Minnesota Executive Stock Incentive Plan of Octo Limited

Description

How to fill out Executive Stock Incentive Plan Of Octo Limited?

Have you been in a place that you need to have documents for sometimes organization or specific purposes virtually every day? There are a lot of legal record web templates available on the Internet, but finding types you can rely isn`t effortless. US Legal Forms gives 1000s of form web templates, just like the Minnesota Executive Stock Incentive Plan of Octo Limited, that are written to fulfill state and federal specifications.

Should you be previously knowledgeable about US Legal Forms web site and also have your account, simply log in. Afterward, it is possible to download the Minnesota Executive Stock Incentive Plan of Octo Limited format.

Unless you come with an profile and wish to begin using US Legal Forms, follow these steps:

- Find the form you will need and make sure it is to the appropriate city/region.

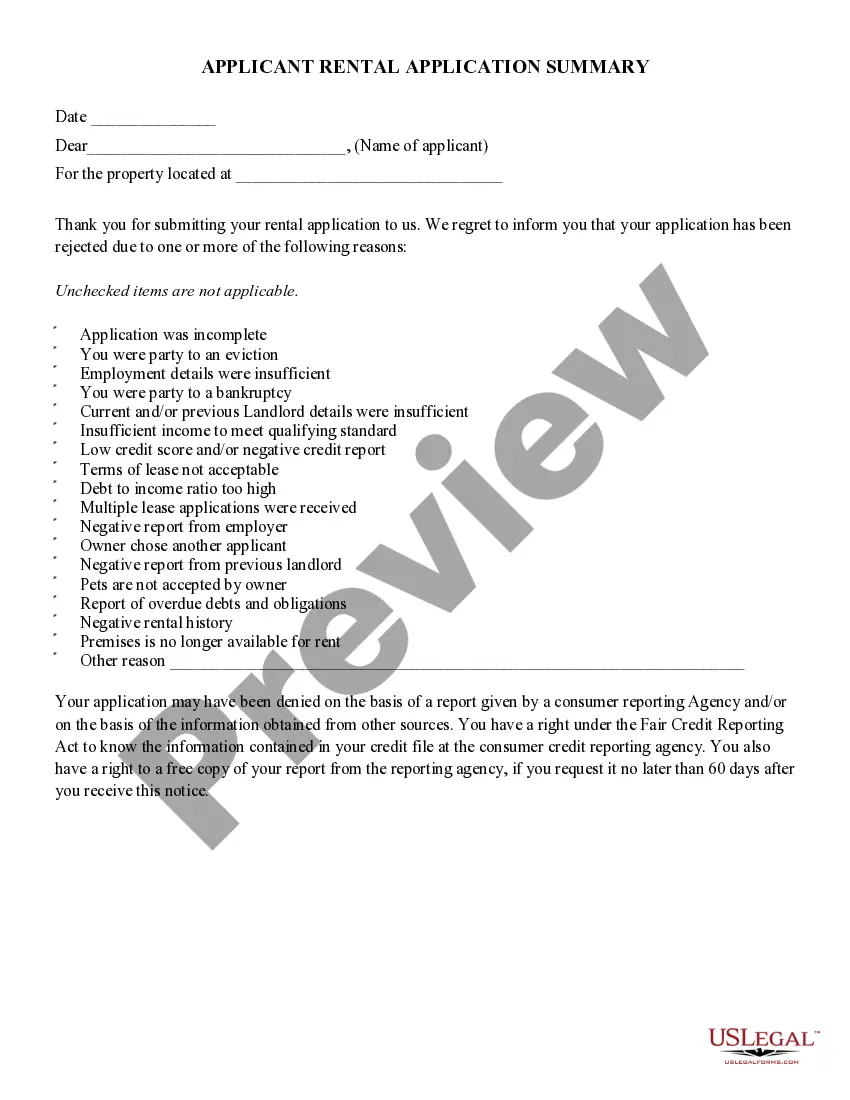

- Take advantage of the Review key to review the form.

- See the description to ensure that you have chosen the right form.

- If the form isn`t what you`re looking for, use the Lookup discipline to discover the form that suits you and specifications.

- Whenever you find the appropriate form, just click Get now.

- Choose the prices program you would like, fill in the required information and facts to make your bank account, and buy the order utilizing your PayPal or charge card.

- Pick a hassle-free document structure and download your copy.

Locate each of the record web templates you may have bought in the My Forms food selection. You can obtain a extra copy of Minnesota Executive Stock Incentive Plan of Octo Limited anytime, if required. Just go through the necessary form to download or print out the record format.

Use US Legal Forms, by far the most comprehensive variety of legal forms, in order to save time as well as avoid blunders. The services gives appropriately created legal record web templates that you can use for a variety of purposes. Create your account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.

Employee stock options can be a lucrative part of an individual's overall compensation package, although not every company offers them. Workers can buy shares at a pre-determined price at a future date, regardless of the price of the stock when the options are exercised.

Taxes and Incentive Stock Options Your employer isn't required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.

term incentive plan (LTIP) is a company policy that rewards employees for reaching specific goals that lead to increased shareholder value. In a typical LTIP, the employee, usually an executive, must fulfill various conditions or requirements.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.