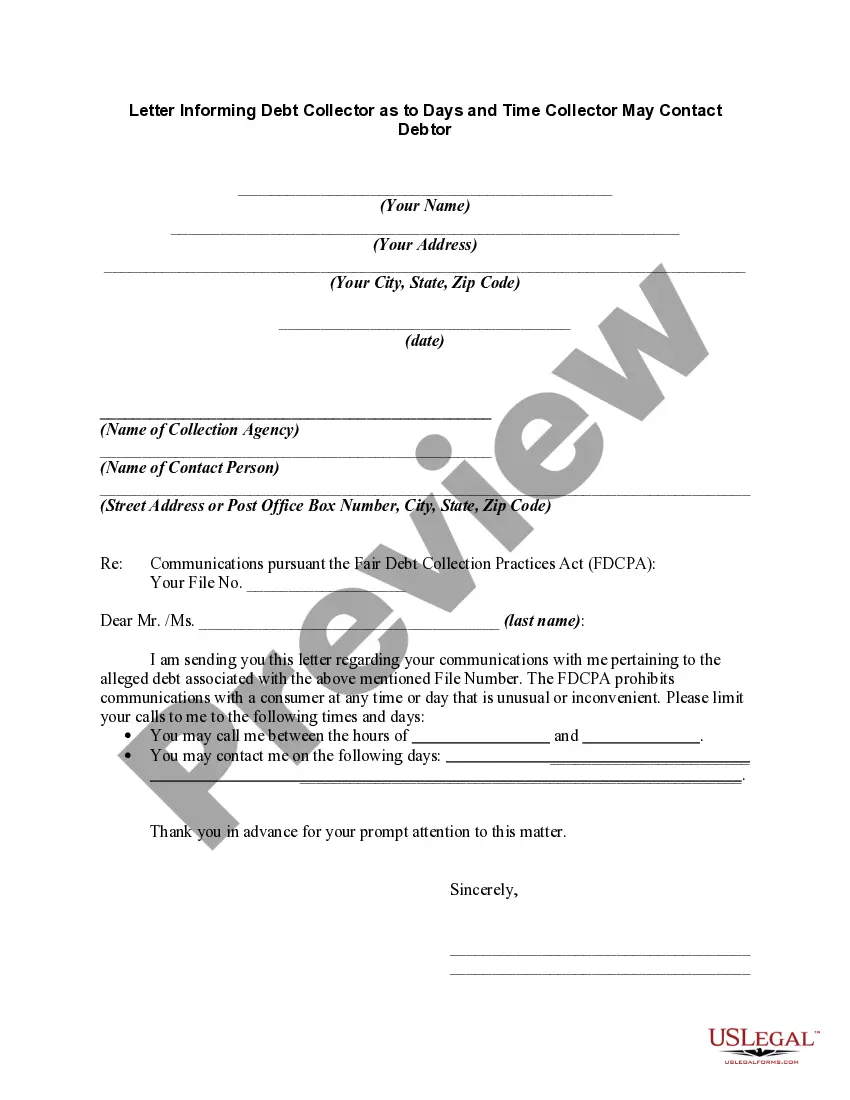

Minnesota Letter to Debt Collector - Only call me on the following days and times

