Minnesota Incentive Stock Option Plan of the Bankers Note, Inc.

Description

How to fill out Incentive Stock Option Plan Of The Bankers Note, Inc.?

US Legal Forms - one of the greatest libraries of legitimate types in the USA - delivers an array of legitimate file layouts you are able to obtain or print out. While using website, you can get a large number of types for organization and person functions, categorized by classes, states, or key phrases.You can get the newest models of types just like the Minnesota Incentive Stock Option Plan of the Bankers Note, Inc. in seconds.

If you have a membership, log in and obtain Minnesota Incentive Stock Option Plan of the Bankers Note, Inc. in the US Legal Forms catalogue. The Download option will show up on each develop you view. You have access to all formerly saved types within the My Forms tab of your bank account.

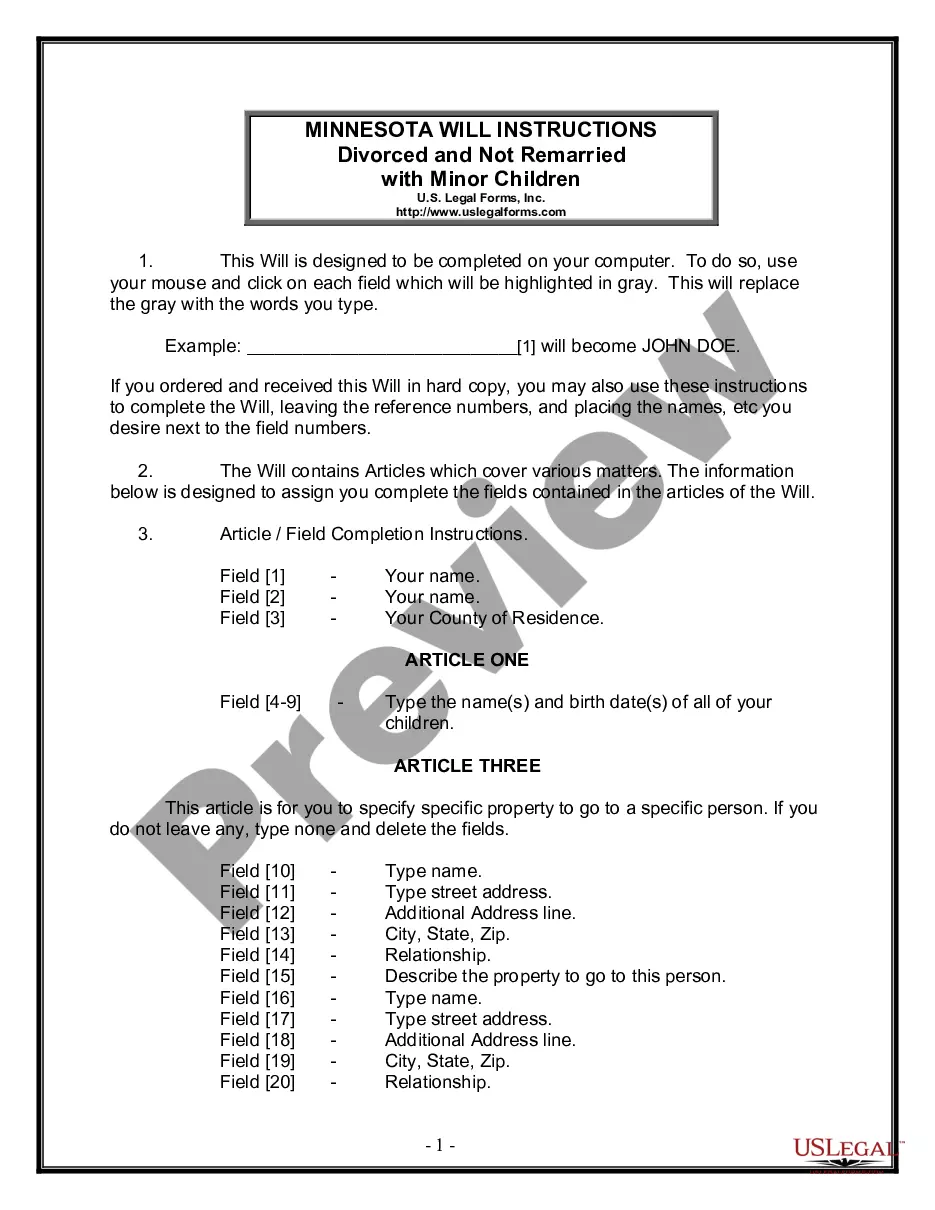

If you would like use US Legal Forms for the first time, listed here are straightforward recommendations to help you get started off:

- Ensure you have chosen the correct develop for your area/area. Click the Review option to examine the form`s content material. See the develop explanation to ensure that you have chosen the appropriate develop.

- In the event the develop doesn`t suit your needs, use the Research field on top of the monitor to obtain the one which does.

- Should you be satisfied with the form, confirm your choice by clicking on the Acquire now option. Then, select the prices program you like and give your credentials to register for an bank account.

- Process the deal. Use your Visa or Mastercard or PayPal bank account to finish the deal.

- Pick the file format and obtain the form in your device.

- Make modifications. Load, change and print out and indicator the saved Minnesota Incentive Stock Option Plan of the Bankers Note, Inc..

Every single web template you included with your money lacks an expiry time and it is yours forever. So, if you want to obtain or print out an additional copy, just visit the My Forms area and then click in the develop you want.

Gain access to the Minnesota Incentive Stock Option Plan of the Bankers Note, Inc. with US Legal Forms, the most considerable catalogue of legitimate file layouts. Use a large number of skilled and condition-distinct layouts that fulfill your company or person requirements and needs.

Form popularity

FAQ

In short, you should exercise your stock options when they have value. But there are other factors to remember, including tax implications and your current financial situation. Whether you're changing careers or your current company is going public, you may have questions about when to exercise stock options.

The ISO $100K limit, also known as the ?ISO limit? or ?$100K rule,? exists to prevent employees from taking too much advantage of the tax benefits associated with ISOs. It states that employees can't receive more than $100,000 worth of exercisable ISOs in a given calendar year.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Taxes and Incentive Stock Options Your employer isn't required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

Cash compensation is the predominant way to motivate workers, but stock options are also a way to supplement employee compensation and encourage productivity. Stock options are the right to purchase shares in a company, usually over a period and ing to a vesting schedule.