Minnesota Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase

Description

How to fill out Equipment Lease Agreement With An Independent Sales Organization With Option To Purchase?

Discovering the right authorized document template can be quite a struggle. Of course, there are a lot of themes available on the Internet, but how will you find the authorized type you need? Utilize the US Legal Forms internet site. The services provides a large number of themes, including the Minnesota Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase, which can be used for business and private requires. Every one of the kinds are checked by pros and meet federal and state needs.

Should you be currently authorized, log in to the accounts and then click the Download option to find the Minnesota Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase. Make use of accounts to search throughout the authorized kinds you possess purchased previously. Proceed to the My Forms tab of the accounts and get one more copy from the document you need.

Should you be a whole new customer of US Legal Forms, listed here are straightforward directions that you should follow:

- Very first, make sure you have selected the right type to your town/area. You may check out the shape while using Review option and study the shape description to make certain this is basically the right one for you.

- In case the type fails to meet your preferences, take advantage of the Seach discipline to obtain the proper type.

- Once you are positive that the shape would work, select the Get now option to find the type.

- Select the prices program you would like and enter the required details. Make your accounts and purchase the order utilizing your PayPal accounts or charge card.

- Opt for the data file file format and acquire the authorized document template to the gadget.

- Total, edit and print and signal the received Minnesota Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase.

US Legal Forms may be the greatest local library of authorized kinds where you can discover different document themes. Utilize the service to acquire professionally-made files that follow status needs.

Form popularity

FAQ

Accounting: Lease is considered an asset (leased asset) and liability (lease payments). Payments are shown on the balance sheet. Tax: As the owner, the lessee claims depreciation expense and interest expense.

A Capital Lease is treated like a purchase for tax and depreciation purposes. The leased equipment is shown as an asset and/or a liability on the lessee's balance sheet, and the tax benefits of ownership may be realized, including Section 179 deductions.

For example, if the present value of all lease payments for a production machine is $100,000, record it as a debit of $100,000 to the production equipment account and a credit of $100,000 to the capital lease liability account. Lease payments.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

The three main types of leasing are finance leasing, operating leasing and contract hire.Finance leasing.Operating leasing.Contract hire.

10 THINGS EVERY RENTAL AGREEMENT SHOULD INCLUDE10 THINGS EVERY RENTAL AGREEMENT SHOULD INCLUDE. Category Advice.Tenant Information.Period of Tenancy.Limits on Numbers of Tenants.Rental Amount and Conditions.Other Amounts Due.Restrictions on Illegal or Unacceptable Activity on the Property.Access.More items...?

A lessee must capitalize a leased asset if the lease contract entered into satisfies at least one of the four criteria published by the Financial Accounting Standards Board (FASB). An asset should be capitalized if: The lessee automatically gains ownership of the asset at the end of the lease.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

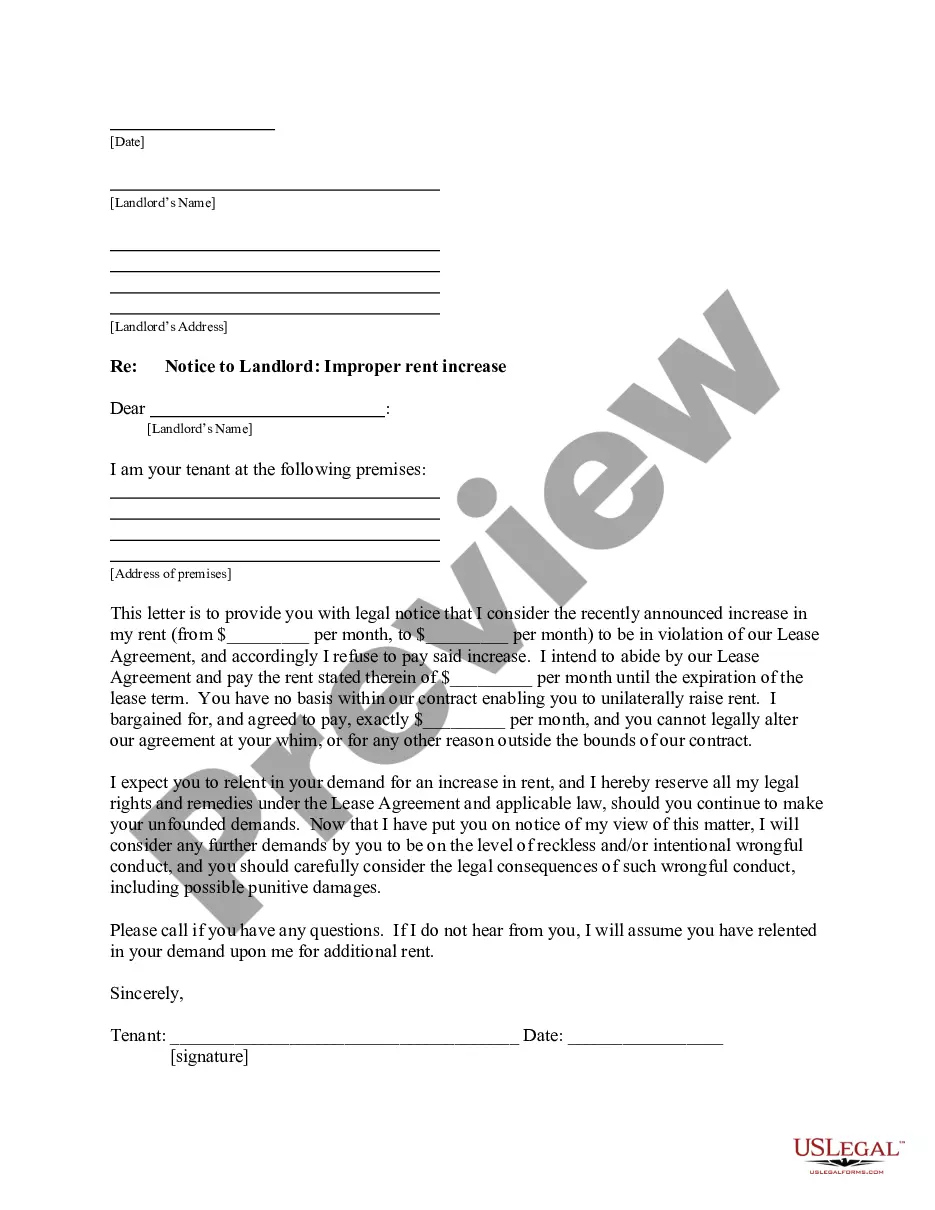

A written lease agreement must contain:The names and addresses of both parties;The description of the property;The rental amount and reasonable escalation;The frequency of rental payments, i.e. monthly;The amount of the deposit;The lease period;The notice period for termination of contract;More items...

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.