Description

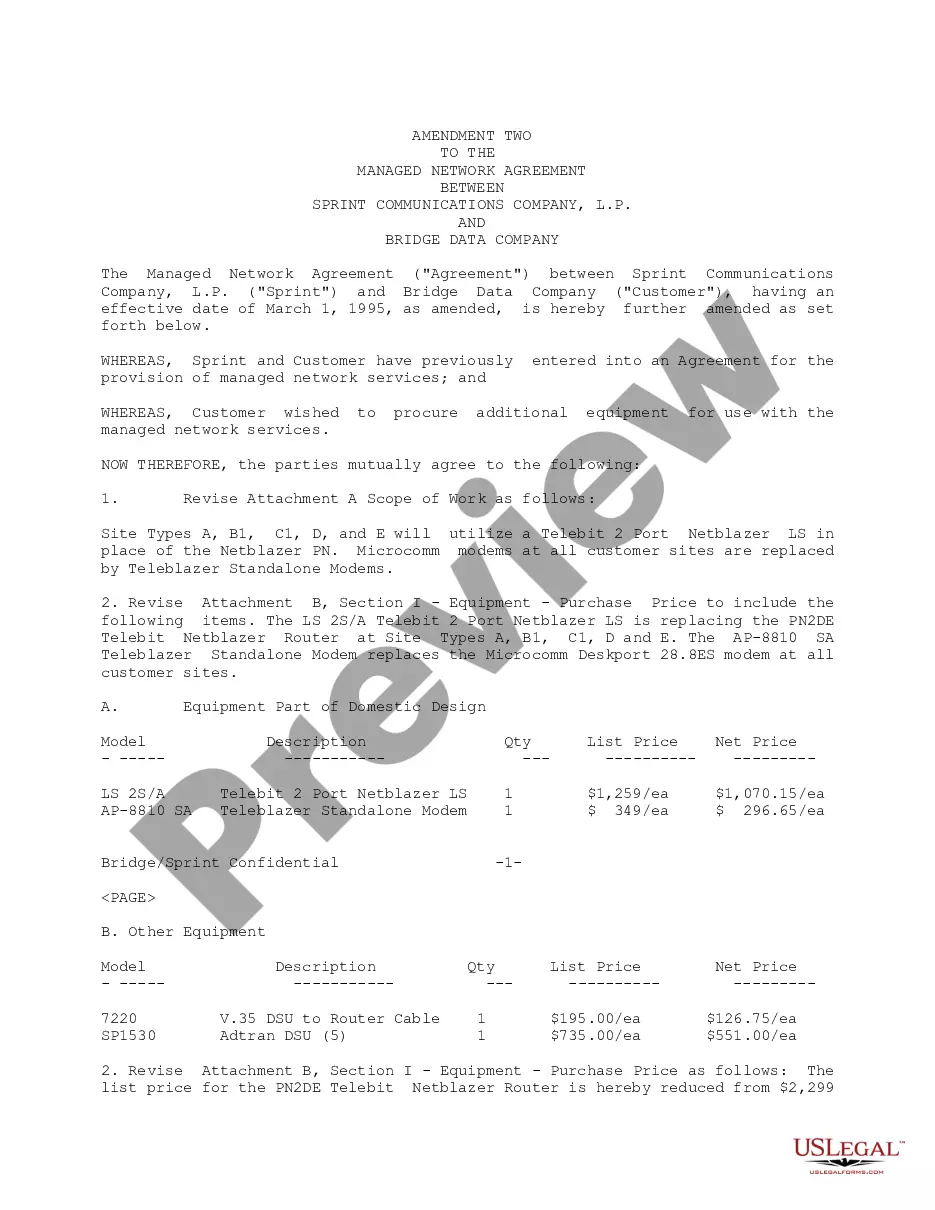

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

If you require extensive, obtain, or print legal document templates, utilize US Legal Forms, the vastest assortment of legal forms, available online.

Employ the website's straightforward and convenient search to find the documents you need.

A multitude of templates for business and personal purposes are categorized by type and state, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find different types in the legal form format.

Step 4. Once you find the form you want, click the Purchase now button. Select the payment plan you prefer and enter your details to register for an account.

- Use US Legal Forms to access the Minnesota Letter to Debt Collector - Only contact me on the following days and times with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to locate the Minnesota Letter to Debt Collector - Only contact me on the following days and times.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

