Minnesota Letter to Debt Collector - Only Contact My Attorney

Description

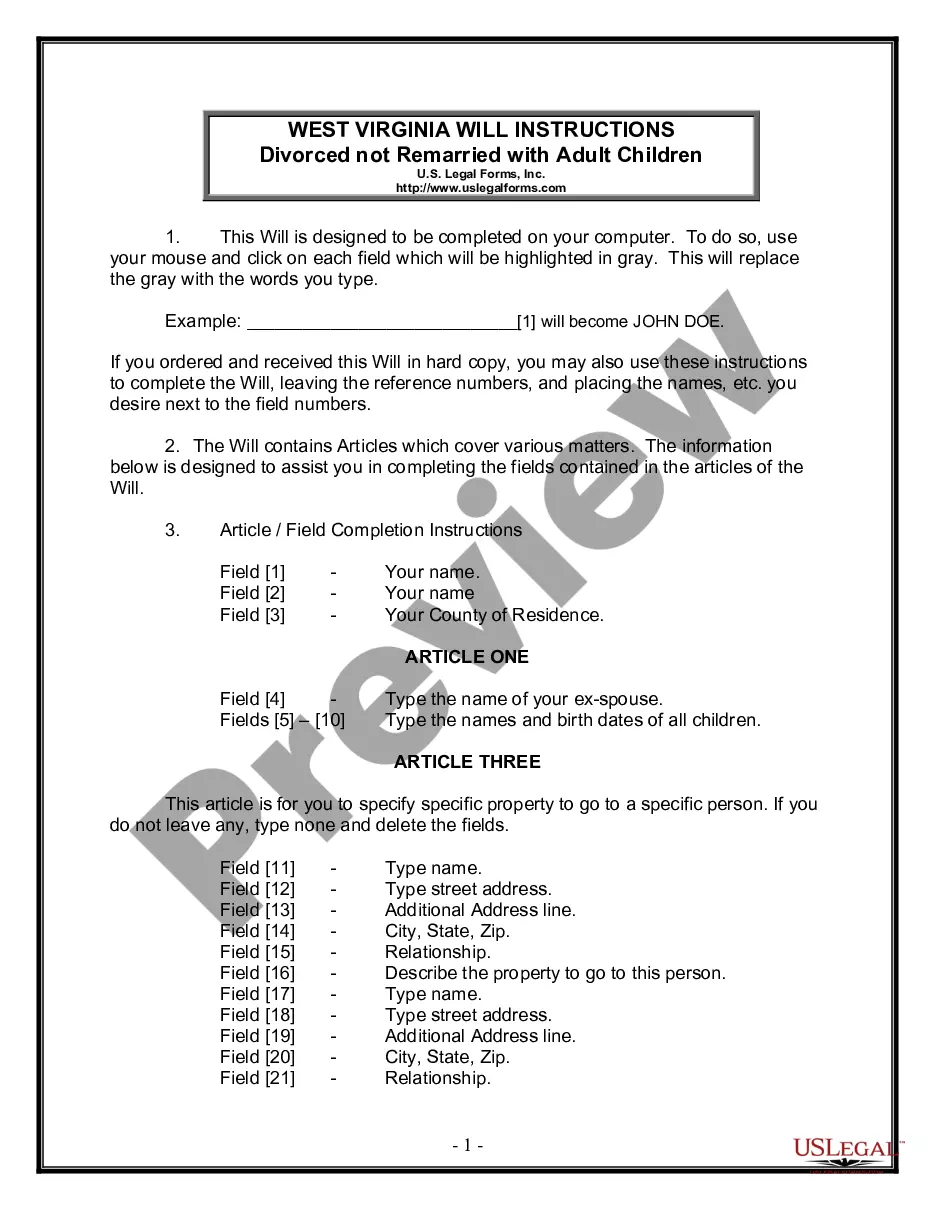

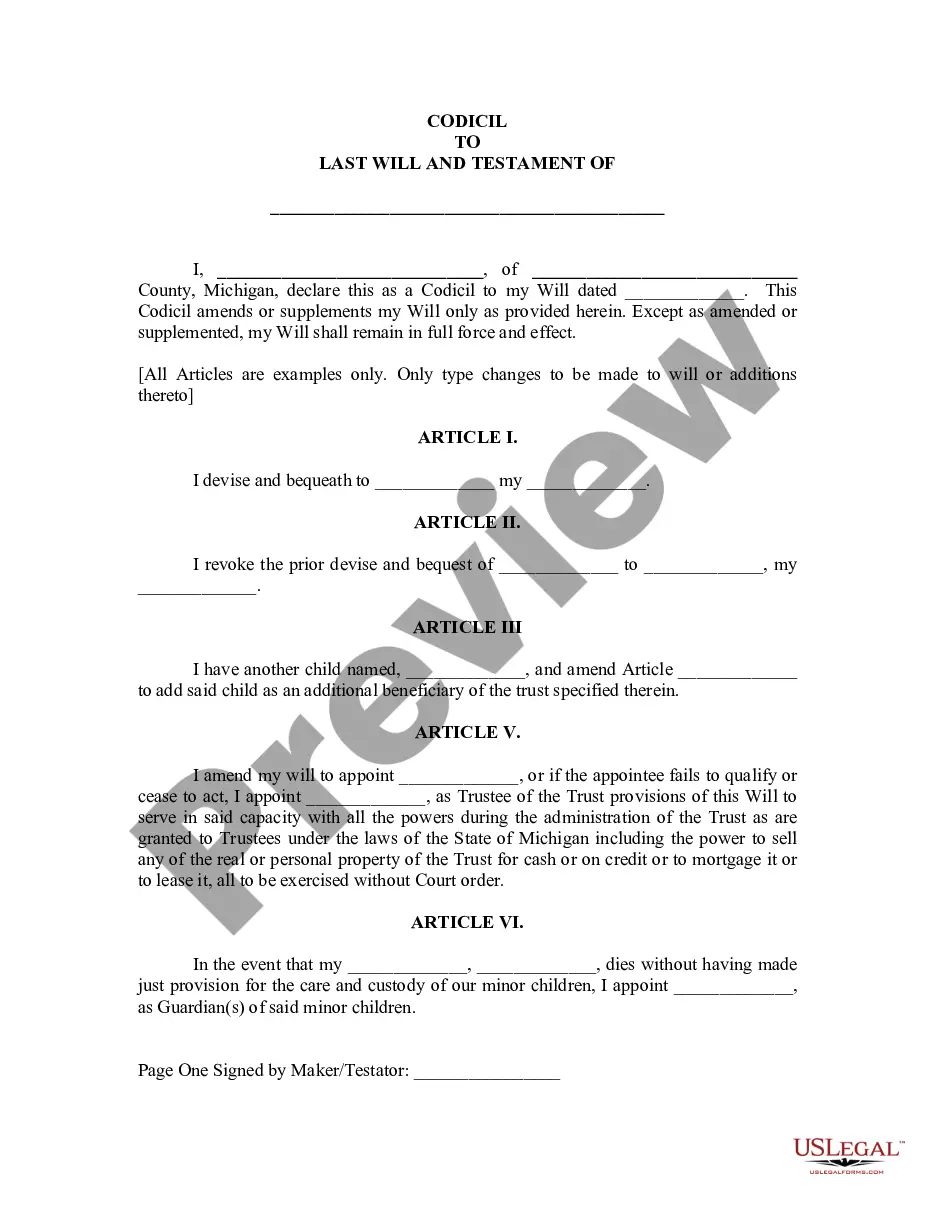

How to fill out Letter To Debt Collector - Only Contact My Attorney?

Finding the right authorized file web template could be a struggle. Of course, there are tons of themes available on the Internet, but how do you obtain the authorized type you will need? Use the US Legal Forms site. The service provides a large number of themes, including the Minnesota Letter to Debt Collector - Only Contact My Attorney, which you can use for enterprise and private demands. Every one of the kinds are examined by professionals and satisfy state and federal requirements.

If you are presently listed, log in in your account and then click the Download button to find the Minnesota Letter to Debt Collector - Only Contact My Attorney. Make use of your account to appear from the authorized kinds you might have purchased previously. Check out the My Forms tab of your account and obtain one more duplicate of your file you will need.

If you are a new consumer of US Legal Forms, listed here are basic guidelines that you can follow:

- Initial, be sure you have selected the correct type for the town/region. You can look through the shape making use of the Preview button and read the shape explanation to guarantee this is basically the right one for you.

- In case the type is not going to satisfy your preferences, use the Seach area to find the appropriate type.

- Once you are certain the shape is proper, go through the Get now button to find the type.

- Opt for the pricing prepare you want and type in the essential information. Make your account and pay money for an order making use of your PayPal account or bank card.

- Choose the file file format and down load the authorized file web template in your system.

