Statutory Guidelines [Appendix A(6) Revenue Procedure 93-34] regarding rules under which a designated settlement fund described in section 468B(d)(2) of the Internal Revenue Code or a qualified settlement fund described in section 1.468B-1 of the Income Tax Regulations will be considered "a party to the suit or agreement" for purposes of section 130.

Minnesota Revenue Procedure 93-34

Description

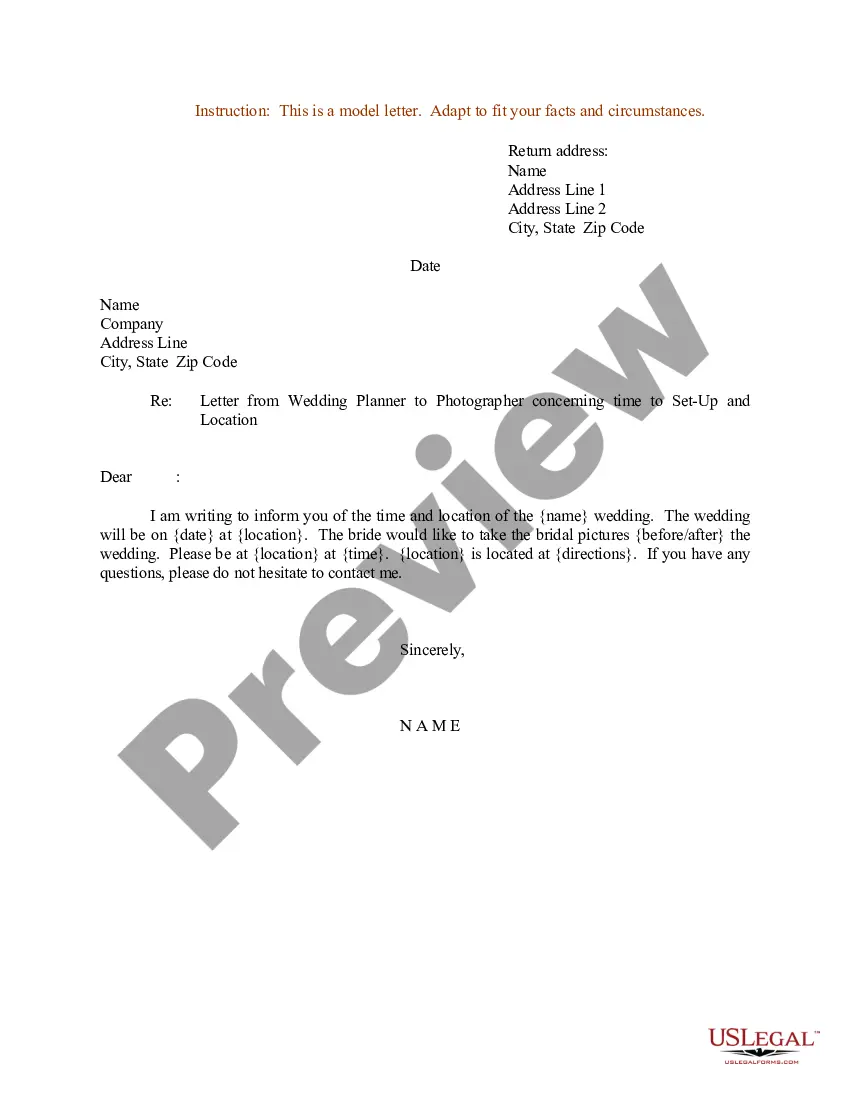

How to fill out Revenue Procedure 93-34?

You can devote time on-line looking for the lawful record format that suits the federal and state demands you want. US Legal Forms gives 1000s of lawful types that happen to be reviewed by experts. It is possible to obtain or printing the Minnesota Revenue Procedure 93-34 from our service.

If you have a US Legal Forms accounts, you may log in and click the Acquire key. Next, you may complete, modify, printing, or sign the Minnesota Revenue Procedure 93-34. Every lawful record format you acquire is the one you have eternally. To have another version associated with a obtained develop, visit the My Forms tab and click the corresponding key.

If you use the US Legal Forms website for the first time, adhere to the basic directions beneath:

- Initially, make sure that you have chosen the right record format for that county/town of your liking. See the develop outline to make sure you have picked the correct develop. If available, take advantage of the Preview key to check through the record format also.

- If you want to discover another edition from the develop, take advantage of the Research area to obtain the format that suits you and demands.

- Once you have discovered the format you want, click on Get now to move forward.

- Choose the rates prepare you want, enter your credentials, and register for your account on US Legal Forms.

- Complete the transaction. You may use your bank card or PayPal accounts to cover the lawful develop.

- Choose the structure from the record and obtain it in your system.

- Make changes in your record if necessary. You can complete, modify and sign and printing Minnesota Revenue Procedure 93-34.

Acquire and printing 1000s of record web templates making use of the US Legal Forms web site, which provides the largest variety of lawful types. Use expert and express-certain web templates to take on your small business or individual requirements.