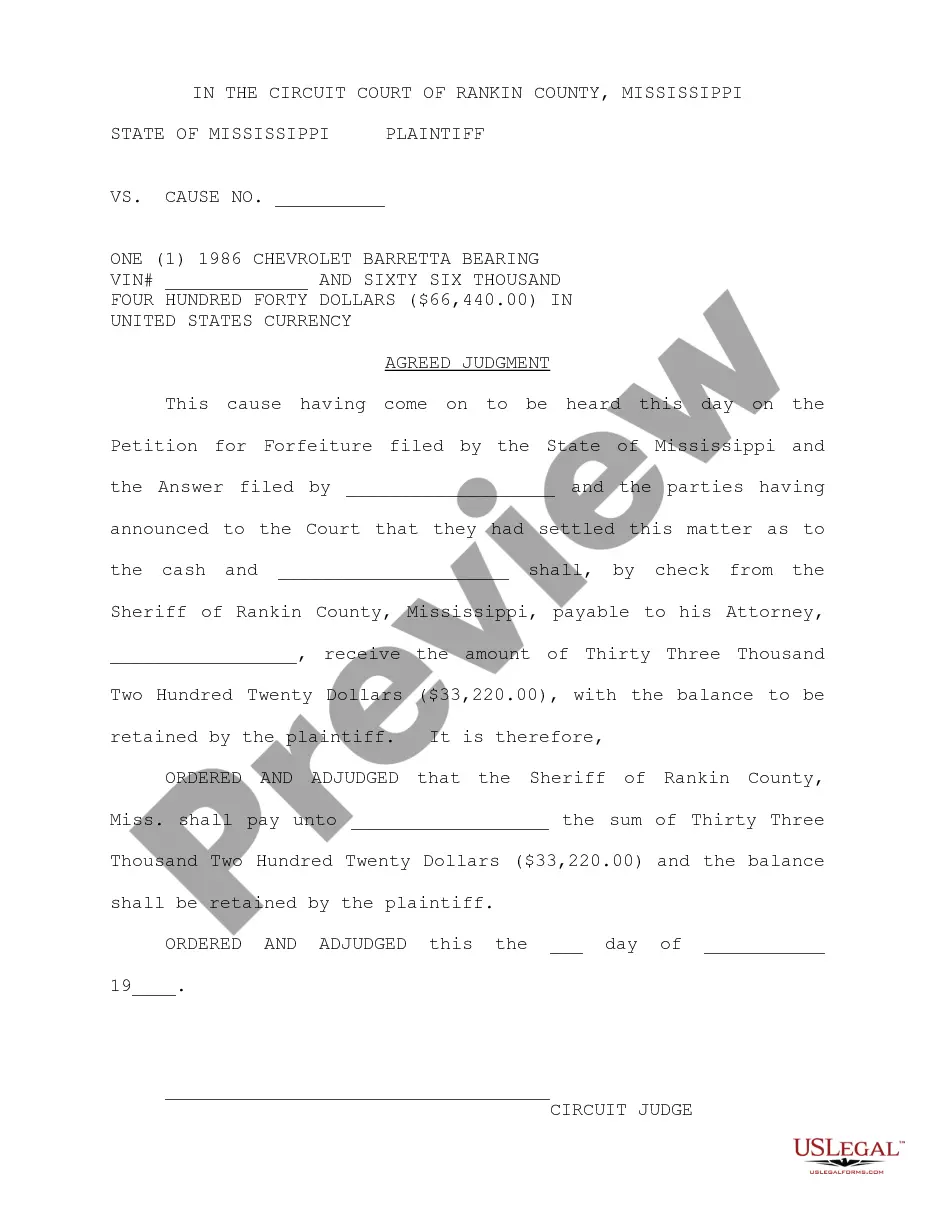

used as a substitute for equity-like structures like a SAFE, convertible note, or equity. It is not debt, doesn't have a fixed repayment schedule, doesn't require a personal guarantee."

How to fill out Shared Earnings Agreement Between Fund & Company?

US Legal Forms - one of the most significant libraries of legitimate forms in the States - offers a variety of legitimate document templates you can down load or produce. Making use of the web site, you can find 1000s of forms for company and personal purposes, sorted by types, suggests, or keywords and phrases.You can get the newest models of forms much like the Minnesota Shared Earnings Agreement between Fund & Company within minutes.

If you already possess a membership, log in and down load Minnesota Shared Earnings Agreement between Fund & Company in the US Legal Forms collection. The Download button will show up on every single develop you perspective. You have accessibility to all in the past delivered electronically forms in the My Forms tab of the profile.

If you would like use US Legal Forms initially, here are straightforward guidelines to get you started out:

- Ensure you have chosen the proper develop for your personal city/state. Click the Preview button to examine the form`s content. Look at the develop information to actually have selected the correct develop.

- If the develop doesn`t match your demands, use the Search area at the top of the screen to obtain the one who does.

- In case you are happy with the form, confirm your choice by simply clicking the Buy now button. Then, select the costs strategy you prefer and give your qualifications to register for the profile.

- Process the transaction. Use your Visa or Mastercard or PayPal profile to complete the transaction.

- Select the structure and down load the form on your own gadget.

- Make adjustments. Load, change and produce and indication the delivered electronically Minnesota Shared Earnings Agreement between Fund & Company.

Every single template you put into your money does not have an expiry particular date and it is yours eternally. So, if you wish to down load or produce yet another backup, just check out the My Forms area and then click around the develop you want.

Obtain access to the Minnesota Shared Earnings Agreement between Fund & Company with US Legal Forms, probably the most extensive collection of legitimate document templates. Use 1000s of skilled and condition-distinct templates that satisfy your small business or personal requirements and demands.