- Complete, change and printing and indicator the acquired Minnesota Letter to Debt Collector - Only Contact My Attorney.

US Legal Forms is definitely the most significant library of authorized kinds where you can find different file themes. Use the company to down load professionally-made papers that follow status requirements.

Form popularity

FAQ

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

Here's what every debt letter should include: Date of the letter. Lawyer's name, firm, and address. Client's name and address. A subject line that states its purpose. The precise amount the client owed your firm and the date when the payment was due. Instructions on how to pay the debt and the new deadline.

Under federal law, a debt collector must go through your attorney if they know that you have one, so it's a good idea ? if you get legal representation ? to tell the collector the name of the attorney who is representing you and how to contact them.

If you're not sure that the debt is yours, write the debt collector and dispute the debt or ask for more information. If the debt is yours, don't worry. Decide on the total amount you are willing to pay to settle the entire debt and negotiate with the debt collector for the rest to be forgiven.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

Tell the debt collector that you'll call them back as soon as you verify the information. Review your bills and bank statements to confirm if the debt is yours. This may also help you confirm if the amount you owe is correct. You can ask the collection agency to contact you only in writing.

Four Steps to Take if You Received a Debt Collection Letter From a Lawyer Carefully Review the Letter to Determine the Claim. ... Consider Sending a Debt Validation Request. ... Gather and Organize All Relevant Financial Documents and Records. ... Be Proactive: Debt Does Not Go Away on its Own.