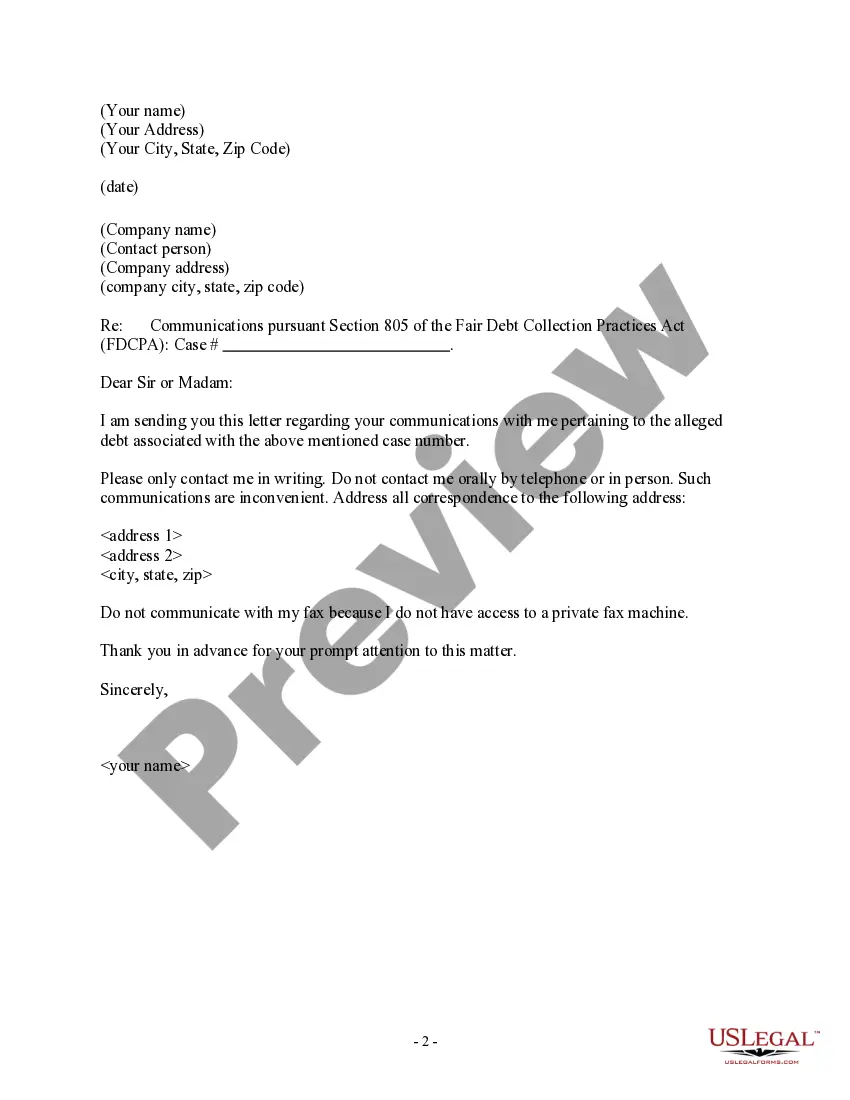

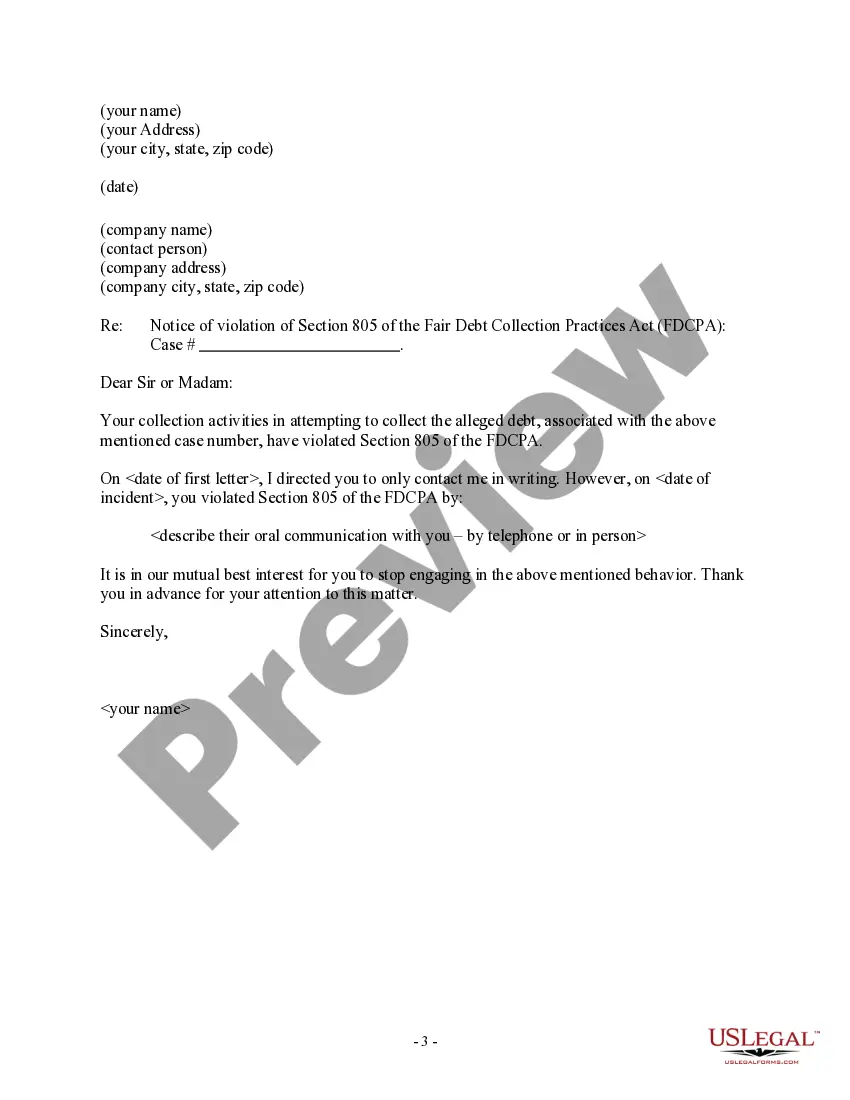

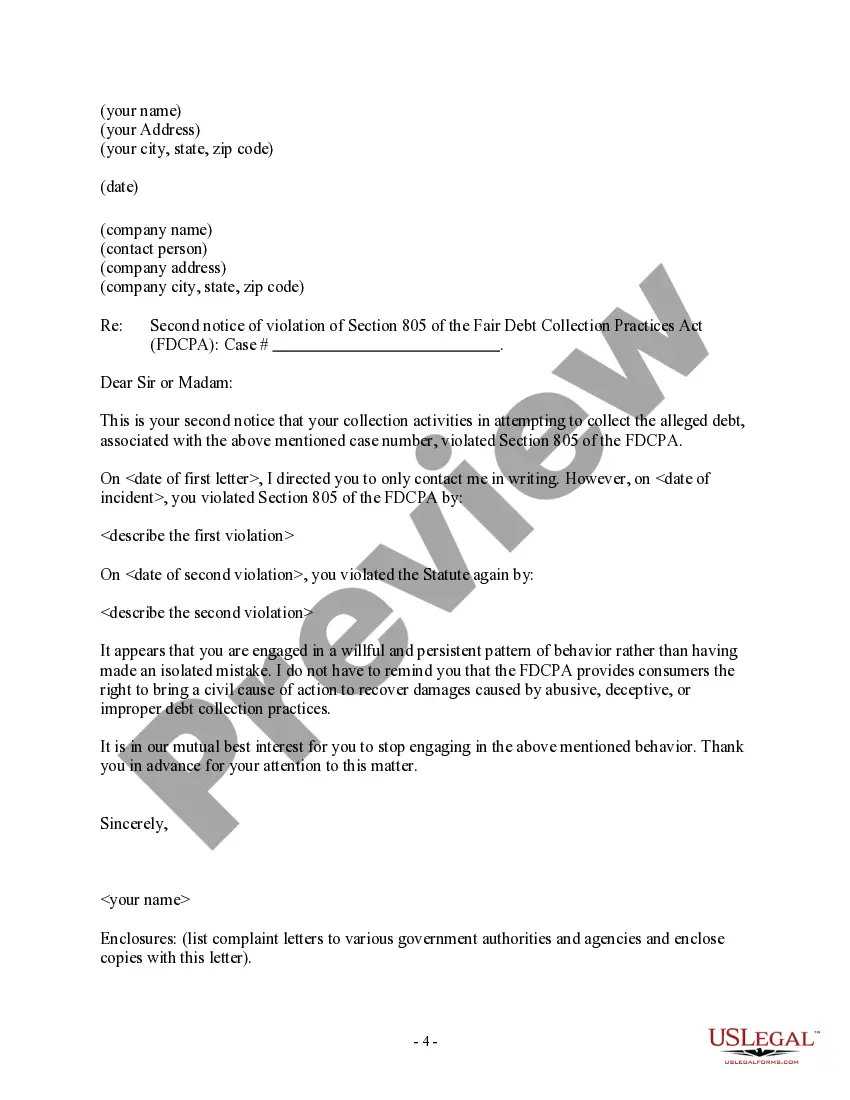

Minnesota Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

Are you currently in a position where you need documents for either business or personal use on a nearly daily basis.

There are many legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Minnesota Letter to Debt Collector - Only Contact Me In Writing, which can be tailored to satisfy federal and state regulations.

Once you have found the correct form, simply click Buy now.

Choose your preferred pricing plan, provide the necessary information to process your payment, and complete your order using PayPal or a credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Minnesota Letter to Debt Collector - Only Contact Me In Writing at any time, as needed. Just click on the required form to download or print the document template. Utilize US Legal Forms, one of the most extensive selections of legal documents, to save time and minimize errors. The service provides professionally crafted legal document templates that can be applied for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Minnesota Letter to Debt Collector - Only Contact Me In Writing template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you desire and confirm it is for the correct city/region.

