Minnesota Option to Purchase Common Stock

Description

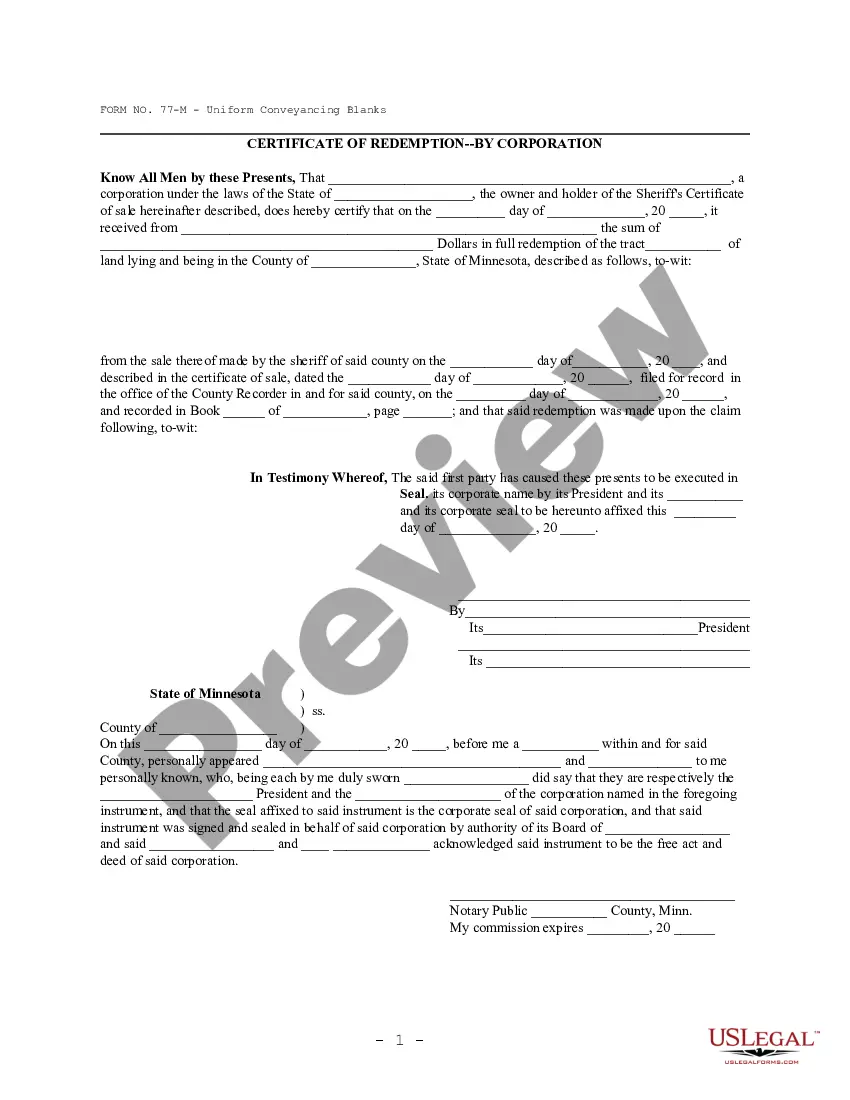

How to fill out Option To Purchase Common Stock?

You may invest several hours online trying to find the lawful file template that suits the state and federal needs you need. US Legal Forms gives a large number of lawful varieties that happen to be evaluated by pros. You can easily obtain or printing the Minnesota Option to Purchase Common Stock from our service.

If you already have a US Legal Forms accounts, you may log in and then click the Download key. Afterward, you may full, revise, printing, or indication the Minnesota Option to Purchase Common Stock. Each and every lawful file template you buy is your own property eternally. To have another copy associated with a acquired form, check out the My Forms tab and then click the related key.

Should you use the US Legal Forms web site the first time, keep to the straightforward recommendations beneath:

- First, make certain you have selected the best file template for that area/city that you pick. Browse the form explanation to make sure you have selected the right form. If available, take advantage of the Review key to appear from the file template as well.

- If you want to discover another version in the form, take advantage of the Research area to find the template that meets your needs and needs.

- Once you have discovered the template you would like, just click Get now to move forward.

- Find the rates strategy you would like, key in your qualifications, and sign up for your account on US Legal Forms.

- Total the deal. You may use your bank card or PayPal accounts to pay for the lawful form.

- Find the format in the file and obtain it for your system.

- Make alterations for your file if required. You may full, revise and indication and printing Minnesota Option to Purchase Common Stock.

Download and printing a large number of file themes using the US Legal Forms Internet site, which offers the biggest assortment of lawful varieties. Use specialist and condition-particular themes to handle your small business or specific demands.

Form popularity

FAQ

The stock options plan is drafted by the company's board of directors and contains details of the grantee's rights. The options agreement will provide the key details of your option grant such as the vesting schedule, how the ESOs will vest, shares represented by the grant, and the strike price.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

A stock option (also known as an equity option), gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date.

Stock options allow employees to buy a piece of your company at a discount in exchange for their dedication and commitment. As a small business, you can consider offering stock options as a great way to compensate employees and help build a hardworking and innovative staff.

Stock options are a popular way for companies to build a strong relationship with employees and to motivate them to work hard in the interests of the company. Stock options are also a way to encourage employees to stay and not be tempted to leave and work for a competitor.

Stock options aren't actual shares of stock?they're the right to buy a set number of company shares at a fixed price, usually called a grant price, strike price, or exercise price. Because your purchase price stays the same, if the value of the stock goes up, you could make money on the difference.