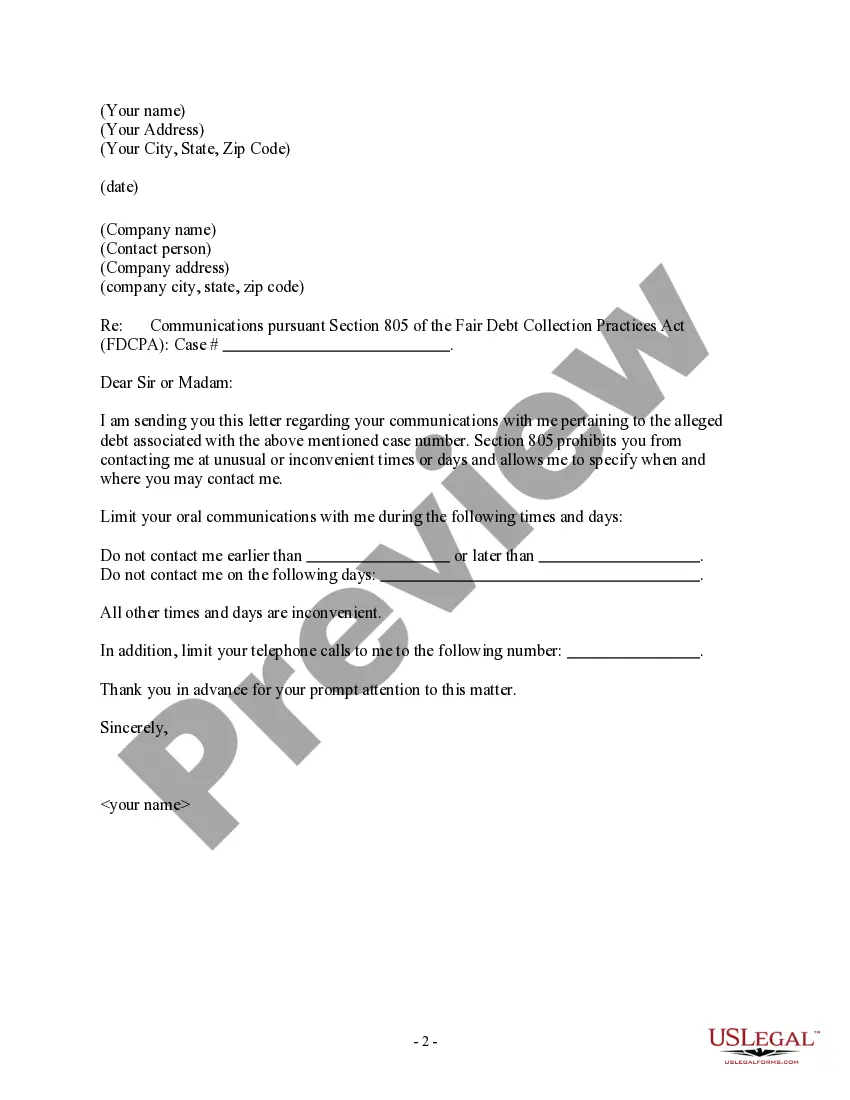

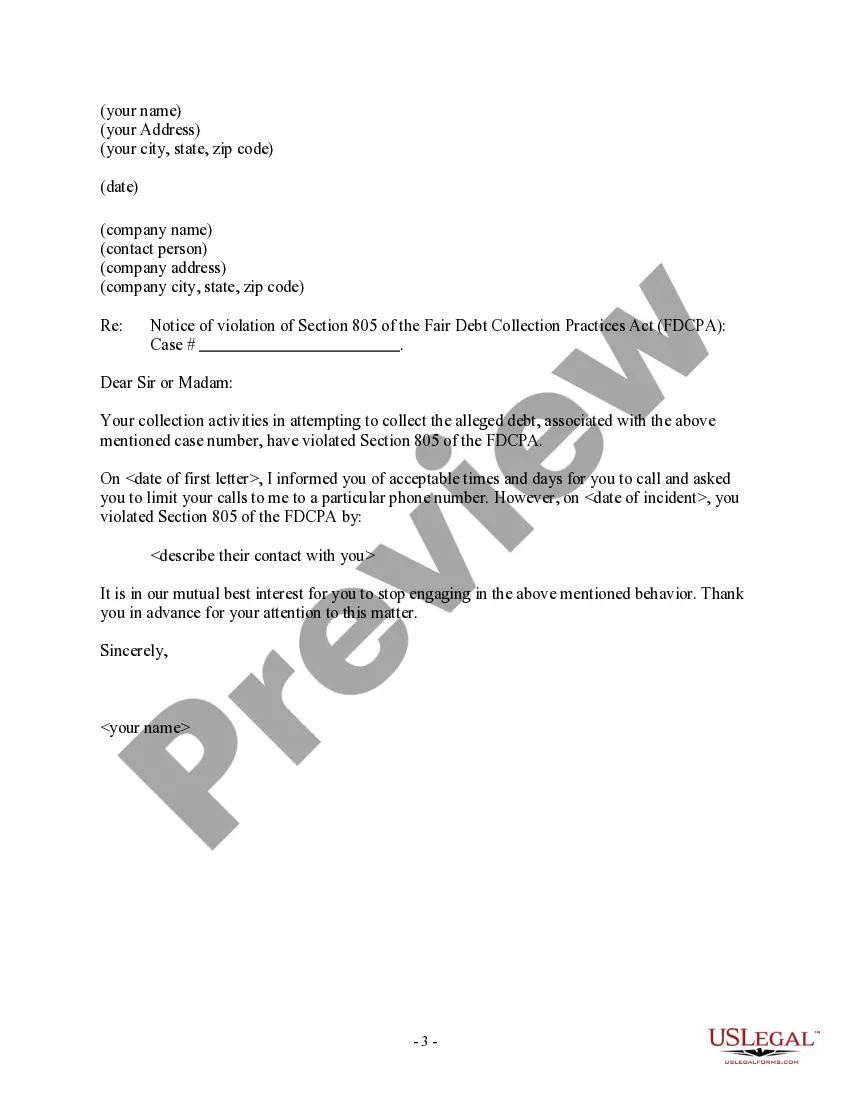

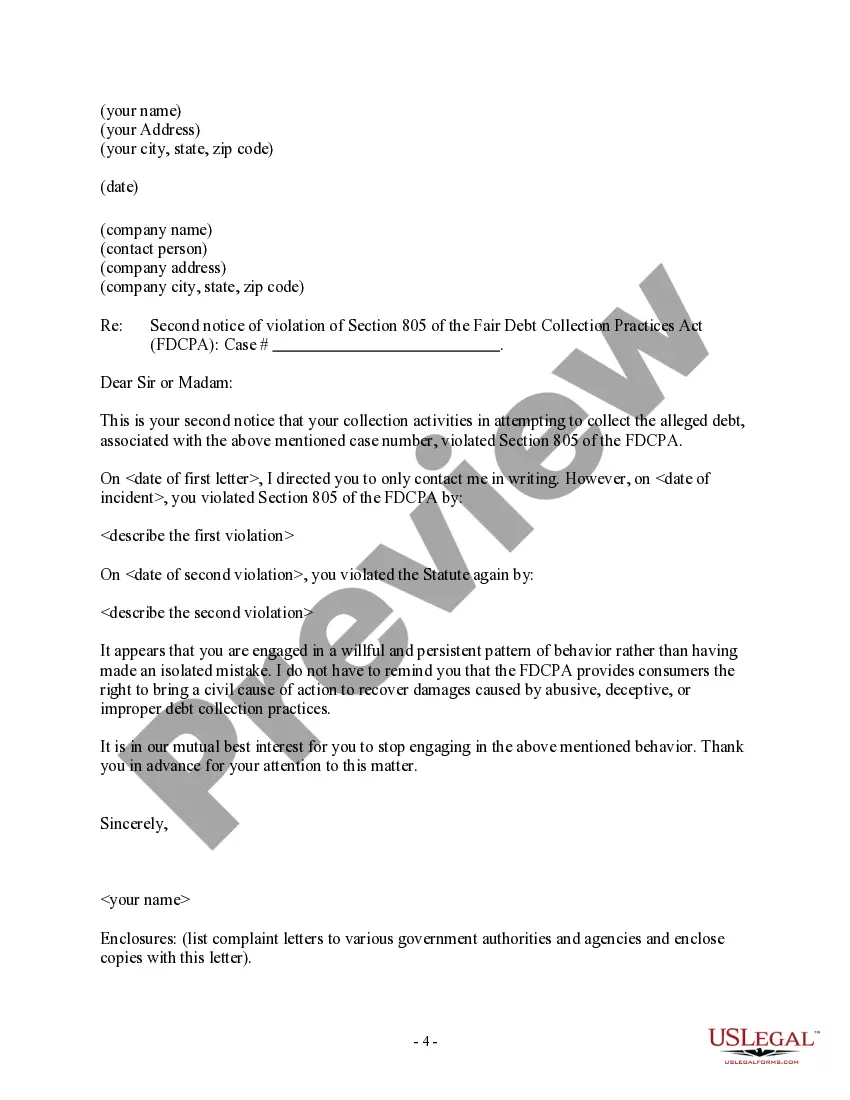

- Step 2. Use the Preview option to review the form’s content. Remember to check the description.

Form popularity

FAQ

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

While an account in collection can have a significant negative impact on your credit, it won't stay on your credit reports forever. Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.