- Utilize the Review button to examine the document.

- Check the overview to ensure you have selected the appropriate form.

- If the form does not meet your expectations, use the Search field to find a form that aligns with your needs and criteria.

Form popularity

FAQ

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

What are debt collectors not allowed to do?Contact you at your workplace or via social media.Give you incorrect or misleading information.Contact you outside the hours of 8am-9pm on working days or at all on weekends and holidays.Tell other people such as family about your debt situation.More items...

As of Nov. 30, 2021, debt collectors have new options for how they may communicate with you about debts they're trying to collect. Now they can text you. Text messages, along with emailing and direct messages on social media, are allowed as part of an update to the Fair Debt Collection Practices Act (FDCPA).

Debt collectors can call you on your mobile to discuss the debt, and if you happen to be at work when they call, this is not an offence. After all, they genuinely might not know you are at work. Moreover, debt collectors can call you at work as long as they do not reveal the reason they are calling.

It should be short, concise, to the point and very clear as to what you want. It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date.

Debt collection agencies don't have any special legal powers. They can't do anything different to the original creditor. Collection agencies will use letters and phone calls to contact you. They may contact by other means too, such as text or email.

No. Under federal law, a debt collector may contact other people but generally only to find out how to contact you. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

Debt collectors have no special legal powers. You may feel under pressure to pay more than you can afford, but don't feel threatened. Find out more about the difference between debt collectors and bailiffs. Debt collectors may work for your creditor, or they may work for a separate debt collection agency.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA).

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA). If the email communication pertains to healthcare debt, the Health Insurance Portability and Accountability Act (HIPAA) applies.